Uploaded by

brennanjmason

Global Supply Chain Risks: Trade Wars, Climate, Cyber Attacks

advertisement

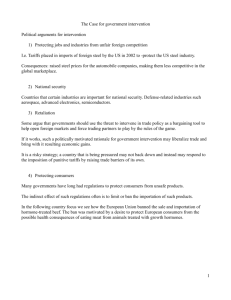

Today’s business environment presents an abundance of risks. Particularly, the prevalence of supply chains that involve global trade has cultivated a variety of risks that supply chain professionals must be wary of. It is not possible to eliminate all risks, but risks can be managed and mitigated. Firstly, economic shifts stimulate uncertainty and risk for firms that engage in global trade. This risk can stem from changes in economic structure, provisions to economic policies, and economic conflicts between countries. Prevalent examples that supply chain professionals must be wary of include the US-China trade war, Brexit, and the renegotiation of the USMCA (NAFTA). Moreover, a trade war can be defined as a situation in which nations impose trade barriers (generally in the form of tariffs or quotas) on each other in an escalating fashion, thus resulting in the reduction of international trade. In today’s business environment, with the prevalence of globalization and resultant global supply chains, the impacts of trade wars can stretch further than ever before. A current example is the US-China trade war. This situation involves a particularly high magnitude of risk due to the importance of both players in the global economy, particularly in the manufacturing sector. The increasing tariffs imposed on Chinese goods being imported to the US and vice-versa have resulted in large cost increases for many businesses. Often times, these price increases can be transferred downstream in the supply chain, stimulating far-reaching cost variances. For example, a Canadian firm who’s supply chain consists of a first-tier supplier in the US and a second-tier supplier in China may suffer a cost increase despite not being directly involved in the trade war. Furthermore, these increased prices for Chinese imports could cultivate monopoly/oligopoly environments in the US, as many smaller players in the market may be unable to survive due to the price increases. Moreover, another current economic issue that poses a high degree of risk is Brexit. As of January 31st, 2020, the United Kingdom has officially separated from the European Union. Through the regional integration provided by the monetary union, Britain priorly experienced a tariff-free status with the other EU members. Now, a new trade agreement must be negotiated between the UK and the EU, which will likely bring increased tariffs. This poses a major risk to many companies in the UK, as it will raise the cost of exports and increase the price of imports. As “more than one third of its imports comes from the EU”, this could have a large negative impact on Britain’s economy, stimulating inflation and lowering the standard of living. Supply networks in the region will likely experience increased costs due to new tariffs and a more restricted flow of capital, labor and goods. Moreover, the ratification of the new USMCA poses risks to some supply chains in North America. For example, the new regional value content provision states that “automobiles must have 75% of their components manufactured in Mexico, the US, or Canada to qualify for zero tariffs (up from 62.5% under NAFTA)” (Kirby, 2020). This may cause automobile manufacturers in the US to experience increased costs due to tariffs or modify their supply networks to comply with the new regional value content regulations. Overall, global supply chains are very susceptible to risk created by economic shifts and changes in economic policy, and therefore must ensure ongoing awareness of current economic events. This voids many of the benefits of regional integrat Firstly, the creation and expansion of trade wars pose on enormous risk to firms that engage in global trade. A trade war can be defined as a situation in which a nation imposes trade barriers, generally in the form of tariffs or quotas, and foreign countries retaliate with similar forms of trade protectionism. The escalation of a trade war results in the reduction of international trade, and thus poses a major economic risk to both countries and businesses alike. Because trade wars can often be politically motivated, I believe that they can also fit into the category of political risk. In today’s business environment, with the rise of globalization and the prevalence of global supply chain networks, the impacts of trade wars can stretch further than ever before. A current example is the US-China trade war. This situation involves a particularly high magnitude of risk due to the importance of both players in the global economy. More specifically, China is the largest exporter of the world’s production – countless firms source products/components from China due to their immense manufacturing capabilities and their provision of relatively low costs. Due to the trade war, many American businesses that import Chinese goods have experienced a large increase in costs as a consequence of the increased tariffs. These cost variances pose a financial risk. Moreover, the critical issue of climate change poses an immense risk to firms that engage in global trade. The issue of climate change is broad in scope, creating a vast array of risks that organizations must mitigate. In recent years, our planet’s environmental situation has become increasingly perilous – this has resulted in the implementation of new regulations and policies in an effort to move towards a more sustainable civilization. Although the implementation of new laws and regulations is essential to ensure the ultimate survival of the planet, changing policies can have negative impacts on businesses and on the economy. This can be exemplified by the recent implementation of a carbon tax in Canada. The carbon tax has caused an increase in transportation costs and energy costs in Canadian supply chains. Specifically, “the province estimates the tax will cost Ontario’s long-haul trucking sector about $750 million between 2019 and 2022” (Smith, 2019). Many firms have been forced to simply absorb these increased costs, as increasing prices to offset costs will reduce competitiveness. Therefore, the financial risk stemming from the carbon tax has placed a burden upon many Canadian firms. The implementation of new regulations in the future will likely have a similar impact, causing firms to invest in more sustainable materials and processes. Furthermore, climate change poses risks to supply chain infrastructure and increases the probability of supply disruption. For example, many vital ports may fall victim to flooding and “land sinking” due to rising sea levels. Furthermore, rising temperatures will likely result in the faster deterioration of asphalt and rail lines. Therefore, large investments in infrastructure maintenance and repair will be required to sustain current distribution networks. In addition, climate change will likely bring increased frequency of natural disasters including wildfires, hurricanes and earthquakes. These events pose the risk of supply disruption. Resource availability. A final risk that is prevalent in today’s supply chains is that of cyber attacks. This technological risk has arisen due to the crucial nature of software, data, and the Internet in today’s business environments. Furthermore, this risk has been accentuated due to an increase in the sharing of information between supply chain partners in recent times. The recent trend of building strategic relationships, fostering integrative communication and increasing data transparency between channel partners leaves firms more susceptible to cyber attacks than ever before. This is because, although internal cyber security can be effectively managed, it is much harder to ensure that all suppliers and customers comply with security standards to protect sensitive information. This is exemplified by the finding that “at least 59% of organizations have suffered cyberattacks through third-party companies” (Scott, 2019). One of the most prevalent forms of cyber attacks is the data breach, in which sensitive information is exposed to criminals. As an example, the Equifax breach in 2018 resulted in criminals obtaining the personal data of at least 143 million people (Scott, 2019). These data breaches pose the ominous risk of negatively impacting a firm’s reputation and decreasing goodwill. Other sensitive data that may be at risk to a data breach can include the financial dealings of organizations and intellectual property information. The probability of cyber attacks is ever-rising in today’s technology-driven environment, and the impact can be enormous, thus stimulating substantial risk. It has been found that “if a company evaluates the security and privacy policies of all its suppliers, the likelihood of a breach falls from 66 percent to 46 percent” (Korolov, 2019). Therefore, to mitigate this risk, firms should ensure to periodically audit supplier cyber security systems and policies to identify potential issues.