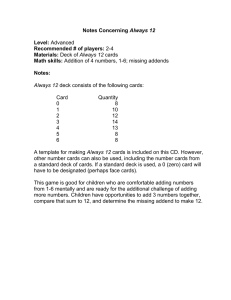

PITCH DECK GUIDANCE How to have a good deck? • Own your story – Don’t be generic. o Make sure it carries your unique voice o What sets you apart from other teams? What is your momentum so far? • Has to capture attention and keep it too. Investor will only be excited if you are! • What are you trying to do? Be clear and understand the problem you’re solving • You should be the expert of your product/market. Why is it better than the alternatives? • Evidence is key! Get data for the market, users and feedback on product • Why are you the right team to solve this problem? What is your EDGE? • Be clear on unit economics – How much money will you make on a single unit? o Easiest business is selling Rs 100 for Rs 50! Private & Confidential 1 Fundraising truths • Investors see multiple pitch decks in a day/week. Need to stand apart • Fund-raising is a long process o After presentation, there will be meetings and negotiations which take 1-2 months o Even if you find the right investor, legals and all will take 2-4 months before money reaches your bank account • An investor provides more than money. Make sure you find one who cares and give you time as well. • The investor is betting on YOU. Your commitment + drive is the most important thing you can control. Private & Confidential 2 Understand where you are Friends & Family Pre-Seed Seed Series A When should you raise? Idea At launch Early Product Market Fit Demonstrated Product Market Fit Traction? (monthly revenue) Negligible Negligible $5k-$20k $20k-$100k From who? Angels, Early HNW Individuals, Local VC Friends & Family stage VC Funds, specialist international Funds VC funds Local & International VCs To do what? Build MVP & early team Launch Reach early scale with reasonable unit economics Scale Average Round size? <$50k $100k-$400k $0.5m-$2m $2m-$5m Private & Confidential 3 Structure options – What does the deck include? These are just options! There are no limitations Classic Structure: • Purpose • Problem • Solution • Why now • Market Size • Competition • Product • Business Model • Team • Financials Private & Confidential Story-telling Structure: • Origin Story • What you’ve learned so far? • Who are users and customers? • Traction so far? • Key milestones so far? • What happens in the future? • What you need to make the future happen? • Summary 4 Alternative Structure: • Team • Problem/Opportunity • Market • Solution • Traction so far? • Product overview • Competition • Business Model • Unit Economics • Marketing/Growth • Fund Raising Five key ingredients all good pitches must have! This is the starting point to build on • PROBLEM: Explain why a set of circumstances are painful for set of users o In a world of vitamins, be a pain-killer • SOLUTION: How do you alleviate the pain for the consumers? o Need to solve the problem, not impose your vision on the problem • MARKET: Is the market large enough and/or rapidly growing? o Why is now the right time to invest in this market? • BUSINESS: How do you make money? o How are you different from the competitors? • TEAM: Why are you the best placed to build this? o By far the most important thing! Everything else is academic without execution. Private & Confidential 5 Think like an investor Questions to answer in the deck What an investor wants to know: Things to include: • Is the business going to grow fast ✓ What is the Value proposition ✓ Key Milestones so far and become huge? ✓ What have you learned? • What are the risks they are facing ✓ How have you improved? that will stop them becoming huge? ✓ What does the product do? • What have they done to address ✓ What are the costs? these risks? ✓ Market Opportunity? • Why will these guys win? ✓ Future Milestones? • What happens after the business is ✓ Why is the team right? funded? Have they done their market ✓ Forecasts and financials research and have a strategy? ✓ How much money you need? Private & Confidential 6 Housekeeping: Structure Basics Key rules for your deck • Follow basic PowerPoint etiquette o Add page numbers o Limit text o Cite sources • Make sure the deck is how you want to tell your story o PRACTICE, PRACTICE, PRACTICE! • Send deck to investors before presenting • For early-stage start-ups: o Focus on market, GTM strategy and product • Later stage start-ups: o Focus on solution, product, financials and traction • Try to keep deck under 15 slides excluding appendices Private & Confidential 7 Other tips • Don’t use generic slide titles • Include only most useful information • Infographics can be better than words, but they should be clear and simple to follow • Don’t put way too much information in the slide • Don’t use fancy words, keep it concise and avoid jargon/buzzwords Private & Confidential 8