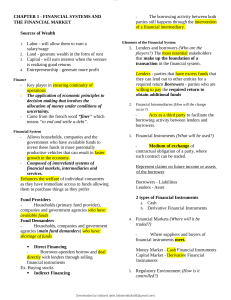

Finance -key player in ensuring continuity of operations. Finance - French 'finer' > to end and settle a debt. Sources of Wealth Entrepreneurship - Profit Capital - Interest Land - Rent Labor - Salaries/Wages Tools used in financial decision-making - drawn from: Mathematics Statistics Psychology Accountancy Deals in providing quantitative information. Focuses of capital markets study: 1. Financial System 2. Structure of Interest Rates 3. Pricing of Assets Financial System -> Financial system permits an efficient method to move funds between entities who have funds and entities who need funds. Fund providers - have available funds because they spend less than their income Fund demanders - have fund shortage because they spend more than their income. Funds can flow in two routes Direct Financing - borrower-spenders borrow and deal directly with lenders through selling financial instruments. Indirect Financing - borrowing activity happens indirectly through the intervention of financial intermediaries. -> Transfer of funds allows parties to gain some return. -> A properly functioning financial system also enhances welfare of individual consumers as they have immediate access to funds. Flow back of fund Business enterprise - through profit Government - through taxes Investors - through interest or dividends. -> Efficient financial markets enhance the economic well-being of all members of the society. ELEMENTS OF FINANCIAL SYSTEM 1. Lenders and borrowers (who are the players) o without these two parties, the financial system will not exist. 2. Financial Intermediaries (how will the exchange occur) o acts as third party to facilitate borrowing activity between lenders and borrowers. o gather funds from lenders and redistribute to borrowers through investment vehicle 3. Financial Instruments (what will be used) o medium of exchange of contractual obligation of a party where such contract can be traded. 4. Financial Markets (where will it be traded) o same with other economic markets where suppliers and buyers of financial instruments meet. 5. Regulatory Environment (how is it controlled) o governance body to ensure that the transactions that occur between financial systems complies with the laws and regulations 6. Money Creation (what is the value it creates) o used to either be reinvested or earned out of the system flows 7. Price Discovery (how much is created) o the process of determining or valuing the financial instrument in the market THE FINANCIAL MARKETS channels where funds and financial instruments are exchanged between willing entities/individuals. provide additional options to lenders and borrowers on which form they want their transaction to be in. -> exchanging of financial instruments is also known as trading 3 Major Economic Functions of Financial Instruments 1. Price Discovery o interaction between buyers and sellers in the financial market in order to come up with the price of the traded financial instrument. o Price level willing to be bought by buyer willing to be sold by seller 2. Liquidity o easy access to a venue where investors can sell their financial instruments for cash 3. Reduction in Transaction Costs o transaction costs are incurred of parties' transaction to trade a financial instruments. Two types: a. Search Cost costs incurred to look for financial instruments that can be purchased or sold by a party b. Information Cost costs related in evaluating investment characteristics of a financial instrument. information gathered a. profitability b. liquidity c. stability d. market value TYPES OF FINANCIAL MARKETS Based on Instruments Traded Money Market o short-term security o sector where financial instruments that will mature or be redeemed in one year or less from issuance date are traded o not exclusive for short-term investors. Long-term investors also need it to meet their shortterm liquidity needs. o offer an investment opportunity that yields a higher return than just mere holding of cash. o very liquid and easily convertible to cash and has very little default risk Capital Market o financial Instruments issued by governments and corporations that will mature beyond one year from issuance date are traded. Based on Market Type Primary Market a. Public Offering securities are offered for sale to the general public b. Private Placement the issuer looks for a single investor, an institutional buyer or group of buyers to purchase the whole securities issuance instead of offering it to the general public. c. Auction Usually used for issuance of treasury bills, bonds and other securities Dutch Auction Seller begins the sale at a high price English Auction prospective buyers commence the auction by submitting an initial bid price Descending Price Sealed Auction bidders submit sealed bid to the sellers d. Tap Issue issuers are open to receive bids for their securities at all times Secondary Market o securities issued in primary market are subsequently traded, resold and repurchased Economic functions o Price Discovery secondary market provides information about prices of the securities traded which can influence economic decisions o Liquidity and Reduction in Borrowing Cost secondary market allows active trading which improves liquidity and marketability of the securities o Support to the Primary Market price discovery helps in giving information that can be helpful in a. setting prices for new issuances executed in the primary market b. assessing receptiveness of the market for new issuances o Implementation of Monetary Policy secondary market allows regulators such as BSP to trade securities to influence liquidity and interest rates set in the financial system Classification based on Market Structure o Order-Driven the buyers and sellers propose their price through their brokers who conveys the bid in centralized location Market orders deals with the instruction to execute transaction at the prevailing best market price Limit orders orders placed where clients set a price or price range that may be below/above the existing price Day orders orders placed that only valid until the end of the business day Good-until-cancelled orders orders placed that remains valid for a sustained period up until the client voluntarily cancels o Quote-Driven Market Structure the market makers establish a price quote at which the market participants should trade with Based on Where Financial Instruments are Traded Exchange o financial instruments are purchased or sold between market participants Over-the-counter o unlisted financial instruments are allowed to be traded o can also be done through computers o market do not have formalized mechanisms to regulate transactions unlike exchanges Based on Country's Perspective Internal or National Market Financial market operating in a certain country o Domestic Market Market where issuers who are considered residents in a country issue the securities and where these securities are traded afterwards o Foreign Market Market where issuers who are not residents of a country can sell or issue securities and subsequently traded External Market a. Upon issuance, offered simultaneously to investors in different countries b. Securities are issued outside the regulatory jurisdiction of any single country Based on Manner of Financial Intermediaries In a broker market o the buyer and the seller of the securities are brought together by a broker and the trade occurs at that point In a dealer market o the buyer and seller are not brought directly together by a third party. Instead, market makers execute the sell or buy orders Reference: Lascano, M.V., Baron, H.C., and Cachero, A.L. (2019) Fundamentals of Financial Markets.