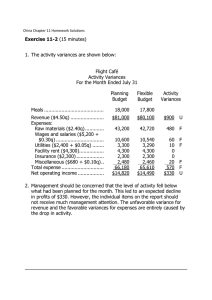

Taha Wael Qandeel Cost Accounting II Chapter 1 Flexible Budgets, Direct-Cost Variances, and Management Control Variance: difference between actual results and expected (budgeted/planned) performance. Uses of Variances: Variances assist managers in implementing their strategies by enabling management by exception. * Management by exception: the practice of focusing attention on areas not operating as expected (budgeted). Enable managers to focus their efforts on the most critical areas and also used in performance evaluation and to motivate managers. Managers take corrective actions to ensure that decisions are implemented correctly and that previously budgeted results are attained. Level 1 Static Budgets and Static-Budget Variances (Between Static budget and Actual result) A static budget: is based on the level of output planned at the start of the budget period The static-budget variance: is the difference between the actual result and the corresponding budgeted amount in the static budget. NOTES: Favorable variances has the effect of operating income (Positively). ليس شرط ان يكون موجب Unfavorable variances has the effect of operating income (Negatively).ليس شرط ان يكون سالب Revenue/Profit Cost operating income operating income vice versa vice versa 1 Taha Wael Qandeel Cost Accounting II Level 2 Flexible Budgets 1. (Flexible budget variances) (Between Flexible budget and Actual result) 2. (Sales volume variances) (Between Flexible budget and Static budget) The only difference between the static budget and the flexible budget is that the static budget is prepared for the planned output planned at the begging of the period, whereas the flexible budget is based on the actual output at the end. If we have to assess the performance of the manager, we prefer the flexible budget. 1- Sales-Volume Variances The sales-volume variance is the difference between the static budget for the number of units expected to be sold and the flexible budget for the number of units that were actually sold. The original method Contribution margin 2- Flexible budget variances 2 Taha Wael Qandeel Cost Accounting II a) Selling price variance: The flexible-budget variance for revenues is called the selling-price variance because it arises solely from the difference between the actual selling price and the budgeted selling price 3 Taha Wael Qandeel Cost Accounting II Level 3 Price Variances and Efficiency Variances for Direct-Cost Inputs This level helps managers to better understand past performance and take corrective actions to implement superior strategies in the future. To calculate price and efficiency variances , the company needs to obtain budgeted input prices and budgeted input quantities Three main sources for this information are past data, data from similar companies, and standards A standard is a carefully determined price, cost, or quantity that is used as a benchmark for judging performance. Standards are usually expressed on a per-unit basis. A standard input is a carefully determined quantity of input—such as square yards of cloth or direct manufacturing labor-hours—required for one unit of output, such as a jacket A standard price is a carefully determined price that a company expects to pay for a unit of input A standard cost is a carefully determined cost of a unit of output A price variance is the difference between actual price and budgeted price, multiplied by actual input quantity, such as direct materials purchased or used. An efficiency variance is the difference between actual input quantity used—such as square yards of cloth of direct materials—and budgeted input quantity allowed for actual output, multiplied by budgeted price 4 Taha Wael Qandeel Cost Accounting II Journal Entries Using Standard Costs Favorable variances are credits; unfavorable variances are debits 5