17157795, Gulati - Assignment 2

advertisement

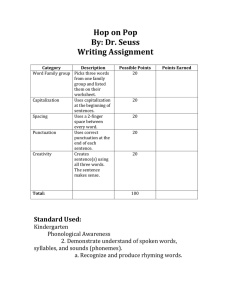

127.245 Introduction to Property Finance & Investment ASSESSMENT 2, CASE ANALYSIS YATIN GULATI, 17155795 YATIN GULATI, 17155795 This report has been conducted to undertake an NPV analysis of the property my company has been researching as a potential investment purchase, it will provide information on the possibilities the investment provides under a 10-year holding period involving the possible amortization, NOI (net operating income), the NPV (net profit value) and the IRR (internal rate of return) whilst also considering factors such as interest rates, vacancies & depreciation rates. Further analysis’s such as risk and sensitivity will also be looked into in-depth to narrow the potential, the investment proposes. To conclude the report, recommendations will be provided with justification to help give a clearer understanding as to why certain aspects will be better off as suggested. The property which has been professionally selected is Unit 18, 14 Airborne Road, Albany, on sale in the North Shore by Harcourts. The current asking price being stated at $530,000. The property offers a total floor area of 140m2, both floors providing significant rental returns, ground floor being $450.00 gross per week followed by the first level at $350.00 per week. The tenants are also required to pay share of electricity cost and their own phone and broadband costs. If the entire property is leased to one party, it will likely propose a rental agreement of $27,000. The estate is stratum in freehold which is beneficial but involves a body corporate of $2,190.62. The CV provided is dated to July 2014, at $420,000 which is involving the $100,000 Land value and the $320,000 improvement value. A risk analysis will help aid in identifying possible risks and factors which could in scenarios impact the investment significantly. The investment could possibly face risks due to factors that affect the performance of the financial market. Such as an alteration in the supply and demand for rental properties, which could be influenced by an excessive increase in development or a decline in demand due to depleting economy. Tenant risk also should be considered as the estate provides to sections for rent which increases the chances of an unwelcoming tenant but does also decrease the chances of 100% vacancy as chances are the leasable property will always remain at least 50% occupied. Sensitivity Analysis is quite vital to understand the large scope of possibilities the investment property can offer depending on the changes in certain factors such as the net operating income, the capitalization rate, and the possible vacancy during the 10year holding period. Assuming the property is purchased at $530,000, with at 30% deposit at the interest rate of 4.39% whilst sustaining 6.3% capitalization over the 10 years, taking consideration of vacancy at 4.17% and a rental increase of 5% the Net Profit Value should equate to $165,162.94 due to the 8% discount rate with the Internal Rate of Return at 17%. If the entire property were to be leased to one party, it would severely impact the Net Operating Income offered by the two separate floors, resulting in a huge decrease from $552,618.48 to $337,469.20 over the 10-year holding period. To determine the given selling price, the 10th year of the net operating income must be divided by the capitalization rate, which in this case was $800,960.48 due to the YATIN GULATI, 17155795 capitalization rate of 6.3%. This could also vary as a higher rate will result in a lower selling price, which could possibly be lower than the purchase price itself, defeating the intent of the investment properties, 10-year holding period. Any capitalization rate above 9.520851% will result in a loss of the investment as the selling price would be $530,000 and below. But if anything is offered below, it will help ensure in a positive investment. Researching major national banks, the most effective loan was proposed by BNZ, providing a term of 20 years with a 30% deposit and an interest rate of 4.39%. Which was quite competitive as other offered loans would average the interest rate around 4.5% to 5% depending on the purchase price of the property. For example, if we were to secure a loan from ASB at the same interest rate, we’d be required to make monthly payments of $3,322.00 in comparison to BNZ which is $2,325.00. This would reciprocate into progressively paying the loan balance as we aren’t allowed to decide our choice of deposit. Taking in to consideration of potential market risks and the sensitivity analysis the results which are graphed show the best potential outcome of the investment retaining a realistic and positive result. The most beneficial banks to pursue would be either BNZ or ANZ as the offer loans which are adjustable to the preference of the consumer which could aid in retaining a desirable out. The vacancies assumption is also set at 5 months as over the 10-year holding period it will be reasonable for both the ground floor and first floor to gradually be vacant, hopefully on separate occasions to ensure a consistent Net Operating Income. The rental increase could be beneficial to implement progressively as a straight-line incline will result in more vacancies. The capitalization rate and discount rate are likely to be set reasonably, as though the property does offer a larger potential, keeping a more realistic rate will show the more likely outcome. Through the results of the NPV analysis the potential investment shows quite a positive result, which could heavily influence the purchase of the estate, considering the property delivers a stable net operating income with several options of leasing, a low base OPEX which benefits in maintaining the property whilst owned, aiding in retaining the value and slowing the depreciation. Overall the purchase offers a greater return then the input during the holding period which will be a profitable investment for my company, under the circumstances that market risks, and tenants risks don’t occur, which is inevitable for a subtle influence during the investment. The company is likely to go through with investment though as it presents lower risks in comparison to the reward offered.