Making Capital Investment Decisions

(Part 2)

Today’s Topics

Alternative Definitions of OCF

Special Cases of DCF Analysis

Alternative Definitions of OCF

Alternative Definitions of OCF

• Assume an all-equity firm (no debt, no interest expense)

•

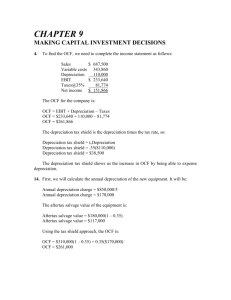

Tax shield benefit from interest expense deduction is reflected in the cost of debt

𝐸𝐸𝐸𝐸𝐸𝐸𝐸𝐸 = 𝑆𝑆𝑆𝑆𝑆𝑆𝑆𝑆𝑆𝑆 − 𝐶𝐶𝐶𝐶𝐶𝐶𝐶𝐶𝐶𝐶 − 𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷

𝑇𝑇𝑇𝑇𝑇𝑇 = 𝐸𝐸𝐸𝐸𝐸𝐸𝐸𝐸 × 𝑡𝑡𝐶𝐶

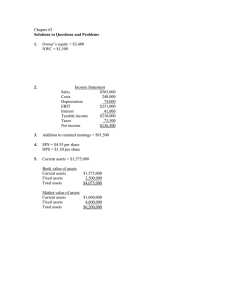

𝑂𝑂𝑂𝑂𝑂𝑂 = 𝐸𝐸𝐸𝐸𝐸𝐸𝐸𝐸 + 𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷 − 𝑇𝑇𝑇𝑇𝑇𝑇

Alternative Definitions of OCF Continued

• The Bottom-Up Approach

•

Start with net income that appears at the bottom line of income statement

𝑂𝑂𝑂𝑂𝑂𝑂 = 𝐸𝐸𝐸𝐸𝐸𝐸𝐸𝐸 + 𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷 − 𝑇𝑇𝑇𝑇𝑇𝑇

= (𝐸𝐸𝐸𝐸𝐸𝐸𝐸𝐸 − 𝑇𝑇𝑇𝑇𝑇𝑇) + 𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷

= 𝑁𝑁𝑁𝑁𝑁𝑁 𝐼𝐼𝐼𝐼𝐼𝐼𝐼𝐼𝐼𝐼𝐼𝐼 + 𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷

Alternative Definitions of OCF Continued

• The Top-Down Approach

•

Start from the top of the income statement (sales and costs)

𝑂𝑂𝑂𝑂𝑂𝑂 = 𝐸𝐸𝐸𝐸𝐸𝐸𝐸𝐸 + 𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷 − 𝑇𝑇𝑇𝑇𝑇𝑇

= 𝑆𝑆𝑆𝑆𝑆𝑆𝑆𝑆𝑆𝑆 − 𝐶𝐶𝐶𝐶𝐶𝐶𝐶𝐶𝐶𝐶 − 𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷 + 𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷 − 𝑇𝑇𝑇𝑇𝑇𝑇

= 𝑆𝑆𝑆𝑆𝑆𝑆𝑆𝑆𝑆𝑆 − 𝐶𝐶𝐶𝐶𝐶𝐶𝐶𝐶𝐶𝐶 − 𝑇𝑇𝑇𝑇𝑇𝑇

Alternative Definitions of OCF Continued

• The Tax Shield Approach

•

•

OCF has two components

(OCF in the absence of depreciation) + (tax shield benefit of depreciation)

𝑂𝑂𝑂𝑂𝑂𝑂 = 𝐸𝐸𝐸𝐸𝐸𝐸𝐸𝐸 + 𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷 − 𝑇𝑇𝑇𝑇𝑇𝑇

= 𝑆𝑆𝑆𝑆𝑆𝑆𝑆𝑆𝑆𝑆 − 𝐶𝐶𝐶𝐶𝐶𝐶𝐶𝐶𝐶𝐶 − 𝐷𝐷𝐷𝐷𝐷𝐷. + 𝐷𝐷𝐷𝐷𝐷𝐷. −(𝑆𝑆𝑆𝑆𝑆𝑆𝑆𝑆𝑆𝑆 − 𝐶𝐶𝐶𝐶𝐶𝐶𝐶𝐶𝐶𝐶 − 𝐷𝐷𝐷𝐷𝐷𝐷. ) × 𝑡𝑡𝐶𝐶

= 𝑆𝑆𝑆𝑆𝑆𝑆𝑆𝑆𝑆𝑆 − 𝐶𝐶𝐶𝐶𝐶𝐶𝐶𝐶𝐶𝐶 × 1 − 𝑡𝑡𝐶𝐶 + 𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷 × 𝑡𝑡𝐶𝐶

Depreciation Tax Shield

• Tax after depreciation

𝑇𝑇𝑇𝑇𝑇𝑇 = 𝑆𝑆𝑆𝑆𝑆𝑆𝑆𝑆𝑆𝑆 − 𝐶𝐶𝐶𝐶𝐶𝐶𝐶𝐶𝐶𝐶 − 𝐷𝐷𝐷𝐷𝐷𝐷. × 𝑡𝑡𝐶𝐶

• Tax without depreciation

𝑇𝑇𝑇𝑇𝑇𝑇 = 𝑆𝑆𝑆𝑆𝑆𝑆𝑆𝑆𝑆𝑆 − 𝐶𝐶𝐶𝐶𝐶𝐶𝐶𝐶 × 𝑡𝑡𝐶𝐶

• Tax shield benefit of depreciation

∆𝑇𝑇𝑇𝑇𝑇𝑇 = 𝐷𝐷𝐷𝐷𝐷𝐷. × 𝑡𝑡𝐶𝐶

Special Cases of DCF Analysis

Three Common Special Cases

• Setting the bid price

• Evaluating Equipment Options with Different Lives

• The General Decision to Replace

Setting the Bid Price

•

•

•

•

Imagine we are in the business of buying stripped-down truck platforms and then

modifying them to customer specifications for resale. A local distributor has

requested bids for five specially modified trucks each year for the next four years, for

a total of 20 trucks in all.

Suppose we can buy the truck platforms for $10,000 each. The facilities we need can

be leased for $24,000 per year. The labor and material cost to do the modification

works out to be about $4,000 per truck.

We will need to invest $60,000 in new equipment. This equipment will be

depreciated straight-line to a zero salvage value over the four years. It will be worth

about $5,000 at the end of that time. We will also need to invest $40,000 in raw

materials inventory and other working capital items. The relevant tax rate is 21

percent.

What price per truck should we bid if we require a 20 percent return on our

investment?

Setting the Bid Price continued

Year

(1) Operating cash flow

(2) NWC

(3) Change in NWC

(4) Capital spending

(5) Depreciation

(6) Acc. Dep.

(7) Book value

(8) Total cash flow [(1)+(3)+(4)]

0

1

2

$40,000

−40,000

−60,000

60,000

−100,000

+OCF

$40,000

15,000

15,000

45,000

+OCF

+OCF

$40,000

15,000

30,000

30,000

+OCF

Aftertax salvage value = 5,000 – 0.21 x (5,000 – 0) = 5,000 – 1,950 = $3,950

Yearly straight-line depreciation = 60,000/4 = 15,000

3

4

+OCF

+OCF

$40,000

40,000

3,950

15,000

15,000

45,000

60,000

15,000

+OCF +OCF + 43,950

Setting the Bid Price continued

𝑂𝑂𝑂𝑂𝑂𝑂

𝑂𝑂𝑂𝑂𝑂𝑂

𝑂𝑂𝑂𝑂𝑂𝑂

𝑂𝑂𝑂𝑂𝑂𝑂 + 43,950

+

𝑁𝑁𝑁𝑁𝑁𝑁 = −100,000 +

+

+

=0

2

3

4

1.2

1.2

1.2

1.2

𝑂𝑂𝑂𝑂𝑂𝑂

𝑂𝑂𝑂𝑂𝑂𝑂

𝑂𝑂𝑂𝑂𝑂𝑂

𝑂𝑂𝑂𝑂𝑂𝑂

+

𝑁𝑁𝑁𝑁𝑁𝑁 = −78,805 +

+

+

=0

2

3

4

1.2

1.2

1.2

1.2

𝑁𝑁𝑁𝑁𝑁𝑁 = −78,805 + 𝑂𝑂𝑂𝑂𝑂𝑂 × 2.58873 = 0

𝑂𝑂𝑂𝑂𝑂𝑂 = $30,442

−78805 PV , 4 N , 20 {I/YR}, {PMT}

=𝑃𝑃𝑃𝑃𝑃𝑃(0.2, 4, −78805)

Setting the Bid Price continued

𝑂𝑂𝑂𝑂𝑂𝑂 = $30,442

𝑵𝑵𝑵𝑵𝑵𝑵 𝑰𝑰𝑰𝑰𝑰𝑰𝑰𝑰𝑰𝑰𝑰𝑰 = 𝑂𝑂𝑂𝑂𝑂𝑂 − 𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷

= 30,442 − 15,000 = $15,442

𝐶𝐶𝐶𝐶𝐶𝐶𝐶𝐶𝐶𝐶 = 24,000 + 5 × 10,000 + 4,000 = $94,000

𝑁𝑁𝑁𝑁𝑁𝑁 𝐼𝐼𝐼𝐼𝐼𝐼𝐼𝐼𝐼𝐼𝐼𝐼 = 𝑆𝑆𝑆𝑆𝑆𝑆𝑆𝑆𝑆𝑆 − 𝐶𝐶𝐶𝐶𝐶𝐶𝐶𝐶𝐶𝐶 − 𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷 × 1 − 𝑡𝑡𝐶𝐶

= 𝑆𝑆𝑆𝑆𝑆𝑆𝑆𝑆𝑆𝑆 − 94,000 − 15,000 × 1 − 0.21 = $15,442

𝑺𝑺𝑺𝑺𝑺𝑺𝑺𝑺𝑺𝑺 = $128,546

𝑷𝑷𝑷𝑷𝑷𝑷𝑷𝑷𝑷𝑷 𝑜𝑜𝑜𝑜 𝑎𝑎 𝑡𝑡𝑡𝑡𝑡𝑡𝑡𝑡𝑡𝑡 = 128,546⁄5 = $25,709

Equipment with Different Lives

•

•

•

•

•

The Downtown Athletic Club must choose between two mechanical tennis ball

throwers. Machine A costs less than Machine B but will not last as long.

The aftertax cash outflows from the two machines are shown in the table below.

Assume that machine A will be replaced at Date 4 (no loss of revenue at Date 4)

Revenues per year are assumed to be the same, regardless of machine, so they are

ignored in the analysis

Which machine should the firm purchase? Which one is cheaper?

DATE

MACHINE

A

B

0

$500

600

1

$120

100

2

$120

100

3

$120

100

4

$100

Equipment with Different Lives continued

• PV of costs (does not consider machine A’s cost at Date 4)

$120 $120

$120

𝑀𝑀𝑀𝑀𝑀𝑀𝑀𝑀𝑀𝑀𝑀𝑀𝑀 𝐴𝐴 ∶ 500 +

+

+

= $798.42

2

3

1.1

1.1

1.1

$100 $100

$100

$100

+

𝑀𝑀𝑀𝑀𝑀𝑀𝑀𝑀𝑀𝑀𝑀𝑀𝑀 𝐵𝐵 = $600 +

+

+

= $916.99

2

3

4

1.1

1.1

1.1

1.1

• Need to compare on a per-year basis → Obtain annuity payment

Annuity

𝑀𝑀𝑀𝑀𝑀𝑀𝑀𝑀𝑀𝑀𝑀𝑀𝑀 𝐴𝐴: $798.42 = 𝐶𝐶 × 𝑃𝑃𝑃𝑃𝑃𝑃𝑃𝑃𝑃𝑃10%,3 = 𝐶𝐶 × 2.4869

Factor

𝐶𝐶 = $321.06

𝑀𝑀𝑀𝑀𝑀𝑀𝑀𝑀𝑀𝑀𝑀𝑀𝑀 𝐵𝐵: $916.99 = 𝐶𝐶 × 𝑃𝑃𝑃𝑃𝑃𝑃𝑃𝑃𝑃𝑃10%,4 = 𝐶𝐶 × 2.4869

𝐶𝐶 = $289.28

Equipment with Different Lives continued

• This per-year annuity payment = equivalent annual cost (EAC)

•

It is now obvious that the firm should choose machine B

DATE

MACHINE

A

B

0

$500

600

1

$120

100

2

$120

100

3

$120

100

2

$321.06

289.28

3

$321.06

289.28

4

$100

DATE

MACHINE

A

B

0

1

$321.06

289.28

4

$289.28

General Decision to Replace

•

•

•

Consider the situation of BIKE, which must decide whether to replace an existing

machine. The replacement machine costs $9,000 now (net of old machine’s salvage

value) and requires maintenance of $1,000 at the end of every year for eight years. At

the end of eight years, the machine would be sold for $2,000.

The existing machine requires increasing amounts of maintenance each year, and its

salvage value falls each year, as shown in the table below.

If BIKE faces an opportunity cost of capital of 15 percent, when should it replace the

machine? Immediately or a year later? Assume that BIKE currently pays no tax.

YEAR

Present

1

2

3

4

MAINTENANCE

$

0

1,000

2,000

3,000

4,000

SALVAGE

$4,000

2,500

1,500

1,000

0

General Decision to Replace continued

• Equivalent Annual Cost (EAC) of New Machine (annual rental price)

𝑃𝑃𝑃𝑃𝑐𝑐𝑐𝑐𝑐𝑐𝑐𝑐

2,000

= 9,000 + 1,000 × 𝑃𝑃𝑃𝑃𝑃𝑃𝑃𝑃𝑃𝑃15%,8 −

= $12,833.5

8

1.15

𝑃𝑃𝑃𝑃𝑐𝑐𝑐𝑐𝑐𝑐𝑐𝑐 = 𝐴𝐴𝐴𝐴𝐴𝐴𝐴𝐴𝐴𝐴𝐴𝐴𝐴𝐴 × 𝑃𝑃𝑃𝑃𝑃𝑃𝑃𝑃𝑃𝑃15%,8

$12,833.5 = 𝐴𝐴𝐴𝐴𝐴𝐴𝐴𝐴𝐴𝐴𝐴𝐴𝐴𝐴 × 4.4873

𝐴𝐴𝐴𝐴𝐴𝐴𝐴𝐴𝐴𝐴𝐴𝐴𝐴𝐴 𝐸𝐸𝐸𝐸𝐸𝐸 = $2,860

• Cost of keeping the Old Machine for 1 year

𝑃𝑃𝑃𝑃𝑐𝑐𝑐𝑐𝑐𝑐𝑐𝑐

1,000 2,500

= 4,000 +

−

= $2,696

1.15

1.15

𝐶𝐶𝐶𝐶𝐶𝐶𝐶𝐶 𝑎𝑎𝑎𝑎 𝑡𝑡𝑡𝑡𝑡 𝑒𝑒𝑒𝑒𝑒𝑒 𝑜𝑜𝑜𝑜 𝑌𝑌𝑌𝑌𝑌𝑌𝑌𝑌 1 = 2,696 × 1.15 = $3,100

General Decision to Replace continued

• Comparison on a per-year basis (assume replacement every 8 years)

•

It is now obvious that it is better to replace the machine now

Immediate Replacement

Next-year Replacement

YEAR 1

$2,860

YEAR 1

$3,100

YEAR 2

$2,860

YEAR 2

$2,860

YEAR 3

$2,860

YEAR 4

$2,860

…

…

YEAR 3

$2,860

YEAR 4

$2,860

…

…