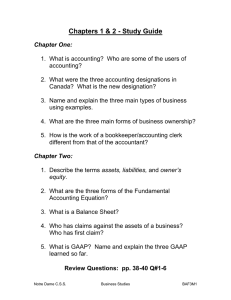

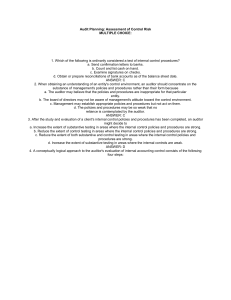

CH # 2: Introduction to Financial Statements and Other Financial Reporting Topics By, Sumaira Aslam Lecturer The Islamia University Of Bahawalpur, Pakistan Forms of Business Entities Business: Any legal activity to earn profit. • Sole Proprietorship: A business owned and controlled by one person, is not a legal entity separate from its owner. • Partnership: A business owned by two or more individuals. Each owner, called a partner, is personally responsible for debts of the partnership. Partners and business are separate entities. • Joint Stock Company/Business Corporation: Business which is formed under company’s ordinance 1984 and has legal right to act as a person. A legal entity incorporated in a particular state. Ownership is evidenced by shares of stock. The Financial Statements 1. Balance Sheet (Statement of Financial position) Measures the financial position at any point in time. Three major sections: I. Assets: Resources of the firm II. Liabilities: The debts of the firm. III. Owners’ Equity: Owners’ claims against the assets of the business. Continued……….. 2. Income Statement (Statement of Earnings): Summarizes revenues and expenses and gains and losses (operating costs), ending with net income (at the end of an accounting period) 3. Statement of Owners’ Equity (Reconciliation of owners’ equity account): Reconciliation of beginning and ending balances of their owners’ equity account. R/E links the balance sheet to income statement. Continued………….. 4. Statement of Cash Flows: Details the inflows and outflows of cash during a specified period of time. Three main Sections: I. Cash flows from operation activities II. Cash flows from investing activities III.Cash flows from financing activities 5. Footnotes: Footnotes to financial statements are used to present additional information about items included in financial statements and to present additional financial information. The Accounting Cycle Accounting Period: it is a time period in which the business measures its operating results. Accounting Cycle: The sequence of accounting procedures completed during each accounting period is the accounting cycle. Steps: Recording transactions Recording adjusting entries Recording the financial statements Continued………… Transaction: An event that causes a change in a company’s assets, liabilities, or owners; equity, thus changing the company’s financial position. A transaction recorded in a journal is referred to as journal entry. Working of steps: • Recording to trial balances( T-Account) • Adjusting to ledgers • Presenting to statements Human Resources And Social Accounting Human Resource Accounting: Attempts to account for the services of employees. Social Accounting: Attempts to account for benefits to social environments within which the firm operates. Reporting in development phase. Disclosure is being started by many firms. Auditor’s Report An auditor’s report is the formal statement of the auditor’s opinion of the financial statement after conducting an audit. Audit: An auditor(Certified public accountant) conducts an independent examination of the accounting information presented by the business and issues a report thereon. He/she inspect the conformity of GAAP. Classification of auditor’s opinion: Unqualified opinion (Clean): Financial statements presents fairly, in all material respects, the financial position, results of operations, and cash flows of the entity, in conformity with GAAP. Qualified Opinion: States that, except for the effects of the matter(s) to which the qualification relates, the financial statements present fairly, in all material respects the financial positions, results of operations, and cash flows of the entity , in conformity with GAAP. A Qualified Opinion report is issued when the auditor encountered one of two types of situations which do not comply with generally accepted accounting principles, however the rest of the financial statements are fairly presented. Continued………….. Adverse Opinion: It states that the financial statements do not present fairly the financial position, results of the operations, and cash flows of the entity, in confirmatory with GAAP. Disclaimer of Opinion: It states that auditor does not express an opinion on the financial statements. A disclaimer of opinion is rendered when the auditor has not performed an audit sufficient in scope to form an opinion. Auditing Standards 1. General Standards 2. Fieldwork Standards 3. Reporting Standards Review Report: Outside accountant associated with financial statements to indicate that accountants are not aware of any material modifications that should be made to FS in order for them to be in confirmatory with GAAP or the report will indicate departures from GAAP. Accountant’s report indicates the deficiencies as: • • • Omission of substantially all disclosures Omission of statement of cash flows Accounting principles not generally accepted. Other Reports Form 10-K: The difference between an annual report and a 10-K report, is that the annual is used to represent the state of the company to shareholders. A 10-K is an official document that traded companies must file with the Securities and Exchange Commissions. Unlike the annual report, it is filed to fulfill a regulatory requirement for transparency. Due within 90 days of the end of fiscal year. Form 10-Q: Quarterly Reports Due quarterly but not required for forth quarter. Form 8-K: Current Reports Due after 8 days of event