rd

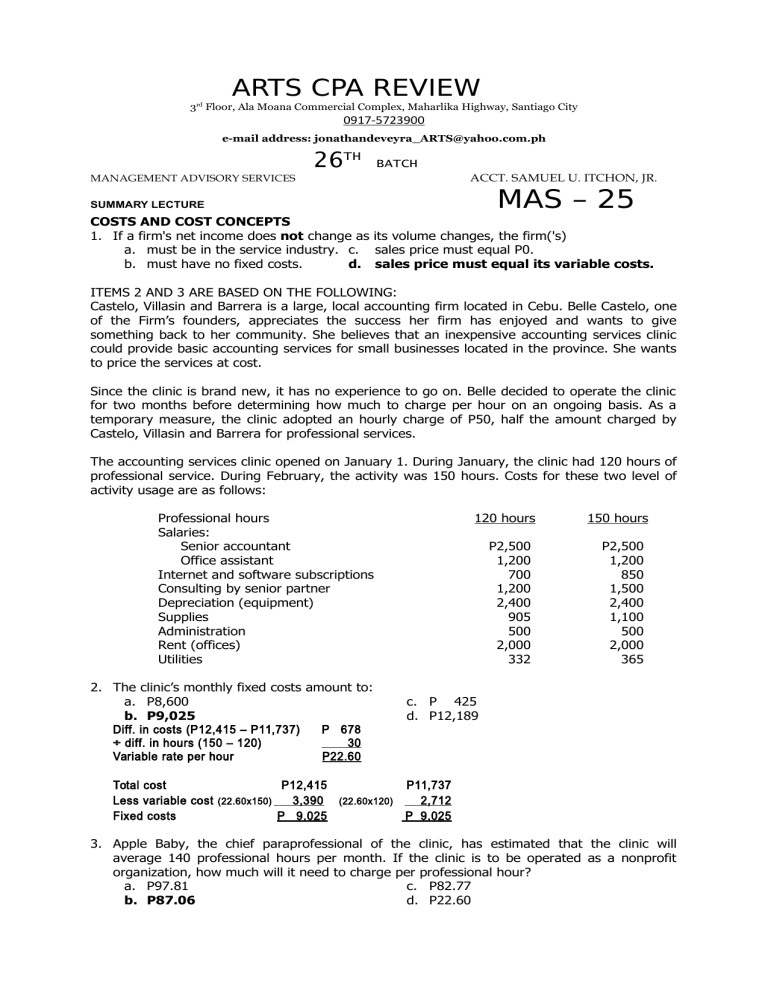

ARTS CPA REVIEW

3 Floor, Ala Moana Commercial Complex, Maharlika Highway, Santiago City

0917-5723900

e-mail address: jonathandeveyra_ARTS@yahoo.com.ph

26TH

BATCH

ACCT. SAMUEL U. ITCHON, JR.

MANAGEMENT ADVISORY SERVICES

MAS – 25

SUMMARY LECTURE

COSTS AND COST CONCEPTS

1. If a firm's net income does not change as its volume changes, the firm('s)

a. must be in the service industry. c. sales price must equal P0.

b. must have no fixed costs.

d. sales price must equal its variable costs.

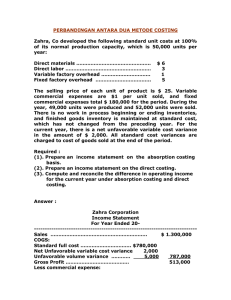

ITEMS 2 AND 3 ARE BASED ON THE FOLLOWING:

Castelo, Villasin and Barrera is a large, local accounting firm located in Cebu. Belle Castelo, one

of the Firm’s founders, appreciates the success her firm has enjoyed and wants to give

something back to her community. She believes that an inexpensive accounting services clinic

could provide basic accounting services for small businesses located in the province. She wants

to price the services at cost.

Since the clinic is brand new, it has no experience to go on. Belle decided to operate the clinic

for two months before determining how much to charge per hour on an ongoing basis. As a

temporary measure, the clinic adopted an hourly charge of P50, half the amount charged by

Castelo, Villasin and Barrera for professional services.

The accounting services clinic opened on January 1. During January, the clinic had 120 hours of

professional service. During February, the activity was 150 hours. Costs for these two level of

activity usage are as follows:

Professional hours

Salaries:

Senior accountant

Office assistant

Internet and software subscriptions

Consulting by senior partner

Depreciation (equipment)

Supplies

Administration

Rent (offices)

Utilities

2. The clinic’s monthly fixed costs amount to:

a. P8,600

b. P9,025

Diff. in costs (P12,415 – P11,737)

P 678

÷ diff. in hours (150 – 120)

30

Variable rate per hour

P22.60

120 hours

P2,500

1,200

700

1,200

2,400

905

500

2,000

332

150 hours

P2,500

1,200

850

1,500

2,400

1,100

500

2,000

365

c. P 425

d. P12,189

Total cost

P12,415

P11,737

Less variable cost (22.60x150)

3,390 (22.60x120)

2,712

Fixed costs

P 9,025

P 9,025

3. Apple Baby, the chief paraprofessional of the clinic, has estimated that the clinic will

average 140 professional hours per month. If the clinic is to be operated as a nonprofit

organization, how much will it need to charge per professional hour?

a. P97.81

c. P82.77

b. P87.06

d. P22.60

Page 2

Variable cost (140 x P22.60)

Fixed cost

Total cost

÷ number of hours

Cost per hour

P 3,164

9,025

P12,189

140

P 87.06

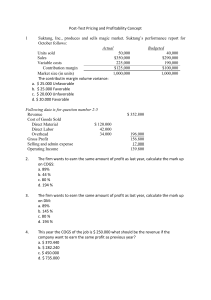

4. HSR Computer System designs and develops specialized software for companies and use a

normal costing system. The following data are available for 2015:

Budgeted

Overhead

P600,000

Machine hours

24,000

Direct labor hours

75,000

Actual

Units produced

100,000

Overhead

P603,500

Prime costs

P900,000

Machine hours

25,050

Direct labor hours

75,700

Overhead is applied on the basis of direct labor hours.

What is the unit cost for the year?

a. P15.03

b. P15.06

c. P15.09

d. P15.00

Prime costs P 900,000

Applied overhead (P600,000/75,000 DLH x 75,700)

Total cost

÷ Units produced

605,600

P1,505,600

100,000

Unit cost

P

15.06

ABC SYSTEM

5. Hazelnut Company uses activity-based costing. The company produces two products:

coats and hats. The annual production and sales volume of coats is 8,000 units and of hats

is 6,000 units. There are three activity cost pools with the following expected activities and

estimated total costs:

Activity

Cost Pool

Activity 1

Activity 2

Activity 3

Estimated

Cost

P20,000

P37,000

P91,200

Expected

Activity

Coats

100

800

800

Expected

Activity

Hats

400

200

3,000

Total

500

1,000

3,800

Using ABC, the cost per unit of coats is approximately:

a. P2.40

c. P 6.60 ->52,800/8,000

b. P3.90

d. P10.59

Activity 1 (P20,000 x 100/500)

P 4,000

Activity 2 (P37,000 x 800/1,000)

29,600

Activity 3 (P91,200 x 800/3,800)

19,200

Total allocated cost

P52,800

÷ number of units

8,000

Cost per unit

P 6.60

6.

Elaine Hospital plans to use the activity-based costing to assign hospital indirect costs to the care

of patients. The hospital has identified the following activities and activity rates for the

hospital indirect costs:

Activity

Activity Rate

Room and meals

P150 per day

Radiology

P95 per image

Page 3

Pharmacy

Chemistry lab

Operating room

P28 per physician order

P85 per test

P550 per operating room hour

The records of two representative patients were analyzed, using the activity rates. The activity

information associated with the two patients are as follows:

Patient 1

Patient 2

Number of days

7

3

Number of images

4

2

Number of physician orders

5

1

Number of tests

6

2

Number of operating room hours

4.5

1

Determine the activity cost associated with Patient 2.

a. P1,388

c. P1,816

b. P 908

d. P4,555

Activity costs, Patient 2:

Room and meals (3 x P150)

Radiology (2 x P95)

Pharmacy (1 x P28)

Chemistry lab (2 x P85)

Operating room (1 x P550)

Total

P 450

190

28

170

550

P1,388

7.

Balat Leather Works, which manufactures saddles and other leather goods, has three

departments. The Assembly Department manufactures various leather products, such as

belts, purses, and saddle bags, using automated production process.

The Saddle

Department produces handmade saddles and uses very little machinery. The Tanning

Department produces leather. The tanning process requires little in the way of labor or

machinery, but it does require space and process time. Due to the different production

processes in the three departments, the company uses three different cost drivers for the

application of manufacturing overhead. The cost drivers and overhead rates are as follows:

Cost Driver

Predetermined Overhead Rate

Tanning Department

Square-feet of leather

P3 per square-foot

Assembly Department

Machine time

P9 per machine hour

Saddle Department

Direct-labor time

P4 per direct labor hour

The company’s deluxe saddle and accessory set consists of handmade saddle, two

saddlebags, a belt, and a vest, all coordinated to match. The entire set uses 100 squarefeet of leather from the Tanning Department, 3 machine hours in the Assembly

Department, and 40 direct-labor hours in the Saddle Department. The company is

processing Job No. 20 consisting of 20 deluxe saddle and accessory sets.

How much is the applied manufacturing overhead in the Assembly Department for Job

No. 20?

a. P3,200

c. P6,000

b. P 540 ->9x3x20

d. P3,000

Assembly department = P9/machine hour x 3 machine hours x 20 sets = P540

8. If activity-based costing is implemented in an organization without any other changes

being effected, total overhead costs will

a. be reduced because of the elimination of non-value-added activities.

b. be reduced because organizational costs will not be assigned to products or services.

c. be increased because of the need for additional people to gather information on cost

drivers and cost pools.

d. remain constant and simply be spread over products differently.

CVP AND BREAKEVEN ANALYSIS

Page 4

9. Harry Manufacturing incurs annual fixed costs of P250,000 in producing and selling a single

product. Estimated unit sales are 125,000. An after-tax income of P75,000 is desired by

management. The company projects its income tax rate at 40 percent. What is the

maximum amount that Harry can expend for variable costs per unit and still meet its profit

objective if the sales price per unit is estimated at P6?

a. P3.37

c. P3.00 ->75,000/60%=125,000+

b. P3.59

d. P3.70 250,000=375,000 / 125,000

=3. Therefore 6-3=3

10. For its most recent fiscal year, a firm reported that its contribution margin was equal to 40

percent of sales and that its net income amounted to 10 percent of sales. If its fixed costs

for the year were P60,000, how much was the margin of safety?

a. P150,000

c. P600,000

b. P200,000

d. P 50,000

Let S = Sales; CM = 0.40S; NY = 0.10S

Fixed Cost = (0.40S – 0.10S) = 0.30S

Sales (P60,000 ÷ 0.30)

P200,000

Less breakeven sales (P60,000 ÷ 0.40) 150,000

Margin of safety

P 50,000

11. Sam Company manufactures a single product. In the prior year, the company had sales of

P90,000, variable costs of P50,000, and fixed costs of P30,000. Sam expects its cost

structure and sales price per unit to remain the same in the current year, however total

sales are expected to increase by 20 percent. If the current year projections are realized,

net income should exceed the prior year’s net income by:

a. 100 percent.

c. 20 percent. ->90-50=40-30=10

b. 80 percent.

d. 50 percent. 40/10 =4 DOL

Increase in profit (P40,000 x 20%)

P 8,000

÷ Present profit:

Contribution margin

P40,000

Less fixed costs

30,000

10,000

% change in profit

80%

12. Edil Company produces and sells a single product. The costs and selling prices on a per-unit

basis are as follows:

Selling Price

Materials

Labor

Variable overhead

Fixed overhead

Variable selling and administrative

Fixed selling and administrative

P120

35

15

10

10

20

5

The above per-unit figures are computed based on the company’s normal capacity of

20,000 units. The company’s expected margin of safety is

a. 7,500 units.

c. 62.5%.

b. P2,400,000.

d. P12,500.

Expected sales - units

20,000

Less break-even sales:

Fixed costs (20,000 x [10 + 5])

P300,000

÷ Unit contribution margin

(120 – [35 + 15 + 10 + 20])

P40

7,500

Margin of safety

12,500 units

Margin of safety in pesos (12,500 x P120)

Margin of safety ratio (12,500 ÷ 20,000)

P1,500,000

62.5%

13.

Antiporda, Inc. sells three products, A, B, and C. The company sells three (3)

units of C for each unit of A and two (2) units of B for each unit of C. Total fixed costs

amount to P760,000. Product A’s contribution margin per unit is P2, Product B’s is 150%

Page 5

of A’s, and Product C’s is twice as much as B’s. How many units of each product must be

sold to break-even?

Product A

Product B

Product C

a.

2,000

12,000

6,000

b. 20,000

120,000

60,000 ->20,00x1 20,000x6 20,000x3

c.

29,231

58,462

87,692

d.

69,091

414,546

207,273

Product A

Product B

Product C

Total

CM per unit

P2 (2 x 150%) P 3

(P3 x 2) P 6

x Sales mix ratio

1

(2 x 3)

6

3

Composite CM

P2

P18

P18

P38

÷ Number of units per mix (1 + 6 + 3)

10

Weighted average CM per unit

P3.8

Weighted-average UCM

P3.8

Break-even point Fixed costs

P760,000

=

= 200,000 composite units

=

WaUCM

P3.8

Breakdown:

Breakdown: Product A =

Product B =

Product C =

Product A =200,000 x 1/10

=20,000 units

200,000 x 1/10 = 20,000 units

200,000 x 6/10 = 120,000

200,000 x 3/10 = 60,000

200,000 composite units

ITEMS 14 to 16 ARE BASED ON THE FOLLOWING INFORMATION:

A company is making plans for next year, using cost-volume-profit analysis as its planning

tool. Next year’s sales data about its product are as follows:

Selling price

P60.00

Variable manufacturing costs per unit

22.50

Variable selling and administrative costs

4.50

Fixed operating costs (60% is manufacturing cost)

P148,500

Income tax rate

32%

14. How much should sales be next year if the company wants to earn profit after tax of

P22,440, the same amount that it earned last year?

a. P310,800

c. P330,000 ->181,500/55%

b. P397,500

d. P222,000

15. Assume that the company’s management learned that a new technology that will increase

the quality of its product is available. If implemented, its projections for next year will be

changed:

1. The selling price of the product will increase to P75 per unit.

2. Fixed manufacturing costs will increase by 20%.

3. Additional advertising costs will be incurred to promote the higher-quality

product. This will increase fixed non-manufacturing cost by 10%.

4. The improved product will require a new material that will increase direct

materials cost by P4.50

If the new technology is adapted, how much sales should the company make to earn a pretax profit of 10% on sales?

a. P366,130

c. P253,324

b. P358,875 ->172,260/48%

d. P353,897

16. If the sales required in Item #15 is realized, the company will have an operating leverage

factor of

a. 8.53.

c. 17.24%.

b. 5.80. ->58%/10%

d. 5.50.

17. As projected net income increases the

Page 6

a. degree of operating leverage declines. c. break-even point goes down.

b. margin of safety stays constant.

d.contribution margin ratio goes up.

18. Yamyam Company is considering introducing a new product that will require a P250,000

investment of capital. The necessary funds would be raised through a bank loan at an

interest rate of 8%. The fixed operating costs associated with the product would be

P122,500 while the variable cost ratio would be 58%. Assuming a selling price of P15 per

unit, determine the number of units (rounded to the nearest whole unit) Yamyam would

have to sell to generate earnings before interest and taxes (EBIT) of 32% of the amount of

capital invested in the new product.

250,000x32%=80,000

a. 35,318 units

c. 32,143 units ->80+122.5/6.3

b. 25,575 units

d. 23,276 units

STANDARD COSTS AND VARIANCE ANALYSIS

19. The materials mix variance for a product is P450 unfavorable and the materials yield

variance is P150 unfavorable. This means that

a. the materials price variance is P600 unfavorable.

b. the materials quantity variance is P600 unfavorable

c. the total materials cost variance is definitely P600 unfavorable.

d. the materials price variance is also unfavorable, but the amount cannot be

determined from the given information.

20. Variance analysis would be appropriate to measure performance in

a. profit centers

c. cost centers

b. investment centers

d. all of the above

21. Samson Company uses a standard costing system in the production of its only product. The

84,000 units of raw materials inventory were purchased for P126,000 and 4 units of raw

materials are required to produce one unit of final product. In October, the company

produced 14,400 units of product. The standard cost allowed for materials was P72,000,

and there was an unfavorable usage variance of P3,000.

The materials price variance for the units used in October was

a. P15,000 unfavorable.

c. P3,000 unfavorable.

b. P15,000 favorable.

d. P3,000 favorable.

22. The standard direct materials cost to produce a unit of a product is four meters of materials

at P2.50 per meter. During June, 2015, 4,200 meters of materials costing P10,080 were

purchased and used to produce 1,000 units of the product. What was the materials price

variance for June, 2015?

a. P480 unfavorable

c. P400 favorable

b. P 80 unfavorable

d. P420 favorable

23. Buchoy Company manufactures one product with a standard direct manufacturing labor cost

of four hours at P12.00 per hour. During June, 1,000 units were produced using 4,100

hours at P12.20 per hour. The unfavorable direct labor efficiency variance was:

a. P820

c. P1,200

b. P400

d. P1,220

ITEMS 24 TO 28 ARE BASED ON THE FOLLOWING:

Vhong, Inc. evaluates manufacturing overhead in its factory by using variance analysis. The

following information applies to the month of July:

ACTUAL

BUDGETED

Number of units produced

19,000

20,000

Variable overhead costs

P4,100

P2 per direct labor hour

Fixed overhead costs

P22,000

P20,000

Direct labor hours

2,100

0.1 hour per unit

24. The controllable variance amounts to

a. P2,500 unfavorable

c. P2,300 unfavorable

Page 7

b. P1,000 unfavorable

d. P2,000 unfavorable

25. Using the three-way variance analysis, the spending variance amounts to

a. P100 favorable

c. P2,000 unfavorable

b. P1,900 unfavorable

d. P2,100 unfavorable

26. The efficiency variance amounts to

a. P400 unfavorable

b. P1,900 unfavorable

c. P400 favorable

d. P1,000 unfavorable

27. The non-controllable variance is

a. P2,300 unfavorable

b. P400 unfavorable

c. P2,000 unfavorable

d. P1,000 unfavorable

28. The fixed overhead efficiency variance is:

a. P400 unfavorable

b. PP2,000 unfavorable

c. P400 favorable

d. 0 ->no such variance, never a

meaningful variance

PRODUCT COSTING

29. A basic tenet of variable costing is that period costs should be currently expensed.

What is the rationale behind this procedure?

a. Period costs are uncontrollable and should not be charged to a specific product.

b. Period costs are generally immaterial in amount and the cost of assigning the

amounts to specific products would outweigh the benefits.

c. Allocation of period costs is arbitrary at best and could lead to erroneous decision by

management.

d. Because period costs will occur whether production occurs, it is improper

to allocate these costs to production and defer a current cost of doing

business.

30. The following information regarding fixed production costs from a manufacturing firm is

available for the current year:

Fixed costs in the beginning inventory

P16,000

Fixed costs incurred this period

100,000

Which of the following statements is not true?

a. The maximum amount of fixed production costs that this firm could deduct using

absorption costs in the current year is P116,000.

b. The maximum difference between this firm's the current year income based on

absorption costing and its income based on variable costing is P16,000.

c. Using variable costing, this firm will deduct no more than P16,000 for

fixed production costs.

d. If this firm produced substantially more units than it sold in the current year,

variable costing will probably yield a lower income than absorption costing.

31. Absorption costing differs from variable costing in all of the following except

a. treatment of fixed manufacturing overhead.

b. treatment of variable production costs.

c. acceptability for external reporting.

d. arrangement of the income statement

32. If a firm produces more units than it sells, absorption costing, relative to variable costing,

will result in

a. higher income and assets.

c. lower income but higher assets.

b. higher income but lower assets.

d. lower income and assets.

33. How will a favorable volume variance affect net income under each of the following

methods?

Page 8

Absorption

a. reduce

b. reduce

c. increase

d. increase

Variable

no effect

increase

no effect

reduce

ITEMS 34 TO 36 ARE BASED ON THE FOLLOWING:

The following information is available for X Co. for its first year of operations:

Sales in units

5,000

Production in units

8,000

Manufacturing costs:

Direct labor

P3 per unit

Direct material

5 per unit

Variable overhead

1 per unit

Fixed overhead

P100,000

Net income (absorption method)

P30,000

Sales price per unit

P40

34. What would X Co. have reported as its income before income taxes if it had used variable

costing?

a. P30,000 ->100,000/8,000=12.5

c. P67,500

b. (P7,500) 12.5x(8,000-5,000)

d. can’t be determined from the given

37,500 higher Abs.

35. What was the total amount of SG&A expense incurred by X Co.?

a. P30,000

c. P6,000

b. P62,500 ->(7,500)-55,000

d. can’t be determined from the given

40-3-5-1=31x5,000=155,000

information

155,000-100,000=55,000

36. Based on variable costing, what would X Co. show as the value of its ending inventory?

a. P120,000

c. P27,000 ->3+5+1=9x3,000

b. P 64,500

d. P24,000

37. Which of the following is an advantage of using variable costing?

a. Variable costing complies with Generally Accepted Accounting Principles.

b. Variable costing complies with the National Internal Revenue Code.

c. Variable costing is most relevant to long-run pricing strategies.

d. Variable costing makes cost-volume-profit relationships more easily

apparent.

38. In its first year of operations, Nasty Company had the following costs when it produced

100,000 units and sold 80,000 units of its only product:

Manufacturing costs:

Fixed

P180,000

Variable

160,000

Selling and administrative costs:

Fixed

90,000

Variable

40,000

How much higher would Nasty’s net income be if it used full absorption costing instead of

variable costing?

a. P94,000

c. P36,000 ->180,000/100,000=1.8

b. P68,000

d. P54,000

1.8 x (100,000-80,000)

=36,000

DIFFERENTIAL COSTS ANALYSIS

39. Siomitos makes bite-size siomai. Which of the following could be a constraint at Siomitos?

a. The siomai steamer

b. The workers who mix the ingredients

c. The workers who prepare the siomai for steaming

d. Any of the above could be the constraint

Page 9

40. Ning Company has only 25,000 hours of machine time each month to manufacture its two

products. Product X has a contribution margin of P50, and Product Y has a contribution

margin of P64. Product X requires 5 hours of machine time, and Product Y requires 8 hours

of machine time. If Ning Company wants to dedicate 80 percent of its machine time to the

product that will provide the most income, the company will have a total contribution

margin of

a. P250,000.

c. P210,000.

b. P240,000. ->20,000x10 + 5,000x8 d. P200,000.

41. Mangit Company is currently operating at a loss of P15,000. The sales manager has

received a special order for 5,000 units of product, which normally sells for P35 per unit.

Costs associated with the product are: direct material, P6; direct labor, P10; variable

overhead, P3; applied fixed overhead, P4; and variable selling expenses, P2. The special

order would allow the use of a slightly lower grade of direct material, thereby lowering the

price per unit by P1.50 and selling expenses would be decreased by P1. If Mangit wants this

special order to increase the total net income for the firm to P10,000, what sales

price must be quoted for each of the 5,000 units?

a. P23.50 ->25,000/5,000=5

c. P27.50

b. P24.50

5+6+10+3+2-1.5-1=23.5 d. P34.00

42. Dolly Company has 3 divisions: R, S, and T. Division R's income statement shows the

following for the year ended December 31:

Sales

P1,000,000

Cost of goods sold

(800,000)

Gross profit

P 200,000

Selling expenses

P100,000

Administrative expenses

250,000

(350,000)

Net loss

P (150,000)

Cost of goods sold is 75 percent variable and 25 percent fixed. Of the fixed costs, 60

percent are avoidable if the division is closed. All of the selling expenses relate to the

division and would be eliminated if Division R were eliminated. Of the administrative

expenses, 90 percent are applied from corporate costs. If Division R were eliminated, Dolly’s

income would >800,000x25%=200,000x60%

+100,000+(250,000x10%)=245,000 AFC

1,000,0000 – (800-000x75%) =400,000-245,000=155,000

a. increase by P150,000.

c.

decrease by P155,000.

b. decrease by P 75,000.

d.

decrease by P215,000.

43. The opportunity cost of making a component part in a factory with excess capacity for

which there is no alternative use is

a. the total manufacturing cost of the component.

b. the total variable cost of the component.

c. the fixed manufacturing cost of the component.

d. zero.

ITEMS 44 TO 47 ARE BASED ON THE FOLLOWING:

Schundel Hair Care Company produces shampoo with conditioner. This is the company’s

only product, which it sells under the name “Shamcon.”

The manufacturing cost data for Shamcon are as follows:

Quantity required

Current market price

Materials:

per 1,000-ml bottle

per ml

Chem 1

4 ml

P0.54

Chem 2

3 ml

0.36

Chem 3

2 ml

0.20

Direct labor: 2 hours per bottle @ P3 per hour

Page 10

Factory overhead:

Variable overhead

Fixed overhead

–

–

P2.00 per direct labor hour

4.00 per direct labor hour

Clever Company, owner and operator of a chain of hotels, asked Schundel Hair Care Company

to submit a bid for 500 boxes of Shamcon. Each box will contain 24 bottles. Per Clever’s

specifications, its order should be different in chemical composition from the regular Shamcon.

According to Schundel Company’s production manager, Clever’s specifications can be met if an

additional chemical, Chem 4 would be used. Schundel Company has 60,000 ml of this

chemical. Chem 4 was used by the company in one of its brands that it decided to eliminate.

The remaining inventory of Chem 4 was not sold or discarded because it does not deteriorate

and the company has adequate space for its storage. Schundel Company can sell Chem 4 at

the prevailing market price of P0.40 per ml less P0.10/ml selling and handling costs. Clever’s

order would require 5 ml of Chem 4 per bottle.

The company has a stock of Chem 5. This was used by Schundel Hair Care for its manufacture

of another product that is no longer being produced. Chem. 5, which cannot be used in

Shamcon, can be substituted for Chem 1 on a one-for-one basis without affecting the quality of

the Clever order. There is no problem about the supply of Chem 1. At present, the company

has 20,000 ml of Chem 5 in its inventory, which has a salvage value of P6,000.

The production of the Clever’s order would require the same direct labor hours per bottle as in

the regular Shamcon. However, at present, the company has only 20,000 direct labor hours

available. The Clever order can be produced if the workers would work overtime, although an

overtime premium of 30% of the regular rate should be paid.

Schundel Hair Care Company’s policy is to price new products at 130% of full manufacturing

cost.

44. If Schundel Company bids this month for the special one-time order of 500 boxes of the

product, the special order’s total direct materials cost will be

a. P73,944.

c. P68,880.

b. P61,680.

d. P56,880.

C1 12,000x4=48,000-20,000(C5)=28,000x0.54

C2 12,000x3=36,000x0.36

C3 12,000x2=24,000x0.20

C4 12,000x5=60,000x(0.40-0.10)

C5 20,0000 ->>>cost 6,000

45. If Schundel Hair Care Company bids this month for the special one-time order of 500 boxes

of the product, the special order’s total relevant conversion cost will be

a. P123,600. ->20,000x3 +4,000x3x1.3

c. P120,000.

b. P219,600.

+12,000x2x2

d. P216,000.

46. If the company’s policy is to price new products at 130% of full manufacturing cost,

what is the bid price per unit for this one-time special order of Clever Company?

a. P19.55

c. P29.95 ->56,880+123,600+

b. P 6.91

d. P23.80

(12,000x2x4)=276,480

276,480x1.3=359,424/12,000

=29.95

47. What will be the total variable manufacturing costs for the subsequent, recurring 500-box

orders?

a. P180,480

c. P287,280

b. P373,464

d. P191,280

C1 12,000x4=48,000x0.54

CC 123,600 -> no.45

C2 12,000x3=36,000x0.36

C3 12,000x2=24,000x0.20

C4 12,000x5=60,000x0.40

Total =191,280

DM

67,680

Page 11

ITEMS 48 and 49 ARE BASED ON THE FOLLOWING INFORMATION:

Jane Corporation produces wood glue that is used by furniture manufacturers. The

company normally produces and sells 10,000 gallons of the glue each month. White Glue is

sold for P280 per gallon, variable costs is P168 per gallon, fixed factory overhead cost totals

P460,000 per month, and the fixed selling costs totals P620,000 per month.

Labor strikes in the furniture manufacturers that buy the bulk of White Glue have caused

the monthly sales of Jane Corporation to temporarily decrease to only 15% of its normal

monthly volume. Jane Corporation’s management expects that the strikes will last for

about 2 months, after which, sales of White Glue should return to normal. However, due

to the dramatic drop in the sales level, Jane Corporation’s management is considering to

close down its plant during the two-moth period that the strikes are on.

If Jane Corporation will temporarily shut down its operations, it is expected that the fixed

factory overhead costs can be reduced to P340,000 per month and that the fixed selling

costs can be reduced by P62,000 per month. Start-up costs at the end of the shut-down

period would total P56,000. Jane Corporation uses the JIT system, so no inventories are

on hand.

48. The shut down point in units is

a. 2,750.00. ->308,000/112

b. 9,642.86.

c. 3,250.00.

d. 1,100.00.

49. At the sales level of only 30% of the normal volume, should the company continue

operating or shut down temporarily for two months?

a. Continue, because the expected sales is above the shutdown point.

b. Shut down, because the expected sales is above the shutdown point.

c. Continue, so that the shutdown costs may be avoided.

d. Shut down, because the shutdown costs is less than the contribution margin under

continued operations.

50. The process of choosing among competing alternatives is called

a. controlling

c. decision making

b. planning

d. performance evaluation

51. Spikey Company produces two products: Pat and Chin. The projected income for the

coming year, segmented by product line, follow:

Pat

Chin

Total

Sales

Less variable expenses

Contribution margin

Less direct fixed expenses

Product margin

Less common fixed cost

Operating income

P300,000

100,000

P200,000

28,000

P172,000

P2,500,000

500,000

P2,000,000

1,500,000

P 500,000

P2,800,000

600,000

P2,200,000

1,528,000

P 672,000

100,000

P 572,000

The selling prices are P30 for Pat and P50 for Chin.

Spikey company can increase the sales of Pat with increased advertising. The extra

advertising would cost an additional P245,000, and some of the potential purchasers of Chin

would switch to Pat. In total, sales of Pat would increase by 25,000 units, and sales of Chin

would decrease by 5,000 units. This strategy would

a. increase Spikey’s total sales by P750,000.

b. decrease Spikey’s total contribution margin by P300,000.

c. increase Spikey’s total income by P55,000.

d. not affect Spikey’s total fixed costs.

Page 12

PAT

CHIN

Cont. margin

P200,000 P2,000,000

÷ units (P300k ÷ P30) 10,000

50,000

CM per unit

P

20 P

40

X change in units

25,000

(5,000)

Change in CM

P500,000 (P200,000)

Increase in CM (P500k – P200K)P300,000

Less incremental fixed cost

245,000

Increase in profit

P 55,000

CAPITAL BUDGETING

ITEMS 52 AND 53 ARE BASED ON THE FOLLOWING

Ricky Ironworks is considering a proposal to sell an existing lathe and purchase a new

computer-operated lathe. Information on the existing lathe and the computer-operated

lathe follow:

Computer-operated

Existing Lathe

Lathe

Cost

P100,000

P300,000

Accumulated depreciation

60,000

0

Salvage value now

20,000

Salvage value in 4 years

0

60,000

Annual depreciation

10,000

75,000

Annual cash operating costs

200,000

50,000

Remaining useful life

4 years

4 years

52. What is the payback period for the computer-operated lathe?

a. 1.87 years

c. 3.53 years

b. 2.00 years

d. 3.29 years

Acquisition cost, new lathe

P300,000

Less salvage value of old lathe

20,000

Net cost of investment

P280,000

÷ savings in cash operating costs (P50,000 – P200,000) 150,000

Payback period

1.87 years

53. If the company uses 10 percent as its discount rate, what is the net present value of the

proposed new lathe purchase? (Round present value factors to four decimal places)

a. P236,465

c. P195,485

b. P256,465

d. P30,422

Present value of cost savings (P150,000 x 3.1699)

Present value of salvage value (P60,000 x 0.6830)

Total PV of cash inflows

Less net cost of investment

Net present value

P475,485

40,980

P516,465

280,000

P236,465

54. RPI Corporation bought a piece of machinery. Selected data is presented below:

Useful life

Yearly net cash inflow

Salvage value

Internal rate of return

Cost of capital

6 years

P45,000 x 3.4976

-018% PVF 3.4976

14%

The initial cost of the machinery was (round present value factor to four decimal places)

Page 13

a. P157,392.

b. P174,992.

c. P165,812.

d. impossible to determine from the information given.

55. All other factors equal, a large number is preferred to a smaller number for all capital

project evaluation measures except

a. net present value.

c. internal rate of return.

b. payback period.

d. profitability index.

56. Tanya Corporation issued preferred stocks for P120 per share. The issue price is P20 more

than the stock’s par value. The company incurred underwriting fees of P10 per share. The

stocks will earn annual dividends of P12 per share. If the tax rate is 30%, the cost of

capital (preferred stocks) is

a. 10%

c. 7.42%

b. 12%

d. 10.91% ->12/120-10

57.

At the beginning of the year, Djorn Corporation purchased a new equipment for P360,000. The

machine has an estimated useful life of four (4) years with no salvage value. It is expected to produce

cash flows from operations, net of income taxes of 32%, as follows:

Year 1

2

3

4

5

P128,000

112,000

144,000

96,000

80,000

Djorn Corporation uses the sum-of-the-years-digits method (SYD) in computing depreciation of its

depreciable assets. Using SYD, the new equipment will be depreciated as follows:

Year 1

2

3

4

(P360,000 x 4/10)

(P360,000 x 3/10)

(P360,000 x 2/10)

(P360,000 x 1/10)

P144,000

108,000

72,000

36,000

The company’s cost of capital is 10%. The present value factors at 10% are as follows:

End of Year 1

2

3

4

Total, 4 years

0.909

0.826

0.751

0.683

3.170

If Djorn Corporation used the straight-line method of depreciation instead of the SYD method, the net

present value provided by the equipment would increase (decrease) by:

a. P13,464

c. (P4,308.48)

b. (P13,464)

d. P4,308.48

Depreciation expense, as a tax shield, provides tax savings. The difference in the present values of

the tax savings under the two depreciation methods will represent the difference in the net

present values of the equipment.

Year 1

P144,000 x 32% =

P46,080

0.909

P41,886.72

2

108,000 x 32% =

34,560

0.826

28,546.56

3

72,000 x 32% =

23,040

0.751

17,303.04

4

36,000 x 32% =

11,520

0.683

7,868.16

Total present value of tax savings, SYD method

PV of tax savings, straight-line method

(P360,000 ÷ 4 years = P90,000 x 32% x 3.170)

Decrease in net present value

P95,604.48

91,296.00

P 4,308.48

58. Harry owns a computer reselling business and is expanding his business. Harry is presented

with one proposal, Proposal P1, such that the estimated investment for the expansion

project is P85,000 and it is expected to produce cash flows after taxes of P25,000 for each

of the next 6 years. An alternate proposal, Proposal P2, involves an investment of P32,000

Page 14

and after-tax cash flows of P10,000 for each of the next 6 years. The present value factors

for an annuity of P1 for 1 to 6 years are as follows:

n

10%

12%

14%

16%

18%

20%

1

0.909

0.893

0.877

0.862

0.847

0.833

2

1.736

1.690

1.647

1.605

1.566

1.528

3

2.487

2.402

2.322

2.246

2.174

2.106

4

3.170

3.037

2.914

2.798

2.690

2.589

5

3.791

3.605

3.433

3.274

3.127

2.991

6

4.355

4.111

3.889

3.685

3.498

3.326

The cost of capital that would make Harry indifferent between these two proposals lies between

a.

10% and 12%

c. 16% and 18%

b.

14% and 16%

d. 18% and 20%

Indifference point is when the NPVs of the two proposals are equal.

Let x =present value factor for a cost of capital for 6 years

85,000 – 25,000x =32,000 – 10,000x

x=

3.533, which is between 16% and 18%

59. Harold Co. is considering an investment in a capital project. The sole outlay will be

P716,417.90 at the outset of the project and the annual net after-tax cash inflow will be

P216,309.75 for 6 years. The present value factors at Harold’s 8% cost of capital are:

Year

PV Factors

1

0.926

2

0.857

3

0.794

4

0.735

5

0.681

6

0.630

What is the break-even time (BET)?

a. 3.31 years

c. 5.00 years

b. 4.00 years

d. 6.00 years

Break-even time: the cumulative present value of cash inflows equals the cost of investment

Cash Inflows

x

PVF

=

PV

1

216,309.75

0.926

P200,302.83

2

216,309.75

0.857

185,377.46

3

216,309.75

0.794

171,749.94

4

216,309.75

0.735

158,987.67

5

216,309.75

0.681

147,306.94

Total PV of cash inflows, first 4 years = P716,417.90

Break even time = 4 years

60.The investment banking firm of M and Associates will use a dividend valuation model to

appraise the shares of the L&L Corporation. Dividends (D) at the end of the current

year will be P1.20. The growth rate (g) is 9% and the discount rate (K) is 13%.

What should be the price of the stock to the

public?

a. P28.75

c. P30.00

b. P31.50

Price =

d. P29.00

D

1.20

=

K–G

13 – 9

= P30

61. BSR Co, has an opportunity to purchase a new conveyor line for P250,000. They can

borrow P200,000, paying P50,000 down with annual payments for five years and an interest

of 15%. They also have an opportunity to lease the line for P65,000 a year. The present

Page 15

value of an annuity of P1 for five years at 9% and 15% are 3.8897 and 3.3522,

respectively. At the end of five years, the estimated salvage value is P40,000. If owned,

the cost of maintenance is expected to be P10,000 per year. Assume straight-line

depreciation, a 40% tax rate, a cost of debt of 15%, and a cost of capital of 9%. What

is

the present value of the after-tax cost of leasing for the five-year period?

a. P151,698

c. P144,000

b. P 98,698

d. P165,800

Annual lease expense, net of tax (P65,000 x 60%)

x PVF, 9%, 5 years

Present value of the after-tax cost of leasing

- END -

P 39,000

3.8897

P151,698