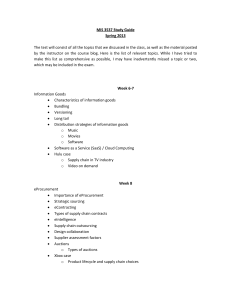

DOS4712 Coordination and Flexibility in Supply Chain Management p2 - Topic 1 (Chapter 1) p4 - Challenges and Risks of Global SC p4 - Impact by globalization, macroeconomic changes, emerging markets, disruptive technologies Chapter 1 – Introduction to Supply Chain Management 1.1 What is Supply Chain Management? Supply chain management (SCM) involves the coordination of physical activities that enable the delivery of products to the end customer. This value chain encompasses the sourcing and procurement of raw materials, production or procurement of intermediate products, production of finished products, delivery to the end customer, and after-sales support for maintenance and returns. Involves long-term horizons at strategic levels and short-term horizons at operational levels Involves a holistic consideration of many factors and dealing with trade-offs Supply chain processes from a purchasing perspective: Search Acquire Use Maintain Dispose Supply chain processes from a supplier’s perspective: Research Design Manufacture or provide Sell Service Along with the product movement, there are concurrently information flows and cash flows associated with the flow of products between different companies and departmental entities. An Effective Supply Chain Management involves handling 3 flows. While the term “supply chain” implies a linear flow of products from suppliers to end customers, supply chains have evolved into collaboration networks, where information can be shared by all platers simultaneously. In addition, supply chains have also been transformed to be more proactive rather than just reactive, and more adaptive to real-time events and changes. Companies need to make both strategic and operational decisions on their sourcing, factories and distribution centers, according to criteria such as cost, convenience, customer and supplier locations, and future needs. The complexity of supply chain planning and design comes in deciding how to take into account all these factors and constraints from a holistic point of view, ensuring that there is overall optimality. 1.2 Scope of Supply Chain At a Strategic level, on a long-term planning horizon Where should the manufacturing plants be located? What is the cost of building or renting the facilities? Whom should we buy from? Where should suppliers be located? What are the terms and conditions of purchase? Which components to make in-house and which ones to outsource? What is our product roadmap? How do we tie in the mass customization and individualization of products that customers are looking for and still maintain a profitable margin per product? How do we create the appropriate kinds of global supplier and customer relationships through collaboration and partnership mechanisms? At a Strategic level, on a short-term planning horizon SCM deals with issues relating to sales forecasts and ensuring that production and inventory are synchronized with the forecasts. How much of each type of goods to produce? What kind of distribution channels to use? What is the level of product availability to maintain? What is the appropriate level of inventory to keep? What level of service does each customer segment expect? What is the cost of providing that level of service? At an Operational level, SCM deals with execution issues that involve achieving process efficiency and improving productivity in the movement and deployment of people, products, machines and transportation. How to manage warehousing and distribution operations? How well utilized are the logistics assets? What is the process and information flow between marketing, production, warehousing and distribution departments, whenever a customer order is to be fulfilled? How to collect and repair or dispose faulty products? When does the customer expect the product? How can this product be delivered more cost-effectively to the customer? How to prevent pilferage, damage or contamination of products? An effective supply chain strategy needs to take into account the demand pattern of the products being sold, differentiating between new products and functional products. New and Innovative Products Functional Products Uncertain demand and high profit margins Satisfy basic needs, relatively stable and predictable demand and low profit margins Require market-responsive processes that can respond quickly, with significant levels of buffer Require efficient processes that keep lead times and stocks inventory holdings low in order to minimize the costs of supplying commodity type products Examples: Fashion apparel, Consumer electronics Examples: Household items, Food In the initial phases of introduction into the market, products may follow an innovative profile as they rapidly gain market share, but their demand patterns may stabilize after they have gained market acceptance With new product lines, versions and features being introduced, the demand for the existing product will start to taper Plans for discontinuation of the product line, in terms of production, maintenance, and continued production of spare parts for warranty and maintenance support 1.3 Challenges and Risks of Global Supply Chain …in an era of globalization, macroeconomic changes, emerging markets, and disruptive technologies. The changing business landscape impacts the structure of supply chains. (1) (2) (3) (4) (5) (6) Macroeconomic changes (economic, inflation, employment etc) Government regulations Emerging global companies New channels of marketing and distribution Technology innovations New business models *all of these will change Supply Chain Configuration* 1.3.1 Macroeconomics, Regulations, Technology impact Global Supply Chains Configurations Reading: Guest Outlook From Singapore 2020 Outlook for Global Supply Chains To fulfil tasks; - Risk management in existing markets - Diversification into new and often unfamiliar markets - Prepare for disruption in traditional industry structures; Leaders need to translate technology into both short-term operational & long-term strategic outcomes. Macroeconomic changes will drive reconfiguration of global supply chain networks For example, a number of global changes like Brexit and potentially the Regional Comprehensive Economic Partnership (RCEP), will transform sourcing and trade relations. New trading patterns may develop and grow over time Strategic level: companies need to understand how to optimize new global networks, as well as rebalance sourcing, production and inventory levels in different locations Operational level: companies need to integrate new partners, suppliers and customers. This will involve planning, use of data, supply chain optimization, and technology implementation. Integration is key It is insufficient to just automate an existing process in order to glean the full benefits of technologies, but would also require redesigning existing workflows For example, automation would require more than just putting in place robots – it is about integrating robotics into overall system, and monitoring usage and maintenance For example, Industry 4.0 built around robotoics, IOT, 3D printing wold require integration of hardware and software Creating a visible supply chain with technology Companies often want to track their product movements globally Technologies such as IOT and blockchain will likely play a role in supply chain integration for tracking of product movement, and communication of information across multiple parties, with more proofs of concept involving partners that are ready Conclusion As we advance into 2020 and the next decade, we are likely to see large scale changes in global supply chain structures as companies adjust to new business imperatives. Technology adoption and implementation will play a big role in company and supply chain transformation. Reading : The high price of breaking up global supply chain Consumers will suffer as US-China trade war strains production, markets and regulation fragment Companies running production supply chains will have to factor in international politics to a much greater degree than before – not just cost, speed, and efficiency. Supply chains will need to become geographically diversified, more regionalized For example, Apple is asking suppliers to evaluate diversifying their production capacity out of China For example, companies will be obliged to spread production across different bases – eg with a distinct production base to serve North America, and another to serve China and the rest of the world Who will benefit/suffer from regionalization? Mexico 😊 labor costs are relatively low, and its geographic proximity to the U.S. and open trading relationships with many other countries have already made it a major player in autos, electronics, and increasingly aerospace Taiwan ☹ Taipei has recognized overdependence on China, encouraged to diversify to Southeast Asia starting with Indonesia, Thailand, Malaysia. Taiwan’s major electronic companies have been slowed to move because of their great success with China model. Major implications for global manufacturing Fragmentation of production = Higher costs + Loss of scale efficiencies Divided component sourcing will be a major challenge China is the sole/dominant source of many electronic components like battery Fragmentation of standards Conclusion New tariffs and trade restrictions are popping up as a transactional view of world trade mixes with an increasingly tense geopolitical agenda headlined by the strategic rivalry between the US and China This will affect the manufacturers more complicated and costly 1.3.2 Government & Trade Regulations impact Supply Chains Example of SC change due to regulation: Ford Motor in US wanted to open a plant facility in Mexico for low-costs. But President Donald Trumph introduced taxation for cars from Mexico into US, to “force” Ford to make the cars in US, instead of Mexico. 1.3.2 New Manufacturing locations arise Push factor: China, Vietnam, Cambodia low cost Pull factor: But where are the new emerging markets? Example: o Samsung in South Korea: set up many factories in Vietnam due to low cost strategy. But how to enter emerging markets? o Huawei: relocate to India, because of big domestic market, not solely because of low cost. 1.3.3 Emerging Global Companies Trend: Most top companies belong to Asia countries. Gradually, shares of Chinese companies start to increase. Projection by 2025: almost half 500 top companies will not come from US, Europe, Japan, they will belong to Chinese companies/emerging markets. Hence, the companies we work for, strategies we employ, will also change. (Eg. Lenovo; inhouse vs Dell; outsourcing supply chain are different - Pros and Cons of inhouse/outsource) 1.3.4 New Infrastructure & Distribution Routes emerge How do these affect distribution? 1.3.5 Technology Disruption Manufacturing and Supply Chains become “smarter” Conclusion: even traditional aircraft manufacturing will not be the same due to technology disruption New products disrupt traditional industry 1.3.6 New business models & Competitors Example of New sharing business model similar to Grab, but using the concept to apply to truck/delivery services companies can share truck to do delivery. Can we extend to same sharing economy to distribution/manufacturing/warehousing/trucking?? - SC Function: Changing traditional business model. 1.3.7 Industry Lines get blurred leading to New Competitors Example of Amazon having a new business model Instead of outsourcing everything to UPS & FedEx to do delivery, Amazon now bought its own planes to do in-house delivery o Industry lines get blurred: Is Amazon the 3pl/delivery now? o New competitors: Amazon becomes a new competitor for UPS/FedEx they lost 26% of what it used to deliver for Amazon o (?) Technology does not take away market, it helps company who are doing better. 1.3.8 Procurement & Finance Risks increase Retail closing have implications on up and downstream of SC o Payment term of 90 days to suppliers o Up stream: suppliers didnt get paid within 90 days bc toysrus became bankrupt o Down stream: implication to shopping malls. Toysrus went bankrupt, unable to pay the leasing fees. Implication to investors/banks bc shopping malls are funded by them to build malls. Conclusion: Banks are making less profits - because they anticipate that retails/others cannot repay them. 1.4 Impact of Recent Trends 1.3.1 Government and Trade regulations impact supply chains Case Study: Indian Exports to China, impacted by Sino-US trade war (Feb 2019) Due to Sino-US trade war, there is a rise in Indian exports to China 1.3.2 Technology Innovations New technologies continue to transform the nature of production, and the nature of products. 3D Printing, which allows products to be built individually by layering raw materials, can potentially transform the assumption of large scale mass production, and create more opportunities for mass customization and individualization of products Industrial Internet, where machines, equipment, and transport fleets, can be fitted with sensors that produce amounts of data, which can then be shared and analyzed real-time to create operational efficiencies 1.3.2 e-Commerce and Mobile Technologies Restructuring of traditional physical retail chains Puts strain on the supply chain to have back-end integration to warehouse or retail, tracking of inventory, and delivery of small volumes to many individual buyers Traditional methods of organizing retail and distribution are being revisited as companies combine their online and offline presence, and create partnerships for “omni-channel” sales to customers Case Study: Tesco Introduces Mobile Commerce for Grocery Shopping Tesco's South Korean branch, called Home Plus, has found a way to encourage commuters to buy products through their mobile when waiting for their trains by building virtual aisles on the platforms. Home Plus created enormous, rich images of food items and plastered them across the walls of train platforms - laid out in the same way as they would be in the shop. Every item has a corresponding QR barcode, and people waiting on the platform can check out the items on the huge billboard and scan the QR code of the relevant item using their mobile, immediately adding to their online shopping basket. Home Plus online sales went up by 130% in three months, and the number of registered users went up by 76%. 1.3.3 Corporate Social Responsibility (CSR) Shift of focus towards contribution to the social community and adherence to ethical practices and international norms, rather than focusing purely on profit Choices about sourcing and procurement are now made taking into account the environmental impact of the suppliers CSR measures can also contribute to the bottom line, through savings Case Study: Eliminate excessive packaging for On Kid Connection, Walmart’s private-label lien of toys For example, by eliminating excessive packaging for On Kid Connection, Walmart’s private-label lien of toys, it could save US$2.4 million a year in shipping costs, 3,800 trees, and one million barrels of oil. 1.3.4 Product Innovations Develop from Emerging Markets Traditional assumptions that product design is done in the key cities in developed countries, while manufacturing is carried out in low cost countries and then shipped to developed markets, is being revisited Case Study: Reverse Innovation at Unilever Unilever is a global consumer products company which has 53% of its sales in developing markets and expects this to reach 70% in 2020. Pioneered the use of low-cost, single-use packets to make its products affordable for lower-income consumers who often shop daily for necessities In a sign of reverse innovation, these products from emerging markets are being used for more developed markets. For instance, after the 2009 financial crisis, with lower spending power in Europe, Unilever introduced similar small packaged products into its Europeans markets. Forward-looking companies like Unilever cultivate an inclusive growth strategy that considers rural consumers as part of their plans for growth. Readings: Fighting for the Next Billion Shoppers (The Economist) How Unilever Reaches Rural Consumers in Emerging Markets (HBR) 1.3.5 Business Models in Retail and Logistics Continue to Evolve and Blur Online retail businesses build out their physical logistics infrastructure in order to ensure inventory availability and on-time delivery, they themselves become capable of providing logistics service as a service Case Study: Delivery Innovation using Customers at Walmart (Crowd-Sourcing/Sharing Economy) Wal-Mart currently uses carriers like FedEx Corp for delivery from stores - or, in the case of a same-day delivery service called Walmart To Go with its own delivery trucks. Shoppers can provide information to Walmart about where they live and sign up to drop off packages for online customers on their way home. In return, these shoppers could be offered a discount on their Walmart bills. If this were done on a large scale, it could create greater synergies between Walmart’s physical stores and online stores, giving Walmart a competitive advantage compared to pure e-retailers. Reading 1 : Starbucks’ Howard Schultz Finally, a CEO who gets the importance of the Supply Chain With most companies looking for new ways of growth, Schultz stressed that growth is directly linked to technology and innovation and is geared towards the foundational needs of the supply chain. The supply chain and technology relevance of a business is recognizing the global nature of the business itself. The supply chain needs to be at the forefront of every enterprise in the world, especially the ones that are consumerfacing For instance, Starbucks has a primary focus on creating new growth innovation incrementalities based on shortterm delivery “Mobile Order & Pay”: allowing a customer to place an order in advance and pay for it using their mobile phone. The order can then be picked up from the store later. Conclusion Supply chain not only has a seat at the table, it is a primary co-author of the strategy of businesses Reading 4: The Pandemic Helped Topple Two Retailers. So did private equity. At a time when J. Crew and Neiman Marcus needed to be investing money to adjust to changing shopping habits, enormous sums were going to their owners. 10 of the 14 largest retail chain bankruptcies involved companies that private equity firms had acquired. Anything that would take more than a trivial amount of capital and have a longer payout time doesn’t generally fit with a private equity model Conclusion Reading 5: Warehousing sector well-positioned to weather coronavirus disruption, report finds Logistics real estate sector could be among the best positioned to handle inventory supply and demand disruptions from COVID-19 outbreak due to standard long-term occupancy contracts and a potential shift to more regional supply chains in the future, according to a report from Prologis released in March. Supply chain managers typically prefer to keep inventory levels low, but shortages of consumer goods such as food and cleaning supplies could lead supply chain managers to rethink optimal inventory levels and storage locations, the report found. As a result, there could be increased demand for space to handle an eventual surge in goods and build up resiliency against future shocks. E-commerce may increase consumers choose to shop online as a result of social distancing measures or store closures Conclusion Shippers may reconsider their logistics footprint, preferring a regionalized approach that can offer greater flexibility, proximity to key urban centers and better insulate supply chains from market disruptions