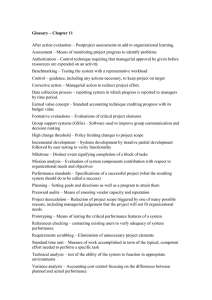

MANAGERIAL ACCOUNTING What Is Managerial Accounting? Managerial accounting is the practice of identifying, measuring, analyzing, interpreting, and communicating financial information to managers for the pursuit of an organization's goals. It varies from financial accounting because the intended purpose of managerial accounting is to assist users internal to the company in making well-informed business decisions. What Do Management Accountants Do? If you like keeping track of a company's income and expenses but also want to hold a position with significant responsibility and authority, management accounting could be the job for you. This article teaches you about the profession of management accounting, touching on everything from a management accountant's job responsibilities, skill set, and formal educational requirements right down to the professional designations that can help you get ahead. . How Managerial Accounting Works Managerial accounting encompasses many facets of accounting aimed at improving the quality of information delivered to management about business operation metrics. Managerial accountants use information relating to the cost and sales revenue of goods and services generated by the company. Cost accounting is a large subset of managerial accounting that specifically focuses on capturing a company's total costs of production by assessing the variable costs of each step of production, as well as fixed costs. It allows businesses to identify and reduce unnecessary spending and maximize profits. Managerial Accounting vs. Financial Accounting The key difference between managerial accounting and financial accounting relates to the intended users of the information. Managerial accounting information is aimed at helping managers within the organization make well-informed business decisions, while financial accounting is aimed at providing financial information to parties outside the organization. Financial accounting must conform to certain standards, such as generally accepted accounting principles (GAAP). All publicly held companies are required to complete their financial statements in accordance with GAAP as a requisite for maintaining their publicly traded status. Most other companies in the U.S. conform to GAAP in order to meet debt covenants often required by financial institutions offering lines of credit. Because managerial accounting is not for external users, it can be modified to meet the needs of its intended users. This may vary considerably by company or even by department within a company. For example, managers in the production department may want to see their financial information displayed as a percentage of units produced in the period. The HR department manager may be interested in seeing a graph of salaries by employee over a period of time. Managerial accounting is able to meet the needs of both departments by offering information in whatever format is most beneficial to that specific need. References: https://www.investopedia.com/terms/m/managerialaccounting.asp