Financial Statement Analysis & Time Value of Money

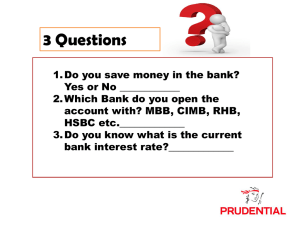

advertisement

STUDENT NAME : CASSANDRA RABAI AK GORDON LUTA (56-2079-013) THERESA MARIA AK ALBERT BANGAU (56-2074-013) ELYSHA EJJAH AK MAXSON GALAU (56-2073-013) NATRA CARLISSA BINTI ABDILLAH (56-2088-014) NAME OF LECTURER : MR. KOBE COURSE : DIPLOMA IN BUSINESS ADMINISTRATION SUBMISSION DATE : 28TH OCTOBER 2019 1 Table of Contents Contents Pages 1.0 Question 1, The Energy Company’s 2017 and 2018 financial statements follow, along with some industry average ratios. A) Assess Energy Company’s liquidity position, and determine how it 9 – 10 compares with peers and how the liquidity position has changed over time. B) Assess Energy Company’s asset management position, and 11 determine how it compares with peers and how its asset management efficiency has changed over time. C) Assess Energy Company’s debt management position, and 12 determine how it compares with peers and how its debt management has changed over time. D) Assess Energy Company’s profitability ratios, and determine how 13 – 14 they compare with peers and how its profitability positions has changed over time. E) What do you think would happen to its ratios if the company 15 initiated cost-cutting measures that allowed it to hold lower levels of inventory and substantially decreased the cost of goods sold? No calculations are necessary, Think about which ratios would be affected by changes in these two accounts. 2.0 Question 2 a) Assuming a rate of 10% annually, find the future value of 16 RM1,000 after 5 years. b) Find the present value RM1,000 due in 5 years if the discount rate 16 is 10%. c) What is the rate of return on a security that costs RM1,000 and 16 returns RM2,000 after 5 years? 2 d) Suppose Malaysia’s population is 36.5 million people and its 17 population is expected to grow by 2% annually. How long will it take for the population to double? e) Find the present value of an ordinary annuity that pays RM1,000 17 each of the next 5 years if the interest rate is 15%? f) Find the future value of an ordinary annuity that pays RM1,000 each 17 of the next 5 years if the interest rate is 15%? g) How will the present value and future value of the annuity in part 18 (f) and (g) change if it is an annuity due? h) What will the future value and the present value be for RM1,000 18 due in 5 years if the interest rate is 10%, semi-annual compounding? i) What will annual payments be for an ordinary annuity for 10 years 19 with a present value of RM1,000 if the interest rate is 8%? j) What will the annual payments be for an annuity due for 10 years 19 with a present value of RM1,000 if the interest rate is 8%? k) Find the present value and the future value of an investment that 20 pays 8% annually and makes the following end-of-year payments: l) Five banks offer nominal rates of 6% on deposits, but A pays interest annually, B pays semi-annually, C pays quarterly, D pays monthly, and E pays daily. i) What effective annual rate does each bank pay? 20 – 21 ii) If you deposit RM5,000 in each bank today, how much will 21 – 22 you have in each bank at the end of 1 year? iii) If you deposit RM5,000 in each bank today, how much will 22 – 23 you have in each bank at the end of 2 year? iv) If all of the banks are insured by the government (the PIDM) 23 – 24 and thus are equally risky, will they be equally able to attract funds? If not (and the TVM is the only consideration), what nominal rate will cause all the banks to provide the same effective annual rate as Bank A? 3 v) Suppose you don’t have the RM5,000 but need it at the end 24 – 26 of 1 year. You plan to make a series of deposits – annually for A, semi-annually for B, quarterly for C, monthly for D, and daily for E – with payments beginning today. How large must the payments be to each bank? m) Suppose you borrow RM15,000. The loan’s annual interest rate is 27 – 30 8%, and it requires four equal end-of-year payments. Set up an amortization schedule that shows the annual payments, interest payments, principal repayments, and beginning and ending loan balances. 4 1.0 Question 1, The Energy Company’s 2017 and 2018 financial statements follow, along with some industry average ratios. • YEAR 2017 Current Ratio Current Assets 1,206,000 = = 2.11 times Current Liabilities 571,500 Inventory Turnover Cost of Goods Sold 2,980,000 = = 3.67 times Inventory 813,000 Days Sales Outstanding Account Receivable 328,000 = = 32.9 days Sales 3,635,000 ( ) ( ) 365 days 365 days Fixed Assets Turnover Sales 3,635,000 = = 9.00 times Net Fixed Assets 404,000 Total Assets Turnover Sales 3,635,000 = = 2.18 times Total Assets 1,667,000 Return on Assets Net Income 95,970 = = 0.0576 ≈ 5.76% Total Assets 1,667,000 Return on Equity Net Income 95,970 = = 0.1669 ≈ 16.69% Common Equity 575,000 5 Profit Margin Net Profit 95,970 = = 0.0264 ≈ 2.64% Sales 3,635,000 Debt Ratio Total Debt 1,092,000 = = 0.6550 ≈ 65.50% Total Assets 1,667,000 6 • YEAR 2018 Current Ratio Current Assets 1,405,000 = = 2.33 times Current Liabilities 602,000 Inventory Turnover Cost of Goods Sold 3,680,000 = = 4.21 times Inventory 894,000 Days Sales Outstanding Account Receivable 439,000 = = 37.79 days 4,240,000 Sales ( ) ( ) 365 days 365 days Fixed Assets Turnover Sales 4,240,000 = = 11.46 times Net Fixed Assets 370,000 Total Assets Turnover Sales 4,240,000 = = 2.31 times Total Assets 1,836,000 Return on Assets Net Income 18,408 = = 0.0498 ≈ 4.98% Total Assets 370,000 Return on Equity Net Income 18,408 = = 0.0320 ≈ 3.20% Common Equity 575,000 7 Profit Margin Net Profit 18,408 = = 0.00434 ≈ 0.43% Sales 4,240,000 Debt Ratio Total Debt 1,261,000 = = 0.6868 ≈ 68.68% Total Assets 1,836,000 The Energy Company’s Financial Ratio Analysis (2017 and 2018) Financial Ratios The Energy The Energy Industry Indicator Company’s Company’s Financial Ratio (Good/Poor) 2017 2018 2018 Current Ratio 2.11 times 2.33 times 2.70 times Poor Inventory Turnover 3.67 times 4.12 times 7.0 times Poor Days Sales 32.9 days 37.7 days 32.0 days Poor 9.00 times 11.46 times 13.0 times Poor 2.18 times 2.31 times 2.6 times Poor Return on Assets 5.76% 4.98% 9.1% Poor Return on Equity 16.69% 3.20% 18.2% Poor Profit Margin 2.64% 0.43% 3.5% Poor 68.68% 50.0% Poor Outstanding Fixed Assets Turnover Total Assets Turnover Debt-to-capital-ratio 65.5% 8 Question 1 (A): Based on The Energy Company’s liquidity position, the difference of them between its peers and how the liquidity position has changed over time is by through its current ratio, difference between The Energy Company’s current ratio, it is 2.33 times and its peers is by 2.70 times. Through this, it shows that their indicator for The Energy Company’s current ratio is poor. However, in the year 2017, the company managed increased their current ratio in 2018, which was 2.11 times in 2017 and increased to 2.33 times in 2018. Through The Energy Company’s inventory turnover, the difference of them between its peers is that the company’s inventory turnover is 4.12 times while its peers rate is at a 7.0 times. This is indicating that The Energy Company’s has a poor inventory turnover than the Industry Financial Ratio. However, in year 2017, The Energy Company has managed to increase its inventory turnover in year 2018 which was from 3.67 times to 4.12 times. Even though among its peers, they are doing poorly but have managed to increase and be better in their own company inventory turnover. Days sales outstanding is also in one of The Energy Company’s liquidity position. The difference of the company’s days sales outstanding between its peers is that it has a higher days sales outstanding than its peers. The Energy Company manages to have 37.7 days outstanding rather than its peers who has 32.0 days. This indicates that The Energy Company’s days sales outstanding is poor from its peers. The changes however in The Energy Company’s itself on their days sales outstanding in year 2017 was 32.9 days which was much better than in 2018 because they have increased their days to 37.7 days. There are a few ways on how The Energy Company can improve their liquidity position to become better. One of the ways they can do to improve it is by reducing overhead. Overhead refers to all non-labor expenses required to operate the business. These expenses are either fixed expenses or variable expenses. By reducing overhead, objectively evaluating regular expenses such as rent, utilities and insurance may provide opportunities to cut costs. For example, a regular analysis of insurance needs is a smart practice to employ. Situations can change, assets also changes and thus coverage needs changing too. Contracting multiple types of insurance, such as vehicle, liability and business insurance, through one provider often makes the policyholder eligible for discounts. 9 Be cost effective about travel, and consider whether you could rent instead of buying equipment to reduce the overhead. Secondly, The Energy Company can improve their liquidity position by selling unneeded assets. Whether the asset is land, machinery, equipment, vehicles or office machines, any surplus assets that the company doesn’t need to represent potential cash. Selling unneeded assets can increase liquidity as soon as the transaction takes place. That extra cash can then be used to reduce current liabilities such as short-term debt obligations or property tax bills, for example, improve solvency. But, The Energy Company has to give careful thought to which assets they sell off. Lastly, one of the ways The Energy Company can improve their liquidity position is handling their accounts management well. Both accounts receivable and accounts payable impact liquidity. To increase liquidity, the company should consistently review accounts receivable to make sure customers receive and pay bills on time. Delays in sending bills, particularly in businesses without a fixed billing schedule, can severely inhibit cash flow and damage liquidity. In terms of accounts payable, vendors sometimes offer a longer payment plan or installments when dealing with a business. By lowering total payments due or spreading out the payments with longer intervals between bill, the business can improve its liquidity. 10 Question 1 (B): Based on Energy Company’s asset management position, the peers generates 13.0 times more fixed asset compare to Energy Company. Compare to the Energy Company, they only generates 11.6 times lesser. Which states at the indicator is poor. This means that the Energy Company utilizes their fixed assets less efficiently than does its peers. Also, the Energy Company’s asset management position based on year 2017 and 2018 is very different. The difference is that during 2017, the firm generates 9.00 times while on 2018 the firm generates as high as 11.46 times more than the last year. This shows that the fixed asset turnover for the company is increasing within a year. Next in the asset management, comparing Energy Company and the peers, the peers generates cash 2.6 times more than the Energy Company. The Energy Company only generates 2.31 times that year. Which states at the indicator that the Energy Company did poorly on their asset turnover. This shows that the Energy Company utilizes assets less efficiently than their peers. As for the company’s evaluation based on the year 2017, the company generates 2.18 times. While on the year 2018, the firm generates 2.31 times which is slightly higher than the last year. In this term the company did a great job in increasing their asset turnover in a yearly basis. As for the return on asset, the Energy Company ratio is 4.98% in other words, during the year they produced $4.98 of net income. Compare to the peers, they produced 9.1% of asset which is more than what the Energy Company can produce. Hence, the poor results at the indicator table. In the year 2017, the Energy Company produced 5.76% which is $5.76 of net income. Then it drops by 4.98% on the year 2018. This means that the Energy Company manage their return on assets very poorly over the year. There are many ways for the Energy Company to improve their ways of managing their assets. One of the ways they can use is they should Identify key performance indicators to highlight strengths and improvement opportunities and to measure performance and progress over time. Defining a manageable number of key performance indicators can be a critical first step toward addressing the daunting challenge of measuring progress in asset management. Basic measures to track include percentage of devices lost or stolen, and effort spent per week in investigation of unknown devices. 11 Question 1 (C): Based on Energy Company’s debt management position, the difference between it and its peers, also how its debt management has changed over time is by its debt-to-capital ratio. In year 2017, Energy Company’s peer’s debt-to-capital ratio is 65.5% and it increases to 68.68% in the year 2018. Compared its peers, their debt-to-capital ratio is 50%. This means that the Energy Company’s debt-to-capital ratio is poor. By Energy Company’s Return on Equity, the difference between it and its peers is very far by comparison. In year 2017, Energy Company’s peers return on equity is 16.69% and it decreases to 3.20% in the year 2018. Compared its peers, their return on equity is 18.2%. This means that the Energy Company’s return on equity ratio is poor. The owners of Energy Company are receiving a return on their investment that is very bad when compared to its peers. The peers company’s ratio is far more profitable in its operations than the Energy Company. It is expected that the Energy Company would have less return on common equity. There are a few ways on how the Energy Company can improve their debt management. From their Debt-to-capital ratio, it can be reduced by increasing sales revenues to generate profits. This can be achieved by raising prices, increasing sales, or reducing costs and then it can be used to pay off existing debt. Also, to restructure the debt. If a company is paying relatively high interest rates on its loans, and current interest rates are significantly lower, the company can seek to refinance its existing debt. This will reduce both interest expenses and monthly payments and its cash flow. To improve the Return on Equity ratio, Energy Company should balance revenue growth with cost management by controlling the costs. To maintain the cost means growth of revenue or cost cutting. For example, lessen the workforce is in order to do cost cutting, though you must ensure that the loss of these positions does not reduce any revenue contributions or reducing utility expenses is another savings strategy. Also, to Improve asset turnover by calculating it and dividing sales by the company's total assets. The more sales a company produces relative to its assets, the more profitable it should be, and the higher return on equity it should earn. 12 Question 1 (D): Based on The Energy Company’s profitability ratios, which is their profit margin, the difference between them and its peers is that The Energy Company profit margin is only 0.43% whereas its peers has a 3.5% profit margin which is 3.07 higher than The Energy Company. This has indicated that The Energy Company is doing very poorly in the profit margin. However, the profitability position has changed very drastically over time. In the year 2017, The Energy Company’s profit margin was 2.64% and in the year 2018, it has dropped to 0.43% which is a difference in 2.21%. Profit margin is a ratio analysis method used by accountants and financial analysts to gauge the profitability of a business by comparing to previous records or other businesses within the same industry. The figures used are taken from an income statement and primarily involve sales as basis of computation. Profit margin show how much profit is earned from every dollar worth of sales. Dividing net profit or net loss by sales will result in a net profit margin. A net loss will result in a negative profit margin. A few possible reasons as to why The Energy Company has decreased their profit margin in 2018 could possibly be because of low revenues. Any decrease in revenue will result in a decrease in profits. Once a company’s sales decrease below the total amount spent for expenses and cost of goods sold in a given period, a net loss will occur. Poor pricing strategies, ineffective marketing programs, competition, inability to keep up with market changes and inefficient marketing personnel are common causes of decreasing revenues. To reverse the negative margin, management must implement ways to increase market share and revenues. The next possible reason to why The Energy Company profit margin dropped because of their cost of goods. High production or purchase costs of merchandise intended for sale can lead to inadequate funds to cover expenses. Cost of goods sold is directly deducted from sales. Whatever amount is left after the deduction will be used to pay for business expenses and generate profit. When cost of goods sold increases to the point that there are not enough funds left to support all expenses for the period, a net loss will occur. The higher the cost of goods sold, the lower the net profit margin becomes. 13 In order for The Energy Company to improve their profitability ratio, especially in their profit margin, The Energy Company can improve it by improving their sales. Increasing sales is of paramount importance when it comes to improving profit margin. How a company goes about increasing sales depends on its business model. For instance, a retailer can raise the price of its merchandise, focusing on items that sells the most. If the company increases the price of an item from RM10 to RM12 and sells 10,000 units, sales increase by Rm20,000. A retailer can also focus its attention on selling higher-priced items, while reducing low margin products in its store. The Energy Company can also focus on lowering costs or providing incentives to increase demand thereby boosting sales. Secondly, what The Energy Company can do to increase their profit margin is by handling their gross profit margin better. Before getting to profit margin, a company should look at its gross margin, which essentially is the amount of money it makes per each items sold. Gross margin is a function of sales calculated as sales minus cost of goods sold by sales. Cost of goods sold refers to the direct costs associated with the production of goods sold by the company and usually the largest cost component on the income statement. Therefore, managing your company’s cost of goods sold is another way to improve profit margin. Some companies manage cost of goods sold by finding cheap sources of raw material or negotiating the cost of production. Lastly, the company, The Energy Company can increase their profit margin is by managing their expenses. During the course of doing business, a company will incur numerous operating expenses and deducts these from the money it takes in to arrive at net income. Operating expenses include salaries, rent, utilities, depreciation, and other expenses necessary to run the business. High expenses receives a lot of attention from business owners and is another way to improve profit margin. Every company approaches the issue of managing operating expenses differently. Cutting back on work hours is a common practice or downsizing staff. The ultimate goal is to make the organization as lean as possible without sacrificing productivity and performance. 14 Question 1 (E): If the Energy Company initiated cost cutting measures, it would improve the profit margin ratio. Profit margin is one of the commonly used profitability ratios to gauge the degree to which a company or a business activity makes money. It represents what percentage of sales has turned into profits. It will also increase its net income. Not to mention it will also improve return on assets. Return on assets is a financial ratio that tells how much profit a company can generate from its assets. In general, the higher the return on assets, the better the company is doing because higher return on assets indicate a company is more effectively using its assets to generate profits. In other words, they’re earning more money on less investment. If the Energy Company also reduce its level of inventory, it will improve its current ratio. The current ratio is a liquidity ratio that measures a company's ability to pay short-term obligations or those due within one year. It tells investors and analysts how a company can maximize the current assets on its balance sheet to satisfy its current debt and other payables. This is because the higher the current ratio, the more capable a company is of paying its obligations because it has a larger proportion of short-term asset value relative to the value of its short-term liabilities. This will also reduce the company’s liabilities as well. This will also result as improving Energy Company’s Inventory Turnover. Inventory Turnover is a ratio showing how many times a company has sold and replaced inventory during a given period. A company can then divide the days in the period by the inventory turnover formula to calculate the days it takes to sell the inventory on hand. The higher inventory turnover ratio, the more profitable the company will be. By reducing costs and lowering inventory would also improve debt ratio where it means a financial ratio that indicates the percentage of a company's assets that are provided via debt. It is the ratio of total debt and total assets. Lastly, this will affect Return on Equity (ROE) which means to measure of the profitability of a business in relation to the equity which also known as net assets or assets minus liabilities. It improves the ROE in a way where Energy Company can finance themselves with debt and equity capital by increasing the amount of debt capital relative to its equity capital, a company can increase its return on equity. Also, increasing profits relative to equity increases a company's return on equity. Increasing profits does not necessarily have to come from selling more product. It can 15 also come from increasing prices of each product sold, lowering the cost of goods sold, reducing its overhead expenses, or a combination of each. QUESTION 2 a) Assuming a rate of 10% annually, find the future value of RM1,000 after 5 years. FV = PV(1 + r)n FV = RM1,000(1 + 0.10)5 = RM1,610.51 b) Find the present value RM1,000 due in 5 years if the discount rate is 10%. FV = RM1,000 n = 5 years i = 10% PV = FV (1 + r)n PV = RM1,000 (1 + 0.10)5 c) What is the rate of return on a security that costs RM1,000 and returns RM2,000 after 5 years? PV = RM1,000 FV = RM2,000 1 FV [n] i = [[ ] ] − 1 PV 1 RM2,000 [5] i = [[ ] ]−1 RM1,000 = 1.1487 − 1 = 0.1487 ≈ 14.87% 16 d) Suppose Malaysia’s population is 36.5 million people and its population is expected to grow by 2% annually. How long will it take for the population to double? PV = RM36,500,000 FV for double population = 36.5 million × 2 = 73,000,000 i = 2% n = 1 years FV Time will be taken = [ log [PV] i log [1 + n] [ ] RM73,000,000 ] log RM36,500,000 Time will be taken = [ ] 0.02 log [1 + n1 ] log(2) = log(1.02) = 0.3010 = 35 years 0.0006 e) Find the present value of an ordinary annuity that pays RM1,000 each of the next 5 years if the interest rate is 15%? 1 1−[ ] (1 + i)n CF × [ ] i 1 1−[ ] (1 + 0.15)5 RM1,000 × [ ] = RM3,352.16 0.15 f) Find the future value of an ordinary annuity that pays RM1,000 each of the next 5 years if the interest rate is 15%? [1 + i]n − 1 CF × [ ] i [1 + 0.15]5 − 1 RM1,000 × [ ] 0.15 = 6742.38 17 g) How will the present value and future value of the annuity in part (f) and (g) change if it is an annuity due? CF/FV ordinary annuity = RM1,000 i = 15% n = 5 years [1 + i]n − 1 FV annuity due = CF × [ ] [1 + i] i [1 + 0.15]5 − 1 RM1,000 × [ ] [1 + 0.15] 0.15 = RM1,000 × 6.74238 × 1.15 = RM7,753.74 h) What will the future value and the present value be for RM1,000 due in 5 years if the interest rate is 10%, semi-annual compounding? FV/PV = RM1,000 i = 10% n = 5 years Present Value Future Value FV i (1 + m)n×m RM1,000 PV = 0.10 (1 + 2 )5×2 RM1,000 = = RM613.91 (1.05)10 FV = PV(1 + m)n×m PV = i FV = RM1,000(1 + 0.10 5×2 ) 2 = RM1,000 × (1.05)10 = RM1,628.89 18 i) What will annual payments be for an ordinary annuity for 10 years with a present value of RM1,000 if the interest rate is 8%? PV ordinary annuity = RM1,000 i = 8% n = 10 years Annual payments for an ordinary annuity for 10 years =[ (i ×PV ordinary annuity) =[ = ] 1−(1+i)−n (0.08 × RM1,000) ] 1 − (1 + 0.08)−10 80 0.5368 = RM149.00 j) What will the annual payments be for an annuity due for 10 years with a present value of RM1,000 if the interest rate is 8%? PV ordinary annuity = RM1,000 i = 8% n = 10 years Annual payments for an ordinary annuity for 10 years =[ [ (i ×PV annuity due) 1−(1+i)−n ×(1+i) ] (0.08 × RM1,000) ] 1 − (1 + 0.08)−10 × (1 + 0.08) = 80 0.5798 = RM137.99 19 k) Find the present value and the future value of an investment that pays 8% annually and makes the following end-of-year payments: 0 1 2 3 100 200 400 100 Year 1, Cash flow RM100, (1+0.08)1 = RM92.59 200 Year 2, Cash flow RM200, (1+0.08)1 = RM171.47 400 Year 3, Cash flow RM400, (1+0.08)1 = RM317.53 Total = RM581.59 l) Five banks offer nominal rates of 6% on deposits, but A pays interest annually, B pays semi-annually, C pays quarterly, D pays monthly, and E pays daily. i) What effective annual rate does each bank pay? 𝑘 Effective Annual Rate (EAR) = (1 + 𝑚)𝑚 − 1 Nominal Rate = 6% → Bank A, m = 1 (annually) EAR = (1 + 0.06 1 ) 𝑚 − 1 = 6% → Bank B, m = 2 (semi-annually) EAR = (1 + 0.06 2 ) 2 − 1 = 6.09% → Bank C, m = 4 (quarterly) EAR = (1 + 0.06 4 ) 4 − 1 = 6.136% → Bank D, m = 1 (monthly) EAR = (1 + 0.06 12 ) 12 − 1 = 6.168% 20 → Bank E, m = 365 (daily) 0.06 EAR = (1 + 365 )365 − 1 = 6.183% Bank Annual Rate Bank A 6% Bank B 6.09% Bank C 6.136% Bank D 6.168% Bank E 6.183% Each banks have the same nominal rate which is 6% but they have different number of compounding cycle. For Bank A, its number of compounding cycle is 1 which makes its Effective Annual Rate to be 6%. . For Bank B, its number of compounding cycle is 2 which makes its Effective Annual Rate to be 6.09%. For Bank C, its number of compounding cycle is 4 which makes its Effective Annual Rate to be 6.136%. For Bank D, its number of compounding cycle is 12 which makes its Effective Annual Rate to be 6.168%. Lastly, for Bank E, its number of compounding cycle is 365 which makes its Effective Annual Rate to be 6.183%. ii) If you deposit RM5,000 in each bank today, how much will you have in each bank at the end of 1 year? Future Value, FV = PV (1 + i)n → Bank A, i = 6%, n = 1 FV = RM5,000 (1 + 0.06)1 = RM 5,300.00 → Bank B, i = 6.09%, n = 1 FV = RM5,000 (1 + 0.0609)1 = RM 5,304.50 → Bank C, i = 6.136%, n = 1 FV = RM5,000 (1 + 0.06136)1 = RM 5,306.80 → Bank D, i = 6.168%, n = 1 FV = RM5,000 (1 + 0.06168)1 = RM 5,308.40 21 → Bank E, i = 6.183%, n = 1 FV = RM5,000 (1 + 0.06183)1 = RM 5,309.15 Bank Future Value Bank A RM 5300.00 Bank B RM 5304.50 Bank C RM 5306.80 Bank D RM 5308.40 Bank E RM 5309.15 Each of the bank has different future value since each interest for each bank is different but they have the same amount for their years which is only 1 years. Bank A has an interest of 6% which makes its future value to be RM 5,300.00. Bank B has an interest of 6.09% which makes its future value to be RM 5,304.50. Bank C has an interest of 6.136% which makes its future value to be RM 5,306.80. Bank D has an interest of 6.168% which makes its future value to be RM 5,306.80. And lastly, Bank E has an interest of 6.183% which makes its future value to be RM 5,309.15 iii) If you deposit RM5,000 in each bank today, how much will you have in each bank at the end of 2 year? Future Value, FV = PV (1 + i)n → Bank A, i = 6%, n = 2 FV = RM5,000 (1 + 0.06)2 = RM 5,618.00 → Bank B, i = 6.09%, n = 2 FV = RM5,000 (1 + 0.0609)2 = RM 5,627.54 → Bank C, i = 6.136%, n = 2 FV = RM5,000 (1 + 0.06136)2 = RM 5,632.43 → Bank D, i = 6.168%, n = 2 FV = RM5,000 (1 + 0.06168)2 = RM 5,635.82 22 → Bank E, i = 6.183%, n = 2 FV = RM5,000 (1 + 0.06183)2 = RM 5,637.41 Bank Future Value Bank A RM5,618.00 Bank B RM5,627.54 Bank C RM5,632.43 Bank D RM5,635.82 Bank E RM5,637.41 Each of the bank has different future value since each interest for each bank is different but they have the same amount for their years which is only 2 years. Bank A has an interest of 6% which makes its future value to be RM5,618.00. Bank B has an interest of 6.09% which makes its future value to be RM5,627.54. Bank C has an interest of 6.136% which makes its future value to be RM5,632.43. Bank D has an interest of 6.168% which makes its future value to be RM5,635.82. And lastly, Bank E has an interest of 6.183% which makes its future value to be RM5,637.41. iv) If all of the banks are insured by the government (the PIDM) and thus are equally risky, will they be equally able to attract funds? If not (and the TVM is the only consideration), what nominal rate will cause all the banks to provide the same effective annual rate as Bank A? Nominal rate = i m , m = number of compounding cycle → Bank B, i = 6%, m = 2 (semi-annually) Nominal rate = 6 = 3% 2 → Bank C, i = 6%, m = 4 (quarterly) Nominal rate = 6 = 1.5% 4 → Bank D, i = 6%, m = 12 (monthly) 23 Nominal rate = 6 = 0.5% 12 → Bank E, i = 6%, m = 365 (daily) Nominal rate = 6 = 0.0164% 365 Bank Nominal Rate Bank B 3% Bank C 1.5% Bank D 0.5% Bank E 0.0164% These four banks have different values of number of compounding cycle but the same value of interest which is 6%. Bank B number of compounding cycle is 2 which makes its nominal rate to be 3%. Bank C number of compounding cycle is 4 which makes its nominal rate to be 1.5%. Bank D number of compounding cycle is 12 which makes its nominal rate to be 0.5%. Lastly, Bank E number of compounding cycle is 365 which makes its nominal rate to be 0.0164%. v) Suppose you don’t have the RM5,000 but need it at the end of 1 year. You plan to make a series of deposits – annually for A, semi-annually for B, quarterly for C, monthly for D, and daily for E – with payments beginning today. How large must the payments be to each bank? → Bank A n = 1 (annually) i = 6% ≈ 0.06 FV annuity due = CF [ (1+i)n −1 i ] [1 + i] (1 + 0.06)1 − 1 RM5,000 = CF [ ] [1 + 0.06] 0.06 RM5,000 = CF × 1 × 1.06 CF = RM5,000 = RM4,716.98 1.06 24 → Bank B n = 2 (semi-annually) i= 6% = 3% ≈ 0.03 2 FV annuity due = CF [ (1+i)n −1 i ] [1 + i] (1 + 0.03)2 − 1 RM5,000 = CF [ ] [1 + 0.03] 0.03 RM5,000 = CF × 2.03 × 1.03 CF = RM5,000 = RM2,391.32 2.0909 → Bank C n = 4 (quarterly) i= 6% = 1.5% ≈ 0.015 4 FV annuity due = CF [ (1+i)n −1 i ] [1 + i] (1 + 0.015)4 − 1 RM5,000 = CF [ ] [1 + 0.015] 0.015 RM5,000 = CF × 4.09 × 1.015 CF = RM5,000 = RM1,204.82 4.15 → Bank D n = 12 (monthly) i= 6% = 0.5% ≈ 0.005 12 FV annuity due = CF [ (1+i)n −1 i ] [1 + i] (1 + 0.005)12 − 1 RM5,000 = CF [ ] [1 + 0.005] 0.005 RM5,000 = CF × 12.33 × 1.005 CF = RM5,000 = RM403.55 12.39 25 → Bank E n = 365 (daily) i= 6% = 0.016% ≈ 0.00016 365 FV annuity due = CF [ (1+i)n −1 i ] [1 + i] (1 + 0.00016)365 − 1 RM5,000 = CF [ ] [1 + 0.00016] 0.00016 RM5,000 = CF × 375.84 × 1.00016 CF = RM5,000 = RM13.30 375.90 For Bank A, since it is annually, and the interest for Bank A is 6%, the amount of payment they have to make is around RM 4,716.98. For Bank B, it is semi-annually, and the interest for Bank B is 3%, the amount of payment they have to make is around RM 2,391.32. For Bank C, it is quarterly, and the interest for Bank C is 1.5%, the amount of payment they have to make is around RM 1,204.82. For Bank D, it is monthly, and the interest for Bank D is 0.5%, the amount of payment they have to make is around RM 403.55. Lastly, for Bank E, it is daily, and the interest for Bank E is 0.016%, the amount of payment they have to make is around RM 13.30. 26 m) Suppose you borrow RM15,000. The loan’s annual interest rate is 8%, and it requires four equal end-of-year payments. Set up an amortization schedule that shows the annual payments, interest payments, principal repayments, and beginning and ending loan balances. Year 1 PV = RM15,000 n = 4 years i = 8% m=1 1−[ Present Value annually = CF × [ RM15,000 = CF × [ RM15,000 = CF × [ CF = 1−[ 1 ] (1+0.08)4 0.08 1 ] (1+i)n i ] ] 1−0.73502 0.08 ] RM15,000 3.312125 CF = RM4,528.81 Interest payments i FV = PV × (1 + m)n×m FV = RM15,000 × (1 + 0.08 1×1 ) 1 FV = RM16,200 – RM15,000 FV = RM1,200 Beginning of year 1 balance (Annuity payment – Interest) = [RM15,000 – (RM4,528.81 – RM1,200)] = RM15,000 – RM3,328.81 =RM1,1671.19 End of Year 2 payment = RM1,1671.19 27 Year 2 PV = RM15,000 n = 4 years i = 8% m=1 1−[ Present Value annually = CF × [ RM15,000 = CF × [ RM15,000 = CF × [ CF = 1−[ 1 ] (1+0.08)4 0.08 1 ] (1+i)n i ] ] 1−0.73502 0.08 ] RM15,000 3.312125 CF = RM4,528.81 Interest payments i FV = PV × (1 + m)n×m FV = RM1,1671.19× (1 + 0.08 1×1 ) 1 FV = RM12,604.89 – RM1,1671.19 FV = RM933.70 Beginning of year 1 balance (Annuity payment – Interest) = [RM1,1671.19 – (RM4,528.81 – RM933.70)] = RM1,1671.19 – RM3,595.12 = RM8,076.07 End of Year 3 payment = RM8,076.07 Year 3 PV = RM15,000 n = 4 years i = 8% m=1 28 1−[ Present Value annually = CF × [ RM15,000 = CF × [ RM15,000 = CF × [ CF = 1−[ 1 ] (1+0.08)4 0.08 1 ] (1+i)n i ] ] 1−0.73502 0.08 ] RM15,000 3.312125 CF = RM4,528.81 Interest payments i FV = PV × (1 + m)n×m FV = RM8,076.07× (1 + 0.08 1×1 ) 1 FV = RM8,722.16 – RM8,076.07 FV = RM646.09 Beginning of year 1 balance (Annuity payment – Interest) = [RM8,076.07 – (RM4,528.81 – RM646.09)] = RM8,076.07 – RM3,882.72 = RM4,193.35 End of Year 4 payment = RM4,193.35 Year 4 PV = RM15,000 n = 4 years i = 8% m=1 29 1−[ Present Value annually = CF × [ RM15,000 = CF × [ RM15,000 = CF × [ CF = 1−[ 1 ] (1+0.08)4 0.08 1 ] (1+i)n i ] ] 1−0.73502 ] 0.08 RM15,000 3.312125 CF = RM4,528.81 Interest payments i FV = PV × (1 + m)n×m FV = RM4,193.35× (1 + 0.08 1×1 ) 1 FV = RM4,528.818 – RM4,193.35 FV = RM335.47 Beginning of year 1 balance (Annuity payment – Interest) = [RM4,193.35– (RM4,528.81 – RM335.47)] = RM4,193.35– RM4,193.34 = RM0.00 Amortization Table Year Beginning Balance Annual Interest Principal Ending Loan Payment Payment Payment Balance 1 RM15,000.00 RM4,528.81 RM1,200.00 RM3,328.81 RM11,671.19 2 RM11,671.19 RM4,528.81 RM933.70 RM3,595.12 RM8,076.07 3 RM8,076.07 RM4,528.81 RM646.09 RM3,882.73 RM4,193.34 4 RM4,193.34 RM4,528.81 RM335.47 RM4,193.34 RM0.00 30