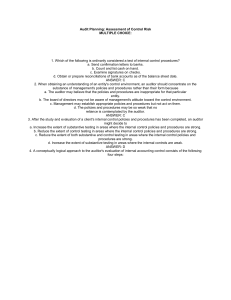

INSTRUCTION: Write the letter of your answer before each number. 1. An auditor believes that an understanding with the client has not. Been established. In this case, the auditor should ordinarily: A. Modify the assessment of risk due to fraud. B. Decline to accept to perform the engagement. C. Perform the engagement with renewed professional skepticism. D. Assess control risk at a HIGH level and rely primarily on substantive audit procedures. 2. An auditor reconciles the total of the accounts receivable subsidiary ledger to the general ledger control accounts as of June 30, 2021. By this procedure the auditor would be most likely to learn which of the following? A. An October invoice was improperly computed. B. An account balance is past due and should be written off. C. An October check from a customer was posted in error to the account of another customer. D. An opening balance in a subsidiary ledger account was improperly carried forward from the previous accounting period. 3. Which of the following events occurring after issuance of an auditor's report most likely would cause the auditor to make further inquiries about the previously issued financial statements? A. The final resolution of a lawsuit explained in a. Separate paragraph of the auditor's report. B. The entity's sale of a subsidiary that accounts for 30 percent of the entity's consolidated sales. C. A technological development that could affect the entity's future ability to continue as a going concern. D. The discovery of information regarding a contingency that existed before the financial statements were issued. 4. The auditor finds a situation in which one person has the ability to collect receivables, make the deposits, issue credit memos, and record receipt of payments. The auditor suspects the individual may be stealing from cash receipts. Which of the following audit procedures will be most effective in discovery fraud in this scenario? A. Send positive confirmations to a random selection of customers. B. Send negative confirmation to all outstanding accounts receivable customers. C. Take a sample of bank deposits and trace the detail in each bank deposit back to the entry in the cash receipts journal. D. Perform a detailed revenue of debits to customer discounts, sales returns, or other debit accounts, excluding cash posted to the cash receipts journal 5. The auditor is not required to document in the audit working papers A. The assessment of control risks B. The basis for the conclusions if control risk is assessed at a high level C. The basis for the conclusions if control risk is assessed at less than high level D. The understanding obtained of the entity's accounting and internal control systems 6. During the initial planning for an audit, a CPA obtains a level of knowledge about the client's business to help him evaluate A. The profitability of the business B. The nature of the audit report he will issue C. Whether to accept the engagement or not D. The reasonableness of estimates, such as valuation of inventories and allowances for doubtful accounts. 7. Which of the following statements ordinarily is included among the written client representations obtained by the auditor? A. Management acknowledges responsibility for illegal actions committed by employees. B. Management acknowledges that there are no material weaknesses in internal control. C. Sufficient evidential matter has been made available to permit the issuance of an unqualified opinion. D. Compensating balances and other arrangements involving restrictions on cash balances have been disclosed. 8. Which of the following is not one of the basic elements of the auditor's report? A. Auditor's signature C. Date of the report B. Client's address D. Title 9. The auditor's report contains a paragraph explaining that the entity changed from the straight line to the declining balance method of depreciation. The auditor expressed an: A. Adverse opinion C. Qualified opinion B. Disclaimer of opinion D. Unqualified opinion 10. An entity’s financial statements were misstated over a period of years due to large amounts of revenue being recorded in journal entries that involved debits and credits to an illogical combination of accounts. The auditor could most likely have been alerted to this irregularity by A. Performing a revenue cut-off test at year end. B. Scanning the general journal for unusual items. C. Tracing a sample of journal entries to the general ledger. D. Examining documentary evidence of sales returns and allowances recorded after year end. 11. Which of the following statements best describes assurance services? A. Services designed for the improvement of operations, resulting in better outcomes. B. Services designed to express an opinion on the fairness of historical financial statements based on the results of an audit. C. The preparation of financial statements or the collection, classification, and summarization of other financial information. D. Independent professional services that are intended to enhance the credibility of information to meet the needs of an intended user 12. When a CPA does not confirm material accounts receivable, but is satisfied by the application of alternative auditing procedures, he/she normally should A. Issue an adverse opinion. B. Issue an unmodified opinion with no reference to this omission but be prepared to defend the action. C. Issue a qualified opinion or a disclaimer of opinion, depending on the materiality of the receivables. D. Issue an unmodified opinion but disclose elsewhere in the report this departure from a customary procedure.