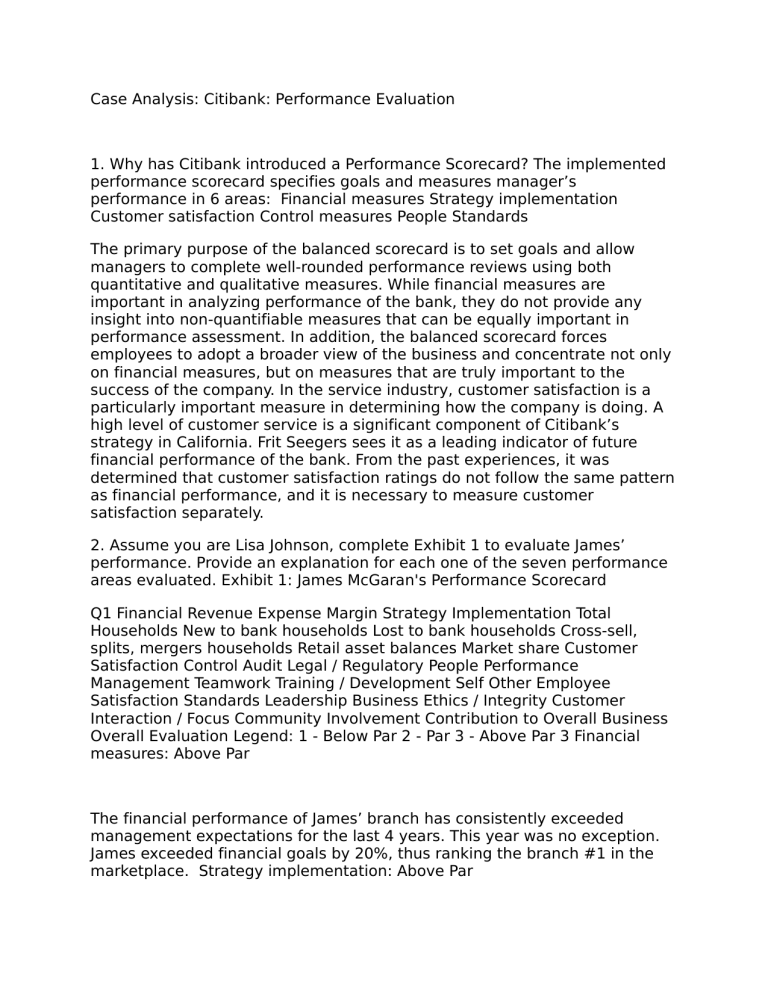

Case Analysis: Citibank: Performance Evaluation 1. Why has Citibank introduced a Performance Scorecard? The implemented performance scorecard specifies goals and measures manager’s performance in 6 areas: Financial measures Strategy implementation Customer satisfaction Control measures People Standards The primary purpose of the balanced scorecard is to set goals and allow managers to complete well-rounded performance reviews using both quantitative and qualitative measures. While financial measures are important in analyzing performance of the bank, they do not provide any insight into non-quantifiable measures that can be equally important in performance assessment. In addition, the balanced scorecard forces employees to adopt a broader view of the business and concentrate not only on financial measures, but on measures that are truly important to the success of the company. In the service industry, customer satisfaction is a particularly important measure in determining how the company is doing. A high level of customer service is a significant component of Citibank’s strategy in California. Frit Seegers sees it as a leading indicator of future financial performance of the bank. From the past experiences, it was determined that customer satisfaction ratings do not follow the same pattern as financial performance, and it is necessary to measure customer satisfaction separately. 2. Assume you are Lisa Johnson, complete Exhibit 1 to evaluate James’ performance. Provide an explanation for each one of the seven performance areas evaluated. Exhibit 1: James McGaran's Performance Scorecard Q1 Financial Revenue Expense Margin Strategy Implementation Total Households New to bank households Lost to bank households Cross-sell, splits, mergers households Retail asset balances Market share Customer Satisfaction Control Audit Legal / Regulatory People Performance Management Teamwork Training / Development Self Other Employee Satisfaction Standards Leadership Business Ethics / Integrity Customer Interaction / Focus Community Involvement Contribution to Overall Business Overall Evaluation Legend: 1 - Below Par 2 - Par 3 - Above Par 3 Financial measures: Above Par The financial performance of James’ branch has consistently exceeded management expectations for the last 4 years. This year was no exception. James exceeded financial goals by 20%, thus ranking the branch #1 in the marketplace. Strategy implementation: Above Par This is the rating James received in quarters 2, 3 and 4. The branch met or exceeded its growth goals in the business, professional and retail segments. (The scorecard does not indicate the goals for this measure, which makes analysis less dependable as we have to rely on comments only.) Control measures: Par This measure was assessed only in 3 quarters, and in all 3 quarters the branch scored above par. Even though James works hard on making sure his branch operates in compliance, there is still some room for improvement in this area, and James can implement several measures to lower the operating and fraud losses sustained by his branch. People: Above Par James is an excellent people manager. His performance is consistent in this area and always exceeds expectations. Standards: Above Par James is a well respected leader that has high standards for himself and people he employs. He continually works on improving himself and his employees. He is involved in the community and encourages the same from his employees. Customer Satisfaction: Below Par This is a measure that can potentially cause the most controversy as James is concerned with the survey that is used to asses customer satisfaction. In two quarters, James scored below par on customer satisfaction. However, he identified the improvement opportunities and substantially improved service scores by the end of the year. Overall Evaluation: Above Par We understand that according to current policy James can not get an above par overall rating due to a below par score on the customer satisfaction measure. However, we will disregard the policy in this case due to several reasons: This is the first year the balanced scorecard was implemented. It will take some time to insure that all the areas are measured appropriately. James’ concerns about adequacy of the survey used to measure customer satisfaction might be valid. Management should review the survey and get some input from the branch managers on what indicators should be used to measure customer satisfaction. The current review process raises some concerns as well. Presently, a branch manager’s supervisor subjectively assesses performance in the non-quantifiable areas. The process can be improved by allowing the manager to self-asses his own performance and discuss it with his superior. This will allow the process to be less subjective. The manager will get an opportunity to defend his performance if he does not agree with the assessment of his superior. If we give James an overall rating of par, disregarding his hard work, it will lower the morale of one of our most successful managers and will possibly result in lower performance in the future, jeopardizing the performance of the #1 branch in the marketplace. Management has a valid concern that if James receives an above par score on his evaluation, employees might think that management disregards nonfinancial measures during the evaluation. However, it is easier to reiterate the importance of non-financial measures than to negate the effects of low morale in James’ branch. Management should communicate the importance of qualitative measures in the balanced scorecard and the fact that it will be taken into full consideration during the performance review after management makes sure the survey is well suited to measure a customer satisfaction. 3. How would you communicate the decision to James? James should be aware that his concerns with the customer survey and consistently exceptional performance were the main reason for management’s decision to give him an overall above par rating. He should also be told that in the future he will not get an above par rating if he fails to score par on all the measures. James should be aware that management will not disregard nonquantifiable measures in the future as steps are being taken to insure that they are measured appropriately. 4. What do you think James will do after receiving the communication? If James is aware of all the things mentioned in the answer to the previous questions, he will continue to consistently exceed the expectations of his superiors. Since James will see from his performance evaluation that management values his efforts, he will continue to work as hard or even harder than before to ensure that his branch remains #1 in the marketplace. 5. Would you roll-out this performance scorecard to other regions at Citibank? The balanced scorecard should not be rolled-out to other regions at Citibank without some revisions. James has already raised some concerns about the adequacy of the survey that measures customer satisfaction. His main concern is that the survey measures not only branch services but also centralized services such as ATMs that are out of the control of a branch manager. The survey can be revised in order to better meet the performance evaluation needs. It is possible that several surveys will need to be developed in order to better assess the different branches based on different types of customers served by them. This will result in increased costs but will allow for closer gauging of the performance of the bank and setting more defined performance goals for the branches. The concerns about the current review process were also raised above. The manager should be given an opportunity to asses his own performance on non-quantifiable measures in order to make the performance review less subjective. In addition, the discussion of the manager’s performance with his superior will ensure that the manager is satisfied with his performance evaluation and will result in increased employee morale.