Managerial Accounting Chapter 42

advertisement

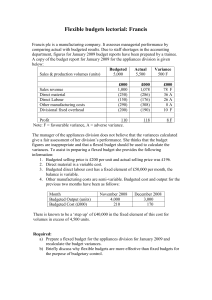

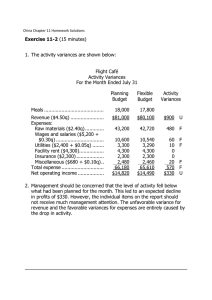

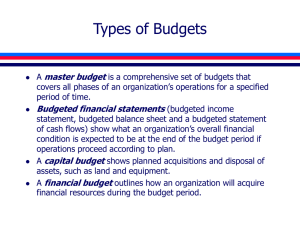

Chapter 42 Managerial Accounting Budgetary Control Prepared by Diane Tanner University of North Florida Budgetary Control Managers are responsible for controlling revenues and expenses Budgeted amounts are often called ‘benchmarks’ Against which actual results are compared Any difference between actual activity and budgeted amounts is called a budget variance Variances are reported on performance reports 2 2 Why Budget Variances Exist Variances have three causes Budget may have errors in creation Conditions may have changed Job performance – may have very good or very poor managers 3 3 Investigating Variances Management by exception approach Only ‘exceptional’ variances are investigated I.e., must be material in amount If the dollar amount is large enough to impact someone's decision then it should be considered significant Determining how much is ‘material’ A designated amount or percentage of expected cost Such as All variances exceeding $800 All variances that exceed budgeted cost by more than 10% A materiality threshold is established and any amount greater is investigated 4 Static and Flexible Budgets Not adjusted for actual level of production Prepared for a single level of activity Prepared at the beginning of the period Based on the initial estimated budget level 5 Budget that can be adjusted to various activity levels Prepared for the level of activity actually achieved Prepared at the end of the period Eliminates the problem caused by comparing actual costs at one activity level to budgeted costs for a different level When comparing actual activity to budgeted activity, both activity levels must be the same. 5 Static Budget The initial budget prepared at the estimated level of activity Prepared for a single level of activity Difficult to compare actual costs at a different activity level to a static budget Why? Total variable costs change at different levels of activity, while amounts on a static budget are for one level of activity All budgets in the master budget are static budget, and flexible budgets can be created for each of them. 6 The Problem with Static Budgets 7 Suppose the following report contains the variable costs for West Division for May: Static Budget 1,000 units Actual Cost 900 units Variance $80,000 $78,000 $2,000 The amount allowed at 1,000 units. Per unit = $80,000/1,000 = $80 per unit Favorable The division should have been allowed $80 times 900 units, totaling $72,000. Flexible budget variance = $78,000$72,000 = $6,000 unfavorable Flexible Budgets A budget that adjusts for changes in activity such as sales volume Performance evaluation should always use a flexible budget comparison to actual results Common flexible budgets for performance evaluation Income statement Selected costs within the income statement Production costs Selling costs Various general and administration costs Costs of specific activities, such as maintenance or purchasing 8 The End