Finance Assignment: Annuities, Future Value, Investment Returns

advertisement

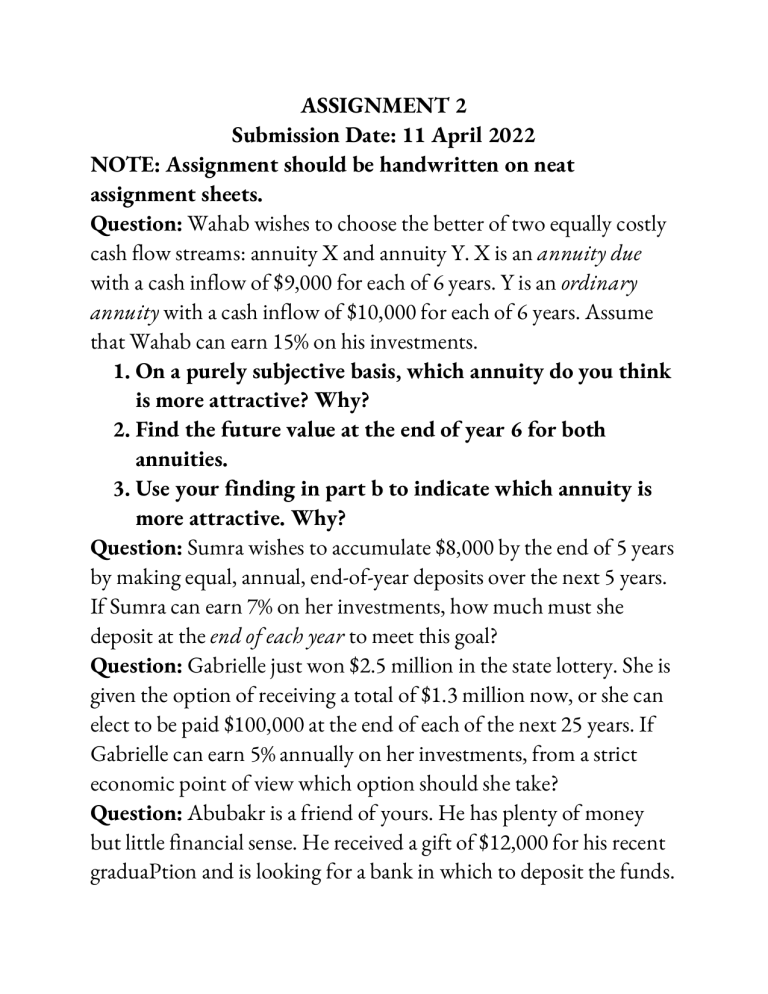

ASSIGNMENT 2 Submission Date: 11 April 2022 NOTE: Assignment should be handwritten on neat assignment sheets. Question: Wahab wishes to choose the better of two equally costly cash flow streams: annuity X and annuity Y. X is an annuity due with a cash inflow of $9,000 for each of 6 years. Y is an ordinary annuity with a cash inflow of $10,000 for each of 6 years. Assume that Wahab can earn 15% on his investments. 1. On a purely subjective basis, which annuity do you think is more attractive? Why? 2. Find the future value at the end of year 6 for both annuities. 3. Use your finding in part b to indicate which annuity is more attractive. Why? Question: Sumra wishes to accumulate $8,000 by the end of 5 years by making equal, annual, end-of-year deposits over the next 5 years. If Sumra can earn 7% on her investments, how much must she deposit at the end of each year to meet this goal? Question: Gabrielle just won $2.5 million in the state lottery. She is given the option of receiving a total of $1.3 million now, or she can elect to be paid $100,000 at the end of each of the next 25 years. If Gabrielle can earn 5% annually on her investments, from a strict economic point of view which option should she take? Question: Abubakr is a friend of yours. He has plenty of money but little financial sense. He received a gift of $12,000 for his recent graduaPtion and is looking for a bank in which to deposit the funds. HBL Savings Bank offers an account with an annual interest rate of 3% compounded semiannually, while MCB offers an account with a 2.75% annual interest rate compounded continuously. Calculate the value of the two accounts at the end of one year, and recommend to Abubakr which account he should choose. Question: JIMMY and JULIE have just had their first child. If college is expected to cost $150,000 per year in 18 years, how much should the couple begin depositing annually at the end of each year to accumulate enough funds to pay the first year’s tuition at the beginning of the 19th year? Assume that they can earn a 6% annual rate of return on their investment. Question: As part of your financial planning, you wish to purchase a new car exactly 5 years from today. The car you wish to purchase costs $14,000 today, and your research indicates that its price will increase by 2% to 4% per year over the next 5 years. 1. Estimate the price of the car at the end of 5 years if inflation is (1) 2% per year and (2) 4% per year. 2. How much more expensive will the car be if the rate of inflation is 4% rather than 2%? 3. Estimate the price of the car if inflation is 2% for the next 2 years and 4% for 3 years after that. Question: AYRA needs to have $15,000 at the end of 5 years to fulfill her goal of purchasing a small sailboat. She is willing to invest a lump sum today and leave the money untouched for 5 years until it grows to $15,000, but she wonders what sort of investment return she will need to earn to reach her goal. Use your calculator to figure out the approximate annually compounded rate of return needed in each of these cases: 1. Misty can invest $10,200 today. 2. Misty can invest $8,150 today. 3. Misty can invest $7,150 today. Question: SHAHRUKH has been offered an investment that will pay him $500 three years from today. 1. If his opportunity cost is 7% compounded annually, what value should he place on this opportunity today? 2. What is the most he should pay to purchase this payment today? 3. If SHAHRUKH can purchase this investment for less than the amount calculated in part a, what does that imply about the rate of return that he will earn on the investment? Question: An Iowa state savings bond can be converted to $100 at maturity 6 years from purchase. If the state bonds are to be competitive with U.S. savings bonds, which pay 8% annual interest (compounded annually), at what price must the state sell its bonds? Assume no cash payments on savings bonds prior to redemption. Question: You put $10,000 in an account earning 5%. After 3 years, you make another deposit into the same account. Four years later (that is, 7 years after your original $10,000 deposit), the account balance is $20,000. What was the amount of the deposit at the end of year 3? Question: An insurance agent is trying to sell you an immediate retirement annuity, which for a single amount paid today will provide you with $12,000 at the end of each year for the next 25 years. You currently earn 9% on low-risk investments comparable to the retirement annuity. Ignoring taxes, what is the most you would pay for this annuity? Question: Assume that you just won the state lottery. Your prize can be taken either in the form of $40,000 at the end of each of the next 25 years (that is, $1,000,000 over 25 years) or as a single amount of $500,000 paid immediately. 1. If you expect to be able to earn 5% annually on your investments over the next 25 years, ignoring taxes and other considerations, which alternative should you take? Why? 2. Would your decision in part a change if you could earn 7% rather than 5% on your investments over the next 25 years? Why? Question: Using annual, semiannual, and quarterly com- pounding periods for each of the following, (1) calculate the future value if $5,000 is deposited initially, and (2) determine the effective annual rate (EAR). 1. At 12% annual interest for 5 years. 2. At 16% annual interest for 6 years. 3. At 20% annual interest for 10 years. Question: Sara wishes to determine the future value at the end of 2 years of a $15,000 deposit made today into an account paying a nominal annual rate of 12%. 1. Find the future value of Sara deposit, assuming that interest is compounded (1) annually, (2) quarterly, (3) monthly, and (4) continuously. 2. Compare your findings in part a, and use them to demonstrate the relationship between compounding frequency and future value. 3. What is the maximum future value obtainable given the $15,000 deposit, the?2-year time period, and the 12% nominal annual rate? Use your findings in part A to explain. Question: A retirement home at Deer Trail Estates now costs $185,000. Inflation is expected to cause this price to increase at 6% per year over the 20 years before C. L. Donovan retires. How large an equal, annual, end-of- year deposit must be made each year into an account paying an annual interest rate of 10% for Donovan to have the cash needed to purchase a home at retirement?