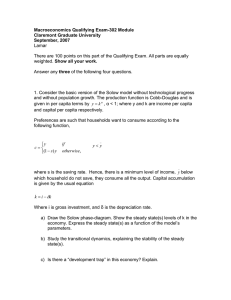

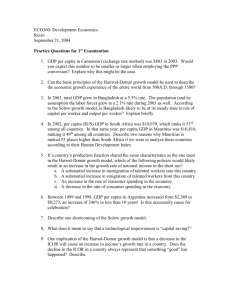

Chapter 6 Long-Run Economic Growth Hewei Shen University of Oklahoma 1 Introduction 2 Introduction • Last chapter, the labor productivity is determined by • Capital per worker (capital-labor ratio) • Total factor productivity (TFP) • This chapter: the long-run growth rate of the economy, which is strongly affected by • The rate of technological change • The growth rate of the labor force • How to determine an equilibrium growth rate, or steady state growth rate. 3 This Chapter • Understand the effect of capital accumulation on labor productivity. (Baseline Solow growth model) • Understand the effect of labor force growth on labor productivity. (Solow growth w/ labor force growth) • Understand the effect of technological change on labor productivity and the standard of living. (Solow growth w/ labor force & technology growth) • Explain balanced growth, convergence, and long-run equilibrium. 4 The Solow Growth Model 5 The Solow Growth Model - Production • The Solow growth model has become the foundation for how economists think about economic growth. • Helps us understand why some countries experience rapid economic growth while the others don’t. • We work with the per worker production function : 𝑦 = 𝐴𝑓(𝑘) • 𝑦 is real GDP per worker; 𝑘 is the capital-labor ratio; 𝐴 is productivity. • For simplicity, we assume 𝐴 =1 : 𝑦 = 𝑓(𝑘) • For now, assume constant labor force (growth rate=0). • We will add labor force and technology growth later. 6 The Solow Growth Model - Capital • Capital stock changes over time: capital accumulation • Investment: increases the capital stock • Depreciation: decreases the capital stock • Depreciation rate is the rate at which the capital stock declines due to • Capital goods becoming worn out by use • Capital goods become obsolete. • In our model, assumptions: • Closed economy: export= import=0, NX=0 • No government: G=0 • Real GDP per worker = consumption per worker + investment per worker 𝑦=𝑐+𝑖 7 The Solow Growth Model - Investment • Investment is from households’ saving. • 𝑠 is the fraction of 𝑦 that is saved: the national saving rate. Then 𝑖=𝑠𝑦 • Substituting this into the equation y = 𝑐 + 𝑖: 𝑐 = (1 − 𝑠)𝑦 • substituting the production function 𝑦=𝑓(k): 𝑖 = 𝑠𝑓(𝑘) 8 The Solow Growth Model - Investment 𝑦 = 𝑓(𝑘), and 𝑖 = 𝑠𝑓 𝑘 • Increases in 𝑘 cause smaller and smaller increases in 𝑦 and 𝑖 due to diminishing marginal returns. 9 The Solow Growth Model - Depreciation • Let 𝑑= depreciation rate; 𝑘 = capital-labor ratio; then Depreciation=𝑑𝑘 • How to show it on graph? 10 The Solow Growth Model – Steady State • We know • Investment increases 𝑘 • Depreciation decreases 𝑘 • If the increase in 𝑘 exactly offsets the decreases in 𝑘 • Capital-labor ratio (𝑘) is constant. • real GDP per worker (𝑦) is also constant. • This equilibrium in the Solow growth model is called steady state. • In the Solow growth model, in steady state: • 𝑘 and 𝑦 are constant. • Capital, labor, and real GDP are all growing at the same rate. 11 The Solow Growth Model – Stock vs. Flow • We need to distinguish between stock and flow variables. • Capital-labor ratio is a stock variable: measured at a point in time, which may have accumulated in the past. • Investment and depreciation are flow variables: measured per period of time. • Example: You put $10 dollars into a piggy bank every week. • Flow: The money you put into the Piggy bank this week. • Stock: The money already in the Piggy bank. • Are the following stocks or flows? • the number of miles that you have driven today. • the millage on your car. 12 The Solow Growth Model – Steady State • Capital-labor ratio is a stock. • The investment and depreciation are flow. 13 The Solow Growth Model – Steady State • Change in the level of water = Water flowing in – Water flowing out. • Change in the capital-labor ratio = Investment – Depreciation 14 The Solow Growth Model – Steady State • Change in the capital-labor ratio = Investment – Depreciation • When investment = depreciation, capital- labor ratio does not change. • Steady state! • Similarly, we can write as ∆𝑘=𝑖−𝑑𝑘 Or, ∆𝑘=𝑠𝑓(𝑘)−𝑑𝑘 • If 𝑠𝑓(𝑘) > 𝑑𝑘, ∆𝑘>0, capital-labor ratio increases • If 𝑠𝑓(𝑘) < 𝑑𝑘, ∆𝑘<0, capital-labor ratio decreases • If 𝑠𝑓(𝑘) = 𝑑𝑘, ∆𝑘=0, capital-labor ratio is constant (𝑘 ∗ ). • At steady state: 𝑠𝑓 𝑘 ∗ = 𝑑𝑘 ∗ 15 The Solow Growth Model – Steady State • Steady state capital-labor ratio is constant (𝑘 ∗ ) is given by 𝑠𝑓 𝑘 ∗ = 𝑑𝑘 ∗ 16 Calculating the Steady State 1 3 • Suppose 𝑦 = 𝑘 , 𝑠 = 0.45, 𝑑 = 0.05. What is the steady-state capital-labor ratio? • In the steady state, we have 𝑠𝑓 𝑘 ∗ = 𝑑𝑘 ∗ . Rewrite this as: 𝑘∗ 𝑓 𝑘∗ = 𝑠 𝑑 1 3 • Since 𝑓 𝑘 = 𝑘 , 𝑠 = 0.45, 𝑑 = 0.05, we can write: 𝑘∗ 1 ∗ 𝑘 3 = 0.45 0.05 2 𝑘∗ 3 =9 3 ∗ 𝑘 = 9 2 = 27 • steady-state capital-labor ratio is $27 per worker. • Real GDP per worker 𝑦∗ 1 = 𝑘∗3 = $3. • 𝑖 ∗ = 𝑠𝑦 ∗ =1.35. 𝑐 ∗ = 1 − 𝑠 𝑦 ∗ = 1.65. 17 Transition to the Steady State • If the economy starts with a 𝑘 ≠ 𝑘 ∗ , it converges to its steady state. • When 𝑘 = 𝑘 ∗ : ∆𝑘=𝑖−𝑑𝑘=0. 𝑘 remains equal to 𝑘 ∗ . • When 𝑘 < 𝑘 ∗ : ∆𝑘=𝑖−𝑑𝑘>0. 𝑘 increases. • Until 𝑘 = 𝑘 ∗ . • When 𝑘 > 𝑘 ∗ : ∆𝑘=𝑖−𝑑𝑘<0. 𝑘 decreases. • Until 𝑘 = 𝑘 ∗ . 18 Transition to the Steady State • Suppose the initial 𝑘 = 8 < 27 = 𝑘 ∗ . It converges to its steady state value, so do 𝑦, 𝑐, and 𝑖. Steady-state values. 19 Saving Rates and Growth Rates • How does an increase in 𝑠 affect 𝑘 ∗ and growth rates? • Increase in 𝑠 shifts up the investment curve, results in a higher 𝑘 ∗ and 𝑦 ∗ . • Only affect ss value of “per worker” variables. No change in growth rate. 20 Data: Saving Rate and Real GDP per Worker • The Solow growth model predicts that higher saving rates will result in higher real GDP per worker. Do we see this in real-world data? 21 Labor Force Growth and the Solow Growth Model 22 Labor Force Growth and the Steady State • Now we assume that labor force grow and growth rate = 𝑛, but keep the technology unchanged. • Consider an example: • Our class has 5 students and has a joint bank account with $20. • On average, each student has $4. • Now we have 5 new students, so we have 10 students now. • What happens to average $/student? • Dollar-student ratio has been diluted. This effect is called dilution. • When there is labor force growth, capital-labor ratio is diluted as well. • The dilution is given by Dilution= 𝑛𝑘 • Dilution decreases the capital-labor ratio. 23 Labor Force Growth and the Steady State • Now the capital-labor ratio decreases by both depreciation and dilution. • Investment increases 𝑘. 24 Labor Force Growth and the Steady State • Now the capital-labor ratio decreases by both depreciation and dilution. • Investment increases 𝑘. ∆𝑘=𝑖−(𝑑+𝑛)𝑘 • Or, • ∆𝑘 = 𝑠𝑓(𝑘) − (𝑑 + 𝑛)𝑘 • In steady state, ∆𝑘=0, so 𝑠𝑓 𝑘 ∗ = (𝑑 + 𝑛)𝑘 ∗ • 𝑘 ∗ denotes the equilibrium capital-labor ratio. • The break-even investment: 𝑖 = 𝑑𝑘 + 𝑛𝑘 = 𝑑 + 𝑛 𝑘 25 Labor Force Growth and the Steady State • Equilibrium capital-labor 𝑘 ∗ is given by investment = Break-even investment. • Aggregate variables growth rate=𝑛. 26 An Increase in the Labor Force Growth Rate • What happens to 𝑘 ∗ if the labor force growth rate 𝑛 increases? • The capital stock gets diluted faster—current investment cannot keep up with the growing labor force. • 𝑘 ∗ falls. 27 An Increase in the Labor Force Growth Rate • What happens to 𝑘 ∗ if the labor force growth rate 𝑛 increases? • The steady-state value of k* falls. • Real GDP per worker 𝑦 ∗ = 𝑓(𝑘 ∗ ) also falls. • The steady-state growth rate of real GDP per worker will NOT fall. • Δ𝑦 = 0 in the steady-state. • The growth rate of aggregate variables (𝑌, 𝐶, 𝐼, 𝐾) falls from 𝑛1 to 𝑛2 . • Therefore, differences in labor-force growth rates cannot explain differences in steady-state growth rates across countries. 29 Practice Question: Slower Growth Rate • According to the United Nations’ Population Division, the world’s population growth rate averaged 1.7% per year between 1950 and 2010. The following table shows the Population Division’s forecasts for the population growth rates for different regions in the world: • In every region, the forecast is for slower population growth (slower labor force growth). • What effect does the Solow growth model predict this reduction will have on the standard of living in the world? 30 Technological Change and the Solow Growth Model 32 Technological change and the Solow growth model • So far, we have seen the effects of • Changes in saving rate 𝑠 • Changes in labor force growth rate 𝑛 • These changes have no effects on steady-state growth rate of real GDP per worker (𝑦). • We also assumed a constant 𝐴: 𝑦 = 𝐴𝑓(𝑘) • What are the effects of technological advancements in the growth rate of 𝑦? • Can technological change explain the different growth rates? 33 Technological change and the Solow growth model • Improvements in technology or efficiency does not affect capital and labor equally. • We focus on Labor-augmenting technological change: • the technological improvement that makes labor more productive, but not capital. • E.g. assembly line increases worker productivity. 34 Technological change and the Solow growth model • Rewrite the production function: 𝑌=𝐹(𝐾,𝐿×𝐸) • 𝐿: # of labor units; 𝐸: efficiency of labor. • 𝐿 × 𝐸 is the effective units of labor. • Improving the productivity of workers ≡ increasing the number of workers. • Intuition: • If technology makes labor 3% more productive, it is equivalent to have 3% more workers. • Example: • If Brazil and Pakistan have the same labor force. But workers in Brazil are more efficient (𝐸 in Brazil is twice the 𝐸 in Pakistan) . • Effective labor supply in Brail = 2 × effective labor supply in Pakistan. 35 Technological change and the Solow growth model • Rewrite the production function: 𝑌=𝐹(𝐾,𝐿×𝐸) • 𝐿: # of labor units; 𝐸: efficiency of labor. • 𝐿 × 𝐸 is the effective units of labor. • Assume 𝑔 = growth rate of 𝐸. • 𝑛 = growth rate of 𝐿. • Then the growth rate of effective labor force (𝐿 × 𝐸) = 𝑛 + 𝑔. 36 Equilibrium with technological change • Now we define: • Output per effective worker: 𝑦=𝑌/(𝐸×𝐿) • Capital per effective worker: 𝑘=𝐾/(𝐸×𝐿) • 𝑘 increases due to • Investment: 𝑠𝑓(𝑘) • 𝑘 decreases due to • Depreciation: 𝑑𝑘 • Dilution from labor force growth: 𝑛𝑘 • Dilution from effective labor growth: 𝑔𝑘 • So the change in capital – (effective) labor ratio 𝑘 becomes ∆𝑘 = 𝑠𝑓 𝑘 − 𝑑𝑘 + 𝑛𝑘 + 𝑔𝑘 ∆𝑘 = 𝑠𝑓 𝑘 − 𝑑 + 𝑛 + 𝑔 𝑘 37 Equilibrium with technological change Investment and breakeven investment • The steady state (∆𝑘=0) requires 𝑘 ∗ such that: 𝑠𝑓 𝑘 ∗ = 𝑑 + 𝑛 + 𝑔 𝑘 ∗ Investment = Break-even Investment Break-even investment, 𝑑 + 𝑛 + 𝑔 𝑘 Investment, 𝑠𝑓(𝑘) 𝑘∗ Capital per effective worker: 𝑘 38 Steady state growth rates in the Solow growth model • In steady state, 𝑘 = 𝑘 ∗ is fixed. • But 𝑘=𝐾/(𝐸×𝐿), what is the growth rate of 𝐾? Note: 𝐾= 𝑘 ×(𝐸×𝐿). • 𝐾 grows at the rate of 𝑛 + 𝑔, the growth rate of 𝐸×𝐿. • Similarly, real GDP 𝑦=𝑌/(𝐸×𝐿) is fixed in steady state. • 𝑌 = 𝑦 ×(𝐸×𝐿). • Real GDP 𝑌 has a growth rate of 𝑛 + 𝑔. • How about GDP per worker 𝑌/𝐿 ? • 𝑌/𝐿= 𝑦 ×𝐸 • Real GDP per worker grows at a growth rate of 𝑔. • So does GDP per capita if labor input is constant. • Changes in the underlying rate of labor-augmenting technological change (𝑔) will affect the steady-state growth rate of the standard of living. 39 Steady state growth rates in the Solow growth model • Summary of steady-state growth rates. 40 Balanced Growth, Convergence, and Long-Run Equilibrium 41 Balanced growth • In the steady-state equilibrium: • The capital-labor ratio: 𝐾/𝐿 • Real GDP per worker: 𝑌/𝐿 • grow at the same rate: 𝑔 , the growth rate of 𝐸. • This is called balanced growth: • 𝐾/𝐿 and 𝑌/𝐿 grow at the same constant rate. • However, before reaching the steady state, growth of these variables may not be constant. 42 Convergence to the balanced growth path Investment and break-even investment • Recall this graph, and 𝐾 𝐿 = 𝑘 × 𝐸: • If 𝑘 = 𝑘 ∗ , 𝑘 stay unchanged, 𝐾/𝐿 grows at rate 𝑔. • If 𝑘 < 𝑘 ∗ , 𝑘 gradually increases, 𝐾/𝐿 grows at rate larger than 𝑔. • If 𝑘 > 𝑘 ∗ , 𝑘 gradually decreases, 𝐾/𝐿 grows at rate smaller than 𝑔. Break-even investment, 𝑑+𝑛+𝑔 𝑘 Investment, 𝑠𝑓(𝑘) 𝑘∗ Capital per effective worker: 𝑘 43 Convergence to the balanced growth path • Recall this graph, and 𝐾 𝐿 = 𝑘 × 𝐸: • If 𝑘 = 𝑘 ∗ , 𝑘 stay unchanged, 𝐾/𝐿 grows at rate 𝑔. • If 𝑘 < 𝑘 ∗ , 𝑘 gradually increases, 𝐾/𝐿 grows at rate larger than 𝑔. • If 𝑘 > 𝑘 ∗ , 𝑘 gradually decreases, 𝐾/𝐿 grows at rate smaller than 𝑔. • Summary: • When 𝑘 = 𝑘 ∗ : the economy stays on balanced growth path. 𝐾/𝐿 and 𝑌/𝐿 grows at the balanced growth rate 𝑔 . • When 𝑘 < 𝑘 ∗ : 𝑘 grows and gradually converges to 𝑘 ∗ , the economy grows faster than 𝑔, the economy converges to the balanced growth path. • When 𝑘 > 𝑘 ∗ : 𝑘 declines and gradually converges to 𝑘 ∗ , the economy grows smaller than 𝑔, the economy converges to the balanced growth path. 44 Convergence to the balanced growth path On balanced growth path, growth rate = 𝑔. War destroyed a lot of capital. Making 𝑘 < 𝑘 ∗ . Grow faster than rate 𝑔, converge to the balanced growth path. 45 Do all countries converge to the same balanced growth? • 2010 real income per capita for the average country was $9,400. • U.S. income per capita was $47,400. • Lowest income per capita was $300 in the Congo. • Convergence means poor countries catch up to rich countries in terms of income per capita. • Some countries (i.e., Japan) converge, while others do not (i.e., Zaire). • Different savings rates (𝑠) and labor force growth rates (𝑛). • Differing levels of TFP growth (𝑔). • Conditional convergence means countries all converge to their own balanced growth path. • After controlling for factors leading to different balanced growth paths, convergence occurs at about 2% per year. • Would take about 35 years for poor country to close half the gap. 46