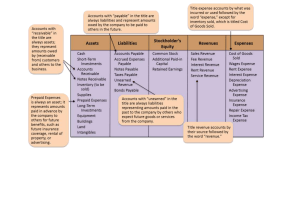

I will walk you through each of the five types of adjusting entries in lots of detail. If you are adjusting, you need something to adjust from and something to adjust to. You are adjusting from a cash accounting based trial balance to an accrual accounting based trial balance. Let’s get some of these bank transactions onto a trial balance, and then start adjusting. We are going to record a few sample cash transactions for a training and consulting company that also runs a YouTube channel, and then produce a “cash accounting” based trial balance. As you pay and get paid for things, you debit and credit accounts. The company receives payments from customers. For the moment, all of these get recorded as revenues. Cash=balance sheet Revenue- income Statement There are two categories of adjusting entries: adjusting entries that deal with SOMETHING, and adjusting entries that deal with NOTHING. If an adjusting entry deals with SOMETHING, then something has been entered in the general ledger, but the amount needs to be moved or split between accounting periods. The three types of adjusting journal entries in this category are: prepaid expenses, deferred (or “unearned”) revenue, and depreciation. If an adjusting entry deals with NOTHING, then we have a case where nothing has been entered in the general ledger yet, but certain expenses or revenues did occur that need to accounted for in the current period. The two types of adjusting journal entries in this category are: accrued expenses and accrued revenue. In total, there are two categories and five types of adjusting entries. The common theme is that we want to put revenues and expenses in the period they belong. Revenues are recognized when earned and expenses are recognized when incurred. So half of the amount relates to the current year, and the other half to next year. 05:07 If we left the full amount in expenses for the current year, 05:10 we would be overstating expenses. 05:13 We need to move half of the amount to next year, split it between two accounting periods. Different journal entries, same end result in terms of movement by account: prepaid expense on the balance sheet gets a net debit of $250, subscription expense a net debit of $250, and cash a net credit movement of $500. Deferred revenue You could conceptually call this adjusting entry “prepaid revenue”, but the common name for it is deferred revenue or unearned revenue. Deferred revenue is a liability, because if you fail to provide the services agreed in the contract in the future, you will have to pay the money back. The third type of adjusting entry is depreciation. This is a case where an amount needs to be split not just between two accounting periods, but multiple periods. Depreciation allocates the amount paid for the fixed asset to current expense in those periods expected to benefit from the use of the asset. In the case of a laptop, the useful economic life is expected to be five years, and no residual value is expected. Prepaid expenses, deferred revenue, and depreciation, are adjusting journal entries dealing with SOMETHING: something has been entered in the general ledger, but the amount needs to be moved or split between accounting periods. We are looking for cases where nothing has been recorded yet, but certain expenses or revenues did occur that need to accounted for in the current period. ACCRUED EXPENSES We are looking for cases where nothing has been recorded yet, but certain expenses or revenues did occur that need to accounted for in the current period. We don’t want to understate current period expenses! This is a type of revenue for which you don’t have to send an invoice, YouTube prepares 11:20 the overviews for you on the YouTube Analytics dashboard, and transfer you the money. 11:25 In February, you receive payment for your January revenue. 11:30 In March, you receive payment for your February revenue. 11:33 And on and on and on through the year. What’s important for our adjusting entries, is that in January of next ye ar, you receive 11:41 payment for your channel revenue that you earned in December. 11:45 We want to capture that revenue in the current year, as we don’t want to understate revenue. Old trial balance, there is movement, then it will show a new trial balance. Adjusting entries almost always involve a balance sheet account 13:03 and an income statement account. 13:07 Here’s a summary table with the four possible combinations: revenues versus expenses, and 13:12 accrued versus deferred or prepaid. Deferred revenue adjusting entries occur when revenue is earned after the invoice is sent 13:36 and/or the payment is received, the recognition of the revenue needs to be postponed to a 13:42 future period as you have not earned it yet. 13:48 Accrued expense adjusting entries occur when expenses are incurred before the invoice is 13:52 received and/or payment is made, the expenses need to be captured in the current period 13:58 as this is when you have incurred them. 14:02 Prepaid expense and depreciation adjusting entries occur when expenses are incurred after 14:07 the invoice is received and/or payment is made, the expenses need to be moved or split 14:13 between accounting periods.