MANAGEMENT ADVISORY SERVICES

COSTS AND COST CONCEPTS

1. If a firm's net income does not change as its volume changes, the firm('s)

a. must be in the service industry.

c. sales price must equal P0.

b. must have no fixed costs.

d. sales price must equal its variable costs.

ANSWER D

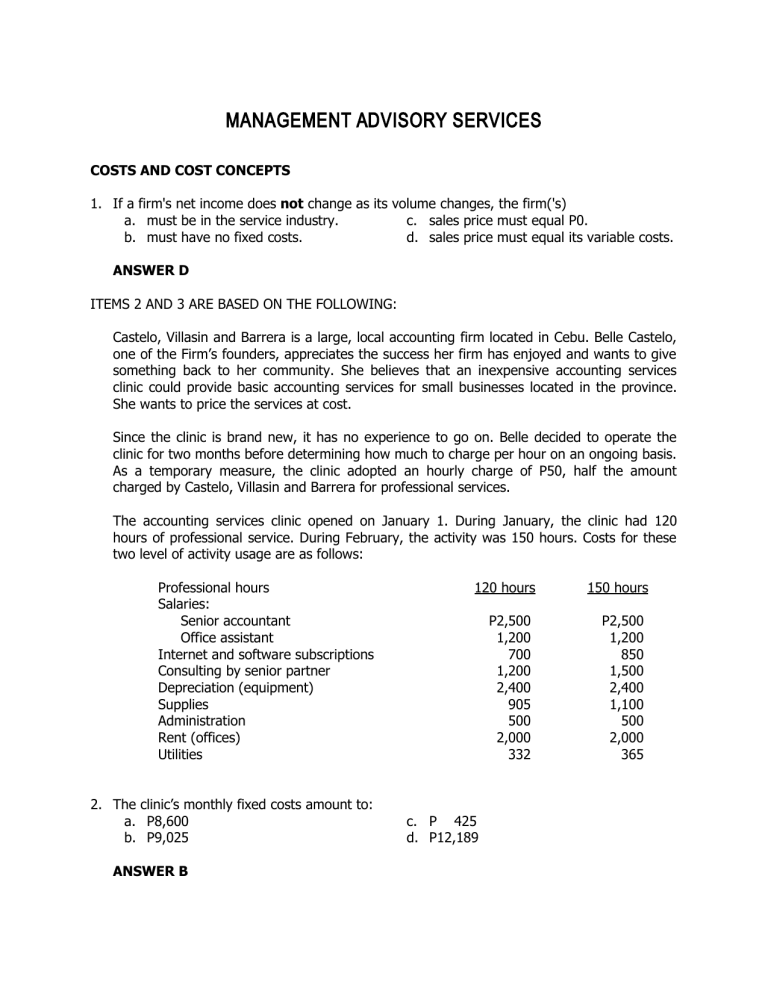

ITEMS 2 AND 3 ARE BASED ON THE FOLLOWING:

Castelo, Villasin and Barrera is a large, local accounting firm located in Cebu. Belle Castelo,

one of the Firm’s founders, appreciates the success her firm has enjoyed and wants to give

something back to her community. She believes that an inexpensive accounting services

clinic could provide basic accounting services for small businesses located in the province.

She wants to price the services at cost.

Since the clinic is brand new, it has no experience to go on. Belle decided to operate the

clinic for two months before determining how much to charge per hour on an ongoing basis.

As a temporary measure, the clinic adopted an hourly charge of P50, half the amount

charged by Castelo, Villasin and Barrera for professional services.

The accounting services clinic opened on January 1. During January, the clinic had 120

hours of professional service. During February, the activity was 150 hours. Costs for these

two level of activity usage are as follows:

Professional hours

Salaries:

Senior accountant

Office assistant

Internet and software subscriptions

Consulting by senior partner

Depreciation (equipment)

Supplies

Administration

Rent (offices)

Utilities

2. The clinic’s monthly fixed costs amount to:

a. P8,600

b. P9,025

ANSWER B

120 hours

P2,500

1,200

700

1,200

2,400

905

500

2,000

332

c. P 425

d. P12,189

150 hours

P2,500

1,200

850

1,500

2,400

1,100

500

2,000

365

Page 2

Diff. in costs (P12,415 – P11,737)

÷ diff. in hours (150 – 120)

Variable rate per hour

Total cost

Less variable cost (22.60x150)

Fixed costs

P 678

30

P22.60

P12,415

3,390 (22.60x120)

P 9,025

P11,737

2,712

P 9,025

3. Apple Baby, the chief paraprofessional of the clinic, has estimated that the clinic will

average 140 professional hours per month. If the clinic is to be operated as a nonprofit

organization, how much will it need to charge per professional hour?

a. P97.81

c. P82.77

b. P87.06

d. P22.60

ANSWER B

Variable cost (140 x P22.60)

Fixed cost

Total cost

÷ number of hours

Cost per hour

P 3,164

9,025

P12,189

140

P 87.06

4. HSR Computer System designs and develops specialized software for companies and use a

normal costing system. The following data are available for 2015:

Budgeted

Overhead

P600,000

Machine hours

24,000

Direct labor hours

75,000

Actual

Units produced

100,000

Overhead

P603,500

Prime costs

P900,000

Machine hours

25,050

Direct labor hours

75,700

Overhead is applied on the basis of direct labor hours.

What is the unit cost for the year?

a. P15.03

b. P15.06

c. P15.09

d. P15.00

ANSWER B

Prime costs

Applied overhead (P600,000/75,000 DLH x 75,700)

P 900,000

605,600

Page 3

Total cost

÷ Units produced

P1,505,600

100,000

Unit cost

P

15.06

ABC SYSTEM

5. Hazelnut Company uses activity-based costing. The company produces two products:

coats and hats. The annual production and sales volume of coats is 8,000 units and of hats

is 6,000 units. There are three activity cost pools with the following expected activities and

estimated total costs:

Activity

Cost Pool

Activity 1

Activity 2

Activity 3

Estimated

Cost

P20,000

P37,000

P91,200

Expected

Activity

Coats

100

800

800

Expected

Activity

Hats

400

200

3,000

Total

500

1,000

3,800

Using ABC, the cost per unit of coats is approximately:

a. P2.40

c. P 6.60

b. P3.90

d. P10.59

ANSWER C

Activity 1 (P20,000 x 100/500)

Activity 2 (P37,000 x 800/1,000)

Activity 3 (P91,200 x 800/3,800)

Total allocated cost

÷ number of units

Cost per unit

P 4,000

29,600

19,200

P52,800

8,000

P 6.60

6. Elaine Hospital plans to use the activity-based costing to assign hospital indirect costs to the care of

patients. The hospital has identified the following activities and activity rates for the hospital indirect

costs:

Activity

Activity Rate

Room and meals

P150 per day

Radiology

P95 per image

Pharmacy

P28 per physician order

Chemistry lab

P85 per test

Operating room

P550 per operating room hour

The records of two representative patients were analyzed, using the activity rates. The activity

information associated with the two patients are as follows:

Patient 1

Patient 2

Number of days

7

3

Page 4

Number of images

Number of physician orders

Number of tests

Number of operating room hours

4

5

6

4.5

2

1

2

1

Determine the activity cost associated with Patient 2.

a. P1,388

c. P1,816

b. P 908

d. P4,555

ANSWER A

Activity costs, Patient 2:

Room and meals (3 x P150)

Radiology (2 x P95)

Pharmacy (1 x P28)

Chemistry lab (2 x P85)

Operating room (1 x P550)

Total

P 450

190

28

170

550

P1,388

7. Balat Leather Works, which manufactures saddles and other leather goods, has three

departments. The Assembly Department manufactures various leather products, such as

belts, purses, and saddle bags, using automated production process. The Saddle

Department produces handmade saddles and uses very little machinery. The Tanning

Department produces leather. The tanning process requires little in the way of labor or

machinery, but it does require space and process time. Due to the different production

processes in the three departments, the company uses three different cost drivers for the

application of manufacturing overhead. The cost drivers and overhead rates are as

follows:

Cost Driver

Predetermined Overhead Rate

Tanning Department

Square-feet of leather

P3 per square-foot

Assembly Department

Machine time

P9 per machine hour

Saddle Department

Direct-labor time

P4 per direct labor hour

The company’s deluxe saddle and accessory set consists of handmade saddle, two

saddlebags, a belt, and a vest, all coordinated to match. The entire set uses 100 squarefeet of leather from the Tanning Department, 3 machine hours in the Assembly

Department, and 40 direct-labor hours in the Saddle Department. The company is

processing Job No. 20 consisting of 20 deluxe saddle and accessory sets.

How much is the applied manufacturing overhead in the Assembly Department for Job No.

20?

a. P3,200

c. P6,000

b. P 540

d. P3,000

ANSWER B

Assembly department = P9/machine hour x 3 machine hours x 20 sets = P540

Page 5

8. If activity-based costing is implemented in an organization without any other changes

being effected, total overhead costs will

a. be reduced because of the elimination of non-value-added activities.

b. be reduced because organizational costs will not be assigned to products or services.

c. be increased because of the need for additional people to gather information on cost

drivers and cost pools.

d. remain constant and simply be spread over products differently.

ANSWER D

CVP AND BREAKEVEN ANALYSIS

9. Harry Manufacturing incurs annual fixed costs of P250,000 in producing and selling a single

product. Estimated unit sales are 125,000. An after-tax income of P75,000 is desired by

management. The company projects its income tax rate at 40 percent. What is the

maximum amount that Harry can expend for variable costs per unit and still meet its profit

objective if the sales price per unit is estimated at P6?

a. P3.37

c. P3.00

b. P3.59

d. P3.70

ANSWER C

Projected sales (125,000 x P6)

Less contribution margin:

Income before tax (75,000/0.60)

Add fixed cost

Variable costs

÷ number of units

Variable cost per unit

P750,000

P125,000

250,000

375,000

P375,000

125,000

P 3.00

10. For its most recent fiscal year, a firm reported that its contribution margin was equal to 40

percent of sales and that its net income amounted to 10 percent of sales. If its fixed costs

for the year were P60,000, how much was the margin of safety?

a. P150,000

c. P600,000

b. P200,000

d. P 50,000

ANSWER D

Let S = Sales; CM = 0.40S; NY = 0.10S

Fixed Cost = (0.40S – 0.10S) = 0.30S

Sales (P60,000 ÷ 0.30)

Less breakeven sales (P60,000 ÷ 0.40)

Margin of safety

P200,000

150,000

P 50,000

11. Sam Company manufactures a single product. In the prior year, the company had sales of

P90,000, variable costs of P50,000, and fixed costs of P30,000. Sam expects its cost

Page 6

structure and sales price per unit to remain the same in the current year, however total

sales are expected to increase by 20 percent. If the current year projections are realized,

net income should exceed the prior year’s net income by:

a. 100 percent.

c. 20 percent.

b. 80 percent.

d. 50 percent.

ANSWER B

Increase in profit (P40,000 x 20%)

÷ Present profit:

Contribution margin

Less fixed costs

% change in profit

P 8,000

P40,000

30,000

10,000

80%

12. Edil Company produces and sells a single product. The costs and selling prices on a per-unit

basis are as follows:

Selling Price

Materials

Labor

Variable overhead

Fixed overhead

Variable selling and administrative

Fixed selling and administrative

P120

35

15

10

10

20

5

The above per-unit figures are computed based on the company’s normal capacity of

20,000 units.

The company’s expected margin of safety is

a. 7,500 units.

b. P2,400,000.

ANSWER C

Expected sales - units

Less break-even sales:

Fixed costs (20,000 x [10 + 5])

÷ Unit contribution margin

(120 – [35 + 15 + 10 + 20])

Margin of safety

Margin of safety in pesos (12,500 x P120)

Margin of safety ratio (12,500 ÷ 20,000)

c. 62.5%.

d. P12,500.

20,000

P300,000

P40

7,500

12,500 units

P1,500,000

62.5%

13. Antiporda, Inc. sells three products, A, B, and C. The company sells three (3) units of C

for each unit of A and two (2) units of B for each unit of C. Total fixed costs amount to

P760,000. Product A’s contribution margin per unit is P2, Product B’s is 150% of A’s, and

Product C’s is twice as much as B’s. How many units of each product must be sold to

break-even?

Product A

Product B

Product C

Page 7

a.

b.

c.

d.

2,000

20,000

29,231

69,091

12,000

120,000

58,462

414,546

6,000

60,000

87,692

207,273

ANSWER B

CM per unit

x Sales mix ratio

Composite CM

÷ Number of units per mix (1 + 6 + 3)

Weighted average CM per unit

Weighted-average UCM

Fixed costs

Break-even point =

WaUCM

Product A

Product B

P2 (2 x 150%) P 3

1

(2 x 3)

6

P2

P18

=

Breakdown:Product A

Breakdown:

Product A

Product B

Product C

=

=

=

P760,000

Product C

(P3 x 2) P 6

3

P18

Total

P38

10

P3.8

P3.8

= 200,000 composite units

P3.8

=200,000 x 1/10

=20,000 units

200,000 x 1/10 = 20,000 units

200,000 x 6/10 = 120,000

200,000 x 3/10 = 60,000

200,000 composite units

ITEMS 14 to 16 ARE BASED ON THE FOLLOWING INFORMATION:

A company is making plans for next year, using cost-volume-profit analysis as its planning

tool.

Next year’s sales data about its product are as follows:

Selling price

Variable manufacturing costs per unit

Variable selling and administrative costs

Fixed operating costs (60% is manufacturing cost)

Income tax rate

P60.00

22.50

4.50

P148,500

32%

14. How much should sales be next year if the company wants to earn profit after tax of

P22,440, the same amount that it earned last year?

a. P310,800

c. P330,000

b. P397,500

d. P222,000

ANSWER C

Fixed costs

Add desired profit

P148,500

(

P22,440

)

1 – 0.32

33,000

P181,500

Total

60 – [22.50 + 4.50]

60

Required sales to earn desired profit

÷ CMR

(

)

55%_

P330,000

Page 8

15. Assume that the company’s management learned that a new technology that will increase

the quality of its product is available. If implemented, its projections for next year will be

changed:

1. The selling price of the product will increase to P75 per unit.

2. Fixed manufacturing costs will increase by 20%.

3. Additional advertising costs will be incurred to promote the higher-quality

product. This will increase fixed non-manufacturing cost by 10%.

4. The improved product will require a new material that will increase direct

materials cost by P4.50

If the new technology is adapted, how much sales should the company make to earn a pretax profit of 10% on sales?

a. P366,130

c. P253,324

b. P358,875

d. P353,897

ANSWER B

Fixed costs:

Manufacturing (148,500 x 60% x 120%)

Non-manufacturing (148,500 x 40% x 110%)

Total fixed costs

P106,920

65,340

P172,260

Contribution margin ratio:

Selling price

Less variable costs:

Manufacturing (P22.50 + P4.50)

Selling and administrative

Contribution margin per unit

÷ Selling price

Contribution margin ratio

P75.00

P27.00

4.50

31.50

P43.50

75.00

P 58%

Required peso-sales to earn a desired profit ratio:

RS =

Fixed Cost

CMR – PR

=

P172,260

58% – 10%

= P358,875

16. If the sales required in Item #15 is realized, the company will have an operating leverage

factor of

a. 8.53.

c. 17.24%.

b. 5.80.

d. 5.50.

ANSWER B

Operating leverage factor =

=

=

Contribution margin

Profit before tax

P358,875 x 58%

P358,875 x 10%

P208,147.50

= 5.8

P35,887.50

Page 9

17. As projected net income increases the

a. degree of operating leverage declines.

b. margin of safety stays constant.

c. break-even point goes down.

d. contribution margin ratio goes up.

ANSWER A

18. Yamyam Company is considering introducing a new product that will require a P250,000

investment of capital. The necessary funds would be raised through a bank loan at an

interest rate of 8%. The fixed operating costs associated with the product would be

P122,500 while the variable cost ratio would be 58%. Assuming a selling price of P15 per

unit, determine the number of units (rounded to the nearest whole unit) Yamyam would

have to sell to generate earnings before interest and taxes (EBIT) of 32% of the amount of

capital invested in the new product.

a. 35,318 units

c. 32,143 units

b. 25,575 units

d. 23,276 units

ANSWER C

Fixed cost

P122,500

Add desired profit (P250,000 x 32%)

80,000

Total

P202,500

÷ CM per unit [P15 x (100% - 58%)]

6.30

Required sales in units

32,143

STANDARD COSTS AND VARIANCE ANALYSIS

19. The materials mix variance for a product is P450 unfavorable and the materials yield

variance is P150 unfavorable. This means that

a. the materials price variance is P600 unfavorable.

b. the materials quantity variance is P600 unfavorable

c. the total materials cost variance is definitely P600 unfavorable.

d. the materials price variance is also unfavorable, but the amount cannot be

determined from the given information.

ANSWER B

Mix variance

Yield variance

Quantity variance

P450 U

150 U

P600 U

Page 10

20. Variance analysis would be appropriate to measure performance in

a. profit centers

c. cost centers

b. investment centers

d. all of the above

ANSWER D

21. Samson Company uses a standard costing system in the production of its only product. The

84,000 units of raw materials inventory were purchased for P126,000 and 4 units of raw

materials are required to produce one unit of final product. In October, the company

produced 14,400 units of product. The standard cost allowed for materials was P72,000,

and there was an unfavorable usage variance of P3,000.

The materials price variance for the units used in October was

a. P15,000 unfavorable.

c. P3,000 unfavorable.

b. P15,000 favorable.

d. P3,000 favorable.

ANSWER A

Total standard cost

P72,000

÷ Std qty for actual production (14,400 x 4)

57,600

Standard price per unit of materials

P1.25

The usage variance is P3,000 unfavorable. The standard price is P1.25. Using the formula for Usage variance,

the difference in quantity may be computed as follows:

Usage variance =Difference in quantity x Std. price

3,000 U = Difference in quantity x P1.25

Difference in quantity = 3,000 ÷ P1.25

= 2,400 unfavorable

If the difference in quantity is unfavorable, the actual quantity is greater than the standard quantity:

Standard quantity (14,400 x 4)

Add unfavorable difference in quantity

Actual quantity used

57,600

2,400

60,000 units

Price Variance = (AP – SP) x AQ

= ([P126,000 ÷ 84,000] – P1.25) x 60,000

= P15,000 unfavorable

22. The standard direct materials cost to produce a unit of a product is four meters of materials

at P2.50 per meter. During June, 2015, 4,200 meters of materials costing P10,080 were

purchased and used to produce 1,000 units of the product. What was the materials price

variance for June, 2015?

a. P480 unfavorable

c. P400 favorable

Page 11

b. P 80 unfavorable

d. P420 favorable

ANSWER D

Actual price (P10,080 ÷ 4,200)

Standard price

Difference in prices - favorable

X actual quantity purchased

Price variance – favorable

P2.40

2.50

P 0.10

4,200

P 420

23. Buchoy Company manufactures one product with a standard direct manufacturing labor cost

of four hours at P12.00 per hour. During June, 1,000 units were produced using 4,100

hours at P12.20 per hour. The unfavorable direct labor efficiency variance was:

a. P820

c. P1,200

b. P400

d. P1,220

ANSWER C

Actual time – hours

Less standard time (1,000 x 4)

Difference in time – unfavorable

X standard rate per hour

Efficiency variance – unfavorable

4,100

4,000

100

P 12

P1,200

ITEMS 24 TO 28 ARE BASED ON THE FOLLOWING:

Vhong, Inc. evaluates manufacturing overhead in its factory by using variance analysis. The

following information applies to the month of July:

ACTUAL

BUDGETED

Number of units produced

19,000

20,000

Variable overhead costs

P4,100

P2 per direct labor hour

Fixed overhead costs

P22,000

P20,000

Direct labor hours

2,100

0.1 hour per unit

24. The controllable variance amounts to

a. P2,500 unfavorable

b. P1,000 unfavorable

c. P2,300 unfavorable

d. P2,000 unfavorable

ANSWER C

25. Using the three-way variance analysis, the spending variance amounts to

a. P100 favorable

c. P2,000 unfavorable

b. P1,900 unfavorable

d. P2,100 unfavorable

ANSWER B

Page 12

26. The efficiency variance amounts to

a. P400 unfavorable

b. P1,900 unfavorable

c. P400 favorable

d. P1,000 unfavorable

ANSWER A

27. The non-controllable variance is

a. P2,300 unfavorable

b. P400 unfavorable

c. P2,000 unfavorable

d. P1,000 unfavorable

ANSWER D

28. The fixed overhead efficiency variance is:

a. P400 unfavorable

b. PP2,000 unfavorable

c. P400 favorable

d. 0

ANSWER D

24 TO 28

Actual variable overhead

Actual time x std. var. rate (2,100 x P2)

Spending variance – favorable

Actual time x std. var. rate (2,100 x P2)

Std. variable overhead [(19,000 x 0.1) x P2]

Efficiency variance – unfavorable

P4,100

4,200

P 100

P4,200

3,800

P 400

Actual fixed overhead

Less budgeted fixed overhead

Fixed spending variance – unfavorable

P22,000

20,000

P 2,000

Budgeted fixed overhead

Less standard fixed overhead

[1,900 x (P20,000/<20,000 x 0.1>)]

Volume variance – unfavorable

P20,000

19,000

P 1,000

24.

Controllable variance (P100 F + P400 U + P2,000 U) = 2,300 U

25.

Spending variance (P100 F + P2,000 U) = P1,900 U

Page 13

PRODUCT COSTING

29. A basic tenet of variable costing is that period costs should be currently expensed. What is

the rationale behind this procedure?

a. Period costs are uncontrollable and should not be charged to a specific product.

b. Period costs are generally immaterial in amount and the cost of assigning the

amounts to specific products would outweigh the benefits.

c. Allocation of period costs is arbitrary at best and could lead to erroneous decision by

management.

d. Because period costs will occur whether production occurs, it is improper to allocate

these costs to production and defer a current cost of doing business.

ANSWER D

30. The following information regarding fixed production costs from a manufacturing firm is

available for the current year:

Fixed costs in the beginning inventory

P16,000

Fixed costs incurred this period

100,000

Which of the following statements is not true?

a. The maximum amount of fixed production costs that this firm could deduct using

absorption costs in the current year is P116,000.

b. The maximum difference between this firm's the current year income based on

absorption costing and its income based on variable costing is P16,000.

c. Using variable costing, this firm will deduct no more than P16,000 for fixed

production costs.

d. If this firm produced substantially more units than it sold in the current year,

variable costing will probably yield a lower income than absorption costing.

ANSWER C

31. Absorption costing differs from variable costing in all of the following except

a. treatment of fixed manufacturing overhead.

b. treatment of variable production costs.

c. acceptability for external reporting.

d. arrangement of the income statement

ANSWER B

32. If a firm produces more units than it sells, absorption costing, relative to variable costing,

will result in

a. higher income and assets.

c. lower income but higher assets.

b. higher income but lower assets.

d. lower income and assets.

ANSWER A

Page 14

33. How will a favorable volume variance affect net income under each of the following

methods?

Absorption

Variable

a. reduce

no effect

b. reduce

increase

c. increase

no effect

d. increase

reduce

ANSWER C

ITEMS 34 TO 36 ARE BASED ON THE FOLLOWING:

The following information is available for X Co. for its first year of operations:

Sales in units

5,000

Production in units

8,000

Manufacturing costs:

Direct labor

P3 per unit

Direct material

5 per unit

Variable overhead

1 per unit

Fixed overhead

P100,000

Net income (absorption method)

P30,000

Sales price per unit

P40

34. What would X Co. have reported as its income before income taxes if it had used variable

costing?

a. P30,000

c. P67,500

b. (P7,500)

d. can’t be determined from the given

information

ANSWER B

Absorption income

Diff. in income (8,000-5,000) x (P100k/8k)

Variable costing income

P30,000

37,500

(P 7,500)

35. What was the total amount of SG&A expense incurred by X Co.?

a. P30,000

c. P6,000

b. P62,500

d. can’t be determined from the given

information

ANSWER B

Sales (5,000 x P40)

Less cost of goods sold (5,000 x P21.50)

Gross profit

Less profit

Selling, gen. & admin. expenses

P200,000

107,500

P 92,500

30,000

P 62,500

36. Based on variable costing, what would X Co. show as the value of its ending inventory?

Page 15

a. P120,000

b. P 64,500

c. P27,000

d. P24,000

ANSWER C

Ending inventory – units (8,000 – 5,000)

X product cost per unit (3 + 5 + 1)

Cost of ending inventory

3,000

P

9

P 27,000

37. Which of the following is an advantage of using variable costing?

a. Variable costing complies with Generally Accepted Accounting Principles.

b. Variable costing complies with the National Internal Revenue Code.

c. Variable costing is most relevant to long-run pricing strategies.

d. Variable costing makes cost-volume-profit relationships more easily apparent.

ANSWER D

38. In its first year of operations, Nasty Company had the following costs when it produced

100,000 units and sold 80,000 units of its only product:

Manufacturing costs:

Fixed

P180,000

Variable

160,000

Selling and administrative costs:

Fixed

90,000

Variable

40,000

How much higher would Nasty’s net income be if it used full absorption costing instead of

variable costing?

a. P94,000

c. P36,000

b. P68,000

d. P54,000

ANSWER C

Change in inventory (100k – 80k)

x fixed overhead cost per unit (P180k ÷ 100

Difference in income

20,000

1.80

P36,000

Page 16

DIFFERENTIAL COSTS ANALYSIS

39. Siomitos makes bite-size siomai. Which of the following could be a constraint at Siomitos?

a. The siomai steamer

b. The workers who mix the ingredients

c. The workers who prepare the siomai for steaming

d. Any of the above could be the constraint

ANSWER D

40. Ning Company has only 25,000 hours of machine time each month to manufacture its two

products. Product X has a contribution margin of P50, and Product Y has a contribution

margin of P64. Product X requires 5 hours of machine time, and Product Y requires 8 hours

of machine time. If Ning Company wants to dedicate 80 percent of its machine time to the

product that will provide the most income, the company will have a total contribution

margin of

Page 17

a. P250,000.

b. P240,000.

c. P210,000.

d. P200,000.

ANSWER B

Product X

P 50

5

P 10

CM per unit

÷ hours per unit

CM per hour

Product Y

P 64

8

P 8

80% of capacity must be applied to Product X, the product with the higher CM per hour.

Product X (25,000 x 80%) ÷ 5 = 4,000 units x P50

Product Y (25,000 x 20%) ÷ 8 = 625 units x P64

Total contribution margin

P 200,000

40,000

P240,000

41. Mangit Company is currently operating at a loss of P15,000. The sales manager has

received a special order for 5,000 units of product, which normally sells for P35 per unit.

Costs associated with the product are: direct material, P6; direct labor, P10; variable

overhead, P3; applied fixed overhead, P4; and variable selling expenses, P2. The special

order would allow the use of a slightly lower grade of direct material, thereby lowering the

price per unit by P1.50 and selling expenses would be decreased by P1. If Mangit wants this

special order to increase the total net income for the firm to P10,000, what sales price must

be quoted for each of the 5,000 units?

a. P23.50

c. P27.50

b. P24.50

d. P34.00

ANSWER A

Loss

Desired profit

Required increase in profit

÷ number of units

Profit per unit

Add production costs:

Materials (P6.00 – P1.50)

Labor

Variable overhead

Variable selling exp (P2 – P1)

Sales price per unit

P15,000

10,000

P25,000

5,000

P 5.00

P 4.50

10.00

3.00

1.00

18.50

P23.50

42. Dolly Company has 3 divisions: R, S, and T. Division R's income statement shows the

following for the year ended December 31:

Sales

P1,000,000

Cost of goods sold

(800,000)

Gross profit

P 200,000

Selling expenses

P100,000

Page 18

Administrative expenses

Net loss

250,000

(350,000)

P (150,000)

Cost of goods sold is 75 percent variable and 25 percent fixed. Of the fixed costs, 60

percent are avoidable if the division is closed. All of the selling expenses relate to the

division and would be eliminated if Division R were eliminated. Of the administrative

expenses, 90 percent are applied from corporate costs. If Division R were eliminated, Dolly’s

income would

a. increase by P150,000.

c. decrease by P155,000.

b. decrease by P 75,000.

d. decrease by P215,000.

ANSWER C

Avoidable sales

Avoidable costs:

Var. CGS (P800,000 x 75%)

Fixed CGS (P800,000 – P600,000) x 60%

Selling expenses

Admin. exps. (P250,000 x 10%)

Decrease in income

P1,000,000

P600,000

120,000

100,000

25,000

845,000

P155,000

43. The opportunity cost of making a component part in a factory with excess capacity for

which there is no alternative use is

a. the total manufacturing cost of the component.

b. the total variable cost of the component.

c. the fixed manufacturing cost of the component.

d. zero.

ANSWER D

ITEMS 44 TO 47 ARE BASED ON THE FOLLOWING:

Schundel Hair Care Company produces shampoo with conditioner. This is the company’s

only product, which it sells under the name “Shamcon.”

The manufacturing cost data for Shamcon are as follows:

Quantity required

Materials:

per 1,000-ml bottle

Chem 1

4 ml

Chem 2

3 ml

Chem 3

2 ml

Direct labor: 2 hours per bottle @ P3 per hour

Factory overhead:

Variable overhead – P2.00 per direct labor hour

Fixed overhead

– 4.00 per direct labor hour

Current market price

per ml

P0.54

0.36

0.20

Page 19

Clever Company, owner and operator of a chain of hotels, asked Schundel Hair Care

Company to submit a bid for 500 boxes of Shamcon. Each box will contain 24 bottles. Per

Clever’s specifications, its order should be different in chemical composition from the regular

Shamcon. According to Schundel Company’s production manager, Clever’s specifications

can be met if an additional chemical, Chem 4 would be used. Schundel Company has

60,000 ml of this chemical. Chem 4 was used by the company in one of its brands that it

decided to eliminate. The remaining inventory of Chem 4 was not sold or discarded

because it does not deteriorate and the company has adequate space for its storage.

Schundel Company can sell Chem 4 at the prevailing market price of P0.40 per ml less

P0.10/ml selling and handling costs. Clever’s order would require 5 ml of Chem 4 per

bottle.

The company has a stock of Chem 5. This was used by Schundel Hair Care for its

manufacture of another product that is no longer being produced. Chem. 5, which cannot

be used in Shamcon, can be substituted for Chem 1 on a one-for-one basis without

affecting the quality of the Clever order. There is no problem about the supply of Chem 1.

At present, the company has 20,000 ml of Chem 5 in its inventory, which has a salvage

value of P6,000.

The production of the Clever’s order would require the same direct labor hours per bottle as

in the regular Shamcon. However, at present, the company has only 20,000 direct labor

hours available. The Clever order can be produced if the workers would work overtime,

although an overtime premium of 30% of the regular rate should be paid.

Schundel Hair Care Company’s policy is to price new products at 130% of full manufacturing

cost

44. If Schundel Company bids this month for the special one-time order of 500 boxes of the

product, the special order’s total direct materials cost will be

a. P73,944.

c. P68,880.

b. P61,680.

d. P56,880.

ANSWER D

The special order is for 500 boxes of 24 bottles each or a total of 12,000 bottles. Materials costs will be:

Chem 1: Total required – 12,000 bottles x 4 ml

48,000 ml

Available Chem 5 that can be substituted

for Chem 1, 20,000 ml, salvage value… *

Balance of Chem 1 required

(48,000 ml – 20,000 ml) x P0.54

Chem 2: 12,000 bottles x 3 ml x P0.36

Chem 3 12,000 bottles x 2 ml x P0.20

Chem 4 12,000 bottles x 5 ml x (P0.40 – P0.10)*

Total materials cost

P 6,000

15,120

12,960

4,800

18,000

P56,880

* The relevant cost of existing stocks is equal to their salvage value that will not be realized if the stocks are

used in the Clever order.

Page 20

45. If Schundel Hair Care Company bids this month for the special one-time order of 500 boxes

of the product, the special order’s total relevant conversion cost will be

a. P123,600.

c. P120,000.

b. P219,600.

d. P216,000.

ANSWER A

Labor: Total required time – 12,000 bottles x 2 hours

Labor cost at regular rate (24,000 hours x P3)

Overtime premium (24,000 – 20,000) x P3 x 30%

Total labor cost

Factory overhead – variable (24,000 hours x P2)

Total relevant conversion cost

24,000 hours

P72,000

3,600

P75,600

48,000

P123,600

The overtime premium is part of labor cost, not of overhead cost, because the overtime work is attributable to a

particular job.

The total fixed factory overhead is assumed to remain constant whether or not the special order is accepted,

hence, irrelevant.

46. If the company’s policy is to price new products at 130% of full manufacturing cost, what is

the bid price per unit for this one-time special order of Clever Company?

a. P19.55

c. P29.95

b. P 6.91

d. P23.80

ANSWER C

Materials cost (from Item #44)

Variable conversion cost (from Item #45)

Fixed factory overhead (24,000 hours x P4)

Full manufacturing cost

÷ Number of bottles ordered (500 boxes x 24)

Full cost per bottle

Bid price per unit

P 56,880

123,600

96,000

P276,480

12,000

P 23.04

130%

P 29.95

47. What will be the total variable manufacturing costs for the subsequent, recurring 500-box

orders?

a. P180,480

c. P287,280

b. P373,464

d. P191,280

ANSWER D

Materials:

Chem 1

Chem 2

Chem 3

12,000 bottles x 4 ml x P0.54

12,000 bottles x 3 ml x P0.36

12,000 bottles x 2 ml x P0.20

P25,920

12,960

4,800

Page 21

Chem 4

12,000 bottles x 5 ml x P0.40

Variable conversion cost (from Item #45)

Total variable manufacturing costs

24,000

P67,680

123,600

P191,280

For subsequent orders, the company will have to buy all the required materials because by this time,

the inventory of Chem 4 and Chem 5 would have been fully utilized in the first order.

ITEMS 48 and 49 ARE BASED ON THE FOLLOWING INFORMATION:

Jane Corporation produces wood glue that is used by furniture manufacturers. The company

normally produces and sells 10,000 gallons of the glue each month. White Glue is sold for P280 per

gallon, variable costs is P168 per gallon, fixed factory overhead cost totals P460,000 per month, and

the fixed selling costs totals P620,000 per month.

Labor strikes in the furniture manufacturers that buy the bulk of White Glue have caused

the monthly sales of Jane Corporation to temporarily decrease to only 15% of its normal

monthly volume. Jane Corporation’s management expects that the strikes will last for

about 2 months, after which, sales of White Glue should return to normal. However, due

to the dramatic drop in the sales level, Jane Corporation’s management is considering to

close down its plant during the two-moth period that the strikes are on.

If Jane Corporation will temporarily shut down its operations, it is expected that the fixed

factory overhead costs can be reduced to P340,000 per month and that the fixed selling

costs can be reduced by P62,000 per month. Start-up costs at the end of the shut-down

period would total P56,000. Jane Corporation uses the JIT system, so no inventories are

on hand.

48. The shut down point in units is

a. 2,750.00.

b. 9,642.86.

c. 3,250.00.

d. 1,100.00.

ANSWER A

Fixed costs under continued operations (for 2 months):

Factory overhead (P460,000 x 2 months)

Selling costs (P620,000 x 2 months)

Total

Less shutdown costs*:

Factory overhead (P340,000 x 2 months)

Selling costs ([P620,000 – P62,000] x 2 months)

Start-up costs

Difference

Divide by CM per unit (P280 – P168)

Shutdown point in units

P 920,000

1,240,000

P2,160,000

P 680,000

1,116,000

56,000

1,852,000

P 308,000

÷

P112

2,750 units

Page 22

49. At the sales level of only 30% of the normal volume, should the company continue

operating or shut down temporarily for two months?

a. Continue, because the expected sales is above the shutdown point.

b. Shut down, because the expected sales is above the shutdown point.

c. Continue, so that the shutdown costs may be avoided.

d. Shut down, because the shutdown costs is less than the contribution margin under

continued operations.

ANSWER A

50. The process of choosing among competing alternatives is called

a. controlling

c. decision making

b. planning

d. performance evaluation

ANSWER C

51. Spikey Company produces two products: Pat and Chin. The projected income for the

coming year, segmented by product line, follow:

Pat

Chin

Total

Sales

Less variable expenses

Contribution margin

Less direct fixed expenses

Product margin

Less common fixed cost

Operating income

P300,000

100,000

P200,000

28,000

P172,000

P2,500,000

500,000

P2,000,000

1,500,000

P 500,000

P2,800,000

600,000

P2,200,000

1,528,000

P 672,000

100,000

P 572,000

The selling prices are P30 for Pat and P50 for Chin.

Spikey company can increase the sales of Pat with increased advertising. The extra

advertising would cost an additional P245,000, and some of the potential purchasers of Chin

would switch to Pat. In total, sales of Pat would increase by 25,000 units, and sales of Chin

would decrease by 5,000 units. This strategy would

a. increase Spikey’s total sales by P750,000.

b. decrease Spikey’s total contribution margin by P300,000.

c. increase Spikey’s total income by P55,000.

d. not affect Spikey’s total fixed costs.

ANSWER C

PAT

CHIN

Cont. margin

P200,000 P2,000,000

÷ units (P300k ÷ P30)

10,000

50,000

CM per unit

P

20 P

40

X change in units

25,000

(5,000)

Change in CM

P500,000 (P200,000)

Page 23

Increase in CM (P500k – P200K)

Less incremental fixed cost

Increase in profit

P300,000

245,000

P 55,000

CAPITAL BUDGETING

ITEMS 52 AND 53 ARE BASED ON THE FOLLOWING

Ricky Ironworks is considering a proposal to sell an existing lathe and purchase a new

computer-operated lathe. Information on the existing lathe and the computer-operated

lathe follow:

Computer-operated

Existing Lathe

Lathe

Cost

P100,000

P300,000

Accumulated depreciation

60,000

0

Salvage value now

20,000

Salvage value in 4 years

0

60,000

Annual depreciation

10,000

75,000

Annual cash operating costs

200,000

50,000

Remaining useful life

4 years

4 years

52. What is the payback period for the computer-operated lathe?

a. 1.87 years

c. 3.53 years

b. 2.00 years

d. 3.29 years

Answer A

Acquisition cost, new lathe

Less salvage value of old lathe

Net cost of investment

÷ savings in cash operating costs (P50,000 – P200,000)

Payback period

P300,000

20,000

P280,000

150,000

1.87 years

53. If the company uses 10 percent as its discount rate, what is the net present value of the

proposed new lathe purchase? (Round present value factors to four decimal places)

a. P236,465

c. P195,485

b. P256,465

d. P30,422

Answer A

Present value of cost savings (P150,000 x 3.1699)

Present value of salvage value (P60,000 x 0.6830)

Total PV of cash inflows

Less net cost of investment

Net present value

P475,485

40,980

P516,465

280,000

P236,465

Page 24

54. RPI Corporation bought a piece of machinery. Selected data is presented below:

Useful life

Yearly net cash inflow

Salvage value

Internal rate of return

Cost of capital

6 years

P45,000

-018%

14%

The initial cost of the machinery was (round present value factor to four decimal places)

a. P157,392.

c. P165,812.

b. P174,992.

d. impossible to determine from the information given.

ANSWER A

Yearly net cash inflow

x PVF, 18% for 6 years

Initial cost of the machine

P 45,000

3.4976

P157,392

55. All other factors equal, a large number is preferred to a smaller number for all capital

project evaluation measures except

a. net present value.

c. internal rate of return.

b. payback period.

d. profitability index.

ANSWER B

56. Tanya Corporation issued preferred stocks for P120 per share. The issue price is P20 more

than the stock’s par value. The company incurred underwriting fees of P10 per share. The

stocks will earn annual dividends of P12 per share. If the tax rate is 30%, the cost of

capital (preferred stocks) is

a. 10%

c. 7.42%

b. 12%

d. 10.91%

ANSWER D

Cost of

Preferred =

Stocks

57.

DPS

Net issuance

price

P12

P120 – P10

= 10.91%

At the beginning of the year, Djorn Corporation purchased a new equipment for P360,000. The

machine has an estimated useful life of four (4) years with no salvage value. It is expected to produce

cash flows from operations, net of income taxes of 32%, as follows:

Year 1

2

3

4

P128,000

112,000

144,000

96,000

Page 25

5

80,000

Djorn Corporation uses the sum-of-the-years-digits method (SYD) in computing depreciation of its

depreciable assets. Using SYD, the new equipment will be depreciated as follows:

Year 1

2

3

4

(P360,000 x 4/10)

(P360,000 x 3/10)

(P360,000 x 2/10)

(P360,000 x 1/10)

P144,000

108,000

72,000

36,000

The company’s cost of capital is 10%. The present value factors at 10% are as follows:

End of Year 1

2

3

4

Total, 4 years

0.909

0.826

0.751

0.683

3.170

If Djorn Corporation used the straight-line method of depreciation instead of the SYD method, the net

present value provided by the equipment would increase (decrease) by:

a. P13,464

c. (P4,308.48)

b. (P13,464)

d. P4,308.48

ANSWER C

Depreciation expense, as a tax shield, provides tax savings. The difference in the present

values of the tax savings under the two depreciation methods will represent the difference

in the net present values of the equipment.

Year 1

P144,000 x 32% =

P46,080

0.909

P41,886.72

2

108,000 x 32% =

34,560

0.826

28,546.56

3

72,000 x 32% =

23,040

0.751

17,303.04

4

36,000 x 32% =

11,520

0.683

7,868.16

Total present value of tax savings, SYD method

PV of tax savings, straight-line method

(P360,000 ÷ 4 years = P90,000 x 32% x 3.170)

P95,604.48

91,296.00

Decrease in net present value

P 4,308.48

58. Harry owns a computer reselling business and is expanding his business. Harry is presented

with one proposal, Proposal P1, such that the estimated investment for the expansion

project is P85,000 and it is expected to produce cash flows after taxes of P25,000 for each

of the next 6 years. An alternate proposal, Proposal P2, involves an investment of P32,000

and after-tax cash flows of P10,000 for each of the next 6 years. The present value factors

for an annuity of P1 for 1 to 6 years are as follows:

n

10%

12%

14%

16%

18%

20%

1

0.909

0.893

0.877

0.862

0.847

0.833

2

1.736

1.690

1.647

1.605

1.566

1.528

3

2.487

2.402

2.322

2.246

2.174

2.106

4

3.170

3.037

2.914

2.798

2.690

2.589

5

3.791

3.605

3.433

3.274

3.127

2.991

Page 26

6

4.355

4.111

3.889

3.685

3.498

3.326

The cost of capital that would make Harry indifferent between these two proposals lies between

a.

10% and 12%

c. 16% and 18%

b.

14% and 16%

d. 18% and 20%

ANSWER C

Indifference point is when the NPVs of the two proposals are equal.

Let x =present value factor for a cost of capital for 6 years

85,000 – 25,000x =32,000 – 10,000x

x =3.533, which is between 16% and 18%

59. Harold Co. is considering an investment in a capital project. The sole outlay will be

P716,417.90 at the outset of the project and the annual net after-tax cash inflow will be

P216,309.75 for 6 years. The present value factors at Harold’s 8% cost of capital are:

Year

PV Factors

1

0.926

2

0.857

3

0.794

4

0.735

5

0.681

6

0.630

What is the break-even time (BET)?

a. 3.31 years

b. 4.00 years

c. 5.00 years

d. 6.00 years

ANSWER B

Break-even time: the cumulative present value of cash inflows equals the cost of investment

Cash Inflows

x

PVF

=

PV

1

216,309.75

0.926

P200,302.83

2

216,309.75

0.857

185,377.46

3

216,309.75

0.794

171,749.94

4

216,309.75

0.735

158,987.67

5

216,309.75

0.681

147,306.94

Total PV of cash inflows, first 4 years = P716,417.90

Break even time = 4 years

60. The investment banking firm of M and Associates will use a dividend valuation model to appraise

the shares of the L&L Corporation. Dividends (D) at the end of the current year will be P1.20. The

growth rate (g) is 9% and the discount rate (K) is 13%?

What should be the price of the stock to the public?

Page 27

a. P28.75

c.

b. P31.50

P30.00

d. P29.00

ANSWER C

Price =

D

1.20

=

K–G

13 – 9

= P30

61. BSR Co, has an opportunity to purchase a new conveyor line for P250,000. They can

borrow P200,000, paying P50,000 down with annual payments for five years and an interest

of 15%. They also have an opportunity to lease the line for P65,000 a year. The present

value of an annuity of P1 for five years at 9% and 15% are 3.8897 and 3.3522,

respectively. At the end of five years, the estimated salvage value is P40,000. If owned,

the cost of maintenance is expected to be P10,000 per year. Assume straight-line

depreciation, a 40% tax rate, a cost of debt of 15%, and a cost of capital of 9%.

What is the present value of the after-tax cost of leasing for the five-year period?

a. P151,698

c. P144,000

b. P 98,698

d. P165,800

ANSWER A

Annual lease expense, net of tax (P65,000 x 60%)

x PVF, 9%, 5 years

P 39,000

3.8897

Present value of the after-tax cost of leasing

P151,698

OPERATING & FINANCIAL BUDGETING

62. After careful planning, Change Style, Inc. has decided to switch to a just-in-time inventory

system effective on July 1 of the current year. As of July 1, the corporation has 70 units of

product in inventory. It has 1,000 labor hours available for the month of July. These hours

could produce 250 units of product. Customer demand for July is 200 units. If just-in-time

principles are correctly followed, how many units should Change Style Inc. plan to produce

in July?

a. 200

c. 180

b. 130

d. 250

ANSWER B

Demand

Less beginning inventory

Production

200

70

130

63. Ideally, the number of units that should be produced in a just-in-time manufacturing system

is equal to

a. the maximum productive capacity for the current period.

b. actual customer demand for the current period.

c. budgeted customer demand for the current period.

d. budgeted customer demand for the following period

Page 28

ANSWER B

64. The projected sales price for a new product (which is still in the development stage of the

product life cycle) is P50. The company has estimated the life-cycle cost to be P30 and the

first-year cost to be P60. On this type of product, the company requires a P12 per unit

profit. What is the target cost of the new product?

a. P60

c. P38

b. P30

d. P43

ANSWER C

Projected sales price

Less required profit

Target cost

P50

12

P38

65. The preparation of an organization's budget

a. forces management to look ahead and try to see the future of the organization.

b. requires that the entire management team work together to make and carry out the

yearly plan.

c. makes performance review possible at all levels of management.

d. all of the above.

ANSWER D

66. Ivory Company has the following expected pattern of collections on credit sales: 70 percent

collected in the month of sale, 15 percent in the month after the month of sale, and 14

percent in the second month after the month of sale. The remaining 1 percent is never

collected. At the end of May, Ivory Company has the following accounts receivable

balances:

From April sales

P21,000

From May sales

48,000

Ivory's expected sales for June are P150,000. What were total sales for April?

a. P150,000

c. P 70,000

b. P 72,414

d. P140,000

ANSWER D

A/R balance from April sales

÷ uncollected portion (100% - 70% - 15%)

April sale

P 21,000

15%

P140,000

67. Bali Company has a policy of maintaining an inventory of finished goods equal to 30 percent

of the following month's sales. For the forthcoming month of March, Bali has budgeted the

beginning inventory at 30,000 units and the ending inventory at 33,000 units. This suggests

that

a. February sales are budgeted at 10,000 units less than March sales.

Page 29

b. March sales are budgeted at 10,000 units less than April sales.

c. February sales are budgeted at 3,000 units less than March sales.

d. March sales are budgeted at 3,000 units less than April sales.

ANSWER B

Increase in inventory

Sales increase for April over March

3,000

÷ 30%

10,000

ITEMS 68 to 71 ARE BASED ON THE FOLLOWING INFORMATION:

The cost of goods sold section of Dale Corporation’s operating budget for 2015 is presented below:

Materials: Inventory, January 1 (16,000 units)

P

960,000

Purchases

9,120,000

Available for use

P10,080,000

Inventory, December 31 (18,500 units)

1,184,000

Labor

Factory overhead: Variable

P 2,009,600

Fixed

1,120,000

Cost of goods manufactured (140,000 units)

Add finished goods inventory, January 1 (9,300 units)

Cost of goods available for sale

Less finished goods inventory, December 31 (3,300 units)

Budgeted cost of goods sold

P 8,896,000

784,000

3,129,600

P12,809,600

744,000

P13,553,600

301,600

P13,255,000

The actual results for the first quarter of 2015 require the following changes in the budget

assumptions:

The budgeted production for the year is expected to increase by 5,000 units.

During the first quarter, the company has already produced 25,000 units. The

balance of production will be scheduled in equal segments over the last 3 quarters

of the budget year.

The expected finished goods inventory on January 1 dropped to only 9,000 units,

but its total value will not be revised anymore. The ending inventory value is

computed using the average manufacturing cost for the year.

A new Labor Bill passed by Congress is expected to be signed into a law by the

President. The new law will take effect beginning the last quarter of the budget

year, including a provision for an increase of 8% in wage rates.

The company uses the FIFO method in valuing its materials inventory. During the

first quarter, the company purchased 27,500 units of direct materials for

P1,760,000. The remaining direct materials requirement will be purchased evenly

for the last 9 months of the budget year. Effective July 1, 2015, the beginning of

the third quarter, direct materials cost is expected to increase by 5%. The

assumptions regarding the quantity of materials inventories at the beginning and

end of the year will remain unchanged.

Page 30

The variable factory overhead of P2,009,600 includes indirect materials and factory

supplies amounting to P889,600. It is computed at 10% of the cost of materials

used. The balance of the variable factory overhead varies directly with production.

There will be no change in the budgeted fixed factory overhead cost.

Considering the given actual data for the first quarter, as well as the changes in

assumptions and estimates in the budgeted data for the year, the company’s accountant

prepared a revised budgeted cost of goods sold statement. This revised statement should

show:

68. budgeted materials purchases of

a. P9,696,000.

b. P9,120,000.

c. P9,280,000.

d. P9,440,000.

ANSWER A

It is assumed that each unit of product requires one unit of materials. So, production is equal to raw materials

to be used.

Budgeted raw materials to be used (or production) – 140,000+ 5,000

Add raw materials ending inventory

Total

Less raw materials beginning inventory

Budgeted purchases

Less actual purchases, 1st quarter

Required purchases in the remaining 3 quarters

145,000 units

18,500

163,500

16,000

147,500

27,500

120,000 units

Cost computation:

First quarter purchases (27,500 units)

Second quarter (120,000/3 or 40,000 x [P1,760,000÷27,500] or P64/unit)

Third and fourth quarters ([40,000/qtr. x 2] x[P64 x 105%])

Total cost of budgeted purchases

P1,760,000

2,560,000

5,376,000

P9,696,000

69. budgeted cost of materials inventory at December 31, 2015 of

a. P1,024,000.

b. P1,243,200.

c. P1,184,000.

d. P1,216,100.

ANSWER B

Materials inventory, December 31, 2015

x Purchase price (P64 x 1.05)

Cost of materials inventory, December 31, 2015

18,500

P67.20

P1,243,200

The company uses the FIFO method of costing inventory. Thus, the ending inventory should be valued at the new

purchase price of P67.20.

70. the budgeted direct labor cost of

a. P846,720.

b. P784,000.

c. P876,960.

d. P829,920.

Page 31

ANSWER D

Original labor cost per unit (P784,000 ÷ 140,000 units)

P 5.60

th

P6.048

Labor cost per unit effective on the beginning of the 4 quarter (P5.60 x 108%)

Budgeted labor cost:

First to third quarters (25,000 + 40,000 + 40,000) x P5.60)

Fourth quarter (40,000 x P6.048)

P588,000

241,920

Total budgeted labor cost

P 829,920

71. the budgeted cost of goods manufactured of

a. P12,809,600.

b. P13,464,000.

c. P14,208,000.

d. P12,344,000.

ANSWER B

Materials:

Inventory, January 1

Add purchases

Available for use

Less inventory, December 31

Labor

Factory overhead:

Variable:

Indirect materials (P9,412,800 x 10%)

P2,009,600 – P889,600

Other variable

(

140,000

overhead

Total variable overhead

Fixed

Budgeted cost of goods manufactured

P 960,000

9,696,000

P10,656,000

1,243,200

P 9,412,800

829,920

P 941,280

x

)

145,000

. 1,160,000

P2,101,280

1,120,000

3,221,280

P13,464,000

72. the budgeted cost of goods sold of

a. P13,901,578.

c.

P13,553,600.

b. P13,252,000.

d. P14,208,000.

ANSWER A

Cost of goods manufactured (from Item #74)

Add finished goods inventory, January 1

Total cost of goods available for sale

Less finished goods inventory, December 31

(3,300 units x [P13,464,000 ÷ 145,000])

Budgeted cost of goods sold

P13,464,000

744,000

P14,208,000

306,422

P13,901,578

Page 32

WORKING CAPITAL MANAGEMENT & FS ANALYSIS

73. At the end of 2015, Gabbuat Company’s total assets was P500,000. In 2016, it earned net

income of P30,000 and paid dividends of P10,000. What is the company’s internal growth

rate?

a. 1%

c. 5%

b. 4%

d. 9%

ANSWER B

Internal growth rate is the percentage increase in assets kept in business.

Increase in assets (P30,000 – P10,000)

÷ Total assets, beginning of 200B

Internal growth rate

P 20,000

÷ 500,000

4%

74. A division of Lockman Corporation reported a return on investment of 20% for a recent

period. If the division's asset turnover was 5, its profit margin must have been

a. 100%

c. 4%

b. 25%

d. 2%

ANSWER C

ROS x ATO = ROA

ROS x 5 = 20%

ROS = 20% ÷ 5 = 4%

75. As of the end of 2015, Ice Company had total assets of P375,000 and equity of P206,250.

For 2016, its budget for capital investment projects is P62,500. To finance a portion of the

capital budget, the company may borrow from a bank which set a condition that the loan

would be approved, provided that the 2016’s debt-to-equity ratio should be the same as the

debt-to-equity ratio in 2015.

How much debt should be incurred to satisfy the bank’s condition?

a. P28,125

c. P34,375

b. P62,500

d. P51,138

ANSWER A

Total assets

Less equity

Debt

P375,000

206,250

P168,750

Debt-to-Equity Ratio (P168,750 ÷ P206,250)

81.82%

*Total financing required for the capital budget

P62,500

÷181.82%

Amount to be financed by equity

P34,375

Page 33

Amount to be financed by debt without changing

the debt-to-equity ratio (P62,500 – P34,375)

P28,125

76. The management of Seymour Corporation asks you to prepare an analysis of the gross

profit variance based on their comparative income statements for 2015 and 2016:

2016

2015

Variance

Sales

P990,000

P800,000

P190,000 F

Cost of goods sold

760,000

640,000

120,000 U

Gross profit

P230,000

P160,000

P 70,000 F

The only known information given to you is that volume increased from 2015 to 2016 by

10%.

The variance in gross profit due to the change in volume is

a. P80,000 favorable.

c. P16,000 favorable.

b. P64,000 unfavorable.

d. P70,000 favorable.

ANSWER C

Sales volume variance

Cost volume variance

Gross profit volume variance

P80,000 F

64,000 U

P16,000 F

– OR –

200B units @ 200A gross profit per unit

(P160,000 x 110%)

Less 200A gross profit

Gross profit volume variance

P176,000

160,000

P 16,000 F

77. Last year’s asset turnover of Johvic Company was 3.0. This year, the company’s sales

increased by 25% and average total assets decreased by 5%. What is this year’s asset

turnover?

a. 3.9

c. 3.4

b. 3.6

d. 3.1

ANSWER A

Asset Turnover

last year

Asset Turnover

this year

Sales

Average Total

Assets

= 3 x 1.25 = 3.75

1 x 0.95

0.95

=

=3

= 3.9

78. During the year, Tindugan Company earned net income of P60,000. For next year, it has a

capital budget of P80,000. If the company’s plowback ratio is 30%, how much external

funding is needed for the capital investment project?

a. P80,000

c. P56,000

Page 34

b. P62,000

d. P98,000

ANSWER B

Capital budget

Fund from net income (P60,000 x 30%)

External funding needed

P80,000

18,000

P62,000

79. The following data are taken from the records of Belle Corporation for the year ended Dec. 31,

2015:

Average Age

(360 days ÷

Turnover)

Turnove

r

1.

R M Inventory

=

Turnover

RM used

Ave. RM Inventory

=

P96,000

P8,000

12 times

2.

Cost of Goods Sold

FG Inventory

=

Turnover

Ave. FG Inventory

=

P576,000 x

75%

P12,000

36 times

P576,000

P80,000

7.2 times

360

7.2

50 days

24 times

360

24

(15) days

3. A/R Turnover =

Net Credit Sales

Ave. A/R

=

Net Credit Purchases

P120,000

=

Ave. A/P

P5,000

Average number of days in the operating cash conversion

cycle

4. A/P Turnover =

Net credit sales

Average materials inventory

Average finished goods inventory

Average accounts receivable

Average accounts payable

Net credit purchases

Raw materials used

Gross profit rate

Number of days in a year

360

12

360

75 days

What is the average number of days in the company’s operating cash conversion cycle?

c.

105 days

b. 75 days

d.

45 days

ANSWER B

10 days

36

P576,000

8,000

12,000

80,000

5,000

120,000

96,000

25%

360 days

a. 50 days

30 days

Page 35

80. Using the data presented below, calculate the cost of sales for the Alpha Corporation for the year

just ended.

Current ratio

3.5

Acid test ratio

3.0

Current liabilities at year-end

P600,000

Beginning inventory

P500,000

Inventory turnover

8.0

a.

P1,600,000

c. P3,200,000

b. P2,400,000

d. P6,400,000

ANSWER C

Cost of sales =Average inventory x Inventory turnover

P500,000 + P300,000*

=

2

= P3,200,000

‘

* Current ratio =

3.50 =

Acid-test ratio =

3.00 =

x8

Current assets

Current liabilities

Current assets

600,000

Current assets

=

2,100,000

Quick assets

=

1,800,000

Quick assets

Current liabilities

Quick assets

600,000

Inventory, ending

DECENTRALIZATION & PERFORMANCE EVALUATION

300,000

Page 36

81. Which of the following is necessary for any valid performance measurement?

a. It must be part of the financial accounting system in use.

b. It must be quantifiable.

c. Goal congruence must be promoted by its use.

d. It must be financial in nature.

ANSWER C

82. A balanced scorecard

a. records the variances between budgeted and actual revenues and expenses.

b. can be used at multiple organizational levels by redefining the categories and

measurements.

c. is most concerned with organizational financial solvency and business processes.

d. all of the above.

ANSWER B

83. Productivity is measured by the

a. total quantity of output generated from a limited amount of input during a time

period.

b. quantity of good output generated from a specific amount of input during a time

period.

c. quantity of good output generated from the quantity of good input used during a

time period.

d. total quantity of input used to generate total quantity of output for a time period.

ANSWER B

84. Failure Corporation is a manufacturer of a versatile statistical calculator. The following

information is a summary of defective and returned units for the previous year.

Total defective units

1,000

Number of units reworked

750

Number of customer units returned

150

Profit for a good unit

P40

Profit for a defective unit

P25

Cost to rework a defective unit

P10

Cost of a returned unit

P15

Total prevention cost

P10,000

Total appraisal cost

P5,000

The total quality cost is

a. P15,000.

b. P15,750.

c. P28,500.

d. P11,250.

ANSWER C

Failure costs:

Rework cost (750 units x P10)

P7,500

Page 37

Returned units (150 x P15)

Not reworked (250 units x P15)

Prevention costs

Appraisal cost

Total quality costs

2,250

3,750

P13,500

10,000

5,000

P28,500

85. A small manufacturing company recently stated its sales goal for a period was P100,000. At

this level of activity, its budgeted expenses were P80,000. Its actual sales were P100,000,

but its actual expenses were P85,000. This company operated

a. effectively and efficiently.

c. effectively but not efficiently.

b. neither effectively nor efficiently.

d. efficiently but not effectively.

ANSWER C

ITEMS 86 AND 87 ARE BASED ON THE FOLLOWING

Computer Solutions Corporation manufactures and sells various high-tech office automation

products. Two divisions of Computer Solutions Corporation are the Computer Chip Division

and the Computer Division. The Computer Chip Division manufactures one product, a "super

chip," that can be used by both the Computer Division and other external customers. The

following information is available on this month's operations in the Computer Chip Division:

Selling price per chip

P50

Variable costs per chip

P20

Fixed production costs

P60,000

Fixed SG&A costs

P90,000

Monthly capacity

10,000 chips

External sales

6,000 chips

Internal sales

0

chips

Presently, the Computer Division purchases no chips from the Computer Chips Division, but

instead pays P45 to an external supplier for the 4,000 chips it needs each month.

86. Two possible transfer prices (for 4,000 units) are under consideration by the two divisions:

P35 and P40. Corporate profits would be ___________ if P35 is selected as the transfer

price rather than P40, and the Computer Division purchases from the Computer Chip

Division instead of from the external supplier.

a. P 20,000 larger

c. P20,000 smaller

b. P100,000 larger

d. the same

ANSWER B

Purchase price

Less variable cost

Savings if acquired from within

P45

20

P25

Page 38

x number of units

Increase in profit

4,000

P100,000

87. Assume, for this question only, that the Computer Chip Division is selling all that it can

produce to external buyers for P50 per unit. How would overall corporate profits be affected

if it sells 4,000 units to the Computer Division at P45? (Assume that the Computer Division

can purchase the super chip from an outside supplier for P45.)

a. no effect

c. P20,000 decrease

b. P20,000 increase

d. P90,000 increase

ANSWER C

Purchase price

Cost if purchased from within:

Variable cost

Opportunity cost

Loss per unit

x number of units

Decrease in profit

P45

P20

30

50

P 5

4,000

P20,000

88. The following information is given for the Alpha Division of Sorority Corporation.

Sales P600,000

Var. cost of goods sold

200,000

Fixed manufacturing costs

50,000

Variable selling

30,000

Fixed admin. (50% allocated)

20,000

Fixed selling (20% allocated)

50,000

Assets at cost

800,000

Accumulated depreciation

200,000

If Sorority Corporation uses ROI to evaluate division managers and uses historical cost as

the investment base, the ROI for Alpha Division is:

a. 31.25%

c. 41.67%

b. 33.75%

d. 45.00%

ANSWER B

Sales

Less cost of goods sold

Gross margin

Variable selling

P30,000

Fixed selling (P50,000 x 80%) 40,000

Fixed admin (P20,000 x 50%) 10,000

Controllable income

÷ Assets

ROI

P600,000

250,000

P350,000

80,000

P270,000

800,000

33.75%

89. The following year-end data pertain to Adan Corporation:

Page 39

Earning before interest and taxes

Current assets

Non-current assets

Current liabilities

Non-current liabilities

P 800,000

800,000

3,200,000

400,000

1,000,000

Adan Corporation pays an income tax rate of 32%. Its weighted-average cost of capital is

10%. What is Adan Corporation’s Economic Value Added (EVA)?

a. P184,000

c. P440,000

b. P144,000

d. P400,000

ANSWER A

After-tax operating income (P800,000 x [1 – 0.32])

Less desired return on investment:

Total assets (P800,000 + P3,200,000) P4,000,000

Less current liabilities

400,000

Investment base

P3,600,000

x Weighted-average cost of capital

10%

Economic value added

90. The

a.

b.

c.

d.

P544,000

360,000

P184,000

format for internal reports in a responsibility accounting system is prescribed by:

Generally Accepted Accounting Principles

The Financial Accounting Standards Board

The Philippine Institute of Certified Public Accountants

Management

ANSWER D

QUANTITATIVE METHODS

91. A company annually consumes 10,000 units of Part C. The carrying cost of this part is P2

per year and the ordering costs are P100. The company uses an order quantity of 500 units.

By how much could the company reduce its total costs if it purchased the economic order

quantity instead of 500 units?

a. P 500

c. P2,500

b. P2,000

d. P 0

ANSWER A

EOQ =

Carrying cost (500/2)2; (1,000/2)2

Ordering cost (10,000/500) x P100

(10,000/1,000) x P100

Total cost

500 units

P 500

2,000

P2,500

= 1,000 units

1,000 units

P1,000

1,000

P2,000

Page 40

Savings (P2,500 – P2,000)

P500

92. In the two following constraint equations, X and Y represent two products (in units)

produced by the Uncommon Products Corporation.

Constraint 1: 3X + 5Y < 4,200

Constraint 2: 5X + 2Y > 3,000

What is the maximum number of units of Product X that can be produced?

a. 4,200

c.

600

b. 3,000

d. 1,400

ANSWER D

1,400 units is the only amount that will not cause Constraint 1 to be violated.

93. King Corporation operates its factory 300 days per year. Its annual consumption of Material

Y is 1,200,000 gallons. It carries a 10,000 gallon safety stock of Material Y and its lead time

is 12 business days. What is the order point for Material Y?

a. 10,000 gallons

c. 48,000 gallons

b. 38,000 gallons

d. 58,000 gallons

ANSWER D

Average daily usage (1,200,000 ÷ 300)

x lead time

Lead time usage

add safety stock

Order point

4,000

12

48,000

10,000

58,000

94. The school canteen can sell either halo-halo or mami (hot noodle soup) on any given day.

The contribution margin that the canteen could earn from halo-halo and mami is affected by

the weather, as follows:

Item sold

Halo-Halo

Mami

CONTRIBUTION MARGIN

Hot Weather

Cold Weather

P15,000

P 6,000

11,400

12,000

If the probability of hot weather on a given day at this time is 60%, which item(s) should

the company sell?

a. Halo-Halo, because this item is salable when weather is hot.

b. Mami, because it has the higher expected payoff.

c. Halo-Halo and mami, so the canteen could maximize contribution margin.

d. 60% halo-halo and 40% mami.

ANSWER B

Page 41

Based on the given data, the expected payoffs are:

Sell halo-halo (15,000 x 60%) + (6,000 x 40%)

Sell mami (11,400 x 60%) + (12,000 x 40%)

P11,400

11,640

Therefore, despite the fact that the weather is hot, the canteen should sell mami because it has the

higher expected value or expected payoff.

95. Mr. Javee owns a piece of land that is adjacent to a big area of a vacant lot owned by the

city government. Recently, Mr. Javee heard that the city government has plans about the

vacant lot. He inquired about such plans and he was given the following, including each

plan’s probability of occurrence:

Probability

Plan A – Lease the lot to a businessman who will construct a mall on the lot

60%

B – Construct a theme park on the vacant lot

30%

C – Construct a building that will house some of the city government’s offices 10%