2015

BUSINESS FINANCE

DECISIONS

PRACTICE KIT

ICAP

Practice Kit

Business finance decisions

First edition published by

Emile Woolf Limited

Bracknell Enterprise & Innovation Hub

Ocean House, 12th Floor, The Ring

Bracknell, Berkshire, RG12 1AX United Kingdom

Email: info@ewiglobal.com

www.emilewoolf.com

© Emile Woolf International, September 2015

All rights reserved. No part of this publication may be reproduced, stored in a retrieval

system, or transmitted, in any form or by any means, electronic, mechanical, photocopying,

recording, scanning or otherwise, without the prior permission in writing of Emile Woolf

Publishing Limited, or as expressly permitted by law, or under the terms agreed with the

appropriate reprographics rights organisation.

You must not circulate this book in any other binding or cover and you must impose the

same condition on any acquirer.

Notice

Emile Woolf International has made every effort to ensure that at the time of writing the

contents of this study text are accurate, but neither Emile Woolf International nor its directors

or employees shall be under any liability whatsoever for any inaccurate or misleading

information this work could contain.

© Emile Woolf International

ii

The Institute of Chartered Accountants of Pakistan

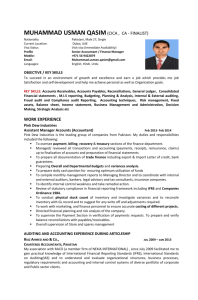

Certified finance and accounting professional

Business finance decisions

C

Contents

Page

Question and Answers Index

v

Section A

Questions

1

Section B

Answers

© Emile Woolf International

149

iii

The Institute of Chartered Accountants of Pakistan

Business finance decisions

© Emile Woolf International

iv

The Institute of Chartered Accountants of Pakistan

Certified finance and accounting professional

Business finance decisions

I

Index to questions and answers

Question

page

Answer

page

Chapter 1 – An introduction to business finance decisions

1.1

Company objectives

1

149

1.2

Possible conflicts

1

151

1.3

Ownership

1

152

Chapter 2 – Relevant cash flows

2.1

Shockolat

2

154

2.2

Topaz Limited

3

156

2.3

Tychy Limited

4

157

Chapter 3 – Decision making

3.1

Pakpattan Electronics Limited

5

159

3.2

Wazir Manufacturing Ltd

6

160

3.3

Khokhar Perfumers Limited

7

163

Chapter 4 – Linear programming

4.1

Proglin

9

166

4.2

Light engineering

10

167

Chapter 5 – Introduction to investment appraisal

There are no specific questions in this area. The topic is covered as

parts of other questions.

Chapter 6 – Discounted cash flow

6.1

© Emile Woolf International

Badger plc

11

v

171

The Institute of Chartered Accountants of Pakistan

Business finance decisions

Question

page

Answer

page

6.2

Hasan and Sons Limited

12

172

6.3

DCF and relevant costs

13

172

6.4

Sadeeq Energy Plc

14

173

6.5

Beta Limited

15

174

Chapter 7 – DCF: taxation and inflation

7.1

More investment appraisal and tax

16

176

7.2

Investment appraisal and tax

16

177

7.3

Alawada Limited

17

178

7.4

Kohat Limited

17

179

7.5

JAP Recreation Club

18

180

7.6

ARG Limited

19

182

7.7

Hafeez Ltd

22

185

Chapter 8 – DCF: risk and uncertainty

8.1

Risk in investment appraisal

23

187

8.2

Calm Plc

23

188

8.3

Outlook Plc

24

190

8.4

Zaheer Ltd

25

191

8.5

JKL Phone Limited

26

192

8.6

Khayyam Limited

26

193

Chapter 9 – DCF: specific applications

9.1

Lease or buy

28

194

9.2

Mohani Limited

28

196

9.3

DS Leasing Company Limited

29

197

9.4

HIN Textiles Mills Limited

30

199

9.5

Crank Plc

30

200

9.6

Asset replacement

31

202

9.7

Rotor Plc

31

204

9.8

UVW Rental Services

32

204

Chapter 10 – Evaluating financial performance

10.1

Equity ratios

33

206

10.2

Ayeland and Zedland

33

207

10.3

Khan Industries plc

34

209

© Emile Woolf International

vi

The Institute of Chartered Accountants of Pakistan

Index to questions and answers

Chapter 11 – Capital rationing

11.1

Capital rationing

36

211

11.2

Basril Company

36

212

11.3

CB Investment Limited

37

214

Chapter 12 – Sources of finance

12.1

Rights

38

216

12.2

Kamalia Carriers Plc

38

216

12.3

Rights issue

39

218

12.4

Stock exchange listing

39

219

12.5

Convertible bonds

39

220

12.6

Shoaib Investment Company

40

220

12.7

Sajawal Sugar Mills Limited

40

222

12.8

PSD Engineering Limited

41

224

Chapter 13 – Cost of capital

13.1

Cost of capital – short questions

43

228

13.2

WACC

44

229

13.3

Redskins

44

229

13.4

Chasanda Agates Plc.

45

230

13.5

Misteri Company

46

233

13.6

Faiz Limited

46

234

Chapter 14 – Portfolio theory and the capital asset pricing model

14.1

Two-asset portfolio

48

238

14.2

Coefficient of variation

49

237

14.3

Portfolio return

49

238

14.4

Dolphin Plc.

50

239

14.5

Risk and return

51

241

14.6

Obtaining a beta factor

51

241

14.7

Sodium Plc

52

242

14.8

Dr Jamal

53

244

14.9

Mr Faraz

53

247

14.10

Mushtaq Limited

54

249

14.11

Attock Index Tracker Fund

55

250

14.12

Iron Limited

56

252

14.13

FR Co-operative Housing Society

56

253

© Emile Woolf International

vii

The Institute of Chartered Accountants of Pakistan

Business finance decisions

Chapter 15 – Dividend policy

15.1

Dividends and retentions

58

254

15.2

Ackers Plc

58

254

15.3

Dividend policy

59

256

15.4

YB Pakistan Limited

59

258

15.5

Al-Ghazali Pakistan Limited

61

260

Chapter 16 – Financing of projects

16.1

Gearing

62

263

16.2

Financing schemes

63

264

16.3

MM, gearing and company valuation

64

265

16.4

Diversify

64

265

16.5

Financial and operating gearing

65

266

16.6

Optimal WACC

66

267

16.7

Geared beta

66

268

16.8

Adjusted Present Value

66

269

16.9

APV method

67

272

16.10

More APV

68

274

16.11

Jalib Limited

69

275

16.12

Javed Limited

69

277

16.13

GHI Limited

70

278

16.14

NS Technologies Limited

71

278

16.15

Copper Industries Limited

71

279

16.16

Mac Fertilizer Limited

72

282

Chapter 17 – Business valuation

17.1

Valuation model

74

285

17.2

Valuation

74

285

17.3

Valuation of bonds

74

285

17.4

Annuities and bond prices

75

286

17.5

Warrants and convertibles

75

287

17.6

Kencast Limited

76

288

17.7

A Plc’s and B Plc’s

78

290

17.8

MNO Chemicals Limited

79

292

17.9

Free cash flow

80

293

17.10

Financial plan

80

294

17.11

Takeover

82

296

© Emile Woolf International

viii

The Institute of Chartered Accountants of Pakistan

Index to questions and answers

17.12

MK Limited

83

299

17.13

Platinum Limited

84

302

17.14

EMH

85

303

17.15

X Plc. and Y Plc

86

304

Chapter 18 – Mergers and acquisitions

18.1

Acquisition

87

307

18.2

Adam Plc

87

308

18.3

D Limited

88

309

18.4

Clooney Plc and Pitt Plc

89

310

18.5

Nelson Plc

90

312

18.6

Hali Ltd

91

313

18.7

URD Pakistan Limited

92

316

18.8

FF International

93

319

95

324

Chapter 19 – Foreign exchange rates

19.1

Interest rate parity

Chapter 20 – International investment decisions

20.1

Cash flows from a foreign project

96

325

20.2

Lahore Pharma Plc

96

325

20.3

Foreign investment

97

327

20.4

Gold Limited

97

328

20.5

Ghazali Limited

99

331

Chapter 21 – Managing foreign exchange risk (I)

21.1

Foreign exchange

100

334

21.2

Money market hedge

100

334

21.3

Dunborgen

101

335

21.4

Currency swap

101

335

21.5

Momin Industries Limited

102

337

21.6

Qalat Industries Limited

103

340

21.7

Silver Limited

104

341

21.8

Khaldun Corporation

106

343

Chapter 22 – Managing foreign exchange risk (II): Currency

futures

22.1

Currency futures

107

344

22.2

More currency futures

107

344

22.3

Basis

108

345

© Emile Woolf International

ix

The Institute of Chartered Accountants of Pakistan

Business finance decisions

22.4

Imperfect hedge and basis

108

346

22.5

Currency hedge

108

347

Chapter 23 – Managing foreign exchange risk (III): Currency

options

23.1

Traded equity options

110

349

23.2

Currency options

110

350

23.3

DEF Securities Limited

111

351

23.4

Alpha Automobiles Limited

111

352

Chapter 24 – Managing interest rate risk

24.1

FRA

113

354

24.2

Swap

113

354

24.3

Credit arbitrage

113

355

24.4

Credit arbitrage

114

355

24.5

Hedging with STIRS

114

356

24.6

More hedging with STIRs

114

356

24.7

FRAs and futures

115

357

24.8

Interest rate hedge

116

359

24.9

Definitions

116

360

24.10

Imran Limited

117

362

Chapter 25 – Forecasting and budgeting

25.1

Gazelle

118

363

25.2

Functional budgets (I)

119

364

25.3

Functional budgets (II)

120

365

25.4

Flexed budget

120

366

25.5

Norton Care Home

121

367

25.6

Three services

122

369

25.7

Private medical practice

123

370

25.8

Headgear Limited

124

371

25.9

Daska Design Limited

126

374

Chapter 26 – Variance analysis

26.1

Good Harvest Limited

127

377

26.2

Moongazer

127

380

26.3

ABC Limited

128

383

27.4

Kasur Mf Limited

129

385

© Emile Woolf International

x

The Institute of Chartered Accountants of Pakistan

Index to questions and answers

Chapter 27 – Advanced variance analysis

27.1

Toxic Kems

130

389

27.2

BRK

130

391

27.3

Carat

131

394

Chapter 28 – Transfer pricing

28.1

Two divisions

133

399

28.2

Shadow price

133

400

28.3

Froom Plc

134

400

28.4

Training company

135

401

28.5

Bricks

135

403

Chapter 29 – Working capital management

29.1

Cash operating cycle

137

405

29.2

Working capital

137

406

29.3

Waseem Limited

139

408

Chapter 30 – Inventory management

30.1

Marx Limited

140

409

30.2

Engels Limited

140

410

30.3

Lenin Limited

140

411

Chapter 31 – Management of receivables and payables

31.1

Trade receivables management

142

413

31.2

Bahawalpur Buliders Ltd

142

414

31.3

Chishtian Construction Plc

143

415

31.4

Discount and factor

143

416

31.5

Vehari IT Solutions Limited

144

417

31.6

Ulnad Co

145

418

31.7

Brutus Company

145

420

Chapter 32 – Cash management

32.1

Baumol and Miller-Orr

146

422

32.2

Renpec Co

146

422

32.3

Baumol

147

424

32.4

Cassius Company

147

425

© Emile Woolf International

xi

The Institute of Chartered Accountants of Pakistan

Business finance decisions

© Emile Woolf International

xii

The Institute of Chartered Accountants of Pakistan

SECTION

Certified finance and accounting professional

Business finance decisions

A

Questions

CHAPTER 1 – AN INTRODUCTION TO BUSINESS FINANCE DECSIONS

1.1

1.2

COMPANY OBJECTIVES

(a)

Justify and criticise the usual assumption made in financial management

literature that the objective of a company is to maximise the wealth of the

shareholders. (Do not consider how this wealth is to be measured.)

(b)

Outline other goals that companies claim to follow, and explain why these

might be adopted in preference to the maximisation of shareholder wealth.

POSSIBLE CONFLICTS

“The major objective of financial management is to maximise the value of the

firm.”

Analyse how the achievement of the above objective might be compromised by

the conflicts which may arise between the management and the other

stakeholders in an organisation.

1.3

OWNERSHIP

“Ascertaining exactly who owns a company’s shares and what, if any, are their

particular preferences and objectives” is a basic piece of information needed by

management, if it is to ensure that, as far as possible, it is acting in the shareholder’s

interest.

(a)

Explain why a publicly quoted company might seek to know the detailed

composition of its shareholders and their objectives in investing in the

company.

(b)

Explain any FIVE the major advantages which may accrue to the corporate

finance manager from obtaining this information.

© Emile Woolf International

1

The Institute of Chartered Accountants of Pakistan

Business finance decisions

CHAPTER 2 – RELEVANT CASH FLOWS

2.1

SHOCKLAT CO

Shoklat Co manufactures and sells one type of chocolate, which is sold as a very wellknown branded item at a price of Rs. 14 per kilogram. This product is targeted mainly

at children.

The product is made in a single process which combines a chocolate casing (material

M1) with a filling (material M2). Material M1 costs Rs. 9 per kilogram and material M2

costs Rs. 7 per kilogram. They are combined in the ratio of 3 kilos of material M1 for

every 4 kilos of material M2 and there is no loss in process.

The product research team, using information obtained from market research, has

now developed two possible new products. By adding an extra ingredient M3 to the

existing product formula Shoklat Co would be able to make a new chocolate product

(CP1) that might appeal to men. Similarly by adding an extra ingredient M4 to the

existing product formula it would be possible to make another new product (CP2) that

might have a particular appeal to women. The market research also suggests that the

appeal of the new products to the target customers would so strong that they could

each be sold for a premium price. The market research cost Rs. 20,000.

Senior management of Shoklat Co are trying to decide whether to experiment with the

two new products for a period of two or three months. The proposal is that about 10%

of normal monthly production would be processed further and made into the two new

products CP1 and CP2.

Data relating to this proposal for each month of the trial period is as follows.

(1)

35,000 kilos of the basic product will be produced and used to make the

CP1 and CP2. Production of this quantity of the basic product will require

2,000 direct labour hours. Direct labour is paid Rs. 20 per hour.

(2)

800 kilos of ingredient M3 will be added to 6,000 kilos of the basic product

to make 6,800 kilos of product CP1. M3 costs Rs. 19 per kilo. Additional

processing will require 900 extra direct labour hours. CP1 is expected to

sell for Rs. 30 per kilo.

(3)

1,200 kilos of ingredient M4 will be added to 29,000 kilos of the basic

product to make 30,200 kilos of product CP2. M4 costs Rs. 80 per kilo.

Additional processing will require 1,250 extra direct labour hours. CP2 is

expected to sell for Rs. 20.50 per kilo.

(4)

Shoklat Co has sufficient machinery to carry out the further processing.

However direct labour is in short supply and the labour needed to making

CP1 and CP2 would have to be taken off making the basic product. It will

not be possible to hire additional labour within the next three months.

(5)

The production of CP1 and CP2 would be supervised by the most

experienced supervisor in the production department. His current annual

salary is Rs. 80,000 which is 10% more than other supervisors in the

department. It is expected that about 10% to 15% of this time would be

taken up with supervision of the new work. This time will be divided 25% to

CP1 and 75% to CP2.

© Emile Woolf International

2

The Institute of Chartered Accountants of Pakistan

Questions

(6)

In the company’s costing system, fixed production overheads are absorbed

into product costs at the rate of Rs. 40 per direct labour hour. There are no

variable production overheads.

Required

2.2

(a)

Explain briefly the financial and other factors that Shoklat Co should

consider when deciding whether or not to make the CP1 and CP2 for a test

period of three months. No calculations are required for this part of your

answer.

(b)

Prepare calculations to assess whether Shoklat Co should decide to

experiment with making the two products CP1 and CP2 for a test period.

Make separate recommendations about producing CP1 and CP2.

(c)

Calculate a selling price per kilogram for CP2 that would achieve

breakeven for production and sales of the product during the test period.

TOPAZ LIMITED

Topaz Limited (TL) is the manufacturer of consumer durables. Pearl Limited, one

of the major customers, has invited TL to bid for a special order of 150,000 units of

product Beta.

Following information is available for the preparation of the bid.

(i)

Each unit of Beta requires 0.5 kilograms (kg) of material “C”. This

material is produced internally in batches of 25,000 kg each, at a variable

cost of Rs. 200 per kg. The setup cost per batch is Rs. 80,000. Material “C”

could be sold in the market at a price of Rs. 225 per kg. TL has the

capacity to produce 100,000 kg of material “C”; however, the current

demand for material “C” in the market is 75,000 kg.

(ii)

Every 100 units of product Beta requires 150 labour hours. Workers are

paid at the rate of Rs. 9,000 per month. Idle labour hours are paid at

60% of normal rate and TL currently has 20,000 idle labour hours. The

standard working hours per month are fixed at 200 hours.

(iii)

The variable overhead application rate is Rs. 25 per labour hour. Fixed

overheads are estimated at Rs. 22 million. It is estimated that the special

order would occupy 30% of the total capacity. The production capacity

of Beta can be increased up to 50% by incurring additional fixed

overheads. The fixed overhead rate applicable to enhanced capacity would

be 1.5 times the current rate. The utilized capacity at current level of

production is 80%.

(iv)

The normal loss is estimated to be 4% of the input quantity and is

determined at the time of inspection which is carried out when the unit

is 60% complete. Material is added to the process at the beginning while

labour and overheads are evenly distributed over the process.

(v)

TL has the policy to earn profit at the rate of 20% of the selling price.

© Emile Woolf International

3

The Institute of Chartered Accountants of Pakistan

Business finance decisions

Required

Calculate the unit price that TL could bid for the special order to Pearl Limited.

2.3

TYCHY LIMITED

Tychy Limited (TL) is engaged in the manufacture of specialised motors. The

company has been asked to provide a quotation for building a motor for a large

textile industrial unit in Punjab. Following information has been obtained by TL’s

technical manager in a one-hour meeting with the potential customer. The

manager is paid an annual salary equivalent to Rs. 2,500 per eight-hour day.

(i)

The motor would require 120 ft. of wire-C which is regularly used by TL in

production. TL has 300 ft. of wire-C in inventory at the cost of Rs. 65 per ft.

The resale value of wire-C is Rs. 63 and its current replacement cost is Rs.

68 per ft.

(ii)

The motor would also require 50 kg of Wire-D and 30 other small

components. Wire-D would be purchased from a supplier at Rs. 10 per kg.

The supplier sells a minimum quantity of 60 kg per order. However, the

remaining quantity of wire-D will be of no use to TL after the completion of

the contract. The other small components will be purchased from the

market at Rs. 80 per component.

(iii)

The manufacturing process would require 250 hours of skilled labour and

30 machine hours.

The skilled workers are paid a guaranteed wage of Rs. 20 per hour and

the current spare capacity available with TL for such class of workers is

100 direct labour hours. However, additional labour hours may be obtained

by either:

Paying overtime at Rs. 23 per hour; or

Hiring temporary workers at Rs. 21 per hour. These workers would

require 5 hours of supervision by AL’s existing supervisor who would

be paid overtime of Rs. 20 per hour.

The machine on which the motor would be manufactured was leased by TL

last year at a monthly rent of Rs. 5,000 and it has a spare capacity of 110

hours per month. The variable running cost of the machine is Rs. 15 per

hour.

(iv)

Fixed overheads are absorbed at the rate of Rs. 25 per direct labour hour.

Required

Compute the relevant cost of producing textile motor. Give brief reasons for

the inclusion or exclusion of any cost from your computation.

© Emile Woolf International

4

The Institute of Chartered Accountants of Pakistan

Questions

CHAPTER 3 – DECISION MAKING

3.1

PAKPATTAN ELECTRONICS LIMITED

Pakpattan Electronics Limited is contemplating outsourcing some of its production.

The company’s management accountant has asked for your advice on the relevant

costs for the contract. The following information is available:

Materials

The contract requires 3,000 kg of material K, which is a material used regularly by the

company in other production. The company has 2,000 kg of material K currently in

stock which had been purchased last month for a total cost of Rs. 19,600. Since then

the price per kilogram for material K has increased by 5%.

The contract also requires 200 kg of material L. There are 250 kg of material L in stock

which are not required for normal production. This material originally cost a total of Rs.

3,125. If not used on this contract, the stock of material L would be sold for Rs. 11 per

kg.

Labour

The contract requires 800 hours of skilled labour. Skilled labour is paid Rs. 9·50 per

hour. There is a shortage of skilled labour and all the available skilled labour is fully

employed in the company the manufacture of product P. The following information

relates to product P:

Rs. per unit

Selling price

Less

Skilled labour

Other variable costs

38

22

–––

Contribution per unit

Rs. per unit

100

(60)

–––

40

–––

Required

(a)

Prepare calculations showing the total relevant costs for making a decision

about the contract in respect of the following cost elements:

(i)

materials K and L; and

(ii)

skilled labour.

(ii)

the maximum price the company should pay the outsourcing

company

(b)

Explain how you would decide which overhead costs would be relevant in

the financial appraisal of the contract.

(c)

Prepare a report for senior management highlighting factors that should be

taken into account when considering an outsourcing decision.

© Emile Woolf International

5

The Institute of Chartered Accountants of Pakistan

Business finance decisions

3.2

WAZIR MANUFACTURING LTD

The managers of Wazir Manufacturing Ltd are reviewing the operations of the

company with a view to making operational decisions for the next month. Details of

some of the products manufactured by the company are given below.

AR2

GL3

HT4

21.00

28.50

27.30

Material R2 (kg per unit

2.0

3.0

3.0

Material R3 (kg/unit)

2.0

2.2

1.6

3.0

Direct labour (hours/unit)

0.6

1.2

1.5

1.7

Variable production overheads (Rs./unit)

1.10

1.30

1.10

1.40

Fixed production overheads (Rs./unit)

1.50

1.60

1.70

1.40

Expected demand for next month (units)

950

1,000

900

Selling price (Rs./unit)

XY5

Products AR2, GL3 and HT4 are sold to customers of Wazir Manufacturing Ltd, while

Product XY5 is a component that is used in the manufacture of other products. The

company manufactures a wide range of products in addition to those detailed above.

Material R2, which is not used in any other of the company’s products, is expected to

be in short supply in the next month because of industrial action at a major producer of

the material. Wazir Manufacturing Ltd has just received a delivery of 5,500 kg of

Material R2 and this is expected to be the amount held in inventory at the start of the

next month.

The company does not expect to be able to obtain further supplies of Material R2

unless it pays a premium price. The normal market price is Rs. 2.50 per kg. Material

R3 is available at a price of Rs. 2.00 per kg and the company does not expect any

problems in securing supplies of this material. Direct labour is paid at a rate of Rs. 4.00

per hour.

Kenzi Chemicals Ltd Company has recently approached Wazir Manufacturing Ltd with

an offer to supply a substitute for Product XY5 at a price of Rs. 10.20 per unit. Wazir

Manufacturing Ltd would need to pay an annual fee of Rs. 50,000 for the right to use

this patented substitute.

Required

(a)

Determine the optimum production schedule for Products AR2, GL3 and

HT4 for the next month, on the assumption that additional supplies of

Material R2 are not purchased.

(b)

If Wazir Manufacturing Ltd decides to purchase further supplies of Material

R2 to meet demand for Products AR2, GL3 andHT4, what should be the

maximum price per kg that the company is prepared to pay?

(c)

Discuss whether Wazir Manufacturing Ltd should manufacture Product XY5

or buy the substitute offered by Kenzi Chemicals Ltd.

Your answer must be supported by appropriate calculations.

(d)

Discuss the limitations of marginal costing (variable costing) as a basis for

making short-term decisions.

© Emile Woolf International

6

The Institute of Chartered Accountants of Pakistan

Questions

3.3

KHOKHAR PERFUMERS LIMITED

Khokhar Perfumers Limited manufactures and sells its standard perfume by blending a

secret formula of aromatic oils with diluted solvent. The oils are produced by another

company following a lengthy process and are very expensive. The standard perfume

is highly branded and successfully sold at a price of Rs. 39·98 per 100 millilitres (ml).

Khokhar Perfumers Limited is considering processing some of the perfume further by

adding a hormone to appeal to members of the opposite sex. The hormone to be

added will be different for the male and female perfumes. Adding hormones to

perfumes is not universally accepted as a good idea as some people have health

concerns. On the other hand, market research carried out suggests that a premium

could be charged for perfume that can ‘promise’ the attraction of a suitor. The market

research has cost Rs. 3,000.

Data has been prepared for the costs and revenues expected for the following month

(a test month) assuming that a part of the company’s output will be further processed

by adding the hormones.

The output selected for further processing is 1,000 litres, about a tenth of the

company’s normal monthly output. Of this, 99% is made up of diluted solvent which

costs Rs. 20 per litre. The rest is a blend of aromatic oils costing Rs. 18,000 per litre.

The labour required to produce 1,000 litres of the basic perfume before any further

processing is 2,000 hours at a cost of Rs. 15 per hour.

Of the output selected for further processing, 200 litres (20%) will be for male

customers and 2 litres of hormone costing Rs. 7,750 per litre will then be added. The

remaining 800 litres (80%) will be for female customers and 8 litres of hormone will be

added, costing Rs. 12,000 per litre. In both cases the adding of the hormone adds to

the overall volume of the product as there is no resulting processing loss.

Khokhar Perfumers Limited has sufficient existing machinery to carry out the test

processing.

The new processes will be supervised by one of the more experienced supervisors

currently employed by Khokhar Perfumers Limited. His current annual salary is Rs.

35,000 and it is expected that he will spend 10% of his time working on the hormone

adding process during the test month. This will be split evenly between the male and

female versions of the product.

Extra labour will be required to further process the perfume, with an extra 500 hours for

the male version and 700 extra hours for the female version of the hormone-added

product. Labour is currently fully employed, making the standard product. New labour

with the required skills will not be available at short notice.

Khokhar Perfumers Limited allocates fixed overhead at the rate of Rs. 25 per labour

hour to all products for the purposes of reporting profits.

The sales prices that could be achieved as a one-off monthly promotion are:

Male version: Rs. 75·00 per 100 ml

Female version: Rs. 59·50 per 100 ml

© Emile Woolf International

7

The Institute of Chartered Accountants of Pakistan

Business finance decisions

Required

(a)

Outline the financial and other factors that Khokhar Perfumers Limited

should consider when making a further processing decision.

Note: no calculations are required.

(b)

Evaluate whether Khokhar Perfumers Limited should experiment with the

hormone adding process using the data provided. Provide a separate

assessment and conclusion for the male and the female versions of the

product.

(c)

Calculate the selling price per 100 ml for the female version of the product

that would ensure further processing would break even in the test month.

(d)

Khokhar Perfumers Limited is considering outsourcing the production of the

standard perfume. Outline the main factors it should consider before

making such a decision.

© Emile Woolf International

8

The Institute of Chartered Accountants of Pakistan

Questions

CHAPTER 4 – LINEAR PROGRAMMING

4.1

PROGLIN

(a)

Proglin is a manufacturing company. It makes and sells two versions of a

product, Mark 1 and Mark 2. The two products are made from the same

direct materials and by the same direct labour employees.

The following budgeted data has been prepared for next year:

Direct materials per unit

Direct labour hours per unit

Maximum sales demand

Contribution per unit

Mark 1

Mark 2

Rs. 2

Rs. 4

3 hours

2 hours

5,000 units

unlimited

Rs. 10 per unit

Rs. 15 per unit

Direct materials and direct labour will be in restricted supply next year, as

follows:

Maximum available

Direct materials

Rs. 24,000

Direct labour hours

18,000 hours

There is no inventory of finished goods at the beginning of the year.

Required

Use the graphical method of linear programming to identify the quantities of

Mark 1 and Mark 2 that should be made and sold during the year in order to

maximise profit and contribution.

Calculate the amount of contribution that will be earned.

(b)

Suppose that the maximum available amount of direct materials next year

is Rs. 24,001, not Rs. 24,000.

Required

(i)

Identify the quantities of Mark 1 and Mark 2 that should be made and

sold during the year in order to maximise profit and contribution.

(ii) Calculate the amount of contribution that will be earned.

(iii) Compare the total contribution you have calculated in (b) with the total

contribution that you calculated in (a), to calculate the shadow price per

Rs. 1 of direct materials.

© Emile Woolf International

9

The Institute of Chartered Accountants of Pakistan

Business finance decisions

4.2

LIGHT ENGINEERING

A light engineering company makes water tanks and water butts. Both products

involve the same staff and equipment. Each product passes through a cutting

and an assembly stage. One water tank makes a contribution of Rs. 50, and

takes six hours cutting time and four hours assembly time. One water butt makes

a contribution of Rs. 40, and takes three hours cutting time and eight hours

assembly time. There are a maximum of 36 cutting hours each week and 48

assembly hours.

The company has to produce at least two water tanks and three water butts.

Calculate the number of water butts and water tanks that should be produced

each week to maximise contribution.

Required

(a)

state the objective function and constraints algebraically

(b)

draw a graph of the problem, shading the feasible region

(c)

find the product mix that best suits company policy, and

(d)

calculate the shadow price of one more unit of cutting time and one more

unit of assembly time.

© Emile Woolf International

10

The Institute of Chartered Accountants of Pakistan

Questions

CHAPTER 6 – DISCOUNTED CASH FLOW

6.1

BADGER PLC

Badger plc., a manufacturer of car accessories is considering a new product line. This

project would commence at the start of Badger plc.’s next financial year and run for

four years. Badger plc.’s next year end is 31st December 2016.

The following information relates to the project:

A feasibility study costing Rs. 8 million was completed earlier this year but will not be

paid for until March 2017. The study indicated that the project was technically viable.

Capital expenditure

If Badger plc. proceeds with the project it would need to buy new plant and machinery

costing Rs. 180 million to be paid for at the start of the project. It is estimated that the

new plant and machinery would be sold for Rs. 25 million at the end of the project.

If Badger plc. undertakes the project it will sell an existing machine for cash at the start

of the project for Rs. 2 million. This machine had been scheduled for disposal at the

end of 2020 for Rs. 1 million.

Market research

Industry consultants have supplied the following information:

Market size for the product is Rs. 1,100 million in 2016. The market is expected to

grow by 2% per annum.

Market share projections should Badger plc. proceed with the project are as follows:

2017

7%

2018

9%

2019

15%

2020

15%

2017

Rs. m

Purchases

40

Payables (at the year-end)

8

Payments to sub-contractors, 6

2018

Rs. m

50

10

9

2019

Rs. m

58

11

8

2020

Rs. m

62

nil

8

Fixed overheads (total for Badger plc)

With new line

133

Without new line

120

110

100

99

90

90

80

Market share

Cost data:

Labour costs

At the start of the project, employees currently working in another department would

be transferred to work on the new product line. These employees currently earn Rs.

3.6 million per annum. They will not be replaced if they work on the new project.

An employee currently earning Rs. 2 million per annum would be promoted to work on

the new line at a salary of Rs. 3 million per annum. A new employee would be

recruited to fill the vacated position.

© Emile Woolf International

11

The Institute of Chartered Accountants of Pakistan

Business finance decisions

As a direct result of introducing the new product line, employees in another department

currently earning Rs. 4 million per annum would have to be made redundant at the end

of 2017 and paid redundancy pay of Rs. 6.2 million each at the end of 2018.

Material costs

The company holds a stock of Material X which cost Rs. 6.4 million last year. There is

no other use for this material. If it is not used the company would have to dispose of it

at a cost to the company of Rs. 2 million in 2017. This would occur early in 2017.

Material Z is also in stock and will be used on the new line. It cost the company Rs. 3.5

million some years ago. The company has no other use for it, but could sell it on the

open market for Rs. 3 million early in 2017.

Further information

The year-end payables are paid in the following year.

The company’s cost of capital is a constant 10% per annum.

It can be assumed that operating cash flows occur at the year end.

Time 0 is 1st January 2017 (t1 is 31st December 2017 etc.)

Required

Calculate the net present value of the proposed new product line (work to the nearest

million).

6.2

HASAN AND SONS LIMITED

Hasan and Sons Limited is considering the purchase of a locally manufactured

machine for Rs. 3 million. In view of the fact that the shares of the company are

not quoted, it finds it difficult to raise money through the issue of shares. The

purchase of this machine becomes absolutely necessary if the sales target given

to the sales manager is to be achieved. In order to ensure that the machine is

purchased, the domineering proprietor of the company and the accountant met

informally to decide on how to source for funds.

Many finance options were considered and they eventually agreed to negotiate

for a loan from Microfinance Bank Ltd. The bank agreed to give the company a

loan of Rs. 2.5 million, which means that the company will have to source for the

balance of Rs.0.5 million elsewhere. However, the company has no tangible

collateral with which to secure additional loan to cover the balance of the value of

the machine. In view of this difficulty, the finance officer offered to advance the

shortfall. The proprietor graciously accepted this offer.

The duration of the loan is 20 years with an interest rate of 12% per annum. The

annual interest charge is to be calculated on the balance outstanding at the

beginning of each year. Repayment is to be made in 20 equal annual

instalments. Each instalment will include both interest and capital. A working

capital of Rs. 250,000 will be required at the beginning of the year. The amount

will be sourced internally. The machine is expected to generate net cashflows of

Rs. 540,000 per annum for FIVE consecutive years from its predominantly local

sales.

Required

(a)

Calculate the amount to be paid in each year on the loan;

(b)

Calculate the NPV of the machine and advise on its viability; and

© Emile Woolf International

12

The Institute of Chartered Accountants of Pakistan

Questions

6.3

DCF AND RELEVANT COSTS

Consolidated Oil wants to explore for oil near the coast of Ruritania. The Ruritanian

government is prepared to grant an exploration licence for a five-year period for a fee

of Rs. 300,000 per year. The option to buy the licence must be taken immediately;

otherwise another oil company will be granted the licence.

However if it does take the licence now, Consolidated Oil will not start its explorations

until the beginning of the second year.

To carry out the exploration work, the company will have to buy equipment now. This

would cost Rs. 10,400,000, with 50% payable immediately and the other 50% payable

one year later. The company hired a specialist firm to carry out a geological survey of

the area. The survey cost Rs. 250,000 and is now due for payment.

The company’s financial accountant has prepared the following projected statements

of profit or loss. The forecast covers years 2-5 when the oilfield would be operational.

Projected statements of profit or loss

Year

2

Rs.

‘000

Sales

Minus expenses:

Wages and salaries

Materials and

consumables

Licence fee

Overheads

Depreciation

Survey cost written off

Interest charges

Rs.

‘.000

4

Rs.

‘000

8,300

Rs.

‘000

5

Rs.

‘000

9,800

Rs.

‘000

550

340

580

360

620

410

520

370

600

220

2,100

250

650

300

220

2,100

650

300

220

2,100

650

300

220

2,100

650

–––––

Profit

3

Rs.

‘000

7,400

4,710

–––––

4,210

–––––

4,300

–––––

Rs.

‘000

5,800

4,160

–––––

–––––

–––––

–––––

2,690

4,090

5,500

1,640

–––––

–––––

–––––

–––––

Notes

(i)

The licence fee charge in Year 2 includes the payment that would be made

at the beginning of year 1 as well as the payment at the beginning of Year

2. The licence fee is paid to the Ruritanian government at the beginning of

each year.

(ii)

The overheads include an annual charge of Rs. 120,000 which represents

an apportionment of head office costs. The remainder of the overheads are

directly attributable to the project.

(iii)

The survey cost is for the survey that has been carried out by the firm of

specialists.

(iv)

The new equipment costing Rs. 10,400,000 will be sold at the end of Year

5 for Rs. 2,000,000.

© Emile Woolf International

13

The Institute of Chartered Accountants of Pakistan

Business finance decisions

(v)

A specialised item of equipment will be needed for the project for a brief

period at the end of year 2. This equipment is currently used by the

company in another long-term project. The manager of the other project

has estimated that he will have to hire machinery at a cost of Rs. 150,000

for the period the cutting tool is on loan.

(vi)

The project will require an investment of Rs. 650,000 working capital from

the end of the first year to the end of the licence period.

The company has a cost of capital of 10%. Ignore taxation.

Required

Calculate the NPV of the project.

6.4

SADEEQ ENERGY PLC

Sadeeq Energy Plc is a fast growing profitable company. The company is based

in Lahore and has just won a new contract to supply gas to the State Electricity

Board. In this regard, the company planned to commission a 35-kilometre

pipeline at a cost of Rs. 260m to enable it execute the contract. The pipeline,

when installed, will carry the gas to an agreed location under the control of the

State Electricity Board.

The anticipated revenue from sales to the State Electricity Board is expected to

be Rs. 120m per annum.

Apart from this contract, the pipeline could also be used to transport Liquefied

Natural Gas (LNG) to other willing customers in the suburb. The sales from this

source are put at Rs. 80m per annum.

The management of Sadeeq Energy Plc considers the useful life of the pipeline

to be 20 years. The financial manager estimates a profit to sales ratio of 20% per

annum for the first 12 years and 17% per annum for the remaining life of the

project.

The project is not likely to have any salvage value.

Sadeeq Energy Plc will enjoy exemption from tax for this project as a result of a

recent government investment incentive.

The company’s cost of capital is 15%.

Required

(a)

Distinguish between mutually exclusive investment and independent

investment.

(b)

Why is the investment decision important to organizations and what

techniques can be used to ensure that optimal investments are undertaken

by firms?

(c)

Evaluate the project by estimating its payback period?

(e)

Compute the project’s NPV and IRR.

© Emile Woolf International

14

The Institute of Chartered Accountants of Pakistan

Questions

6.5

BETA LIMITED

Beta Limited (BL) is engaged in the business of manufacturing and marketing of

high quality plastic products to the large departmental stores in Pakistan and United

Arab Emirates. BL is presently experiencing a decline in sales of its products. Market

research carried out by the Marketing Department suggests that sustained growth

in sales and profits can be achieved by offering a wide range of products rather

than a limited range of quality products. In this regard, BL is considering the following

two mutually exclusive options:

Option I : Introduce low quality products in the market

Following information has been worked out by the Chief Financial Officer of the

company:

Net present value using a nominal discount rate of 13%

Discounted payback period

Rs. 82 million

3.1 years

Internal rate of return

10.5%

Modified internal rate of return

13.2% approximately

Option II : Import variety of plastic products from China

BL would buy in bulk from Chinese suppliers and sell it to the existing customers.

The projected net cash flows at current prices after acceptance of this option are as

follows:

Against import from

China (US$ in million)

From operation in

UAE (US$ in million)

From operations in

Pakistan (Rs. in million)

Year 0

Year 1

Year 2

Year 3

Year 4

(25.00)

(20.00)

(21.33)

(22.33)

(20.67)

-

22.47

24.15

25.23

23.37

333

350

414

450

-

The following information is also available:

(i)

The current spot rate is Re. 1=US$ 0.0111.

(ii)

BL evaluates all its investment using nominal rupee cash flows and a

nominal discount rate.

(iii)

Inflation in Pakistan and USA is expected to be 10% and 3% per annum

respectively.

Tax may be ignored.

Required

Evaluate the two options using net present value, discounted payback period,

internal rate of return and modified internal rate of return. Give brief comments on

each of the above methods of evaluation and their relevance in the given situation.

For the purpose of evaluation, assume that BL has a four year time horizon for

investment appraisal.

© Emile Woolf International

15

The Institute of Chartered Accountants of Pakistan

Business finance decisions

CHAPTER 7 – DCF: TAXATION AND INFLATION

7.1

MORE INVESTMENT APPRAISAL AND TAX

CVB is considering whether to invest in new equipment costing Rs. 600,000. The

equipment is expected to have an economic life of five years and will have no

disposal value at the end of Year 5 (and no disposal costs).

CVB’s after-tax cost of capital is 15%. Tax is charged at an annual rate of 35%

and is payable in the year following the year in which the taxable profits arise.

The following forecasts relate to the project under consideration:

Rs.000s

Year

Sales income

Direct materials

Direct labour

Total direct costs

Depreciation

1

250

50

25

75

120

2

250

55

25

75

120

3

300

58

30

88

120

4

350

64

30

94

120

5

400

70

35

105

120

There will be tax allowances on the cost of the equipment, calculated at 25%

each year on the reducing balance basis. The first depreciation tax allowance

(capital allowance) would be claimed in year 0 (or very early in year 1).

Assume that:

(1)

taxable profits are defined as income minus direct costs and capital

allowances

(2)

cash profits in each year = sales minus direct costs

Required

Calculate the net present value of the project and recommend whether or not the

project should be undertaken.

7.2

INVESTMENT APPRAISAL AND TAX

JKL is considering whether to invest in the purchase of a new machine costing

Rs. 250,000. The machine will have a four-year life and a net disposal value of

Rs. 100,000 at the end of Year 4.

In addition, Rs. 38,000 of working capital will be required from the start of the

project, increasing to Rs. 50,000 at the beginning of the second year. All the

working capital will be recovered at the end of Year 4.

The project is expected to generate extra annual revenues of Rs. 200,000 and

incur annual cash operating costs of Rs. 80,000 for each year of the project.

JKL’s cost of capital is 10% after tax.

Corporation tax is charged on profits at 35%. Tax is payable in the year following

the year in which the profits occur. There will be a 25% annual writing-down

allowance on capital expenditure, for tax purposes. The tax-allowable

depreciation is calculated by the reducing balance method.

© Emile Woolf International

16

The Institute of Chartered Accountants of Pakistan

Questions

Required

Calculate the NPV of the project and state whether or not it should be

undertaken.

7.3

ALAWADA LIMITED

Alawada Limited is considering a five-year project whose initial cost would be Rs.

3million. The contribution consists of annual sales of Rs. 2.8million and variable

costs of Rs. 2million for 1,000,000 units of sales per annum. These are the

expected money values in year 1.

All sales would be made through a single distributor who has asked for a fixed

selling price of Rs. 2.80 per unit for three years after which prices could be

increased by 20% for year 4 and held constant at this new price for years 4 and

5. The variable cost is Rs. 2.00 per unit and it consists of material cost of

Rs.0.80 which is expected to increase by 5% per annum and the balance

represents labour cost which is expected to increase by 10% per annum for each

year. The company’s cost of capital is assumed to be 10%.

Required

7.4

(a)

Calculate the net present value of the project and advise on its viability.

(b)

State TWO features of capital budgeting decision.

(c)

Give FOUR reasons why capital budgeting decision is important.

KOHAT LIMITED

Kohat Limited (KL) is considering to set-up a plant for the production of a single

product IGM3. The initial capital investment required to set up the plant is Rs. 15

billion. The expected life of the plant is only 5 years with a residual value of 20% of

the initial capital investment. The plant will have an annual production capacity of 1.0

million tons.

A local group has offered to purchase all the production for Rs. 8,000 per ton in

year 1 and thereafter at a price to be increased 5% annually. Other relevant

information is as under:

(i)

In year 1, operating costs (other than wages and depreciation) per annum

would be Rs. 2,000 per ton. They are expected to increase in line with

Producer Price Index (PPI). Annual wages would be Rs. 1.0 billion and are

linked to Consumer Price Index (CPI).

(ii)

KL’s cost of capital for this project, in real terms is 6%. General inflation rate

is 11%.

(iii)

The tax rate applicable to the company is 30% and the tax is payable in

the same year. The company can claim normal tax depreciation at 20% per

annum under the reducing balance method.

© Emile Woolf International

17

The Institute of Chartered Accountants of Pakistan

Business finance decisions

Price indices of the last six years are given below:

Year

2010

2011

2012

2013

2014

2015

PPI

107

119

130

142

160

175

CPI

112

125

139

155

173

195

The costs linked to the above indices are expected to grow at their historic

compound annual growth rate.

Required

Advise whether KL should invest in the project.

7.5

JAP RECREATION CLUB

The management of JAP Recreation Club is evaluating the option to launch a

restaurant that would serve complete meal to its members. Presently, it has a

snack bar shop which sells snacks and drinks only.

A management consultant firm was hired at a fee of Rs. 85,000 to prepare the

feasibility of the project. JAP’s Accountant has extracted the following information

from the consultant’s report:

(i)

The restaurant will be launched on the first day of the next year.

(ii)

The club membership has been increasing at the rate of 5% per annum.

As a result of this facility, it is expected that the rate would increase to 10%

per annum.

(iii)

The cost of equipment for the restaurant is estimated at Rs. 7,000,000.

It would have a residual value of Rs. 510,000 at the end of its estimated

useful life of four years.

(iv)

It is estimated that during the first year, an average of 100 customers

would visit the restaurant, per day. The number would increase in line with

the increase in membership. The average revenue from each customer is

estimated at Rs. 400 whereas variable costs per customer would be Rs.

260.

(v)

Four employees would be appointed in the first year at an average salary

of Rs. 200,000 per annum. A fifth employee would be hired from the third

year.

(vi)

The annual fixed overheads for the current year are estimated at Rs. 4.8

million. 15% of the fixed overheads are allocated to the snack bar. As a

result of the establishment of the restaurant the annual expenditure would

increase as follows:

Rupees

Electricity and gas

340,000

Advertising

170,000

Repair and maintenance

© Emile Woolf International

85,000

18

The Institute of Chartered Accountants of Pakistan

Questions

After the establishment of restaurant, 20% of the overheads would be

allocated to the restaurant whereas allocation to snack bar would reduce to

10%.

(vii) The snack bar is presently serving an average of 250 customers per day

and the number is increasing in proportion to the number of members. If

the restaurant is launched, the number of customers would reduce by 40%

in the first year but would continue to increase in subsequent years in line

with the member base. The average contribution margin from snack bar is

Rs. 50 per customer.

(viii) The tax rate applicable to the company is 35% and it is required to pay

advance tax in four equal quarterly instalments. JAP can claim tax

depreciation at 25% under the reducing balance method. Any taxable

losses arising from this investment can be set off against profits of other

business activities.

(ix)

JAP’s post tax cost of capital is 17% per annum before adjustment for

inflation. The rate of inflation is 10%.

Required

Advise whether JAP should invest in the project. Assume that each year has 360

days.

7.6

ARG COMPANY

ARG Company is a leisure company that is recovering from a loss-making venture into

magazine publication three years ago. Recent financial statements of the company are

as follows.

Statement of profit or loss for the year ending 30 June 20X5

$000

140,400

Sales revenue

Cost of sales

112,840

–––––––

27,560

Gross profit

Administration costs

23,000

––––––

4,560

900

––––––

3,660

Profit before interest and tax

Interest

Profit before tax

Tax

1,098

––––––

2,562

––––––

400

Profit after tax

Dividends paid

Retained profit

© Emile Woolf International

2,162

––––––

19

The Institute of Chartered Accountants of Pakistan

Business finance decisions

Statement of financial position as at 30 June 20X5

$000

Non-current assets

$000

50,000

Current assets

Inventory

Receivables

2,400

20,000

Cash

1,500

––––––

23,900

––––––

73,900

––––––

Equity and liabilities

Ordinary shares, $1 par value

2,000

Capital reserves

27,000

Accumulated profits

1,900

––––––

30,900

9% Bonds (redeemable in 9 years)

Current liabilities

10,000

33,000

––––––

73,900

––––––

The company plans to launch two new products, Alpha and Beta, at the start of July

20X5, which it believes will each have a life-cycle of four years. Alpha is the deluxe

version of Beta. The sales mix is assumed to be constant.

Expected sales volumes for the two products are as follows.

Year

1

2

3

4

Alpha

60,000

110,000

100,000

30,000

Beta

75,000

137,500

125,000

37,500

The standard selling price and standard costs for each product in the first year will be

as follows.

Product

Direct material costs

Incremental fixed production costs

Standard mark-up

Selling price

© Emile Woolf International

20

Alpha

Beta

$/unit

$/unit

12.00

8.64

––––––

20.64

10.36

––––––

31.00

––––––

9.00

6.42

––––––

15.42

7.58

––––––

23.00

––––––

The Institute of Chartered Accountants of Pakistan

Questions

ARG Company traditionally operates a cost-plus approach to product pricing.

Incremental fixed production costs are expected to be $1 million in the first year of

operation and are apportioned on the basis of sales value. Advertising costs will be

$500,000 in the first year of operation and then $200,000 per year for the following two

years. There are no incremental non-production fixed costs other than advertising

costs.

In order to produce the two products, investment of $1 million in premises, $1 million in

machinery and $1 million in working capital will be needed, payable at the start of July

20X5. The investment will be financed by the issue of $3 million of 9% debentures,

each $100 debenture being convertible into 20 ordinary shares of ARG Company after

8 years or redeemable at par after 12 years.

Selling price per unit, direct material cost per unit and incremental fixed production

costs are expected to increase after the first year of operation due to inflation:

Selling price inflation: 3% per year

Direct material cost inflation: 3% per year

Fixed production cost inflation: 5% per year

These inflation rates are applied to the standard selling price and standard cost data

provided above. Working capital will be recovered at the end of the fourth year of

operation, at which time production will cease and ARG Company expects to be able

to recover $1.2 million from the sale of premises and machinery. All staff involved in

the production and sale of Alpha and Beta will be redeployed elsewhere in the

company.

ARG Company pays tax in the year in which the taxable profit occurs at an annual rate

of 25%. Investment in machinery attracts a first-year capital allowance of 100%. ARG

Company has sufficient profits to take the full benefit of this allowance in the first year.

For the purpose of reporting accounting profit, ARG Company depreciates machinery

on a straight line basis over four years. ARG Company uses an after-tax discount rate

of 13% for investment appraisal.

Other information

Assume that it is now 30 June 20X5

The ordinary share price of ARG Company is currently $4.00

Average interest cover for ARG Company’s sector is 7.0 times.

Average gearing for ARG Company’s sector is 45% (long-term debt/equity using book

values)

Required

(a)

Calculate the net present value of the proposed investment in products

Alpha and Beta.

(b)

Identify and discuss any likely limitations in the evaluation of the proposed

investment in Alpha and Beta.

(c)

Evaluate and discuss the proposal to finance the investment with a $3

million 9% convertible debenture issue.

© Emile Woolf International

21

The Institute of Chartered Accountants of Pakistan

Business finance decisions

7.7

HAFEEZ LTD

Hafeez Ltd is planning to bid for a contract to supply a machine under an operating

lease arrangement, for 5 years. The terms of proposed contract include a special

arrangement whereby the supplier / lessor will have to operate and maintain the

machine, during the term of lease. Hafeez Ltd is required to quote a consolidated

annual fee consisting of lease rentals and operating changes which shall be payable in

arrears. The following relevant information is available:

(i)

The cost of machine is Rs. 50 million and the expected useful life is 10

years. The residual value at the end of five years is estimated to be 25% of

the cost of machine.

(ii)

Operating cost for the first year is estimated at Rs. 6 million and is expected

to increase at the rate of 10% per annum.

(iii)

The tax rate applicable to the company is 35% and the tax is payable in the

same year. The company can claim initial and normal depreciation at 25%

and 10% respectively under the reducing balance method.

(iv)

The weighted average cost of capital of the company is 14%.

Required

(a)

Calculate the annual consolidated fee to be quoted for the contract if the

company’s target is to achieve a pre-tax net present value of 15% of total

capital outlay.

(b)

Using the fee quoted above, calculate the project’s internal rate of return

(IRR) to the nearest percent

© Emile Woolf International

22

The Institute of Chartered Accountants of Pakistan

Questions

CHAPTER 8 – DCF: RISK AND UNCERTAINTY

8.1

RISK IN INVESTMENT APPRAISAL

East must purchase a new machine for making a new product. There is a choice

between two machines, Machine A and Machine B. Each machine has an

estimated life of three years with no expected scrap value.

Machine A costs Rs. 15,000 and Machine B costs Rs. 20,000.

The variable costs of manufacture would be Rs. 1 per unit of Machine A is used

and Rs.0.50 per unit if Machine B is used. The product will sell for Rs. 4 per unit.

The demand for the product is uncertain. Following some market research, the

following estimates of annual sales demand have been made:

Annual demand

Probability

Units

2,000

0.2

3,000

0.6

5,000

0.2

The sales demand in each year will be the same. For example, if the demand is

2,000 units in Year 1, it will be 2,000 units for every year of the project.

Taxation and fixed costs will be unaffected by any decision made.

East’s cost of capital is 6%.

Required

8.2

(a)

Calculate the NPV for each of investment options, Machine A and Machine

B, for each of the possible levels of sales demand.

(b)

Calculate the expected NPV for each of the investment options.

(c)

Assume now that the decision is taken to buy Machine A.

(i)

Calculate the probability that the NPV of the project will be negative

(ii)

Calculate the minimum annual sales required for the NPV of the

project to be positive.

CALM PLC

Calm Plc designs and manufactures Personal Stress-Monitoring Device (PSMD).

The device is designed for checking individuals’ stress levels. A typical device

has a commercial life of three years.

Recently, the company developed a new device known as “SIMPLE” and paid

Rs. 10 million as development cost.

© Emile Woolf International

23

The Institute of Chartered Accountants of Pakistan

Business finance decisions

The following projections were made in respect of the product “SIMPLE”:

Sales Revenue

Probability

Year 1

Rs. m

Year 2

Rs. m

Year 3

Rs. m

If demand is above average

0.25

240

500

160

If demand is average

If demand is below average

0.60

0.15

140

50

340

180

80

50

Variable costs will amount to 30% of sales. Sales revenue and variable cost will

be received and paid respectively on the last day of the year in which they arise.

If “SIMPLE” is produced, a special machine will have to be purchased at the

beginning of Year 1 at a cost of Rs. 190 million, payable at the time of purchase.

The machine will have a scrap value of Rs. 10 million at the end of the product’s

life. The amount is receivable one year after the last year in which production

takes place. If purchased, the machine will be installed in an unused part of one

of Calm Plc.’s factories. The company has been trying to let this unused factory

space at a rent of Rs. 16 million per annum. Although, there seems to be no

chance of letting the space in year 1, there is a 60% chance of letting it for two

years at the beginning of year 2 and a 50% chance of letting it for one year at the

beginning of year 3 provided it has not been let at the beginning of year 2. All

rental income will be received annually in advance. Fixed costs, which include

depreciation of the special machine on a straight-line basis, are expected to

amount to Rs. 70 million per annum.

These costs which are all specific to the production of “SIMPLE” and will be paid

on the last day of the year in which they arise with the exception of depreciation,

Advertising expenses will be paid on the first day of each year and will amount to

Rs. 30 million at the start of year 1, Rs. 20 million at the start of year 2 and Rs. 10

million at the start of year 3. Calm Plc. has a cost of capital of 20%.

Required

Analyse and evaluate the production of “SIMPLE” based on expected present

value. (Show all relevant calculations).

8.3

OUTLOOK PLC

Outlook Plc is considering a new project for which the following information is

relevant:

Initial investment of Rs. 350,000 with nil scrap value.

Expected life span of 10 years

Sales volume - 20,000 units per annum

Selling price - Rs. 20 per unit

Direct variable cost of Rs. 15 per unit

Fixed cost excluding depreciation of Rs. 25,000 per annum.

© Emile Woolf International

24

The Institute of Chartered Accountants of Pakistan

Questions

The project has IRR of 17%.

The company’s hurdle rate of 15%.

Required

(a)

(b)

8.4

Compute the sensitivity of the NPV to each of the underlisted variables:

(i)

Sales price

(ii)

Initial outlay

(iii)

Sales volume

(iv)

Variable cost

(v)

Fixed cost

State the TWO most sensitive variables

ZAHEER LTD

Zaheer Ltd is a manufacturer of auto parts and is currently operating at below capacity

due to slump in the demand for automobiles. The company has received a proposal

from a truck assembler for supply of 40,000 gear boxes per annum for five years at Rs.

1,900 per gear box.

The cost of each gear box is as follows:

Rupees

800

500

150

200

150

1,800

Material costs

Labour costs

Variable production overheads

Variable selling overheads

Fixed overheads (allocated)

Company has already incurred a cost of Rs. 5 million on the preparation of technical

feasibility. The additional cost for setting up the facility for this order would be Rs. 20

million. The company qualifies for tax allowable depreciation on the cost of setting up

the facility on a straight-line basis over the life of the project.

The company has a post-tax cost of capital of 15%. The rate of tax applicable to the

company is 30%.

Required

(a)

Evaluate whether the proposal is financially feasible for the company.

Assume that revenue and cost of gear box will remain the same during the

next five years.

(b)

Carry out a sensitivity analysis to determine which of the following variables

is most sensitive to the feasibility of the order:

Material costs

Labour costs

Additional cost of setup

© Emile Woolf International

25

The Institute of Chartered Accountants of Pakistan

Business finance decisions

8.5

JKL PHONE LIMITED

JKL Phone Limited is a cellular service provider. The Marketing Director has

recently proposed a marketing strategy which envisages the introduction of a new

package for pre- paid customers, to gain market share. He has carried out a

market research and suggests that the call rates forming part of the proposed

package should either be Re. 0.75 or Re. 1.00 or Rs. 1.25 per minute.

Based on market research, sales demand at different levels of economic growth is

estimated as follows:

Call Rates

Probability

Rs. 0.75

Re. 1

Rs. 1.25

Subscribers in million

Recession

0.30

0.70

0.50

0.30

Moderate

0.50

0.80

0.60

0.40

Boom

0.20

0.90

0.80

0.60

He foresees that the average airtime usage per subscriber would be 1800 minutes or

1600 minutes with a probability of 40% and 60% respectively. In order to cater to the

increased subscriber base, the company would need to commission new cell sites,

details of which are as follows:

No. of subscribers (in million)

Cost of new sites (Rs. in million)

Up to 0.5 million

180.00

Between 0.5 – 0.8 million

300.00

Between 0.8 – 1.0 million

540.00

It is assumed that the present customers of the company would continue to use the

existing packages.

Required

Evaluate the proposal submitted by the Marketing Director and advise the most

suitable call rates.

8.6

KHAYYAM LIMITED (KL)

The directors of Khayyam Limited (KL) are considering an investment proposal

which would need an immediate cash outflow of Rs. 500 million. The investment

proposal is expected to have two years economic life with salvage value of Rs. 50

million at the end of second year.

© Emile Woolf International

26

The Institute of Chartered Accountants of Pakistan

Questions

KL’s Budget and Planning Department anticipates that Net Cash Inflows After Tax

(NCIAT) are dependent on exchange rate of the US $ and has made the following

projections:

Exchange Rate

Exchange Rate

Exchange Rate

Rs. 84-87

Rs. 88-91

Rs. 92-95

NCIAT

Probability

NCIAT

Probability

NCIAT

Probability

250

65%

320

35%

-

-:

If Year 1

exchange

rate is

Rs. 84-87

280

20%

330

65%

360

15%

If Year 1

exchange

rate is

Rs. 88-91

340

5%

380

50%

400

45%

Year 1

Year 2

−

−

All NCIATs are in millions of rupees

KL uses a 14% discount rate for investments having similar risk levels.

Required

(a)

Draw a decision tree to depict the above possibilities.

(b)

Determine whether it would be advisable for Khayyam Limited to undertake

this project.

© Emile Woolf International

27

The Institute of Chartered Accountants of Pakistan

Business finance decisions

CHAPTER 9 – DCF: SPECIFIC APPLICATIONS

9.1

LEASE OR BUY

A company is considering whether to acquire a new machine. The machine has a

purchase cost of Rs. 30,000, an expected useful life of five years and a disposal

value of Rs. 6,000 at the end of year 5. The machine would generate additional

cash flows of Rs. 10,000 in each of its five years.

Two methods of financing are under consideration:

(i)

To buy the machine with money obtained from a bank loan, at an interest

rate of 8% after tax.

(ii)