Chapter2. Financial Markets & Institutions Markets? Financial vs

advertisement

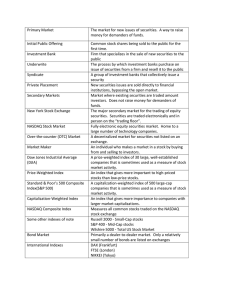

Chapter2. Financial Markets & Institutions - Markets? - Financial vs. Physical Asset Markets * Roles and Functions of Financial Markets (p.28 – p.29) 1) Major role: Surplus ->$-> Deficit, create Financial Assets (stocks, bonds, loans, etc) Why imbalance? = different cash flow streams and needs for cash over time Three types of money transfer (p.28) = direct (no middlemen, but finding your counterpart is difficult), indirect using a broker (just a facilitator, commission), indirect using a dealer (carrying inventories, profits from bid-asked difference, spread) Aside) Asked=price to sell, Bid=price to buy from a dealers’ perspective, Asked price ($25) – bid ($24.5) = spread ($0.50). If 100 shares, then the dealer profit $50. -Alternative ways to divide financial markets into (two) different groups: A) Money vs. Capital Markets (p.30): Money market is a short-term security (money market instrument) market, where short-term debt securities are traded. Capital market is where longterm debt instruments and equity securities (common stock) are traded. Short-term? Maturities less than or equal to one year. Examples of Money market instruments(=securities): T Bills, CDs, CPs, Euro$ Deposits, BAs Examples of Capital market instruments: T Notes, T Bonds, Municipal Bonds (Munis), Corporate Bonds, Preferred Stocks, Common Stocks, etc B) Primary vs. Secondary Markets -> Primary Markets: Brand new securities are issued for the first time. New car market, an influx of capital to the issuer 1) Investment banker (p.34) ~ Goldman Sachs, J P Morgan, Analysis and advice, Underwriting (best effort vs. firm commitment), Selling, Market stabilization 2) Flotation cost = cost of issuing securities. Ex. Amount to raise $100m, Floatation cost 5% => $5m. 3) IPO (auction, eg. Dutch)=Initial Public Offering=Private company going public by selling their ownership to the public. Seasoned Public Offering=more shares issued by already a public company Aside) The market clearing price in the Dutch auction is the highest price at which all the shares will be sold. Every buyer will pay the same market clearing price. Aside) Oversubscription: demand for IPO is greater than the number of the security issued 4) Private placement: inviting only a few major investors (many of them are institutional investors like banks, insurance companies, mutual funds, etc) -Advantages (less government regulations, easy, smaller flotation costs, etc) and Disadvantages (limiting your investor pool and get smaller receipts, still deal with professional investors and end up costing more to raise money) -> Secondary Markets: the place where existing securities are traded. Used car market. No additional influx of money to the issuer. Organized Markets (Exchanges) vs. OTC (Over-The-Counter, unorganized markets) Aside) Exchanges (p.39), NYSE, ASE ~ organized markets. Physically exist. NASD (Bernard Madoff) and NASDAQ (National Assn of Securities Dealers Automatic Quotation system)~ a computer system serving the OTC market. Aside: Series Exams ~ licensing Aside: SEC registration requirements vs. listing requirements C) Public vs. Private Markets (may be able to deal with securities not registered with SEC) * Behavior of Financial Markets 1) Market indexes (p.45) ~ DOW Jones Industrial (DJI), S&P 500, NASDAQ, Russell, etc 2) Models of stock price behavior (p.46 – p.50) Technical Fundamental Efficient market hypothesis: Intrinsic value=> buy & sell Random walk * Other Markets: Currency Markets, Derivative Markets including Futures (fix the price today for future trading), Options, etc. Derivative market instruments are for either speculation or hedging. QUIZ #1 If Asked price is $24.20 and the Bid price is $24, What is the Spread and how much is the dealer’s profit trading 1,000 shares? #2 If the flotation cost of raising $300m is 4%, what is the cost in $ amount and how much is the net influx of capital to the issuing company?