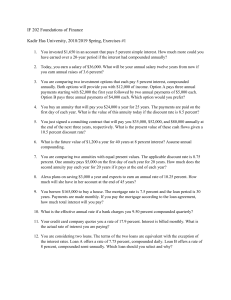

Chapter 05 The Time Value of Money True / False Questions Compound interest pays interest for each time period on the original investment plus the accumulated interest. True False When money is invested at compound interest, the growth rate is the interest rate. True False The present value of an annuity due equals the present value of an ordinary annuity times the discount rate. True False The more frequent the compounding, the higher the future value, other things equal. True False A dollar tomorrow is worth more than a dollar today. True False The Excel function for future value is FV (rate, nper, pmt, PV). True False For a given amount, the lower the discount rate, the less the present value. True False Comparing the values of undiscounted cash flows is analogous to comparing apples to oranges. True False To calculate present value, we discount the future value by some interest rate r, the discount rate. True False The discount factor is used to calculate the present value of $1 received in year t. True False You should never compare cash flows occurring at different times without first discounting them to a common date. True False The Excel function for present value is PV (rate, nper, pmt, FV). True False A perpetuity is a special form of an annuity. True False An annuity factor represents the future value of $1 that is deposited today. True Accrued interest declines with each payment on an amortizing loan. True False False Converting an annuity to an annuity due decreases the present value. True False The term "constant dollars" refers to equal payments for amortizing a loan. True False An annuity due must have a present value at least as large as an equivalent ordinary annuity. True False Any sequence of equally spaced, level cash flows is called an annuity. An annuity is also known as a perpetuity. True False A mortgage loan is an example of an amortizing loan. "Amortizing" means that part of the monthly payment is used to pay interest on the loan and part is used to reduce the amount of the loan. True False The Excel function for interest rate is RATE (nper, pmt, PV, FV). True False An effective annual rate must be greater than an annual percentage rate. True False An annual percentage rate (APR) is determined by annualizing the rate using compound interest. True False In 2002, the U.S. inflation rate was below 2% and a few countries were even experiencing deflation. True False Nominal dollars refer to the amount of purchasing power. True False The appropriate manner of adjusting for inflationary effects is to discount nominal cash flows with real interest rates. True False Multiple Choice Questions What is the future value of $10,000 on deposit for 5 years at 6% simple interest? A. $7,472.58 B. $10,303.62 C. $13,000.00 D. $13,382.26 Under which of the following conditions will a future value calculated with simple interest exceed a future value calculated with compound interest at the same rate? The interest rate is very high. The investment period is very long. The compounding is annually. This is not possible with positive interest rates. How much interest is earned in just the third year on a $1,000 deposit that earns 7% interest compounded annually? A. $70.00 B. $80.14 C. $105.62 D. $140.00 How much interest will be earned in the next year on an investment paying 12% compounded annually if $100 was just credited to the account for interest? A. $88 B. $100 C. $112 D. $200 The concept of compound interest refers to: earning interest on the original investment. payment of interest on previously earned interest. investing for a multiyear period of time. determining the APR of the investment. When an investment pays only simple interest, this means: the interest rate is lower than on comparable investments. the future value of the investment will be low. the earned interest is nontaxable to the investor. interest is earned only on the original investment. Approximately how long must one wait (to the nearest year) for an initial investment of $1,000 to triple in value if the investment earns 8% compounded annually? 9 years 14 years 22 years 25 years How much will accumulate in an account with an initial deposit of $100, and which earns 10% interest compounded quarterly for 3 years? A. $107.69 B. $133.10 C. $134.49 D. $313.84 What will be the approximate population of the United States, if its current population of 300 million grows at a compound rate of 2% annually for 25 years? 413 million 430 million 488 million 492 million How much interest can be accumulated during one year on a $1,000 deposit paying continuously compounded interest at an APR of 10%? A. $100.00 B. $105.17 C. $110.50 D. $115.70 How much interest will be earned in an account into which $1,000 is deposited for one year with continuous compounding at a 13% rate? A. $130.00 B. $138.83 C. $169.00 D. $353.34 What is the discount factor for $1 to be received in 5 years at a discount rate of 8%? A. .4693 B. .5500 C. .6000 D. .6806 Assume the total expense for your current year in college equals $20,000. Approximately how much would your parents have needed to invest 21 years ago in an account paying 8% compounded annually to cover this amount? A. $952.00 B. $1,600.00 C. $1,728.00 D. $3,973.00 How much must be deposited today in an account earning 6% annually to accumulate a 20% down payment to use in purchasing a car one year from now, assuming that the car's current price is $20,000, and inflation will be 4%? A. $3,774 B. $3,782 C. $3,925 D. $4,080 Given a set future value, which of the following will contribute to a lower present value? Higher discount rate Fewer time periods Less frequent discounting Lower discount factor Cash flows occurring in different periods should not be compared unless: interest rates are expected to be stable. the flows occur no more than one year from each other. high rates of interest can be earned on the flows. the flows have been discounted to a common date. A corporation has promised to pay $1,000 20 years from today for each bond sold now. No interest will be paid on the bonds during the 20 years, and the bonds are discounted at a 7% interest rate. Approximately how much should an investor pay for each bond? A. $70.00 B. $258.42 C. $629.56 D. $857.43 What is the present value of your trust fund if it promises to pay you $50,000 on your 30th birthday (7 years from today) and earns 10% compounded annually? A. $25,000.00 B. $25,657.91 C. $28,223.70 D. $29,411.76 How much more would you be willing to pay today for an investment offering $10,000 in 4 years rather than the normally advertised 5-year period? Your discount rate is 8%. A. $544.47 B. $681.48 C. $740.74 D. $800.00 What is the present value of $100 to be deposited today into an account paying 8%, compounded semiannually for 2 years? A. $85.48 B. $100.00 C. $116.00 D. $116.99 How much must be invested today in order to generate a 5-year annuity of $1,000 per year, with the first payment 1 year from today, at an interest rate of 12%? A. $3,604.78 B. $3,746.25 C. $4,037.35 D. $4,604.78 The salesperson offers, "Buy this new car for $25,000 cash or, with appropriate down payment, pay $500 per month for 48 months at 8% interest." Assuming that the salesperson does not offer a free lunch, calculate the "appropriate" down payment. A. $1,000.00 B. $4,520.64 C. $5,127.24 D. $8,000.00 What is the present value of the following payment stream, discounted at 8% annually: $1,000 at the end of year 1, $2,000 at the end of year 2, and $3,000 at the end of year 3? A. $5,022.11 B. $5,144.03 C. $5,423.87 D. $5,520.00 What is the present value of the following set of cash flows at an interest rate of 7%: $1,000 today, $2,000 at end of year 1, $4,000 at end of year 3, and $6,000 at end of year 5? A. $9,731 B. $10,412 C. $10,524 D. $11,524 A cash-strapped young professional offers to buy your car with four, equal annual payments of $3,000, beginning 2 years from today. Assuming you're indifferent to cash versus credit, that you can invest at 10%, and that you want to receive $9,000 for the car, should you accept? Yes; present value is $9,510. Yes; present value is $11,372. No; present value is $8,645. No; present value is $7,461. How much more is a perpetuity of $1,000 worth than an annuity of the same amount for 20 years? Assume a 10% interest rate and cash flows at end of period. A. $297.29 B. $1,486.44 C. $1,635.08 D. $2,000.00 A stream of equal cash payments lasting forever is termed: an annuity. an annuity due. an installment plan. a perpetuity. Which of the following factors is fixed and thus cannot change for a specific perpetuity? PV of a perpetuity Cash payment of a perpetuity Interest rate on a perpetuity Discount rate of a perpetuity The present value of a perpetuity can be determined by: Multiplying the payment by the interest rate. Dividing the interest rate by the payment. Multiplying the payment by the number of payments to be made. Dividing the payment by the interest rate. A perpetuity of $5,000 per year beginning today is said to offer a 15% interest rate. What is its present value? A. $33,333.33 B. $37,681.16 C. $38,333.33 D. $65,217.39 Your car loan requires payments of $200 per month for the first year and payments of $400 per month during the second year. The annual interest rate is 12% and payments begin in one month. What is the present value of this 2-year loan? A. $6,246.34 B. $6,389.78 C. $6,428.57 D. $6,753.05 Which of the following will increase the present value of an annuity, other things equal? Increasing the interest rate Decreasing the interest rate Decreasing the number of payments Decreasing the amount of the payment What is the present value of a five-period annuity of $3,000 if the interest rate is 12% and the first payment is made today? A. $9,655.65 B. $10,814.33 C. $12,112.05 D. $13,200.00 $3,000 is deposited into an account paying 10% annually, to provide three annual withdrawals of $1,206.34 beginning in one year. How much remains in the account after the second payment has been withdrawn? A. $1,326.97 B. $1,206.34 C. $1,096.69 D. $587.32 How many monthly payments remain to be paid on an 8% mortgage with a 30-year amortization and monthly payments of $733.76, when the balance reaches one-half of the $100,000 mortgage? Approximately 268 payments Approximately 180 payments Approximately 92 payments Approximately 68 payments What is the present value of a four-period annuity of $100 per year that begins 2 years from today if the discount rate is 9%? A. $297.21 B. $323.86 C. $356.85 D. $388.97 If $120,000 is borrowed for a home mortgage, to be repaid at 9% interest over 30 years with monthly payments of $965.55, how much interest is paid over the life of the loan? A. $120,000 B. $162,000 C. $181,458 D. $227,598 $50,000 is borrowed, to be repaid in three equal, annual payments with 10% interest. Approximately how much principal is amortized with the first payment? A. $2,010.60 B. $5,000.00 C. $15,105.74 D. $20,105.74 An amortizing loan is one in which: the principal remains unchanged with each payment. accrued interest is paid regularly. the maturity of the loan is variable. the principal balance is reduced with each payment. You're ready to make the last of four equal, annual payments on a $1,000 loan with a 10% interest rate. If the amount of the payment is $315.47, how much of that payment is accrued interest? A. $28.68 B. $31.55 C. $100.00 D. $315.47 What will be the monthly payment on a home mortgage of $75,000 at 12% interest, to be amortized over 30 years? A. $771.46 B. $775.90 C. $1,028.61 D. $1,034.53 Your real estate agent mentions that homes in your price range require a payment of approximately $1,200 per month over 30 years at 9% interest. What is the approximate size of the mortgage with these terms? A. $128,035 B. $147,940 C. $149,140 D. $393,120 Which of the following characteristics applies to the amortization of a loan such as a home mortgage? The amortization decreases with each payment. The amortization increases with each payment. The amortization is constant throughout the loan. The amortization fluctuates monthly with changes in interest rates. How much must be saved annually, beginning 1 year from now, in order to accumulate $50,000 over the next 10 years, earning 9% annually? A. $3,291 B. $3,587 C. $4,500 D. $4,587 Approximately how much should be accumulated by the beginning of retirement to provide a $2,500 monthly check that will last for 25 years, during which time the fund will earn 8% interest with monthly compounding? A. $261,500.00 B. $323,800.00 C. $578,700.00 D. $690,000.00 The present value of an annuity stream of $100 per year is $614 when valued at a 10% rate. By approximately how much would the value change if these were annuities due? An increase of $10 An increase of $61 An increase of $100 Unknown without knowing number of payments Approximately how much must be saved for retirement in order to withdraw $100,000 per year for the next 25 years if the balance earns 8% annually, and the first payment occurs 1 year from now? A. $1,067,000 B. $1,250,000 C. $2,315,000 D. $2,500,000 With $1.5 million in an account expected to earn 8% annually over the retiree's 30 years of life expectancy, what annual annuity can be withdrawn, beginning today? A. $112,150 B. $120,000 C. $123,371 D. $133,241 How much can be accumulated for retirement if $2,000 is deposited annually, beginning 1 year from today, and the account earns 9% interest compounded annually for 40 years? A. $87,200.00 B. $675,764.89 C. $736,583.73 D. $802,876.27 Which of the following strategies will allow real retirement spending to remain approximately equal, assuming savings of $1,000,000 invested at 8%, a 25-year horizon, and 4% expected inflation? Spend approximately $63,000 annually. Spend approximately $78,225 annually. Spend approximately $93,680 annually. Spend approximately $127,500 annually. In calculating the present value of $1,000 to be received 5 years from today, the discount factor has been calculated to be .7008. What is the apparent interest rate? A. 5.43% B. 7.37% C. 8.00% D. 9.50% If the future value of an annuity due = $25,000 and $24,000 is the future value of an ordinary annuity that is otherwise similar to the annuity due, what is the implied discount rate? A. 1.04% B. 4.17% C. 5.00% D. 8.19% A furniture store is offering free credit on purchases over $1,000. You observe that a big- screen television can be purchased for nothing down and $4,000 due in one year. The store next door offers an identical television for $3,650 but does not offer credit terms. Which statement below best describes the "free" credit? The "free" credit costs about 8.75%. The "free" credit costs about 9.13%. The "free" credit costs about 9.59%. The "free" credit effectively costs zero%. The present value of the following cash flows is known to be $6,939.91; $500 today, $2,000 in 1 year, and $5,000 in 2 years. What discount rate is being used? 3% 4% 5% 6% Your retirement account has a current balance of $50,000. What interest rate would need to be earned in order to accumulate a total of $1,000,000 in 30 years, by adding $6,000 annually? A. 5.02% B. 7.24% C. 9.80% D. 10.07% If a borrower promises to pay you $1,900 9 years from now in return for a loan of $1,000 today, what effective annual interest rate is being offered? A. 5.26% B. 7.39% C. 9.00% D. 10.00% "Give me $5,000 today and I'll return $20,000 to you in 5 years," offers the investment broker. To the nearest percent, what annual interest rate is being offered? A. 25% B. 29% C. 32% D. 60% A car dealer offers payments of $522.59 per month for 48 months on a $25,000 car after making a $4,000 down payment. What is the loan's APR? 6% 9% C. 11% D. 12% What APR is being earned on a deposit of $5,000 made 10 years ago today if the deposit is worth $9,948.94 today? The deposit pays interest semiannually. A. 3.56% B. 6.76% C. 7.00% D. 7.12% An interest rate that has been annualized using compound interest is termed the: simple interest rate. annual percentage rate. discounted interest rate. effective annual interest rate. What is the relationship between an annually compounded rate and the annual percentage rate (APR) which is calculated for truth-in-lending laws for a loan requiring monthly payments? The APR is lower than the annually compounded rate. The APR is higher than the annually compounded rate. The APR equals the annually compounded rate. The answer depends on the interest rate. What is the APR on a loan that charges interest at the rate of 1.4% per month? A. 10.20% B. 14.00% C. 16.80% D. 18.16% If interest is paid m times per year, then the per-period interest rate equals the: effective annual rate divided by m. compound interest rate times m. effective annual rate. annual percentage rate divided by m. If the effective annual rate of interest is known to be 16.08% on a debt that has quarterly payments, what is the annual percentage rate? A. 4.02% B. 10.02% C. 14.50% D. 15.19% Which account would be preferred by a depositor: an 8% APR with monthly compounding or 8.5% APR with semiannual compounding? 8.0% with monthly compounding. 8.5% with semiannual compounding. The depositor would be indifferent. The time period must be known to select the preferred account. What is the annually compounded rate of interest on an account with an APR of 10% and monthly compounding? A. 10.00% B. 10.47% C. 10.52% D. 11.05% What is the APR on a loan with an effective annual rate of 15.01% and weekly compounding of interest? A. 12.00% B. 12.50% C. 13.00% D. 14.00% What is the effective annual interest rate on a 9% APR automobile loan that has monthly payments? A. 9.00% B. 9.38% C. 9.81% D. 10.94% Other things being equal, the more frequent the compounding period, the: higher the APR. lower the APR. higher the effective annual interest rate. lower the effective annual interest rate. An APR will be equal to an effective annual rate if: compounding occurs monthly. compounding occurs continuously. compounding occurs annually. an error has occurred; these terms cannot be equal. A credit card account that charges interest at the rate of 1.25% per month would have an annually compounded rate of and an APR of . A. 16.08%; 15.00% B. 14.55%; 16.08% C. 12.68%; 15.00% D. 15.00%; 14.55% If inflation in Wonderland averaged about 20% per month in 2000, what was the approximate annual inflation rate? A. 20% B. 240% C. 790% D. 890% Assume your uncle recorded his salary history during a 40-year career and found that it had increased 10-fold. If inflation averaged 4% annually during the period, how would you describe his purchasing power, on average? His purchasing power remained on par with inflation. He "beat" inflation by nearly 1% annually. He "beat" inflation by slightly below 2% annually. He "beat" inflation by 5% annually. Which of the following statements best describes the real interest rate? Real interest rates exceed inflation rates. Real interest rates can decline only to zero. Real interest rates can be negative, zero, or positive. Real interest rates traditionally exceed nominal rates. What is the expected real rate of interest for an account that offers a 12% nominal rate of return when the rate of inflation is 6% annually? A. 5.00% B. 5.66% C. 6.00% D. 9.46% What happens over time to the real cost of purchasing a home if the mortgage payments are fixed in nominal terms and inflation is in existence? The real cost is constant. The real cost is increasing. The real cost is decreasing. The price index must be known to answer this question. What is the minimum nominal rate of return that you should accept if you require a 4% real rate of return and the rate of inflation is expected to average 3.5% during the investment period? A. 7.36% B. 7.50% C. 7.64% D. 8.01% Essay Questions Discuss the statement, "Money has a time value." Would you prefer a savings account that paid 7% interest, compounded quarterly, over an account that paid 7.5% with annual compounding if you had $1,000 to deposit? Would the answer change if you had $100,000 to deposit? If 4 years of college are expected to cost $150,000 18 years from now, how much must be deposited now into an account that will average 8% annually in order to save the $150,000? By how much would your answer change if you expected 11% annually? Prizes are often not "worth" as much as claimed. Place a value on a prize of $5,000,000 which is to be received in equal payments over 20 years, with the first payment beginning today. Assume an interest rate of 7% over the 20 years. Show numerically that a savings account with a current balance of $1,000 that earns interest at 9% annually is precisely sufficient to make the payments on a 3-year loan of $1,000 that carries equal annual payments at 9% interest. A loan officer states, "Thousands of dollars can be saved by switching to a 15-year mortgage from a 30-year mortgage." Calculate the difference in payments on a 30-year mortgage at 9% interest versus a 15-year mortgage with 8.5% interest. Both mortgages are for $100,000 and have monthly payments. What is the difference in total dollars that will be paid to the lender under each loan? Some home loans involve "points," which are fees charged by the lender. Each point charged means that the borrower must pay 1% of the loan amount as a fee. For example, if 0.5 point is charged on a $100,000 loan, the loan repayment schedule is calculated on the $100,000 loan, but the net amount the borrower receives is only $99,500. What is the effective annual interest rate charged on such a loan, assuming that loan repayment occurs over 360 months, and that the interest rate is 1% per month? In 1973 Gordon Moore, one of Intel's founders, predicted that the number of transistors that could be placed on a single silicon chip would double every 18 months, equivalent to an annual growth of 59% (i.e., 1.591.5 = 2.0). The first microprocessor was built in 1971 and had 2,250 transistors. By 2003 Intel chips contained 410 million transistors, over 182,000 times the number 32 years earlier. What has been the annual compound rate of growth in processing power? How does it compare with the prediction of Moore's law? How should we compare interest rates quoted over different time intervals—for example, monthly versus annual rates? Discuss the statement, "It is always preferred to select an account that offers compound interest over an account that offers simple interest." After reading the fine print in your credit card agreement, you find that the "low" interest rate is actually an 18% APR, or 1.5% per month. Now, to make you feel even worse, calculate the effective annual interest rate. Why is it difficult and perhaps risky to evaluate financial projects based on APR alone? What is the difference between real and nominal cash flows and between real and nominal interest rates? What problem can be caused by "mixing" real and nominal cash flows in discounting exercises? In 2004 there was widespread dismay as the price of unleaded gasoline climbed to $2.03 a gallon. Motorists looked back longingly to 20 years earlier when they were paying just $1.19 a gallon. But how much had the real price of gasoline changed over this period, if the consumer price index was 1.81 times itself in 1984? Compound interest pays interest for each time period on the original investment plus the accumulated interest. TRUE When money is invested at compound interest, the growth rate is the interest rate. TRUE The present value of an annuity due equals the present value of an ordinary annuity times the discount rate. FALSE The more frequent the compounding, the higher the future value, other things equal. TRUE A dollar tomorrow is worth more than a dollar today. FALSE The Excel function for future value is FV (rate, nper, pmt, PV). TRUE For a given amount, the lower the discount rate, the less the present value. FALSE Comparing the values of undiscounted cash flows is analogous to comparing apples to oranges. TRUE To calculate present value, we discount the future value by some interest rate r, the discount rate. TRUE The discount factor is used to calculate the present value of $1 received in year t. TRUE You should never compare cash flows occurring at different times without first discounting them to a common date. TRUE The Excel function for present value is PV (rate, nper, pmt, FV). TRUE A perpetuity is a special form of an annuity. TRUE An annuity factor represents the future value of $1 that is deposited today. FALSE Accrued interest declines with each payment on an amortizing loan. TRUE Converting an annuity to an annuity due decreases the present value. FALSE The term "constant dollars" refers to equal payments for amortizing a loan. FALSE An annuity due must have a present value at least as large as an equivalent ordinary annuity. TRUE Any sequence of equally spaced, level cash flows is called an annuity. An annuity is also known as a perpetuity. FALSE A mortgage loan is an example of an amortizing loan. "Amortizing" means that part of the monthly payment is used to pay interest on the loan and part is used to reduce the amount of the loan. TRUE The Excel function for interest rate is RATE (nper, pmt, PV, FV). TRUE An effective annual rate must be greater than an annual percentage rate. FALSE An annual percentage rate (APR) is determined by annualizing the rate using compound interest. FALSE In 2002, the U.S. inflation rate was below 2% and a few countries were even experiencing deflation. TRUE Nominal dollars refer to the amount of purchasing power. FALSE The appropriate manner of adjusting for inflationary effects is to discount nominal cash flows with real interest rates. FALSE What is the future value of $10,000 on deposit for 5 years at 6% simple interest? A. $7,472.58 B. $10,303.62 C. $13,000.00 D. $13,382.26 FV = PV + (PV r t) ($10,000) + [($10,000 .06) 5] = $13,000.00 Under which of the following conditions will a future value calculated with simple interest exceed a future value calculated with compound interest at the same rate? The interest rate is very high. The investment period is very long. The compounding is annually. This is not possible with positive interest rates. How much interest is earned in just the third year on a $1,000 deposit that earns 7% interest compounded annually? A. $70.00 B. $80.14 C. $105.62 D. $140.00 $1000.00 (1.07)2 = $1,144.90 after 2 years $1,144.90 .07 = $80.14 How much interest will be earned in the next year on an investment paying 12% compounded annually if $100 was just credited to the account for interest? A. $88 B. $100 C. $112 D. $200 The investment will again pay $100 plus interest on the previous interest: $100 1.12 = $112 The concept of compound interest refers to: earning interest on the original investment. payment of interest on previously earned interest. investing for a multiyear period of time. determining the APR of the investment. When an investment pays only simple interest, this means: the interest rate is lower than on comparable investments. the future value of the investment will be low. the earned interest is nontaxable to the investor. interest is earned only on the original investment. Approximately how long must one wait (to the nearest year) for an initial investment of $1,000 to triple in value if the investment earns 8% compounded annually? 9 years 14 years 22 years 25 years $3,000 = $1,000(1.08)n 3 = (1.08)n 14.27, or approximately 14 years = N Solved with financial calculator; can also be solved with tables or logarithms. How much will accumulate in an account with an initial deposit of $100, and which earns 10% interest compounded quarterly for 3 years? A. $107.69 B. $133.10 C. $134.49 D. $313.84 FV = PV (1 + r)2 $100 (1.025)12 = $134.49 What will be the approximate population of the United States, if its current population of 300 million grows at a compound rate of 2% annually for 25 years? 413 million 430 million 488 million 492 million 300 million (1.02)25 = 492.2 million 492 million How much interest can be accumulated during one year on a $1,000 deposit paying continuously compounded interest at an APR of 10%? A. $100.00 B. $105.17 C. $110.50 D. $115.70 Interest = $1,000 e.1 - $1,000 = $1,000 1.1052 - $1,000 = $1,105.17- $1,000 = $105.17 How much interest will be earned in an account into which $1,000 is deposited for one year with continuous compounding at a 13% rate? A. $130.00 B. $138.83 C. $169.00 D. $353.34 What is the discount factor for $1 to be received in 5 years at a discount rate of 8%? A. .4693 B. .5500 C. .6000 D. .6806 Discount factor = 1/(1.08)5 = 1/1.4693 = .6806 Assume the total expense for your current year in college equals $20,000. Approximately how much would your parents have needed to invest 21 years ago in an account paying 8% compounded annually to cover this amount? A. $952.00 B. $1,600.00 C. $1,728.00 D. $3,973.00 $20,000 = x(1.08)21 $20,000 = 5.0338x $3,973.12 = x How much must be deposited today in an account earning 6% annually to accumulate a 20% down payment to use in purchasing a car one year from now, assuming that the car's current price is $20,000, and inflation will be 4%? A. $3,774 B. $3,782 C. $3,925 D. $4,080 Need $20,800 .2 = $4,160 PV = $4,160/(1.06) = $3,924.53 Given a set future value, which of the following will contribute to a lower present value? Higher discount rate Fewer time periods Less frequent discounting Lower discount factor Cash flows occurring in different periods should not be compared unless: interest rates are expected to be stable. the flows occur no more than one year from each other. high rates of interest can be earned on the flows. the flows have been discounted to a common date. A corporation has promised to pay $1,000 20 years from today for each bond sold now. No interest will be paid on the bonds during the 20 years, and the bonds are discounted at a 7% interest rate. Approximately how much should an investor pay for each bond? A. $70.00 B. $258.42 C. $629.56 D. $857.43 PV = $1,000/(1.07)20 = $1,000/3.8697 = $258.42 What is the present value of your trust fund if it promises to pay you $50,000 on your 30th birthday (7 years from today) and earns 10% compounded annually? A. $25,000.00 B. $25,657.91 C. $28,223.70 D. $29,411.76 How much more would you be willing to pay today for an investment offering $10,000 in 4 years rather than the normally advertised 5-year period? Your discount rate is 8%. A. $544.47 B. $681.48 C. $740.74 D. $800.00 $7,350.30 vs. $6,805.83 $544.47 difference. What is the present value of $100 to be deposited today into an account paying 8%, compounded semiannually for 2 years? A. $85.48 B. $100.00 C. $116.00 D. $116.99 $100 (1.0375)0 = $100 How much must be invested today in order to generate a 5-year annuity of $1,000 per year, with the first payment 1 year from today, at an interest rate of 12%? A. $3,604.78 B. $3,746.25 C. $4,037.35 D. $4,604.78 The salesperson offers, "Buy this new car for $25,000 cash or, with appropriate down payment, pay $500 per month for 48 months at 8% interest." Assuming that the salesperson does not offer a free lunch, calculate the "appropriate" down payment. A. $1,000.00 B. $4,520.64 C. $5,127.24 D. $8,000.00 A difference of $4,520.64 exists between cash price and loan value. This should be the down payment. What is the present value of the following payment stream, discounted at 8% annually: $1,000 at the end of year 1, $2,000 at the end of year 2, and $3,000 at the end of year 3? A. $5,022.11 B. $5,144.03 C. $5,423.87 D. $5,520.00 What is the present value of the following set of cash flows at an interest rate of 7%: $1,000 today, $2,000 at end of year 1, $4,000 at end of year 3, and $6,000 at end of year 5? A. $9,731 B. $10,412 C. $10,524 D. $11,524 PV = $1,000/(1.07)0 + $2,000/(1.07)1 = $4,000/(1.07)3 + $6,000/(1.07)5 = $1,000 + $1,869.16 + $3,265.19 + $4,277.92 = $10,412.27 A cash-strapped young professional offers to buy your car with four, equal annual payments of $3,000, beginning 2 years from today. Assuming you're indifferent to cash versus credit, that you can invest at 10%, and that you want to receive $9,000 for the car, should you accept? Yes; present value is $9,510. Yes; present value is $11,372. No; present value is $8,645. No; present value is $7,461. PV = $3,000[1/.1 - 1/.1(1.1)4]/1.1 = $3,000(10 - 6.8301)/1.1 = $3,000 3.1699/1.1 = $9,509.60/1.1 = $8,645.09 How much more is a perpetuity of $1,000 worth than an annuity of the same amount for 20 years? Assume a 10% interest rate and cash flows at end of period. A. $297.29 B. $1,486.44 C. $1,635.08 D. $2,000.00 Difference = $1,000/.10 - $1,000[1/.10 - 1/.10(1.10)20] = $10,000 - $8,513.56 = $1,486.44 A stream of equal cash payments lasting forever is termed: an annuity. an annuity due. an installment plan. a perpetuity. Which of the following factors is fixed and thus cannot change for a specific perpetuity? PV of a perpetuity Cash payment of a perpetuity Interest rate on a perpetuity Discount rate of a perpetuity The present value of a perpetuity can be determined by: Multiplying the payment by the interest rate. Dividing the interest rate by the payment. Multiplying the payment by the number of payments to be made. Dividing the payment by the interest rate. A perpetuity of $5,000 per year beginning today is said to offer a 15% interest rate. What is its present value? A. $33,333.33 B. $37,681.16 C. $38,333.33 D. $65,217.39 Your car loan requires payments of $200 per month for the first year and payments of $400 per month during the second year. The annual interest rate is 12% and payments begin in one month. What is the present value of this 2-year loan? A. $6,246.34 B. $6,389.78 C. $6,428.57 D. $6,753.05 Which of the following will increase the present value of an annuity, other things equal? Increasing the interest rate Decreasing the interest rate Decreasing the number of payments Decreasing the amount of the payment What is the present value of a five-period annuity of $3,000 if the interest rate is 12% and the first payment is made today? A. $9,655.65 B. $10,814.33 C. $12,112.05 D. $13,200.00 $3,000 is deposited into an account paying 10% annually, to provide three annual withdrawals of $1,206.34 beginning in one year. How much remains in the account after the second payment has been withdrawn? A. $1,326.97 B. $1,206.34 C. $1,096.69 D. $587.32 How many monthly payments remain to be paid on an 8% mortgage with a 30-year amortization and monthly payments of $733.76, when the balance reaches one-half of the $100,000 mortgage? Approximately 268 payments Approximately 180 payments Approximately 92 payments Approximately 68 payments What is the present value of a four-period annuity of $100 per year that begins 2 years from today if the discount rate is 9%? A. $297.21 B. $323.86 C. $356.85 D. $388.97 If $120,000 is borrowed for a home mortgage, to be repaid at 9% interest over 30 years with monthly payments of $965.55, how much interest is paid over the life of the loan? A. $120,000 B. $162,000 C. $181,458 D. $227,598 (965.55 360) - 120,000 = $227,598 $50,000 is borrowed, to be repaid in three equal, annual payments with 10% interest. Approximately how much principal is amortized with the first payment? A. $2,010.60 B. $5,000.00 C. $15,105.74 D. $20,105.74 An amortizing loan is one in which: the principal remains unchanged with each payment. accrued interest is paid regularly. the maturity of the loan is variable. the principal balance is reduced with each payment. You're ready to make the last of four equal, annual payments on a $1,000 loan with a 10% interest rate. If the amount of the payment is $315.47, how much of that payment is accrued interest? A. $28.68 B. $31.55 C. $100.00 D. $315.47 $315.47 - ($315.47/1.1) = $28.68 What will be the monthly payment on a home mortgage of $75,000 at 12% interest, to be amortized over 30 years? A. $771.46 B. $775.90 C. $1,028.61 D. $1,034.53 Your real estate agent mentions that homes in your price range require a payment of approximately $1,200 per month over 30 years at 9% interest. What is the approximate size of the mortgage with these terms? A. $128,035 B. $147,940 C. $149,140 D. $393,120 Which of the following characteristics applies to the amortization of a loan such as a home mortgage? The amortization decreases with each payment. The amortization increases with each payment. The amortization is constant throughout the loan. The amortization fluctuates monthly with changes in interest rates. How much must be saved annually, beginning 1 year from now, in order to accumulate $50,000 over the next 10 years, earning 9% annually? A. $3,291 B. $3,587 C. $4,500 D. $4,587 Approximately how much should be accumulated by the beginning of retirement to provide a $2,500 monthly check that will last for 25 years, during which time the fund will earn 8% interest with monthly compounding? A. $261,500.00 B. $323,800.00 C. $578,700.00 D. $690,000.00 The present value of an annuity stream of $100 per year is $614 when valued at a 10% rate. By approximately how much would the value change if these were annuities due? An increase of $10 An increase of $61 An increase of $100 Unknown without knowing number of payments Difference = $614(1.1) - $614 = $61 Approximately how much must be saved for retirement in order to withdraw $100,000 per year for the next 25 years if the balance earns 8% annually, and the first payment occurs 1 year from now? A. $1,067,000 B. $1,250,000 C. $2,315,000 D. $2,500,000 With $1.5 million in an account expected to earn 8% annually over the retiree's 30 years of life expectancy, what annual annuity can be withdrawn, beginning today? A. $112,150 B. $120,000 C. $123,371 D. $133,241 How much can be accumulated for retirement if $2,000 is deposited annually, beginning 1 year from today, and the account earns 9% interest compounded annually for 40 years? A. $87,200.00 B. $675,764.89 C. $736,583.73 D. $802,876.27 Which of the following strategies will allow real retirement spending to remain approximately equal, assuming savings of $1,000,000 invested at 8%, a 25-year horizon, and 4% expected inflation? Spend approximately $63,000 annually. Spend approximately $78,225 annually. Spend approximately $93,680 annually. Spend approximately $127,500 annually. In calculating the present value of $1,000 to be received 5 years from today, the discount factor has been calculated to be .7008. What is the apparent interest rate? A. 5.43% B. 7.37% C. 8.00% D. 9.50% If the future value of an annuity due = $25,000 and $24,000 is the future value of an ordinary annuity that is otherwise similar to the annuity due, what is the implied discount rate? A. 1.04% B. 4.17% C. 5.00% D. 8.19% A furniture store is offering free credit on purchases over $1,000. You observe that a big- screen television can be purchased for nothing down and $4,000 due in one year. The store next door offers an identical television for $3,650 but does not offer credit terms. Which statement below best describes the "free" credit? The "free" credit costs about 8.75%. The "free" credit costs about 9.13%. The "free" credit costs about 9.59%. The "free" credit effectively costs zero%. $350/$4,000 = 8.75% The present value of the following cash flows is known to be $6,939.91; $500 today, $2,000 in 1 year, and $5,000 in 2 years. What discount rate is being used? 3% 4% 5% 6% $6,939.91 = $500/(1 + i)0 + $2,000/(1 + i)1 + $5,000/(1 + i)2 i = 5% by financial calculator Your retirement account has a current balance of $50,000. What interest rate would need to be earned in order to accumulate a total of $1,000,000 in 30 years, by adding $6,000 annually? A. 5.02% B. 7.24% C. 9.80% D. 10.07% i = 7.24% by financial calculator If a borrower promises to pay you $1,900 9 years from now in return for a loan of $1,000 today, what effective annual interest rate is being offered? A. 5.26% B. 7.39% C. 9.00% D. 10.00% "Give me $5,000 today and I'll return $20,000 to you in 5 years," offers the investment broker. To the nearest percent, what annual interest rate is being offered? A. 25% B. 29% C. 32% D. 60% A car dealer offers payments of $522.59 per month for 48 months on a $25,000 car after making a $4,000 down payment. What is the loan's APR? 6% 9% C. 11% D. 12% r = .0075; or 9% annualized rate What APR is being earned on a deposit of $5,000 made 10 years ago today if the deposit is worth $9,948.94 today? The deposit pays interest semiannually. A. 3.56% B. 6.76% C. 7.00% D. 7.12% An interest rate that has been annualized using compound interest is termed the: simple interest rate. annual percentage rate. discounted interest rate. effective annual interest rate. What is the relationship between an annually compounded rate and the annual percentage rate (APR) which is calculated for truth-in-lending laws for a loan requiring monthly payments? The APR is lower than the annually compounded rate. The APR is higher than the annually compounded rate. The APR equals the annually compounded rate. The answer depends on the interest rate. What is the APR on a loan that charges interest at the rate of 1.4% per month? A. 10.20% B. 14.00% C. 16.80% D. 18.16% 1.4% monthly 12 = 16.8% APR If interest is paid m times per year, then the per-period interest rate equals the: effective annual rate divided by m. compound interest rate times m. effective annual rate. annual percentage rate divided by m If the effective annual rate of interest is known to be 16.08% on a debt that has quarterly payments, what is the annual percentage rate? A. 4.02% B. 10.02% C. 14.50% D. 15.19% (1.1608).25 = 1 + quarterly rate 1.0380 - 1 = quarterly rate .0380 = quarterly rate .1519 = quarterly rate 4 Which account would be preferred by a depositor: an 8% APR with monthly compounding or 8.5% APR with semiannual compounding? 8.0% with monthly compounding. 8.5% with semiannual compounding. The depositor would be indifferent. The time period must be known to select the preferred account. (1.0667)12 - 1 = 8.3% (1.0425)2 - 1 = 8.68% Therefore, B is preferred What is the annually compounded rate of interest on an account with an APR of 10% and monthly compounding? A. 10.00% B. 10.47% C. 10.52% D. 11.05% (1.00833) 12 - 1 = 10.47% What is the APR on a loan with an effective annual rate of 15.01% and weekly compounding of interest? A. 12.00% B. 12.50% C. 13.00% D. 14.00% What is the effective annual interest rate on a 9% APR automobile loan that has monthly payments? A. 9.00% B. 9.38% C. 9.81% D. 10.94% Other things being equal, the more frequent the compounding period, the: higher the APR. lower the APR. higher the effective annual interest rate. lower the effective annual interest rate. An APR will be equal to an effective annual rate if: compounding occurs monthly. compounding occurs continuously. compounding occurs annually. an error has occurred; these terms cannot be equal. A credit card account that charges interest at the rate of 1.25% per month would have an annually compounded rate of and an APR of . A. 16.08%; 15.00% B. 14.55%; 16.08% C. 12.68%; 15.00% D. 15.00%; 14.55% Annually compounded rate = (1.0125)12 - 1 = 16.08% APR = 1.25% 12 = 15.00% If inflation in Wonderland averaged about 20% per month in 2000, what was the approximate annual inflation rate? A. 20% B. 240% C. 790% D. 890% (1.20)12 - 1 = 7.916 = 791.6% Assume your uncle recorded his salary history during a 40-year career and found that it had increased 10-fold. If inflation averaged 4% annually during the period, how would you describe his purchasing power, on average? His purchasing power remained on par with inflation. He "beat" inflation by nearly 1% annually. He "beat" inflation by slightly below 2% annually. He "beat" inflation by 5% annually. 10 = 1(1 + i)40, i = 5.925% by financial calculat Which of the following statements best describes the real interest rate? Real interest rates exceed inflation rates. Real interest rates can decline only to zero. Real interest rates can be negative, zero, or positive. Real interest rates traditionally exceed nominal rates. What is the expected real rate of interest for an account that offers a 12% nominal rate of return when the rate of inflation is 6% annually? A. 5.00% B. 5.66% C. 6.00% D. 9.46% 1 + real interest rate = (1 + nominal interest rate)/(1 + inflation) 1 + real interest rate = 1.12/1.06 Real interest rate = 5.66% What happens over time to the real cost of purchasing a home if the mortgage payments are fixed in nominal terms and inflation is in existence? The real cost is constant. The real cost is increasing. The real cost is decreasing. The price index must be known to answer this question. What is the minimum nominal rate of return that you should accept if you require a 4% real rate of return and the rate of inflation is expected to average 3.5% during the investment period? A. 7.36% B. 7.50% C. 7.64% D. 8.01% 7.64% = nominal rate Would you prefer a savings account that paid 7% interest, compounded quarterly, over an account that paid 7.5% with annual compounding if you had $1,000 to deposit? Would the answer change if you had $100,000 to deposit? FV = (1 + i)n for simple interest FV = (1 + i/m)nxm for compound interest Then, FV = (1 + .07/4)1 x 4 = 1.0719 Versus FV = (1 + 0.75)1 = 1.075 Thus, the 7.5% account will earn .31% more in the first year than the 7% account with quarterly compounding. The amount to be deposited will not change your preference: In this case the compounding is not enough to overcome the difference in APR. If 4 years of college are expected to cost $150,000 18 years from now, how much must be deposited now into an account that will average 8% annually in order to save the $150,000? By how much would your answer change if you expected 11% annually? FV = PV (1 + i)n $150,000 = PV (1.08)18 $150,000 = PV 3.996 $37,537.35 = PV If the interest rate increases to 11%, the necessary deposit is reduced to $22,923.33. Prizes are often not "worth" as much as claimed. Place a value on a prize of $5,000,000 which is to be received in equal payments over 20 years, with the first payment beginning today. Assume an interest rate of 7% over the 20 years. Show numerically that a savings account with a current balance of $1,000 that earns interest at 9% annually is precisely sufficient to make the payments on a 3-year loan of $1,000 that carries equal annual payments at 9% interest. The loan payments are: After the first year's addition of interest, the account has $1,090.00 and $395.06 is withdrawn to make the first payment. The balance of $694.94 grows to $757.48 at the end of the second year. After making the second payment of $395.06, $362.42 is left in the account. This amount grows to $395.04 by the end of the third year, which is within a 2-cent rounding error of making the final payment. A loan officer states, "Thousands of dollars can be saved by switching to a 15-year mortgage from a 30-year mortgage." Calculate the difference in payments on a 30-year mortgage at 9% interest versus a 15-year mortgage with 8.5% interest. Both mortgages are for $100,000 and have monthly payments. What is the difference in total dollars that will be paid to the lender under each loan? Difference in total dollars = (804.62 360) - (984.69 180) = 289,663.20 - 177,244.20 = $112,419 Some home loans involve "points," which are fees charged by the lender. Each point charged means that the borrower must pay 1% of the loan amount as a fee. For example, if 0.5 point is charged on a $100,000 loan, the loan repayment schedule is calculated on the $100,000 loan, but the net amount the borrower receives is only $99,500. What is the effective annual interest rate charged on such a loan, assuming that loan repayment occurs over 360 months, and that the interest rate is 1% per month? Since the monthly payment is based on a $100,000 loan: Mortgage payment annuity factor(1%, 360) = 100,000 monthly mortgage payment = $1,028.61 The net amount received is $99,500. Therefore: $1,028.61 annuity factor(r, 360) = $99,500 r = 1.006% per month The effective annual rate is: (1.01006)12 - 1 = 0.1276 = 12.76% In 1973 Gordon Moore, one of Intel's founders, predicted that the number of transistors that could be placed on a single silicon chip would double every 18 months, equivalent to an annual growth of 59% (i.e., 1.591.5 = 2.0). The first microprocessor was built in 1971 and had 2,250 transistors. By 2003 Intel chips contained 410 million transistors, over 182,000 times the number 32 years earlier. What has been the annual compound rate of growth in processing power? How does it compare with the prediction of Moore's law? Call g the annual growth rate of transistors over the 32-year period between 1971 and 2003. Then 2,250 (1 + g)32 = 410,000,000 (1 + g)32 = 182,222 1 + g = 182,2221/32 = 1.46 So the actual growth rate has been g = .46, or 46%, not quite as high as Moore's prediction, but not so shabby either. After reading the fine print in your credit card agreement, you find that the "low" interest rate is actually an 18% APR, or 1.5% per month. Now, to make you feel even worse, calculate the effective annual interest rate. In 2004 there was widespread dismay as the price of unleaded gasoline climbed to $2.03 a gallon. Motorists looked back longingly to 20 years earlier when they were paying just $1.19 a gallon. But how much had the real price of gasoline changed over this period, if the consumer price index was 1.81 times itself in 1984? In 2004 the consumer price index was 1.81 times its level in 1984. If the price of gasoline had risen in line with inflation, it would have cost 1.81 $1.19 = $2.15 a gallon in 2004. That was the cost of gasoline 20 years ago but measured in terms of 2004 dollars rather than 1984 dollars. Thus over the 20 years the real price of gasoline declined from $2.15 a gallon to $2.03, a fall of 6%.