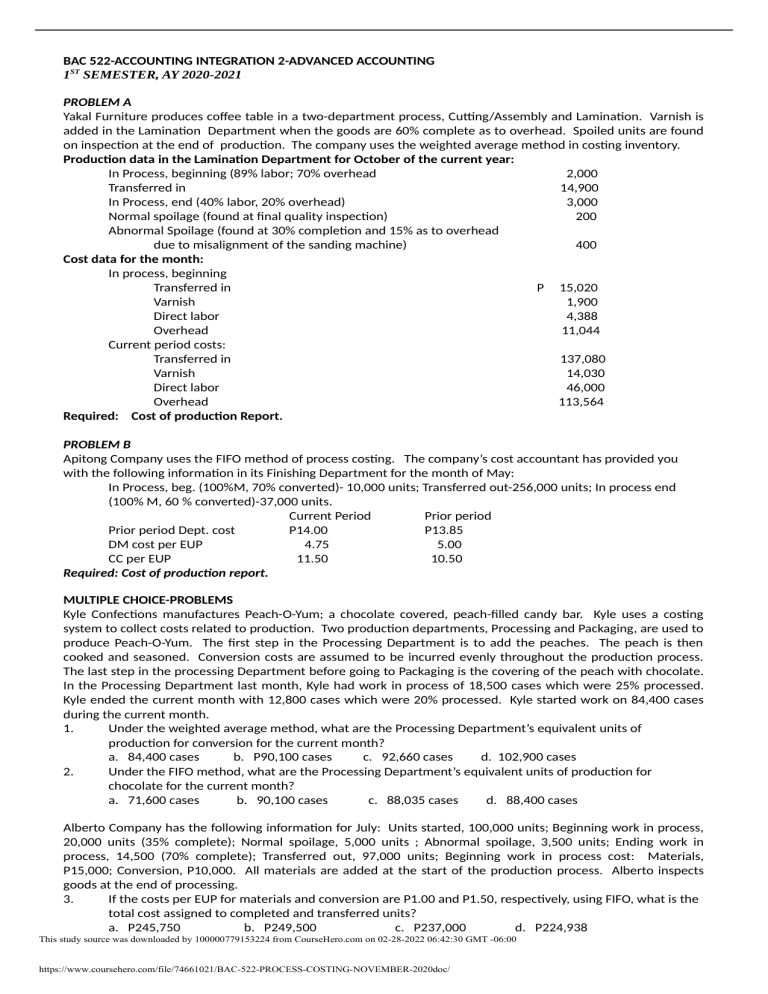

BAC 522-ACCOUNTING INTEGRATION 2-ADVANCED ACCOUNTING 1ST SEMESTER, AY 2020-2021 PROBLEM A Yakal Furniture produces coffee table in a two-department process, Cutting/Assembly and Lamination. Varnish is added in the Lamination Department when the goods are 60% complete as to overhead. Spoiled units are found on inspection at the end of production. The company uses the weighted average method in costing inventory. Production data in the Lamination Department for October of the current year: In Process, beginning (89% labor; 70% overhead 2,000 Transferred in 14,900 In Process, end (40% labor, 20% overhead) 3,000 Normal spoilage (found at final quality inspection) 200 Abnormal Spoilage (found at 30% completion and 15% as to overhead due to misalignment of the sanding machine) 400 Cost data for the month: In process, beginning Transferred in P 15,020 Varnish 1,900 Direct labor 4,388 Overhead 11,044 Current period costs: Transferred in 137,080 Varnish 14,030 Direct labor 46,000 Overhead 113,564 Required: Cost of production Report. PROBLEM B Apitong Company uses the FIFO method of process costing. The company’s cost accountant has provided you with the following information in its Finishing Department for the month of May: In Process, beg. (100%M, 70% converted)- 10,000 units; Transferred out-256,000 units; In process end (100% M, 60 % converted)-37,000 units. Current Period Prior period Prior period Dept. cost P14.00 P13.85 DM cost per EUP 4.75 5.00 CC per EUP 11.50 10.50 Required: Cost of production report. MULTIPLE CHOICE-PROBLEMS Kyle Confections manufactures Peach-O-Yum; a chocolate covered, peach-filled candy bar. Kyle uses a costing system to collect costs related to production. Two production departments, Processing and Packaging, are used to produce Peach-O-Yum. The first step in the Processing Department is to add the peaches. The peach is then cooked and seasoned. Conversion costs are assumed to be incurred evenly throughout the production process. The last step in the processing Department before going to Packaging is the covering of the peach with chocolate. In the Processing Department last month, Kyle had work in process of 18,500 cases which were 25% processed. Kyle ended the current month with 12,800 cases which were 20% processed. Kyle started work on 84,400 cases during the current month. 1. Under the weighted average method, what are the Processing Department’s equivalent units of production for conversion for the current month? a. 84,400 cases b. P90,100 cases c. 92,660 cases d. 102,900 cases 2. Under the FIFO method, what are the Processing Department’s equivalent units of production for chocolate for the current month? a. 71,600 cases b. 90,100 cases c. 88,035 cases d. 88,400 cases Alberto Company has the following information for July: Units started, 100,000 units; Beginning work in process, 20,000 units (35% complete); Normal spoilage, 5,000 units ; Abnormal spoilage, 3,500 units; Ending work in process, 14,500 (70% complete); Transferred out, 97,000 units; Beginning work in process cost: Materials, P15,000; Conversion, P10,000. All materials are added at the start of the production process. Alberto inspects goods at the end of processing. 3. If the costs per EUP for materials and conversion are P1.00 and P1.50, respectively, using FIFO, what is the total cost assigned to completed and transferred units? a. P245,750 b. P249,500 c. P237,000 d. P224,938 This study source was downloaded by 100000779153224 from CourseHero.com on 02-28-2022 06:42:30 GMT -06:00 https://www.coursehero.com/file/74661021/BAC-522-PROCESS-COSTING-NOVEMBER-2020doc/ Information taken from the Costs to Account For schedule of a company with two production departments is as follows: Department A – Initial Processing Department Costs Added by Department: Equivalent Unit Cost Direct materials P4.29 Direct labor 2.93 Factory overhead 1.17 Department B – Final Production Department Equivalent Production Equivalent Unit cost Costs Added by Department Direct labor 20,000 P3.19 Factory overhead 20,000 1.20 4. If Department A transferred 32,000 units into Department B, what is the total cost to be accounted for in Department B? a. P356,280 b. P255,600 c. P419,716 d. P87,800 Marshall Company uses process costing in its two production departments. The following information pertains to Department 2 for August 2020. a. Normal spoilage is 5% of good output; inspection and identification of spoilage takes place at the 90% stage of completion; materials are added after inspection. b. Department 2 received 14,000 units from Department 1 at a cost of P140,000. Department 2 costs were P12,000 for materials and P89,250 for conversion costs. c. A total of 8,000 units were completed and transferred to finished goods. At the end of the month, 5,000 units were still in process, estimated to be 60% complete as to conversion costs. 5. 6. The equivalent units of production for conversion was: a. 11,270 b. 11,900 c. 14,000 The cost of completed units would be: a. P152,000 b. P155,354 c. P158,840 d. 11,540 d. P158,700 Pasay Manufacturing Company manufactures fire extinguisher and uses FIFO method for process and inventory costing. In valuing the finished goods inventory, the costs of units completed from the WIP beginning are kept separate from the costs of those started and completed during the period. The total manufacturing costs for the month of June were P924,000. There were 5,500 units that were completed during the month. All costs were uniformly applied to production. At the beginning of the period, there were 2,500 units in process that were 20% incomplete with a total costs of P448,000 and 1,200 of completed fire extinguishers with a total costs of P268,800. At the end of the month, there were 1,000 units in process that were 50% complete and 1,400 of completed fire extinguishers. 7. The cost of completed units at the end of the month is a. P369,600 b. P235,200 c. P215,600 d. P323,400 8. The cost of goods sold for the month is a. P1,363,600 b. P1,224,300 c. P1,215,900 d. P1,201,900 Sarah Company uses a process cost system for Product C, which requires four processes. Work in process, Department 4, shows the following data for May: Balance, May 1 ( 1,600, units, 1/4 completed )- P 8,120; from Department 3 (4,300 units)- P 15,050; Direct labor- P24,500; factory overhead- P6,370. Processing for the month of May consisted of completing the 1,600 units in process on May 1, completing the processing on 3,500 additional units, and leaving 800 units that are 1/4 completed. During June the charges to Work in process in Department 4 shows the following data: from Department 3, (5,500 units)-P16,500; Direct labor- P23,520; Factory overhead- P5,880. By June 30 all beginning work in process units were completed, of the 5,500 new units 1,500 were left, only 1/5 completed. (FIFO method) 9. The cost of ending inventory for the month of May was: a. P1,260 b. P9,000 c. P6,300 d. P4,060 10. The cost of goods completed and transferred to finished good for the month of June was: a. P49,980 b. P47,200 c. P43,360 d. P43,660 end**********end This study source was downloaded by 100000779153224 from CourseHero.com on 02-28-2022 06:42:30 GMT -06:00 https://www.coursehero.com/file/74661021/BAC-522-PROCESS-COSTING-NOVEMBER-2020doc/ Powered by TCPDF (www.tcpdf.org)