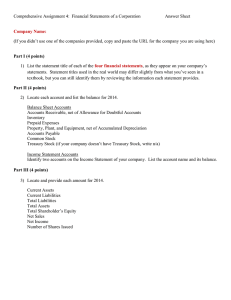

1. Given the profit loss (income statement) and balance sheet for Sam's Sandwich Delivery (Table 4-8), answer the following: a. Calculate the following ratios: current, quick, accounts receivable turnover, fixed asset turnover. b. Using the inventory figure on the balance sheet as average inventory, calculate the inventory turnover ratio. c. Calculate the debt-to-equity ratio, debt-to-total asset ratio, and operating profit margin ratio. d. Perform a vertical analysis of the income statement. e. Perform a vertical analysis of the balance sheet. f. Based on your analysis, would you consider investing in Sam's Sandwich Delivery? Table 4-8 Financial Statements for Sam's Sandwich Delivery Profit Loss (Income Statement) for Six Months Ending 06-30-2013 Revenues Retail Sales Wholesale Sales Total Revenues Cost of Sales Gross Profit Total Operating Expenses Operating Profit Other Income/Expenses Interest Income Interest Expense Depreciation-Store Equipment Total Other Income/Expenses Net Profit $ 68,283 104,417 $ 172,700 52,067 $ 120,633 111,117 $ 9,516 41 (651) (292) (902) $ 8,614 Balance Sheet as of 06-30-2013 Assets Current Assets Change Fund Cash in Bank-Checking Cash in Bank-Savings Accounts Receivable Inventories Total Current Assets Fixed Assets Furniture and Fixtures Less: Accum Depreciation Equipment Less: Accum Depreciation Transportation Equipment Less: Accum Depreciation Total Fixed Assets $ 569 8,612 9,622 6,843 2,607 $ 28,253 4,296 4,110 68,293 67,725 31,168 11,571 186 568 19,597 $ 20,351 Total Assets Current Liabilities Accounts Payable Trade Accrued Payroll Taxes Accrued Sales Taxes Total Current Liabilities Long-Term Liabilities Auto Loans Payable Total Long-Term Liabilities Total Liabilities Stockholder's Equity Common Stock Retained Earnings Net Profit/Loss Total Equity $ 48,604 6,208 3,464 987 $ 10,659 18,626 $ 18,626 $ 29,285 83,081 (72,376) 8,614 19,319