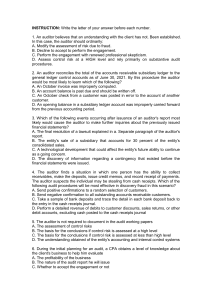

Audit Planning: Assessment of Control Risk MULTIPLE CHOICE: 1. Which of the following is ordinarily considered a test of internal control procedures? a. Send confirmation letters to banks. b. Count and list cash on hand. c. Examine signatures on checks. d. Obtain or prepare reconciliations of bank accounts as of the balance sheet date. ANSWER: C 2. When obtaining an understanding of an entity's control environment, an auditor should concentrate on the substance of management's policies and procedures rather than their form because a. The auditor may believe that the policies and procedures are inappropriate for that particular entity. b. The board of directors may not be aware of management's attitude toward the control environment. c. Management may establish appropriate policies and procedures but not act on them. d. The policies and procedures may be so weak that no reliance is contemplated by the auditor. ANSWER: C 3. After the study and evaluation of a client's internal control policies and procedures has been completed, an auditor might decide to a. Increase the extent of substantive testing in areas where the internal control policies and procedures are strong. b. Reduce the extent of control testing in areas where the internal control policies and procedures are strong. c. Reduce the extent of both substantive and control testing in areas where the internal control policies and procedures are strong. d. Increase the extent of substantive testing in areas where the internal controls are weak. ANSWER: D 4. A conceptually logical approach to the auditor's evaluation of internal accounting control consists of the following four steps: