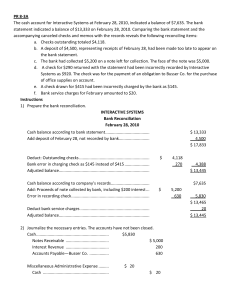

Financial 8 81. A bank statement includes: A. A list of outstanding checks. B. A list of petty cash amounts. C. The beginning and the ending balance of the depositor's account. D. A listing of deposits in transit. E. All of these. 109. An analysis that explains any differences between the checking account balance according to the depositor's records and the balance reported on the bank statement is a(n): A. Internal audit. B. Bank reconciliation. C. Bank audit. D. Trial reconciliation. E. Analysis of debits and credits. 110. On a bank reconciliation, an unrecorded debit memorandum for printing checks is: A. Noted as a memorandum only. B. Added to the book balance of cash. C. Deducted from the book balance of cash. D. Added to the bank balance of cash. E. Deducted from the bank balance of cash. 111. Outstanding checks refer to checks that have been: A. Written, recorded, sent to payees, and received and paid by the bank. B. Written and not yet recorded in the company books. C. Held as blank checks. D. Written, recorded on the company books, sent to the payee, but have not yet been paid by the bank. E. Issued by the bank. 112. On a bank reconciliation, the amount of an unrecorded bank service charge should be: A. Added to the book balance of cash. B. Deducted from the book balance of cash. C. Added to the bank balance of cash. D. Deducted from the bank balance of cash. E. Noted in memorandum form only. 113. A check that was outstanding on last period's bank reconciliation was not among the cancelled checks returned by the bank this period. As a result, in preparing this period's reconciliation, the amount of this check should be: A. Added to the book balance of cash. B. Deducted from the book balance of cash. C. Added to the bank balance of cash. D. Deducted from the bank balance of cash. E. Ignored in preparing the period's bank reconciliation. Financial 9 The following information is available for the Avisa Company for the month of November. a) On November 30, after all transactions have been recorded, the balance in the company's Cash account has a balance of $27,202. b) The company's bank statement shows a balance on November 30 of $29,279. c) Outstanding checks at November 30 include check #3030 in the amount of $1,525 and check #3556 in the amount of $1,459. d) A credit memo included with the bank statement indicates that the bank collected $780 on a noninterest-bearing note receivable for Avisa. The bank deducted a $10 collection fee, and credited the remainder of $770 to Avisa's account. e) A debit memo included with the bank statement shows a $67 NSF check from a customer, J. Brown. f) A deposit placed in the bank's night depository on November 30 totaled $1,675, and did not appear on the bank statement. g) Examination of the checks on the bank statement with the entries in the accounting records reveals that check #3445 for the payment of an account payable was correctly written for $2,450, but was recorded in the accounting records as $2,540. h) Included with the bank statement was a debit memorandum in the amount of $25 for bank service charges. It has not been recorded on the company's books. Required:1. Prepare the November bank reconciliation for the Avisa Company. 2. Prepare the general journal entries to bring the company's book balance of cash into conformity with the reconciled balance as of November 30. Financial 10 Solution Bank reconcliation Cash balance per bank 29279 Cash balance per book Add Deposit in transit Add 1675 Collection of note Error in account payable (2540-2450) Deduct (1525) NSF (account receivable) (1429) Service chrage Collection fees Deduct Outstanding checks #3030 #3556 Adjusted cash balance 27202 780 90 (67) (25) (10) 27970 Adjusted cash balance 27970 b) journal entry Dr التسجيل عند الشركه فقط Cash Cr 870 Note receivable Error in account payable Account receivable – NSF Bank service expense Collection expense Cash 780 90 67 25 10 102 واحدentry ممكن نعمل Account receivable – NSF Bank service expense Collection expense Cash متمم Note receivable Error in account payable 67 25 10 768 780 90 Financial 11 Prepare a bank reconciliation for Jamboree Enterprises for the month ended November 30, 2011. The following information is available to reconcile Jamboree Enterprises’ book balance of cash with its bank statement balance as of November 30, 2011: a. After all posting is complete on November 30, the company’s book balance of Cash has a $16,380 debit balance, but its bank statement shows a $38,520 balance. b. Checks No. 2024 for $4,810 and No. 2026 for $5,000 are outstanding. c. In comparing the canceled checks on the bank statement with the entries in the accounting records, it is found that Check No. 2025 in payment of rent is correctly drawn for $1,000 but is erroneously entered in the accounting records as $880. d. The November 30 deposit of $17,150 was placed in the night depository after banking hours on that date, and this amount does not appear on the bank statement. e. In reviewing the bank statement, a check written by Jumbo Enterprises in the amount of $160 was erroneously drawn against Jamboree’s account. f. A credit memorandum enclosed with the bank statement indicates that the bank collected a $30,000 note and $900 of related interest on Jamboree’s behalf. This transaction was not recorded by Jamboree prior to receiving the statement. g. A debit memorandum for $1,100 lists a $1,100 NSF check received from a customer, Marilyn Welch. Jamboree had not recorded the return of this check before receiving the statement. h. Bank service charges for November total $40. These charges were not recorded by Jamboree before receiving the statement. Financial 12 Solution Bank reconcliation Cash balance per bank 38520 Cash balance per book 16380 Add Add Deposit in transit 17150 Collection of note Bank error النه خصم مني مبلغ مش بتاعي160 Interest revenue 30,000 900 Deduct Outstanding checks #2024 #2026 Deduct NSF (account receivable) (4810) Service chrage (5000) Error in rent (1000 -880) (1,100) (40) (120) Adjusted cash balance 46020 Adjusted cash balance 46020 b) journal entry Dr التسجيل عند الشركه فقط Cash Note receivable Interest revenue Account receivable – NSF Bank service expense Error in rent Cash Cr 30,900 30,000 900 1,100 40 120 1260 Financial 13 The following information is available to reconcile Severino’s Co. book balance of cash with its bank statement cash balance as of December 31, 2017 a. The December 31 cash balance according to the accounting records is $32878.30 and the bank statement cash balance for that date is $46,822.40 b. Checks No. 1273 for $4,589.30 and check No. 1282 for $400, both written and entered in the accounting records in December, are not among the cancelled checks. Two checks No. 1231 for $2289 and No. 410.40, were outstanding on the most recent November 30 reconciliation. Check No. 1231 is listed in the December canceled checks. c. When the December checks are compared with entries in the accounting records, it is found that check No. 1267 had been correctly drawn for $3456 to pay office supplies but was erroneously entered in the accounting records as $3,465 d. Two memoranda are enclosed with the statement and are unrecorded at the time of the reconciliation. The first is for $762.50 that dealt with an NSF check ($745 NSF check from customer and $17.50 fees for processing it). The second $99 in miscellaneous expense for check printing. e. The bank statement shows that the bank collected $19000 cash on note receivable for the company, deducted $20 collection fees. f. Severino’s company December 31 daily cash receipts of $9583.10 were placed in the bank’s night depository on that date but not appear on the December bank statement. Financial 14 Solution Bank reconcliation Cash balance per bank 46,822.40 Cash balance per book Add Collection of note Error in supplies (3465 -3456) 32,878.30 Add Deposit in transit 9,583.10 Deduct Outstanding checks # 1273 #1282 #1242 Deduct (4,589.30) NSF (account receivable) (400) Printing check (410.40) Collection fess (762.5) (99) (20) Adjusted cash balance 51005.8 51005.8 Adjusted cash balance 19,000 9 b) journal entry Dr التسجيل عند الشركه فقط Cash Note receivable Error in supplies Account receivable – NSF Printing checks expense Collection fees expense Cash Cr 19,009 19,000 9 762.5 99 20 881.5