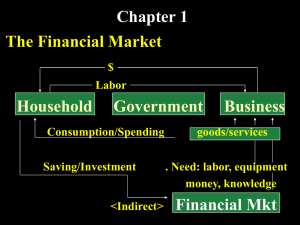

Chapter 1 Principles of Corporate Finance Tenth Edition Goals and Governance of the Firm Slides by Matthew Will McGraw-Hill/Irwin Copyright © 2011 by the McGraw-Hill Companies, Inc. All rights reserved. Topics Covered Corporate Investment and Financing Decisions The Role of the Financial Manager and the Opportunity Cost of Capital Goals of the Corporation Agency Problems and Corporate Governance 1-2 Investment and Financing Decisions Capital Budgeting Decision – Decision to invest in tangible or intangible assets. …also called the Investment Decision …also called Capital Expenditures or (CAPEX) 1-3 Investment and Financing Decisions – “Capital Budgeting” Tangible Assets Intangible Assets Expand Stores New Drug R&D @ $800 million @ $800 million 1-4 Role of The Financial Manager (2) (1) Financial manager Firm's operations (3) 1-5 (4a) (4b) (1) Cash raised from investors (2) Cash invested in firm (3) Cash generated by operations (4a) Cash reinvested (4b) Cash returned to investors Financial markets Who is The Financial Manager? Chief Financial Officer Treasurer Controller 1-6 The Investment Trade-off 1-7 The Investment Trade-off Hurdle rate Cost of capital Opportunity cost of capital 1-8 Goals of The Corporation Profit maximization is not a well-defined financial objective, for at least two reasons: 1. Maximize profits? Which year’s profits? A corporation may be able to increase current profits by cutting back on outlays for maintenance or staff training, but that may add value. Shareholders will not welcome higher short-term profits if long-term profits are damaged. 2. A company may be able to increase future profits by cutting this year’s dividend and investing the freed-up cash in the firm. That is not in the shareholders’ best interest if the company earns less than the opportunity cost of capital. 1-9 1-10 Whose Company Is It? ** Survey of 378 managers from 5 countries 3 Japan 97 17 Germany 22 France United States 71 76 24 0 All Stakeholders 78 29 United Kingdom The Shareholders 83 20 40 60 80 % of responses 100 120 1-11 Dividends vs. Jobs ** Survey of 399 managers from 5 countries. Which is more important...jobs or paying dividends? 3 Japan 97 40 Germany 41 France United States 89 89 11 0 Job Security 59 11 United Kingdom Dividends 60 20 40 60 80 % of responses 100 120 Goals of The Corporation Shareholders desire wealth maximization Do managers maximize shareholder wealth? Managers have many constituencies “stakeholders” “Agency Problems” represent the conflict of interest between management and owners 1-12 Agency Problem 1-13 Ownership vs. Management Difference in Information Stock prices and returns Issues of shares and other securities Dividends Financing Different Objectives Managers vs. stockholders Top mgmt vs. operating mgmt Stockholders vs. banks and lenders Agency Problem Agency costs are incurred when: 1. managers do not attempt to maximize firm value and 2. shareholders incur costs to monitor the managers and constrain their actions. 1-14 Agency Problem Agency Problems – Managers, acting as agents for stockholders, may act in their own interests rather than maximizing value. Stakeholder – Anyone with a financial interest in the firm. 1-15 Agency Problem 1-16 Tools to Ensure Management Pays Attention to the Value of the Firm – Manager’s actions are subject to the scrutiny of the board of directors. – Shirkers are likely to find they are ousted by more energetic managers. – Financial incentives such as stock options Agency Problem Agency Problem and Corporate Governance Solutions 1. Legal and Regulatory Requirements 2. Compensation plans 3. Board of Directors 4. Monitoring 5. Takeovers 6. Shareholder pressure 1-17 Web Resources Click to access web sites Internet connection required www.corpgov.net www.thecorporatelibrary.com www.riskmetrics.com 1-18