Management Advisory Services Exam: Accounting Integration

advertisement

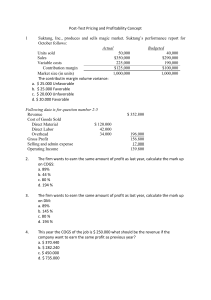

ICCT Colleges Foundation Inc. V.V Soliven Ave. II, Cainta, Rizal ACCOUNTING INTEGRATION PART 5 MANAGEMENT ADVISORY SERVICES MODULE RBR BACAY, CPA, MBA The following information applies to questions 1 and 2. Havana Village Association is planning another Riverboat Extravaganza. The Extravaganza committee has assembled the following expected costs for the event: Dinner (per person)…………………………………………………………………………….P 7 Favors and Program (per person)……………………………………………. 3 Band……………………………………………………………………………………………………………………. 1,500 Tickets and Advertising…………………………………………………………………. 700 Riverboat rental……………………………………………………………………………………. 4,800 Floorshow and strolling entertainers………………………………. 1,000 The committee members would like to charge P30 per person for the evening’s activities. 1. The break-even point for the of persons that must attend) is a. 300 persons b. 350 persons 2. Assume that only 250 persons If the same numbers attend this charged to break even? (2-43) c. P45.00 d. P43.50 Extravaganza (in terms of the number (2-42) c. 450 persons d. 400 persons attended the Extravaganza last year. year, what price per ticket must be c. d. P40 P42 The following information pertains to the questions 3 through 5 Omega Enterprise sells two products, Model E100 and F900. Monthly sales and the contribution margin ratios for the two products, follow : …………………Product……………… Model E100 Model F900 Total Sales P700,000 P300,000 1,000,000 Contribution margin ratio 60% 70% ? The company’s fixed expenses total P598,500 per month. 3. a. b. 4. a. b. 5. mix a. b. What is the company’s total contribution margin ratio? (2-43) 60% c. 70% 63% d. 65% What is the company’s total net operating income? (2-44) P630,000 c. P210,000 P 31,500 d. P420,000 The break-even point for the company based on the current sales is (2-44) P900,000 c. P1,000,000 P950,000 d. P1,050,000 The following information pertains to the questions 6 through 9 Hoopie Company sells a single product. The company’s sales and expenses for a recent month follow: Total Per Unit Sales P 600,000 P 40 Less variable expense 420,000 28 Contribution margin 180,000 P 12 Less fixed expense 150,000 Net operating income P 30,000 6. What is the monthly break-even point in units sold? (2-45) a. 12,000 units c. 15,200 units b. 12,500 units d. 11,000 units 7. How many units would have to be sold each month to earn a minimum target profit of P18,000? (2-45) a. 14,500 c. 14,000 b. 12,000 d. 14,700 8. What is the company’s margin of safety in percentage form? (2-45) a. 15% c. 25% MAS.MODULE.2019 1 of 20 b. 20% d. 16% 9. If monthly sales increase by P80,000 and there is no charge in fixed expenses, by now how much would you expect monthly net operating income to increase? (2-45) a. P20,000 c. P24,000 b. P24,500 d. P42,000 The following information pertains to the questions 10 through 12 Fluffy Inc.’s income statement for the year 2016 on production and sales of 200,000 units is as follows: Revenue P 2,600,000 Cost of goods sold 1,600,000 Gross margin 1,000,000 Marketing and distribution costs 1,150,000 Operating income (loss) (150,000) Fluffy’s fixed manufacturing costs were P500,000, marketing and distribution costs were P4 per unit and variable 10. What is Fluffy’s variable manufacturing costs per unit in 2016? (2-47) a. P5.50 c. P5.75 b. P4.00 d. P9.00 11. What is Fluffy’s fixed marketing and distribution costs in 2016? (2-47) a. P550,000 c. P350,000 b. P800,000 d. P500,000 12. The break-even point for the year 2016 in units is (2-47) a. 242,858 c. 68,965 b. 55,555 d. 142,857 The following information pertains to the questions 13 through 15 Given the following income statement for Jeffrey Company for 2016: Sales (30,000 units) P 600,000 Less operating expenses: Variable P390,000 Fixed 140,000 530,000 Net income 70,000 13. The break-even point for 2016 is (2-55) a. 26,000 units c. 460,000 units b. 17,500 units d. 400,000 units 14. The company’s degree of operating leverage is (2-55) a. 3 c. 4.28 b. 2 d. 8.57 15. The Company’s degree of safety (rounded to the nearest whole percentage) is (2-55) a. 33% c. 12% b. 50% d. 67% The following information pertains to the questions 16 through 18 Super Men’s Clothing’s revenues and cost data for 2016 are: Revenues P 500,000 Costs of goods sold (40% of sales) 200,000 Gross P 300,000 Operating costs: Salaries fixed P 150,000 Sales commissions (10% of sales) 50,000 Depreciation of equipment and fixtures 12,000 Store rent (4,000 per month) 48,000 Other operating cost 50,000 310,000 Operating income (loss) P 10,000 Mr. Super, the owner of the store, is unhappy with the operating results. As analysis of other operating costs reveals that it includes P40,000 variable costs, which vary with the sales volume, and P10,000 (fixed) costs 16. a. b. 17. a. What is the contribution margin of Super Men’s Clothing? (2-58) P300,000 c. P210,000 P260,000 d. P200,000 What is the contribution margin percentage? (2-58) 42% c. 52% MAS.MODULE.2019 2 of 20 b. 60% d. 40% 18. Mr. Super estimates that he can increase revenues by 20% by incurring additional advertising costs of P10,000. As a result, how much would Super Men’s Clothing’s operating income be? (2-58) a. P 32,000 c. P 40,000 b. P 22,000 d. P 50,000 The following information pertains to the questions 19 through 23 The Miguel Company has three product lines of belts – A, B and C – with contribution margins of P3, P2 and P1, respectively. The president foresees sales of 20,000 units of A, 100,000 units of B, and 80,000 units of C. The company’s fixed costs for the period are P225,000 19. What is the company’s break-even point in units, assuming that the given sales mix is maintained? (2-60) a. P90,000 c. P120,000 b. P150,000 d. P75,000 20. If the sales mix is maintained, what is the total contribution margin when 200,000 units are sold? (2-60) a. P200,000 c. P340,000 b. P260,000 d. P300,000 21. If the sales mix is maintained, what is the operating income? (2-60) a. P115,000 c. P75,000 b. P120,000 d. P85,000 22. What would operating income be if 20,000 units of A, 80,000 units of B and 100,000 units of C were sold? (2-60) a. P320,000 c. P240,000 b. P200,000 d. P360,000 23. Referring to additional information in the previous questions, what is the new break-even point in units if these relationships persist in the next period? (2-60) a. 159,380 c. 138,095 b. P125,000 d. P 65,000 The following information applies to questions 24 through 27. Global Corporation manufactured 100,000 buckets during February. The Overhead actual allocation base is P5.00 per machine-hour. The following variable overhead data pertain to February. Actual Budgeted Production 100,000 units 100,000 units Machine-hours 9,800 hours 10,000 hours Variable overhead cost per machine hour P5.25 P5.00 24. a. b. 25. a. b. 26. a. b. 27. a. b. What is the actual variable overhead cost? (2-72) P 49,000 c. P 51,450 P 50,000 d. None of the above What is the flexible-budget amount? (2-72) P 49,000 c. P 51,450 P 50,000 d. None of the above What is the variable overhead spending variance? (2-72) P1,000 favorable c. P2,450 unfavorable P1,450 unfavorable d. None of the above What is the variable efficiency variance? (2-72) P1,000 favorable c. P2,450 unfavorable P1,450 unfavorable d. None of the above The following information applies to questions 28 through 32 Production Variances Spending Volume Variable manufacturing Overhead P 4,500F (B) Fixed manufacturing overhead P 10,000U P40,000U 28. Above is a (2-73) a. 4-variance analysis b. 3-variance analysis MAS.MODULE.2019 Efficiency P15,000U (A) c. d. 2-variance analysis 1-variance analysis 3 of 20 29. In the above chart the amounts for (A) an (B) respectively are: (2-73) a. P10,500U ; P55,000U c. Zero ; P55,500U b. P10,500U ; Zero d. Zero ; Zero 30. In a 3-variance analysis, the spending variance should be: (2-73) a. P4,500F c. P55,500U b. P10,000U d. P10,500U 31. In a 2-variance analysis the flexible-budget variance and the production volume variance should be, respectively. (2-74) a. P5,500U ; P55,000U c. P10,500U ; P50,000U b. P20,500U ; P40,000U d. P60,500U ; Zero 32. In a variance analysis, the total overhead variance should be (2-74) a. P20,500U c. P121,000U b. P60,500U d. None of the above The following information applies to questions 33 through 37 The MA Appliance Manufacturing Corporation manufactures two vacuum cleaners, the Standard and the Super. The following information was gathered about the two products. Standard Super Budgeted sales in units 3,200 800 Budgeted selling price P300 P850 Budgeted distribution margin per unit P210 P550 Actual sales in units 3,500 1,500 Actual selling price P325 P840 33. What is the budgeted sales mix percentage for the Standard and the Super vacuum cleaners respectively: (2-75) a. 0.80 and 0.20 c. 0.20 and 0.80 b. 0.70 and 0.30 d. 0.30 and 0.70 34. What is the total sales-volume variance in terms of the contribution margin (2-75) a. P108,000 unfavorable c. P278,000 favorable b. P108,000 favorable d. P448,000 favorable 35. What is the total sales-quantity variance in terms of the contribution margin? (2-75) a. P110,000 unfavorable c. P278,000 favorable b. P170,000 favorable d. P448,000 favorable 36. What is the total sales-mix variance of the contribution margin? (2-75) a. P110,000 unfavorable c. P278,000 favorable b. P170,000 favorable d. P448,000 favorable 37. The sales-mix variance will be unfavorable when (2-75) a. The actual sales-mix shifts toward the less profitable units. b. The composite unit for the actual mix is greater than for the budgeted mix. c. Actual unit sales are less than the budgeted unit sales d. The actual contribution margin is greater than the static-budget contribution margin. The following data apply to items 38 through 42 Tony Company employs a standard absorption system for product costing. The standard cost of its product is as follows: Raw materials P14.50 Direct labor 2DLH@P8 P16.00 Manufacturing overhead 2DLH@P11 22.00 Total standard cost P52.50 The manufacturing overhead rate is based upon a normal activity level of 600,000 direct labor hours. Tony planned to produce 25,000 units each month during 2016. The budgeted manufacturing overhead for 2016 is as follows. Variable P3,600,000 Fixed P3,000,000 P6,600,000 MAS.MODULE.2019 4 of 20 During November 2016, Tony Corporation produced 26,000 units. Tony used 53,500 direct labor hours in November at a cost of P433,350. Actual manufacturing overhead for the month was P260,000 fixed and P315,000 variable. The total manufacturing overhead applied during November was P572,000. 38. The variable manufacturing overhead spending variance for November is (2-76) a. P9,000 unfavorable c. P11,350 unfavorable b. P4,000 unfavorable d. P6,000 favorable 39. The variable manufacturing overhead efficiency variance for November is (2-77) a. P3,000 unfavorable c. P1000 favorable b. P9,000 unfavorable d. P12,000 unfavorable 40. The fixed manufacturing overhead spending (budget) variance for November (2-77) a. P10,000 favorable c. P6,000 favorable b. P10,000 unfavorable d. P4,000 unfavorable 41. The fixed manufacturing overhead volume variance for November is (2-77) a. P10,000 favorable c. P3,000 favorable b. P10,000 unfavorable d. P2,000 unfavorable 42. The total variance related to efficiency of the manufacturing operation for November is (2-77) a. P9,000 unfavorable c. P21,000 unfavorable b. P12,000 unfavorable d. P11,000 unfavorable 43. Each finished unit of product ET-25 has 60 pounds of raw material. The manufacturing process must provide for a 20 percent waste allowance. The raw material can be purchased for P2.50 a pound under terms of 2/10, n/30. The company takes all cash discounts. The standard direct material cost for each unit of product ET-25 is (2-78) a. P180 c. P183.75 b. P187.50 d. P176.40 44. Each unit of product MN-46 requires three direct labor hours. Employee benefit costs are treated as direct labor costs. Data on direct labor are as follows. (2-78) Number of direct employees 25 Weekly productive hours per employee 35 Estimated weekly wages per employee P245 Employee benefits (related to weekly wages) 25 % The standard direct labor cost per unit of Product MN-46 is a. P21.00 c. P29.40 b. P26.25 d. P36.75 The following data applies to items 45 through 48 Tina Industries employs a standard cost system in which direct materials inventory is carried at standard cost of one unit of product. Standard Standard Standard Quantity Price Cost Direct materials 8 pounds P1.80 per pound P14.40 Direct labor 0.25 hour P8.00 per hour 2.00 45. a. b. 46. a. b. 47. a. b. 48. a. b. P16.40 The direct material purchase price variance for May is (2-79) P16,000 favorable c. P14,250 favorable P16,000 unfavorable d. P14,250 unfavorable The direct material usage (quantity) variance for May is (2-79) P14,400 favorable c. P17,100 unfavorable P1,100 favorable d. P17,100 favorable The direct labor price (rate) variance for May is (2-79) P2,200 favorable c. P2,000 favorable P1,900 unfavorable d. P2,090 favorable The direct labor usage (efficiency) variance for May is (2-79) P2,200 favorable c. P2,000 favorable P2,000 unfavorable d. P1,800 favorable MAS.MODULE.2019 5 of 20 49. Gibbs Castings is a job order chop that uses a full absorption standard cost system to account for its production costs. The overhead costs are applied as a direct labor hour basis. A production volume variance will exist for Gibbs in a month where (280) a. production volume differs from sales volume b. actual direct labor hours differ from standard allowed direct labor hours c. there is a budget variance in fixed factory overhead costs. d. the fixed factory overhead applied on the basis of standard allowed direct labor hours differ from the budgeted fixed factory overhead. 50. Which of the following is not an advantage of using a standard cost system: (2-80) a. Eliminates the need for analysis of variances b. Facilitates establishing an effective system of responsibility accounting c. Requires an analysis of all aspects of operation d. Helps management control costs 51. Under the standard cost procedures, any differences between actual costs and standard costs are: (2-81) a. added to or subtracted from the standard cost amount b. treated as extraordinary production gains or losses c. ignored until the end of the fiscal period, when they are shown in footnotes in the income statement. d. recorded in variance accounts 52. If fewer units are produced than had been estimated when standard unit costs were determined, there would normally be: (2-81) a. a favourable usage variance b. an unfavourable volume variance c. a favourable material quantity variance d. an unfavourable controllable overhead variance. 53. Gilbert Company has a union contract which calls for an 8% cost of living increase in wages paid to all factory workers as of July 1, of the current year. This suggests that : (2-81) a. the labor rate variance for July will be unfavourable b. the labor rate variances during the first half of the current year have been favourable c. the standard labor cost per unit should be revised as of July 1 d. the labor quantity variance for July will be unfavourable. 54. a. b. c. d. A labor usage variance is most likely to occur if (2-82) employees are paid at an overtime wage rate employees are inefficient and units must be reworked labor cost per unit exceeds material costs per unit employee turnover rates are low 55. the a. b. c. d. A large favourable variance from standard costs ate the end of year should be: (2-82) carried forward to the next fiscal year showed as other income in the income statement added to cost of goods sold in the income statement allocated between ending inventories and cost of goods sold. 56. Which of the following unfavourable cost variances would be the least relevant in evaluating the performance of a production supervisor. (2-82) a. Material price variance b. Labor usage variance c. Controllable overhead variance d. Material quantity variance 57. a. b. c. d. An unfavorable volume variance in a factory is generally: (2-82) the responsibility of the production manager viewed as an idle capacity loss the result of actual volume exceeding normal volume treated as part of the controllable factory overhead variance. The following information pertains to the questions 58 through 60 MAS.MODULE.2019 6 of 20 Patience Co. uses a standard costing system in the manufacture of its single product. The 35,000 units of raw materials in the inventory were purchased for P105,000, and two units of raw materials are required to produce one unit of final product. In November, the company produced 12,000 units of product. The standard allowed for material was P60,000, and there was an unfavorable quantity variance of P2,500. 58. Patience’s standard price for one unit of material is (2-92) a. P2.00 c. P3.00 b. P2.50 d. P5.00 59. The units of materials used to produce November output (2-92) a. 12,500 units c. 23,000 units b. 12,500 units d. 25,000 units 60. The material price variance for the units used in November was (2-92) a. P2,500 unfavorable c. P12,500 unfavorable b. P11,000 unfavorable d. P3,500 unfavorable The following information pertains to the questions 61 through 64 Antarctica Enterprises uses a standard cost system in its small appliance division. The standard cost of manufacturing one unit of PIX is as follows: Materials – 60 pounds at P1.50 per pound P 90 Labor – 3 hours at P12.00 per hour 36 Factory overhead – 3hours a P8 per hour 24 Total standard cost per unit P 150 The budgeted variable factory overhead rate is P3 per labor hour, and the budgeted fixed factory overhead is P27,000 per month. During May Antarctica produced 1,650 units of PIX compared with the normal capacity of 1,800 units. The actual cost per unit was as follows: Materials (purchased and used) – 58 pounds at P1.65 per pound P 95.70 Labor – 3.1 hours at P12.00 per hour 37.20 Factory overhead – P39,930 per 1,650 units 24.20 Total actual cost per unit P 157.10 61. a. b. 62. a. b. 63. a. b. 64. a. b. The total material quantity variance for May is (2-98) P14,355 favorable c. P 4,950 favorable P14,355 unfavorable d. P 4,950 unfavorable The total material price variance for May is(2-98) P14,355 unfavorable c. P14,355 favorable P14,850 unfavorable d. P14,850 favorable The labor rate variance for May is (2-99) P1,920 favorable c. P4,950 unfavorable P 0 d. P4,950 favorable The flexible budget overhead variance for May is (2-99) P3,270 unfavorable c. P1,920 unfavorable P3,270 favorable d. P1,920 favorable The following information pertains to the questions 65 through 69 Aqua Control, Inc. manufactures water pumps and uses a standard cost system. The standard factory overhead costs per water pump are based on direct labor hours and are as follows: Variable overhead (4 hours at P8/hour) P32 Fixed overhead (4 hours at P5*/hour) 20 Total overhead cost per unit P52 *Based on a capacity of 100,000 direct labor hours per month. The following additional information is available for the month of November: 22,000 pumps were produced although 25,000 had been scheduled for production. 94,000 direct labor hours were worked at a total cost of P940,000. The standard direct labor rate is P9 per hour. The standard direct labor time per unit is 4 hours. Variable overhead costs were P740,000. Fixed overhead costs were P540,000. 65. The fixed overhead spending variance for November was (2-101) a. P40,000 unfavorable c. P460,000 unfavorable b. P70,000 unfavorable d. P240,000 unfavorable MAS.MODULE.2019 7 of 20 66. a. b. 67. a. b. 68. a. b. 69. a. b. The variable overhead spending variance for November was (2-101) P60,000 favorable c. P 48,000 unfavorable P12,000 favorable d. P 40,000 unfavorable The variable overhead efficiency variance for November was (2-101) P48,000 unfavorable c. P 96,000 unfavorable P60,000 favorable d. P200,000 unfavorable The direct labor price variance for November was (2-101) P54,000 unfavorable c. P 60,000 favorable P94,000 unfavorable d. P148,000 unfavorable The direct labor efficiency variance for November was (2-101) P108,000 favorable c. P 60,000 favorable P120,000 favorable d. P 54,000 unfavorable The following information pertains to the questions 70 through 73 Paige's Pillows produces and sells a decorative pillow for P75.00 per unit. In the first month of operation, 2,000 units were produced and 1,750 units were sold. Actual fixed costs are the same as the amount budgeted for the month. Other information for the month includes: Variable manufacturing costs P20.00 per unit Variable marketing costs P 3.00 per unit Fixed manufacturing costs P 7.00 per unit Administrative expenses, all fixed P15.00 per unit Ending inventories: Direct materials 0 Work in Process 0 Finished goods 250 units 70. What is 115) a. P20 b. P23 71. What is a. P35,000 b. P40,000 72. What is a. P96,250 b. P91,000 73. What is a. P52,250 b. P78,750 cost of goods sold per unit using variable costing? (2c. P30 d. P45 cost of goods sold using variable costing? (2-115) c. P47,250 d. P54,000 contribution margin using variable costing? (2-115) c. P104,000 d. P110,000 operating income using variable costing? (2-115) c. P 65,750 d. P 47,000 The following information pertains to the questions 74 through 77 Kacey Corporation incurred fixed manufacturing costs of P6,000 during 2016. Other information for 2016 includes: The budgeted denominator level is 1,000 units Units produced totalled 750 units Units sold total 600 units Beginning inventory was zero The company uses absorption costing and the fixed manufacturing cost rate is based on the budgeted denominator level. Manufacturing variances are closed to cost of goods sold. 74. Fixed manufacturing cost expensed in the income statement (excluding adjustments for variances) total (2-117) a. P 3,600 c. P 6,000 b. P 4,800 d. zero 75. Fixed manufacturing cost included in ending inventory total (2117) c. P 1,200 c. P 900 d. P 1,500 d. zero 76. The production volume variance is (2-117) a. P 2,000 c. P 2,400 b. P 1,500 d. zero 77. Operating income using absorption costing will be _____ than the operating income f using variable costing. (2-117) a. P 2,400 higher c. P 900 higher b. P 2,400 lower d. P 3,600 lower The following information pertains to the questions 78 through 81 Miggy Corporation incurred fixed manufacturing cost of 7,200 during 2016. Other information for 2016 includes: MAS.MODULE.2019 8 of 20 The budgeted denominator level is 800 units. Units produced total 1,000 units. Units sold total 950 units. Beginning inventory was zero. The fixed manufacturing cost rate is based on the budgeted denominator level manufacturing variances are closed to cost of goods sold. 78. Under absorption costing fixed a manufacturing costs expensed on the income statement (excluding adjustments for variances) total (2118) a. P 8,550 c. P 7,200 b. P 9,000 d. zero 79. Under absorption costing the production- volume variance is (2119) a. P 450 c. P1,800 b. P1,350 d. zero 80. Under variable costing, the fixed manufacturing costs expense on the income statement (excluding adjustments for variances) total (2119) a. P8,550 c. P9,000 b. P7,200 d. zero 81. Operating income using absorption costing will be __operating income if using absorption costing (2-119) a. P 450 higher than c. P1,300 lower than b. P 900 higher than d. the same as The following data apply to items 82 to 85: Samar Company began operations on January 3, 2017. Standard costs were established in early January assuming a normal production volume of 160,000 units. However, Samar produced only 140,000 units of products and sold 100,000 units at a selling price of P180 per unit during 2017. Variable costs totalled P7,000,000 of which 60 percent were manufacturing and 40 percent were selling fixed costs totalled P11,200,000 of which 50 percent were manufacturing and 50 percent were selling. Samar had no raw materials of work in process inventories at December 31, 2016. Actual input price per unit of product and actual input quantities per unit of product were equal to standard 82. Samar’s cost of goods sold at standard cost of 2017 using full absorption cost is (2-123) a. P8,200,000 c. 6,500,000 b. P7,200,000 d. 7,000,000 83. the value assigned to Samar’s December 31, 2017 inventory using variable (direct) costing is (2-123) a. P2,800,000 c. P2,000,000 b. P1,200,000 d. P3,000,000 84. Samar’s manufacturing overhead volume variance in 2017 using full absorption costing is (2-123) a. P800,000 unfavorable c. P700,000 unfavorable b. P800,000 favorable d. P700,000 favorable 85. Samar’s 2017 income from operation using variable (direct) costing is (2-123) a. P3,400,000 c. 2,600,000 b. P1,800,000 d. 1,000,000 The following information pertains to questions 86 through 88: Leyte Company manufactures a single product. Assume the following data for 2016: Variable cost per unit Selling and Administrative P 1 Production P 4 Fixed cost in total: Production P12,000 Selling and Administrative P 8,000 During 2017, 4,000 units were produced and 3,500 units were sold. 86. Under direct costing, the cost of one unit product would be (2125) a. P4 c. P7 b. P5 d. P8 87. The inventory carrying value of finished goods under direct costing would be: (2-125) a. the same as under absorption costing. MAS.MODULE.2019 9 of 20 b. P1,500 higher than under absorption costing. c. P2,000 higher than under absorption costing. d. P1,500 less than under absorption costing. 88. Under absorption costing, the cost of goods sold for 2017 would be (2-125) a. P28,000 c. P17,500 b. P24,500 d. P14,000 The following information pertains to 89 and 90 Kimmy company has identified the following overhead cost pools and cost drivers: Cost Pools Activity Costs Cost Drivers Machine setup P180,000 1,500 setup hours Materials handling 50,000 12,500 pound of materials Electric power 20,000 20,000 kilowatts-hours The following cost information pertains to the production of products X and Y: X Y Number of units produced 4,000 20,000 Direct materials cost (P) P20,000 P25,000 Direct labor cost (P) P12,000 P20,000 Number of setup hours 100 120 Pounds of materials used 500 1,500 Kilowatts 1,000 2,000 89. The unit cost for product X (2-164) a. P11.00 b. P11.75 90. The unit cost for product Y is (2-164) a. P3.75 c. b. P4.30 d. c. d. 10.00 10.50 P4.27 P3.50 The following information pertains to questions 91 and 92: The Randolph Company uses activity based costing and provides this information: Manufacturing Cost Driver Used as Conversion cost per Activity area Application Base Unit of Base 1. Materials Handling Number of parts P 0.45 2. Machinery Machine-hours 51.00 3. Assembly Numbers of parts 2.85 4. Inspection Number of finished units 30.00 Assume that 75 units of a component for packaging machines have been manufactured. Each unit required 105 parts and 3 machine-hours. Direct materials cost P600 per finished unit. All other manufacturing costs are classified into one category, conversion costs. 91. a. b. 92. a. b. Total manufacturing costs is (2-165) P87,412.50 c. P78,412.50 d. The unit cost of the 75 unit is (2-166) P1,219.50 c. P1,219.50 d. P84,712.50 P82,712.50 P 912.50 P1,050.00 The Pangasinan plant of the Pilipinas Company manufactures cash registers. It plans to implement an activity-based costing system. The controller has prepared the following estimates regarding cost pools and activity levels for the next year: Cost pool Electricity Machine setups Material moves Quality inspection inspections Total Activity costs P100,000 300,000 80,000 120,000 Activity driver levels 40,000 kwh 1,500 setup hours 40,000 moves 30,000 P600,000 The plant’s present cost accounting system allocates manufacturing overhead to jobs a plant-wide overhead rate based on machine hours. The MAS.MODULE.2019 10 of 20 total machine hours for the coming year are estimated to be 100,000 hours. The company received a request for a bid to deliver 2,000 units of its cash register model MAI. The following estimates pertain to the production of 2,000 units of MAI: Direct materials cost Direct labor (P10/hour) Machine hours Setup hours Electricity (kwh) Number of quality inspections Number of material moves P30,000 P15,000 2,000 50 2,000 500 200 93. What are the estimated manufacturing costs per unit of MAI if the activity based costing system is implemented? (2-167) a. P22.50 c. P28.50 b. P31.20 d. P26.80 KG Company has established the following of November 2016: Committed costs Materials moves P 60,000 Machine maintenance 180,000 two cost pools for the month Cost driver committed level number of moves 600 machine hours 20,000 The following information pertains to Job KG101 completed during the first week of November 2016: Direct materials cost Direct labor cost Number of material moves Machine hours P25,000 P40,000 150 4,000 94. The total manufacturing costs for Job KG101 using activity-based costing is (2-167) a. P116,000 c. P125,000 b. P 75,000 d. P 86,000 K-Mart Stores Corporation has established the following selling and distribution overhead activity cost pools and their corresponding activity drivers for November 2016. (2-168) LActivity level Activity cost Activity driver Marketing management P30,000 P500,000 of sales Customer service 10,000 5,000 customer Order execution 5,000 100 orders Warehousing 5,000 5,000 sq. feet 95. The overhead rate for the marketing management activity is a. P0.10 c. P0.90 b. P0.06 d. P0.12 The following pertains to questions 96 through 98: Anya, Inc. manufactures two models of high-pressure steam valves, the ABC model and the XYZ model. Data regarding the two products follows: Product ABC XYZ Total Direct Labor hours 0.2 DLHs per unit 0.4 DLHs per unit annual production 20,000 units 40,000 units total direct Labor hours 4,000 DLHs 16,000 DLHs 20,000 DLHs Additional information about the company follows: a. Product ABC requires P35 in direct materials per unit, and product XYZ requires P25. b. The direct labor rate is P20 per hour. c. The company has always used direct labor hours as the base for applying manufacturing overhead cost to products. Manufacturing overhead totals P1,480,000 per year. d. Product ABC is more complex to manufacture than product XYZ and requires the use of special milling machine. MAS.MODULE.2019 11 of 20 e. Because of the special work required in (d) above, the company is considering the use of activity-based costing to apply overhead cost to the products. Three activity cost pools have been identified and the first stage allocations have been completed. Data concerning these activity cost pool appear below: Activity Activity Total Cost Cool Measure Cost Machine setups Number of setups P 180,000 Special milling Machine-hours 300,000 General factory Direct-labor hours 1,000,000 Total Activity . XYZ Total 100 250 0 1,000 16,000 20,000 ABC 150 1,000 4,000 96. Assume that the company continues to use direct labor-hours as the basis for applying overhead cost to products. The unit cost for product ABC would be(2-172) a. P53.80 c. P38.60 b. P44.20 d. P58.00 97. Assume that the company decides to use activity-based costing to apply overhead cost to products. The unit cost of product ABC would be(2-172) a. P39.40 c. P46.70 b. P56.70 d. P69.40 98. Assume that the company decides to use activity-based costing to apply overhead cost to products. The unit cost of product XYZ would be (2-172) a. P68.20 b. P54.80 c. d. P45.20 P64.80 Peluso Company, a manufacturer of snowmobiles, is operating at 70 percent of plant capacity. Peluso's plant manager is considering making the headlights now being purchased for P11.00 each, a price expected to change in the near future. The Peluso plant has the equipment and labor force required to manufacture the headlights. The design engineer estimates that each headlight requires P4.00 of direct material and P3.00 of direct labor. Peluso's plant overhead rate is 200 percent of direct labor pesos, and 40 percent of the overhead is fixed cost. 99. A decision Peluso Company result in a gain (loss) for each a. P(2.00) b. P1.60 to manufacture the headlights headlight of (P. 4-65) c. P0.40 d. P2.80 will The following information applies to questions 100 and 101. Elly Industries is a multi-product company that currently manufactures 30,000 units of Part MR24 each month for use in production. The facilities now being used to produce Part MR24 have fixed monthly cost of P150,000 and a capacity to produce 84,000 units per month. If Elly were to buy Part MR24 from an outside supplier, the facilities would be idle, but its fixed costs would continue at 40 percent of their present amount. The variable production costs of Part MR24 are P11 per unit. 100. If Elly Industries continues to use 30,000 units of Part MR24 each month, it would realize a net benefit by purchasing Part MR24 from an outside supplier only if the supplier's unit price is less than (P. 4-65) a. P14.00 c. P16.00 b. P11.00 d. P13.00 101. If Elly Industries is able to obtain Part MR24 from an outside supplier at a unit purchase price of P12.875, the monthly usage at which it will be indifferent between purchasing and making Part MR24 is (P. 4-66) a. 30,000 units c. 80,000 units b. 32,000 units d. 48,000 units 102. Which factor is not relevant in deciding whether or not to accept a special order? (4-68) a. Incremental revenue that will be earned. b. Additional costs that will be incurred. c. The effect that the order will have on the company’s regular sales volume and selling price. MAS.MODULE.2019 12 of 20 d. The average cost of production if the special order accepted. 103. Accepting a special order is profitable whenever the revenue from special order exceeds(4-68) a. The average unit cost of production multiplied by the number of units in the order. b. The incremental cost of producing the order c. The materials and direct labor costs of producing the order. d. The fixed manufacturing costs for the period. 104. Consider the decision facing a firm of either accepting or not accepting a special offer for one of its products. A cost that is not relevant to a decision of this type is. (4-68) a. Direct materials b. Direct labor c. Variable factory overhead d. Fixed factory overhead that will continue even if the special offer is not accepted Given the following target selling price for a unit of product: Direct materials P18 Direct labor 7 Overhead (20%) Variable 15* Cost of manufacture 40 Desired markup – 30% 12 Target selling price per unit P 52 *Based on 25,000 units produced each year. A foreign special price year through selling costs distributor has offered to purchase 5,000 units at a of P38 per unit. The company is selling only 20,000 per regular channels and so it’s idle capacity. Variable associated with the special order would be P2 per unit. 105. If the special order is accepted, the company’s overall net income will (4-69) a. Increase by P40,000 b. Decrease by P10,000 The following information The Flint Fan Company is the F-27, to its current data for the F-27 fan are c. d. Increase by 50,000 Decrease by P70,000 applies to questions 106 and 107. considering the addition of a new model fan, product lines. The expected cost and revenue as follows: Annual sales 4,000 units Unit selling price P 58 Unit variable costs: Production P 34 Selling P 4 Avoidable direct fixed costs per year: Production P 20,000 Selling P 30,000 If the F-27 model is added as a new product line, it is expected that the contribution margin of other product lines at Flint will drop by P7,000 per year. 106. If the F-27 product line is added next year, the change in net income resulting from this decision would be. (4-70) a. P30,000 increase c. P23,000 increase b. P5,000 decrease d. P15,000 increase 107. What is the lowest unit selling price that could be charged for the F-27 model and still make it economically desirable for Flint to add the new product line? (4-70) a. P52.25 c. P55.75 b. P50.50 d. P49.00 Landor Appliance Company makes and sells electric fans. Each fan regularly sells for P42. The following cost data per fan is based on a full capacity of 150,000 fans produced each period. (4-70) Direct materials P 8 Direct Labor 9 MAS.MODULE.2019 13 of 20 Factory overhead (70% variable and 30% unavoidable fixed) 10 A special order has been received by Landor for a sale of 25,000 fans to an overseas customer. The only selling costs that would be P4 per fan for shipping. Landor is now selling 120,000 fans through regular channels each period. 108. What should Landor use as a minimum selling price per fan in negotiating a price for this special order? (4-70) a. P28 c. 31 b. P27 d. 24 Sunflower Company operates a cafeteria for its employees. The operation-of the cafeteria requires fixed costs of P4,700 per month and variable costs of 40 percent of sales. Cafeteria sales are currently averaging P12,000 per month. Sunflower has an opportunity to replace the cafeteria with vending machines. Gross customer spending at the vending machines is estimated to be 40 percent greater than the current sales because the machines are available at all hours. By replacing the cafeteria with vending machines Sunflower would receive 16 percent of the gross customer spending and avoid all cafeteria costs. 109. A decision by Sunflower Company to replace the cafeteria with vending machines will result in a monthly increase (decrease) in operating income of (4-71) a. P (580) c. P2,588 b. P1,820 d. P 188 Evergreen Farms is a local grocery store that is currently open only Monday through Saturday. Evergreen is considering opening on Sundays. The annual incremental costs of Sunday openings are estimated at P24.960. Evergreen Farms' gross margin on sales is 20 percent. Evergreen estimates that 60 percent of its Sunday sales to customer would be made on other days if stores were not open on Sundays. 110. The one-day volume of Sunday sales that would be necessary for Evergreen Farms to attain the same weekly operating income as the current six-day week is (4-71) a. P5,850 c. P3,900 b. P6,000 d. P4,000 The operating results of Valor Company by division for the current year are summarized below. Unavoidable company headquarters' costs of 1,540,000 included in the total costs have been distributed to the divisions on the basis of sales revenue. The remaining portions of the total costs have been incurred at the divisional level and can be avoided if a division is shut down. (4-72) For Sales revenue Total costs Profit (loss) Total P6,600 6,226 P 374 Valor Company Operating Results the Year Ended November 30, 2016 (P000 omitted) Divisions North South East P 990 P2,640 P 990 572 2,090 1,276 P418 P550 P (286) 111. The division(s) of Valor Company due to failure to cover divisional costs is a. South, East and West c. b. East and West d. . West P1,980 2,288 P (308) that should be shut down (are) (4-72) South and West East The following data apply to items 112 through 114. Condensed monthly operating income data for Cosmo Inc. for November 2016 is presented below. Additional information regarding Cosmo’s operations follows the statement. (4-73) Sales Less variable costs Contribution Margin Less direct fixed expenses Store segment margin Less common fixed expenses MAS.MODULE.2019 Total P 200,000 116,000 P 84,000 60,000 P 24,000 10,000 Mall store P 80,000 32,000 P 48,000 20,000 P 28,000 4,000 Town store P 120,000 84,000 P 36,000 40,000 P (4,000) 6,000 14 of 20 Operating income P 14,000 P 24, 000 P (10,000) • One-fourth of each store’s direct fixed expenses would continue through December 31, 2017, if either store were closed • Cosmo allocates common fixed expenses to each store on the basis of sales pesos. • Management estimates that closing the Town Store would result in a ten percent decrease in Mall Store sales, while closing Mall Store would not affect Town store sales. • The operating results for November 2016 are representative of all months. 112. A decision bay Cosmo Inc. to close the Town Store would result in a monthly increase (decrease) in Cosmo’s operating income during 2017 of (4-73) a. P 4,000 c. P( 800) b. P(10,800) d. P(6,000) (CMA adapted) 113. Cosmo is considering a promotional campaign at the Town Store that would not affect the Mall Store. Increasing annual promotional expenses at the Town Store by P60,000 in order to increase Town Store sales by ten percent would result in a monthly increase (decrease) in Cosmo’s operating income during 2017 of (4-73) a. P(16,800) c. P 7,000 b. P 3,400) d. P(1,400) 114. One-half of Town Store’s peso sales are from items sold at variable cost to attract customers to the store. Cosmo is considering the deletion of these items, a move that would reduce the Town Store’s direct fixed expenses by 15 percent and result in the loss of 20% of the remaining Town Store’s sales volume. This change would not affect the Mall Store. A decision by Cosmo to eliminate the items sold at cost would result in a monthly increase (decrease) in Cosmo’s operating income during 2017 of (4-74) a. P(6,000) c. P2,600 b. P(1,200) d. P2,400 In a sell or process further decision, consider the following costs: I.A variable production cost incurred prior to split-off II.A variable production cost incurred after split-off III.An avoidable fixed production cost incurred after split-off 115. decision (4-75) a. Only b. Only Which of the above costs is (are) not relevant in a regarding whether the product should be processed further? I III c. d. Only I and II Only I and III Computer City manufactured 100 personal computers at a cost of P65,000. It can sell them as is for P100,000 or install hard disks in them and sell them for P140,000. 116. The P65,000 original manufacturing cost is: (4-75) a. An out-of-pocket cost because it has already been paid b. A sunk cost because it is not relevant to the decision c. An incremental cost because it is relevant to the decision d. A fixed cost because it will remain the same no matter which action is taken. The Garey Company has 3,000 circuit boards (all alike) which are out of date and are carried in inventory at a total cost of P216,000. The circuit boards can be reworked and upgraded at the total cost of P63,000 and then sold for P110,000. As an alternative, the company can sell these circuit boards to an outside buyer for P48,000. 117. If Garey chooses to upgrade the circuit boards rather than sell them to the outside buyer, the opportunity cost to Garey is (475) a. P48,000 c. P 27,000 b. P 1,000 d. P116,000 The following data apply to items 118 through 120. MAS.MODULE.2019 15 of 20 The Tolar Company has 400 obsolete desk calculator that are carried in inventory at a total cost of P26,800. If these calculators are upgraded at a total cost of P10,000, they can be sold for a total selling price of P30,000. As an alternative, the calculators can be sold in their present condition for P11,200. 118. The sunk cost in this situation is (4-76) a. P10,000 c. P11,200 b. P26,000 d. P 0 119. What is the net advantage or disadvantage to the company from upgrading and selling the calculators?(4-76) a. P8,800 advantage c. 20,000 advantage b. P18,000 disadvantage d. 8,000 disadvantage 120. Assume that Tolar decides to upgrade the calculators. At what selling price per unit would the company be as well off as if it just sold the calculators in their present condition? (4-76) a. P8 c. P53 b. P30 d. P67 Wallace Company Produces 15,000 pounds of Product A and 30,000 pounds of Product B each week by incurring a common variable cost of P400,000. These two products can be sold as is or processed further. Further processing of either product does not delay the production of subsequent batches of the joint product. Data regarding these two products are as follows: Product A Product B Selling price per pound without further processing P 12.00 P 9.00 Selling price per pound with further processing P 15.00 P11.00 Total separate weekly variable cost of further processing P50,000 P45,000 121. To maximize Wallace Company’s manufacturing contribution margin, the total separate variable costs of further processing that should be incurred each week are (4-77) a. 45,000 c. 95,000 b. 50,000 d. zero Hollie Company produces three products, with costs and selling prices as shown below: ___ Selling price per unit P30 Variable costs per unit 18 Contribution margin per unit P12 A 100% 60 40% Products B P20 100% 15 75 P 5 25% ________________ C P15 100% 6 40 P 9 60% A particular machine is a bottleneck. On that machine, 3 machine hours are required to produce each unit of Product A, 1 hour is required to produce each unit of Product B, and 2 hours are required to produce Product C. 122. In which order should it produce it products? a. C, A, B b. A, C, B c. B, C, A d. The order of production doesn’t matter The following information applies to questions 123 and 124. Farley Company incurs the following costs in producing and selling 5,000 units of product Y each year: Production costs: Variable (materials, labor, and overhead) Fixed (based on 5,000 units produced) Selling and administrative costs Variable Fixed (based on 5,000 units produced) P 7 3 1 2 123. Assume the company uses the absorption approach to costplus pricing and desires a markup of 40 percent. The target selling price would be (4-78) a. P16 c. 16.80 b. P14 d. 18.20 MAS.MODULE.2019 16 of 20 124. Assume that the company uses the contribution approach to cost-plus pricing and desires a markup of 75%. The target price would be. (4-79) a. 17.50 c. 15.75 b. 12.25 d. 14.00 Sauer Company produces and sells 25,000 units of product X each year. The company incurs the following unit costs at the 25,000-unit level of activity: Direct materials P 16 Direct Labor 10 Variable overhead 4 Fixed overhead 13 Variable selling and administrative expense Fixed selling and administrative expense 6 8 125. The “floor” below which the company should not go, even in special pricing decisions, is: (4-79) a. P26 c. P44 b. P36 d. P48 Minden Company estimates that the following costs and activity would be associated with the manufacture and sale of Product A Number of unit sold annually 40,000 Required investment in assets P 800,000 Cost to manufacture one unit 25 Selling and administrative expenses (annual) 600,000 126. If the company uses the absorption approach to cost-plus pricing and desires a 15 percent ROI, the required mark-up for Product would be: (4-79) a. 12% c. 60% b. 15% d. 72% Miter Company, a manufacturer of household products, wants to introduce a new hand-operated food blender. To complete effectively, the blender could not be priced at more than P30. The company requires a 25 percent return on investment on all new products. In order to produce and sell 40,000 blenders each year, the company would need to make an investment of 600,000. Selling and administrative expenses would total 400,000 per year. 127. The target cost to manufacture one blender would be. (4-80) a. P10.00 c. 16.25 b. P20.00 d. 23.25 Roberts Company is planning to introduce a following information has been assembled: Expected annual sales in units Investment required Production costs: Variable (materials, labor, and overhead) Fixed overhead (total) Selling and administrative costs: Variable (freight and commissions) Fixed (total) new product line. The 60,000 750,000 12 480,000 3 420,000 The company requires a 20% return on investments on all product lines. 128. Assuming that the company uses the absorption approach to cost-plus pricing, the mark-up needed to achieve the desired ROI would be (to the nearest tenth of a percent) (4-80) a. 12.5% c. 50.0% b. 20.0% d. 62.5% Baker Company manufactures and sells 20,000 units of Product X per month. Each unit of Product X sells for P15 and has a contribution margin of P4. If Product X is discontinued, P56,000 in fixed monthly overhead of Baker Company’s other products. 129. If Product X is disconnected, income before taxes should: (4-81) MAS.MODULE.2019 Baker Company’s monthly 17 of 20 a. Increase by 80,000 b. Increase by 24,000 c. d. Decrease by P80,000 Decrease by P24,000 130. Accepting a special Order is profitable whenever the revenue from the special order exceeds: (4-81) a. the average unit cost of production multiplied by the number of units in the order. b. the incremental cost of producing the order. c. the materials and direct labor costs for the period. d. the fixed manufacturing costs for the period. On December 31,2016 assets of P8,000,000 debt of P2,400,000. shares. The retained P2,000,000. the balance sheet of Belle Co. disclosed total current liabilities of P1,500,000 and long-term Ordinary shares outstanding amounted to 500,000 earnings account indicated a deficit balance of 131. Bell’s book value per ordinary share as of December 31,2016 is (6-56) a. P 16.00 c. P 12.20 b. P 6.20 d. P 8.20 (PhilCPA adapted) 132. A high quality of earning is indicated by: (6-56) a. Earnings derived largely from newly introduced products b. Declaration of both cash dividends and share dividends c. Use of FIFO method of inventory during sustained inflation d. A history of increasing earning and conservative accounting methods 133. Dividend yield on ordinary shares owned by an investor is computed by: (6-56) a. Dividing annual dividend per share by current market price per share b. Dividing annual dividend per share by investor’s average cost per share c. Dividing annual dividend per share by the lower of investor’s cost or current market price per share d. Dividing annual dividend per share by the price-earnings ratio Nell, Inc. earns a rate of return on ordinary shareholder’s equity of 16%. 134. Which of the following will cause the rate of return to increase? (6-56) a. Issuing 12% bond and investing the proceeds to earn 14% b. Increasing the size of the cash dividend paid on ordinary shares c. An increase in the company’s price-earnings ratio d. An increase in the market price of the company’s shares 135. Extensive use of leverage is usually associated with: (6-57) a. A low equity ratio c. A low debt ratio b. A high current ratio d. High quality of earnings 136. The times interest earned ratio is computed by dividing: (6-57) a. Operating income before interest and income taxes by annual interest expense b. Net income by annual interest expense c. Carrying value of bond by cash interest payments d. Earnings per share by the prime rate of interest 137. The yield of investors in bonds: (6-57) a. Is the effective interest rate that can be earned by buying bonds at their current market price and holding them to maturity b. Is measured by the debt ratio c. Is measured by the number of times interest requirements are earned d. Increases as market prices of bonds increase 138. From the viewpoint of short-term creditors, which of the following relationships would be the least meaningful? (6-57) a. Short-term notes payable as a percentage of accounts payable b. The amount of working capital MAS.MODULE.2019 18 of 20 c. The accounts receivable turnover d. Quick assets as a percentage of current liabilities 139. At the end of the Year 10, Brave Corporation has a current ratio of 2 to 1. Which of the following transactions will decrease the current ratio? (6-57) a. Issuance of long-term bonds at a premium b. Sale of merchandise on open account at a price above cost c. Sale of plant assets for less than book value d. Declaration of a cash dividend on ordinary share 140. In evaluating a company’s ability to repay a 60-day loan, a creditor would probably be most interested in which of the following ratios (6-58) a. The debt ratio c. The quick ratio b. The price-earnings ratio d. The number of times interest earned 141. Which of the the accounts receivable a. Sales decrease b. Accounts receivable c. Sales increase d. Accounts receivable following events is most likely to increase turnover? (6-58) are collected more quickly are collected less quickly The per share market price of Far Eastern Co. shares on January 1, 2016 was P60 and on December 31, 2016 was P72. Net income for 2016 was P48,000. Dividends to the preference shareholders for the year totaled P12,000, and dividends of P2.50 per share were paid on the 6,000 ordinary shares outstanding during the year. 142. The price-earnings ratio for Far Eastern Co. at year end was (6-59) a. 10 to 1 c. 11 to 1 b. 6 to 1 d. 12 to 1 Ryan Company had 20,000 ordinary shares outstanding through 2016. These shares were originally issued at a price of P15 per share. The book value on December 31, 2016 was P25 per share and the market value on December 31, 2016 was P30 per share. The dividend on ordinary shares on total for 2016 was P45,000. 143. 61) a. 9.0% b. 7.5% The dividend yield ratio for Ryan Company for 2016 was: (6c. d. 15.0% 10.0% JunJun & Co. has debt ratio of 0.50, a total assets turnover of 0.25, and a profit margin of 10%. The president is unhappy with the current return on equity, and he thinks it could be doubled. This could be accomplished (1) by increasing the profit margin to 14% and (2) by increasing debt utilization. Total assets turnover will not change. 144. What new debt ratio, along with the 14% profit margin, is required to double the return on equity? (6-61) a. 0.75 c. 0.65 b. 0.70 d. 0.55 Alessandra Company has P10 billion in total assets. Its statement of financial position shows P1 billion in current liabilities P3 billion in long term-debt, and P6 billion in common equity. It has 800 million shares of common stock outstanding, and its stock price is P32 per share. 145. The Company’s market/book ratio is (6-63) a. 4.2667 c. 4.627 b. 4 d. 4.29 Mindanao Mining has P6 million in sales; its ROE is 12%, and its total assets turnover is 3.2 x. The company is 50% equity financed, and it has no preferred stock outstanding. 146. The net income of Mindanao Mining is (6-63) a. P112,450 c. P212,500 b. P150,112 d. P112,500 MAS.MODULE.2019 19 of 20 Consider the following simplified financial statements for the Phillips Corporation assuming no income taxes. Income Statement Sales P23,000 Cost 16,700 Net income P 6,300 Statement of Financial Position Asset P15,800 Debt P 5,200 Equity 10,600 Total P15,800 Total P15,800 Phillips has predicted a sales increase of 15 percent. It has predicted that every item on the statement of financial position will increase by 15 percent as well. Create the pro forma statements and reconcile them. 147. What is the additional financing needed here? (6-63) a. P6,555 c. P5,555 b. P5,655 d. P6,666 The most recent financial statements for Gospel Company are shown here. Income Statement Sales P 42,000 Cost 28,500 Taxable Income P 13,500 Taxes(34%) 4,590 Net income P 8,910 Statement of Financial Position Current assets P 21,000 Debt P 51,000 Fixed Equity 56,000 assets 86,000 Total P107,000 Total P107,000 Assets and costs are proportional to sales. The company maintains a constant 30 percent dividend payout ratio and a constant debt-equity ratio. 148. The maximum increase in sales assuming no new equity is issued is (6-65) a. P5,263 b. P5,632 that c. d. can be sustained P2,562 P5,264 The following information applies to questions 149 and 150. At year-end 2016, total assets for Geneva Corporation were P1.2 million and accounts payable were P375,000. Sales, which in 2016 were P2.5 million, are expected to increase by 25 percent in 2017. Total assets and accounts payable are proportional to sales and that relationship will be maintained. Geneva typically uses no current liabilities other than accounts payable. Common stock amounted to P425,000 in 2016 and retained earnings were P295,000. Geneva plans to sell new common stock in the amount of P75,000. The firm’s profit margin on sales is 6 percent; 40 percent of earnings will be paid out as dividends. 149. Total debt in 2016 was (6-67) a. 420,000 c. b. 480,000 d. 360,000 320,000 150. The new long-term debt financing that will be needed in 2017 is (6-68) a. P480,000 c. P 85,000 b. P 75,000 d. P 18,750 MAS.MODULE.2019 20 of 20