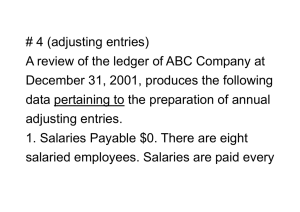

Chapter 5 The Accounting Cycle: Adjustments learning OBJECTIVES LO 1 Describe the purpose of adjustments LO 5 Prepare adjusting entries for prepaid expenses LO 2 Prepare adjusting entries for accrued revenue LO 6 Prepare adjusting entries for depreciation LO 3 Prepare adjusting entries for accrued expenses LO 7 Prepare an adjusted trial balance LO 4 Prepare adjusting entries for unearned revenue LO 8 escribe ethics and internal controls related to D adjusting entries Access ameengage.com for integrated resources including tutorials, practice exercises, the digital textbook and more. Assessment Questions AS-1 LO 1 What is an accounting period? AS-2 LO 1 Is a fiscal year always the same as a calendar year? Explain how a natural business year is related to a fiscal year. AS-3 LO 1 Why must adjustments be made at the end of the accounting period? AS-4 LO 1 What does accrual-based accounting state regarding revenue and expenses? 169 Page 173 Dashed Line=Trim Solid Line=Bleed Allowance Output Date: Mar_08_2018 Job Number: 562735 Chapter 5 AS-5 The Accounting Cycle: Adjustments LO 1 What are the five broad categories of adjusting entries? AS-6 LO 2 Define accrued revenue. AS-7 LO 2 When making an adjustment to record accrued revenue, which accounts are used and how are they affected? AS-8 LO 3 Define accrued expenses. AS-9 LO 3 When making an adjustment to record accrued interest on a bank loan, which accounts are used and how are they affected? AS-10 LO 4 When making an adjustment to record unearned revenue that is now earned, which accounts are used and how are they affected? AS-11 LO 5 When making an adjustment to record the used portion of prepaid insurance, which accounts are used and how are they affected? AS-12 LO 6 When making an adjustment to record depreciation on equipment, which accounts are used and how are they affected? 170 Page 174 Dashed Line=Trim Solid Line=Bleed Allowance Output Date: Mar_08_2018 Job Number: 562735