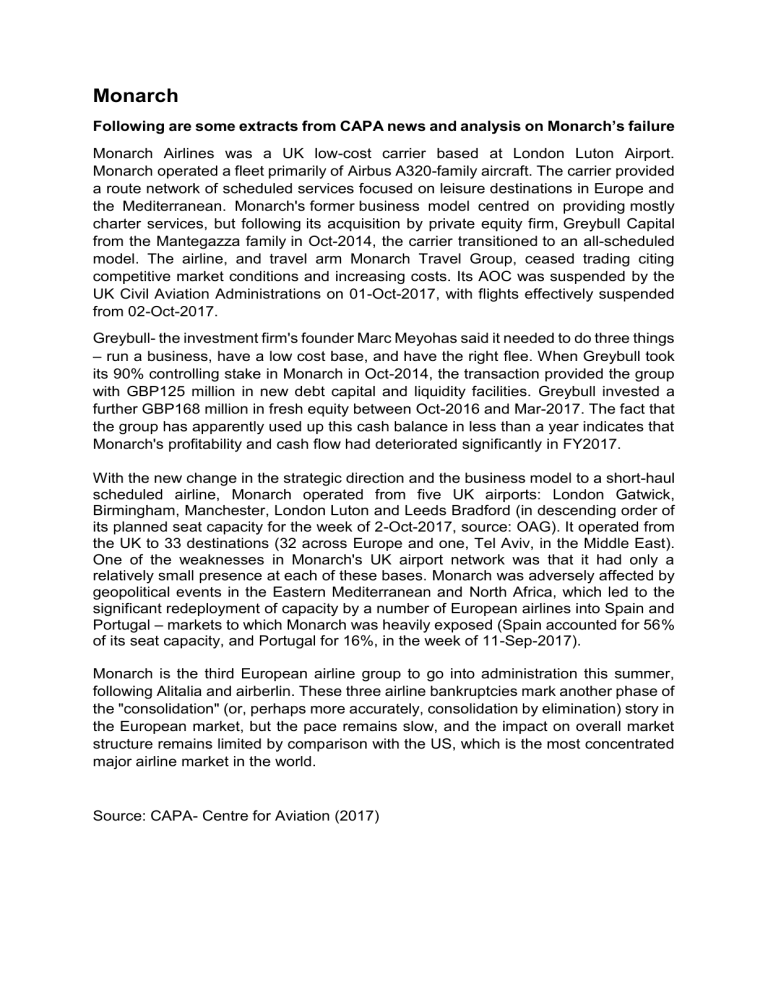

Monarch Following are some extracts from CAPA news and analysis on Monarch’s failure Monarch Airlines was a UK low-cost carrier based at London Luton Airport. Monarch operated a fleet primarily of Airbus A320-family aircraft. The carrier provided a route network of scheduled services focused on leisure destinations in Europe and the Mediterranean. Monarch's former business model centred on providing mostly charter services, but following its acquisition by private equity firm, Greybull Capital from the Mantegazza family in Oct-2014, the carrier transitioned to an all-scheduled model. The airline, and travel arm Monarch Travel Group, ceased trading citing competitive market conditions and increasing costs. Its AOC was suspended by the UK Civil Aviation Administrations on 01-Oct-2017, with flights effectively suspended from 02-Oct-2017. Greybull- the investment firm's founder Marc Meyohas said it needed to do three things – run a business, have a low cost base, and have the right flee. When Greybull took its 90% controlling stake in Monarch in Oct-2014, the transaction provided the group with GBP125 million in new debt capital and liquidity facilities. Greybull invested a further GBP168 million in fresh equity between Oct-2016 and Mar-2017. The fact that the group has apparently used up this cash balance in less than a year indicates that Monarch's profitability and cash flow had deteriorated significantly in FY2017. With the new change in the strategic direction and the business model to a short-haul scheduled airline, Monarch operated from five UK airports: London Gatwick, Birmingham, Manchester, London Luton and Leeds Bradford (in descending order of its planned seat capacity for the week of 2-Oct-2017, source: OAG). It operated from the UK to 33 destinations (32 across Europe and one, Tel Aviv, in the Middle East). One of the weaknesses in Monarch's UK airport network was that it had only a relatively small presence at each of these bases. Monarch was adversely affected by geopolitical events in the Eastern Mediterranean and North Africa, which led to the significant redeployment of capacity by a number of European airlines into Spain and Portugal – markets to which Monarch was heavily exposed (Spain accounted for 56% of its seat capacity, and Portugal for 16%, in the week of 11-Sep-2017). Monarch is the third European airline group to go into administration this summer, following Alitalia and airberlin. These three airline bankruptcies mark another phase of the "consolidation" (or, perhaps more accurately, consolidation by elimination) story in the European market, but the pace remains slow, and the impact on overall market structure remains limited by comparison with the US, which is the most concentrated major airline market in the world. Source: CAPA- Centre for Aviation (2017)