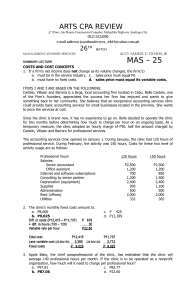

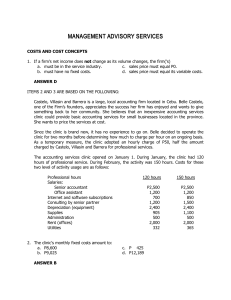

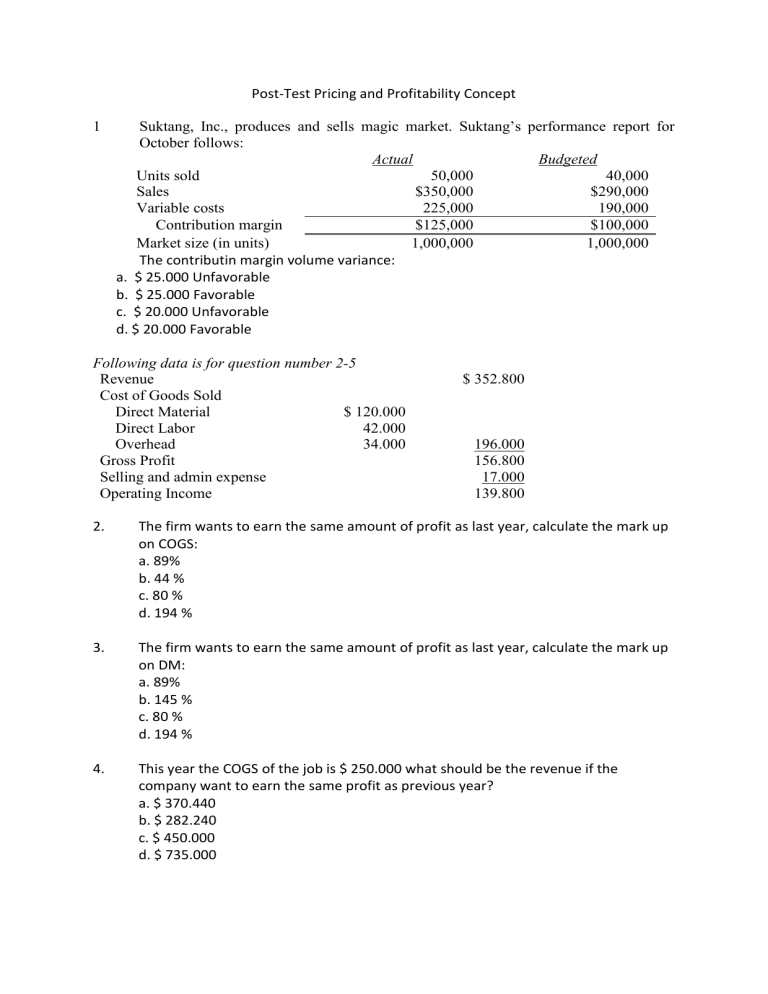

Post-Test Pricing and Profitability Concept 1 Suktang, Inc., produces and sells magic market. Suktang’s performance report for October follows: Actual Budgeted Units sold 50,000 40,000 Sales $350,000 $290,000 Variable costs 225,000 190,000 Contribution margin $125,000 $100,000 Market size (in units) 1,000,000 1,000,000 The contributin margin volume variance: a. $ 25.000 Unfavorable b. $ 25.000 Favorable c. $ 20.000 Unfavorable d. $ 20.000 Favorable Following data is for question number 2-5 Revenue Cost of Goods Sold Direct Material $ 120.000 Direct Labor 42.000 Overhead 34.000 Gross Profit Selling and admin expense Operating Income $ 352.800 196.000 156.800 17.000 139.800 2. The firm wants to earn the same amount of profit as last year, calculate the mark up on COGS: a. 89% b. 44 % c. 80 % d. 194 % 3. The firm wants to earn the same amount of profit as last year, calculate the mark up on DM: a. 89% b. 145 % c. 80 % d. 194 % 4. This year the COGS of the job is $ 250.000 what should be the revenue if the company want to earn the same profit as previous year? a. $ 370.440 b. $ 282.240 c. $ 450.000 d. $ 735.000 5. This year the Direct Material of the job is $ 100.000 what should be the revenue if the company want to earn the same profit as previous year? a. $ 189.000 b. $ 245.000 c. $ 180.000 d. $ 294.000 Following data is for question number 6-8. SUVONSY Corporation, Inc., has just completed its first year of operations. The unit costs on a normal costing basis are as follows: Variable costs per unit: Direct materials $7.00 Direct labor $12.00 Variable overhead $4.00 Variable selling expense $2.50 Fixed costs per year: Fixed overhead $240.000 Fixed selling and administrative expenses $236.000 Unit produced : 120.000 unit Unit sold : 100.000 unit Unit selling price : $30 6. The unit cost based on absorption costing is: a. $ 25 b. $ 23 c. $ 25,4 d. $ 23,4 7. The unit cost based on variable costing is: a. $ 25 b. $ 23 c. $ 25,4 d. $ 23,4 8. Based on the data above, what is the correct condition below: a. absorption-costing income > variable-costing income b. absorption-costing income < variable-costing income c. absorption-costing income = variable-costing income d. no correct answer 9. There are some limitation of profitability analysis, which of the following answer is not correct a. Focus on past performance b. Emphasis on quantifiable measures c. Impact on behavior d. Emphasis on qualitative measures 10. The difference between actual price and expected price multiplied by the actual quantity or volume sold is a. price volume variance b. sales price variance c. contribution margin variance d. contribution margin volume variance