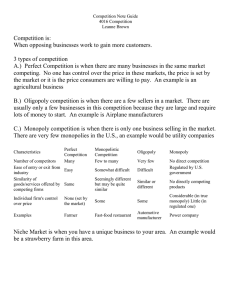

Monopoly 0 Introduction Monopoly A firm that is the sole seller of a product without close substitutes Has market power The ability to influence the market price of the product it sells A competitive firm has no market power Arise due to barriers to entry Other firms cannot enter the market to compete with it 1 Three Barriers to Entry 1. Monopoly resources A single firm owns a key resource. E.g., DeBeers owns most of the world’s diamond mines 2. Government regulation The government gives a single firm the exclusive right to produce the good. E.g., patents, copyright laws 2 Three Barriers to Entry 3. The production process Natural monopoly: a single firm can produce the entire market Q at lower cost than could several firms Example: 1000 homes need electricity. ATC is lower if one firm services all 1000 homes than if two firms each service 500 homes. Cost $80 Electricity ATC slopes downward due to huge FC and small MC $50 ATC 500 1000 Q 3 Monopoly vs. Competition: Demand A monopolist’s P A competitive firm’s Curves P demand curve demand curve D D Q Q In a competitive market, the market demand curve slopes downward. But the demand curve for any individual firm’s product is horizontal at the market price. The firm can increase Q without lowering P, so MR = P for the competitive firm. A monopolist is the only seller, so it faces the market demand curve. To sell a larger Q, the firm must reduce P. Thus, MR ≠ 4 P. Active Learning 1 A monopoly’s revenue Common Grounds is the only seller of cappuccinos in town. The table shows the market demand for cappuccinos. Fill in the missing spaces of the table. What is the relation between P and AR? Between P and MR? 5 Q P 0 $4.50 1 4.00 2 3.50 3 3.00 4 2.50 5 2.00 6 1.50 TR AR n.a. MR Active Learning 1 P = AR, same as for a competitive firm. MR < P, whereas MR = P for a competitive firm. 6 Answers Q P TR AR 0 $4.50 $0 n.a. 1 4.00 4 $4.00 2 3.50 7 3.50 3 3.00 9 3.00 4 2.50 10 2.50 5 2.00 10 2.00 6 1.50 9 1.50 MR $4 3 2 1 0 –1 Common Grounds’ D and MR P,Curves MR Q P 0 $4.50 1 4.00 2 3.50 3 3.00 4 2.50 5 2.00 6 1.50 MR $4 3 2 1 0 –1 $5 4 3 2 1 0 -1 -2 -3 Demand curve (P) MR 0 1 2 3 4 5 6 7 Q 7 Understanding the Monopolist’s MR Increasing Q has two effects on revenue: Output effect: higher output raises revenue Price effect: lower price reduces revenue Marginal revenue, MR < P To sell a larger Q, the monopolist must reduce the price on all the units it sells 8 Profit-Maximization Like a competitive firm, a monopolist maximizes profit by producing the quantity where MR = MC Sets the highest price consumers are willing to pay for that quantity It finds this price from the D curve 9 Profit-Maximization Costs and Revenue The profitmaximizing Q is where MR = MC. Find P from the demand curve at this Q. MC P D MR Q Quantity Profit-maximizing output 10 The Monopolist’s Profit As with a competitive firm, the monopolist’s profit equals Costs and Revenue MC P ATC ATC D (P – ATC) x Q MR Q Quantity 11 A Monopoly Does Not Have an S Curve A competitive firm takes P as given Has a supply curve that shows how its Q depends on P A monopoly firm is a “price-maker” Q does not depend on P Q and P are jointly determined by MC, MR, and the demand curve Hence, no supply curve for monopoly. 12 The Welfare Cost of Monopoly Recall: Competitive market equilibrium: P = MC and total surplus is maximized Monopoly equilibrium, P > MR = MC The value to buyers of an additional unit (P) exceeds the cost of the resources needed to produce that unit (MC) The monopoly Q is too low – could increase total surplus with a larger Q. Monopoly results in a deadweight loss 13 The Welfare Cost of Monopoly Competitive equilibrium: • quantity = QC • P = MC • total surplus is maximized Price Deadweight MC loss P P = MC MC D Monopoly equilibrium: • quantity = QM • P > MC • deadweight loss MR QM QC Quantity 14 Price Discrimination Price discrimination: Sell the same good at different prices to different buyers A firm can increase profit by charging a higher price to buyers with higher willingness to pay Requires the ability to separate customers according to their willingness to pay Can raise economic welfare 15 Price Discrimination in the Real World Perfect price discrimination Not possible in the real world No firm knows every buyer’s WTP Buyers do not reveal it to sellers Price discrimination Firms divide customers into groups based on some observable trait that is likely related to willingness to pay (WTP), such as age 16 Examples of Price Discrimination Movie tickets Discounts for seniors, students, and people who can attend during weekday afternoons. Lower WTP than people who pay full price on Friday night Airline prices Discounts for Saturday-night stayovers Business travelers (higher WTP) vs. more pricesensitive leisure travelers 17 Examples of Price Discrimination Discount coupons People who have time to clip and organize coupons are more likely to have lower income and lower WTP than others Need-based financial aid Low income families have lower WTP for their children’s college education Schools price-discriminate by offering need-based aid to low income families 18 Examples of Price Discrimination Quantity discounts A buyer’s WTP often declines with additional units, so firms charge less per unit for large quantities than small ones. Example: A movie theater charges $4 for a small popcorn and $5 for a large one that’s twice as big 19 Topic: Oligopoly 20 Measuring Market Concentration Concentration ratio: the percentage of the market’s total output supplied by its four largest firms. The higher the concentration ratio, the less competition. This chapter focuses on oligopoly, a market structure with high concentration ratios. OLIGOPOLY 21 Concentration Ratios in Selected U.S. Industries Industry Video game consoles Tennis balls Credit cards Batteries Soft drinks Web search engines Breakfast cereal Cigarettes Greeting cards Beer Cell phone service Autos Concentration ratio 100% 100% 99% 94% 93% 92% 92% 89% 88% 85% 82% 79% Oligopoly Oligopoly: a market structure in which only a few sellers offer similar or identical products. Strategic behavior in oligopoly: A firm’s decisions about P or Q can affect other firms and cause them to react. The firm will consider these reactions when making decisions. Game theory: the study of how people behave in strategic situations. OLIGOPOLY 23 EXAMPLE: Cell Phone Duopoly in Smalltown Smalltown has 140 residents P Q $0 140 5 130 10 120 15 110 20 100 25 90 30 80 (duopoly: an oligopoly with two firms) 35 70 Each firm’s costs: FC = $0, MC = $10 40 60 45 50 OLIGOPOLY The “good”: cell phone service with unlimited anytime minutes and free phone Smalltown’s demand schedule Two firms: T-Mobile, Verizon 24 EXAMPLE: Cell Phone Duopoly in Smalltown P Q $0 140 5 130 650 1,300 –650 10 120 1,200 1,200 0 15 110 1,650 1,100 550 20 100 2,000 1,000 1,000 25 90 2,250 900 1,350 30 80 2,400 800 1,600 35 70 2,450 700 1,750 40 60 2,400 600 1,800 45 50 2,250 500 1,750 OLIGOPOLY Revenue Cost Profit $0 $1,400 –1,400 Competitive outcome: P = MC = $10 Q = 120 Profit = $0 Monopoly outcome: P = $40 Q = 60 Profit = $1,800 25 EXAMPLE: Cell Phone Duopoly in Smalltown One possible duopoly outcome: collusion Collusion: an agreement among firms in a market about quantities to produce or prices to charge T-Mobile and Verizon could agree to each produce half of the monopoly output: For each firm: Q = 30, P = $40, profits = $900 Cartel: a group of firms acting in unison, e.g., T-Mobile and Verizon in the outcome with collusion OLIGOPOLY 26 Collusion vs. Self-Interest Both firms would be better off if both stick to the cartel agreement. But each firm has incentive to renege on the agreement. Lesson: It is difficult for oligopoly firms to form cartels and honor their agreements. OLIGOPOLY 27 The Equilibrium for an Oligopoly Nash equilibrium: a situation in which economic participants interacting with one another each choose their best strategy given the strategies that all the others have chosen Our duopoly example has a Nash equilibrium in which each firm produces Q = 40. Given that Verizon produces Q = 40, T-Mobile’s best move is to produce Q = 40. Given that T-Mobile produces Q = 40, Verizon’s best move is to produce Q = 40. OLIGOPOLY 28 A Comparison of Market Outcomes When firms in an oligopoly individually choose production to maximize profit, oligopoly Q is greater than monopoly Q but smaller than competitive Q. oligopoly P is greater than competitive P but less than monopoly P. OLIGOPOLY 29 The Output & Price Effects Increasing output has two effects on a firm’s profits: Output effect: If P > MC, selling more output raises profits. Price effect: Raising production increases market quantity, which reduces market price and reduces profit on all units sold. If output effect > price effect, the firm increases production. If price effect > output effect, the firm reduces production. OLIGOPOLY 30 The Size of the Oligopoly As the number of firms in the market increases, the price effect becomes smaller the oligopoly looks more and more like a competitive market P approaches MC the market quantity approaches the socially efficient quantity Another benefit of international trade: Trade increases the number of firms competing, increases Q, brings P closer to marginal cost OLIGOPOLY 31 Game Theory Game theory helps us understand oligopoly and other situations where “players” interact and behave strategically. Dominant strategy: a strategy that is best for a player in a game regardless of the strategies chosen by the other players Prisoners’ dilemma: a “game” between two captured criminals that illustrates why cooperation is difficult even when it is mutually beneficial OLIGOPOLY 32 Example: Negative Campaign Ads Election with two candidates, “R” and “D.” If R runs a negative ad attacking D, 3000 fewer people will vote for D: 1000 of these people vote for R, the rest abstain. If D runs a negative ad attacking R, R loses 3000 votes, D gains 1000, 2000 abstain. R and D agree to refrain from running attack ads. Will each one stick to the agreement? OLIGOPOLY 33 Example: Negative Campaign Ads Each candidate’s dominant strategy: run attack ads. R’s decision Do not run attack ads (cooperate) Do not run attack ads (cooperate) D’s decision Run attack ads (defect) OLIGOPOLY no votes lost or gained no votes lost or gained Run attack ads (defect) R gains 1000 votes D loses 3000 votes R loses 3000 votes D gains 1000 votes R loses 2000 votes D loses 2000 votes 34 Another Example: Negative Campaign Ads Nash eq’m: both candidates run attack ads. Effects on election outcome: NONE. Each side’s ads cancel out the effects of the other side’s ads. Effects on society: NEGATIVE. Lower voter turnout, higher apathy about politics, less voter scrutiny of elected officials’ actions. OLIGOPOLY 35