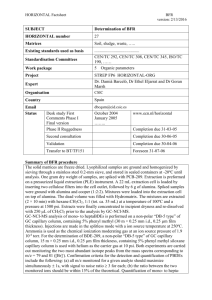

capital requirements Working capital requirements (WCR) (in English working money requirements, or WCR) is the financial measure of the financial result of changes in cash flows other than the costs and revenues of the service. The need for capital is usually the so-called "resource capital". principle of justice They can be paid in advance (deposit) or with delay the goods or services that are sold to them. You pay by hand in advance (deposit) or the term of services you purchase. These terms are specific to derivatives and financial derivatives. Significance depends on the length of the operating cycle, the value fair account Simplifying the expression from BFR is the following: Working capital = current assets (inventory + accounts receivable) current liabilities (trade payables + tax assignment + debts + other non-financial debts). More generally, we can consider that the BFR defines the difference between assets and liabilities starting to consider in the broad sense: Working Capital = Inventories + Realization - Tombstone We can distinguish between operating a BFR (BFRE, or BFE on "operating financing need") non-operating working capital (BFRHE) because some elements of the above equation do not directly apply to operations (including taxes on profits or debts including fixed assets) . Given BFRE and BFRHE, you can use the following calculation: BFR = BFRE + BFRHE Knowing that BFRE = Inventories + Trade Receivables - Trade Payables Operating Credits Taxes and Social Security which On BFRHE = Other Receivables + Marketable Securities (VMP - if not put into cash) - Non-operating miscellaneous debts[1] Don't do anything on business days: simply distribute the pata pata from the company and multiply it by 365 (or 360 LVM by convention). The level of need for working capital is fair In some activities, the BFR is negative: this means that the activity generates cash; This is especially the case for companies in distribution, which are paid after delivery (often 60 days or more), while customers pay in cash. output from the operation process. Three most common cases exist: Capital that leads to growth: run a financial business, run a financial business, medium and mature, medium and adult, middle money, build clauses, BFR: Functions of the company's operations are equal to operation resources; The Jordanian Hashemite Foundation BFR is negative: the operation of the business function is less than the operating resources: the company does not need operating since the primary operating finance trading liabilities; Average Long Term (Capital) Average Medium BFR coverage edit During the establishment of the company during the stages of growth, growth chart, money chart, beginnings, holidays, vacations, FR = BFR + Cash. Thus, working capital shortage occurred before the shortage occurred. Considering commercial representation to financing during factoring, the discount or assignment (daily). More anecdotal, it is possible to use inverse factoring that is to develop a cooperative solution that is paid by a third party financier, that is then paid to maturity. Thus, style is influenced by style. And this is what happened. What do I do, what do I do, take pride in their work and their vitality. This improvement is the task of management, in connection with the functions of purchasing, production and financial services. This is the email box in the customer shelter