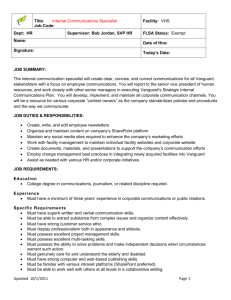

Lat25 Worlwide Corporation is an international ... specifications of the purchaser and sells on a contract basis....

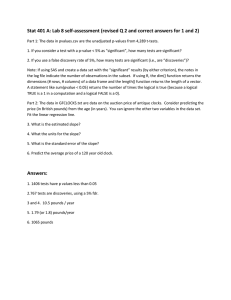

advertisement

Lat25 Worlwide Corporation is an international firm that manufactures to the specifications of the purchaser and sells on a contract basis. The firm is headquartered in New York and its contracts are primarily with European firms. The following transactions and events relate to one of its transactions and related hedging activities. Prepare all journal entries on Worlwide’s books to account for the transactions and events. November 16, 20X6 Contracted to deliver equipment to a British firm on February 14, 20X7. The contract is denominated in pounds, 400,000 pounds are due upon delivery, and the spot rate for pounds is $1,640 on November 16. November 16, 20X6 Acquired a forward contract to sell 200,000 pounds for delivery on February 14, 20X7 at a forward rate of $1,630 in order to hedge 50% of the exposure. December 31, 20X6 Current exchange rate for pounds on this date is $1,650 and the rate of 45 day forward contract is $1,635. February 14, 20X7 Worlwide delivers the equipment, collects the 400,000 pounds, delivers 200,000 pounds the the exchange broker, collect the amount due from the broker, and adjusts the sales account as appropriate. The spot rate for pounds on this date $1,665.