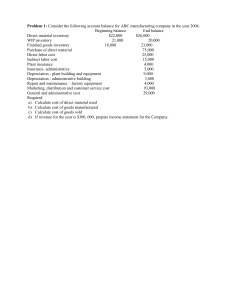

Problem 1: Consider the following account balance for ABC manufacturing company in the year 2004.

Direct material inventory

Beginning balance

$22,000

End balance

$26,000

WIP inventory 21,000 20,000

Finished goods inventory 18,000 23,000

Purchase of direct material 75,000

Direct labor cost 25,000

Indirect labor cost 15,000

Plant insurance 4,000

Insurance- administrative 5,000

Depreciation - plant building and equipment 9,000

Depreciation - administrative building 3,000

Repair and maintenance – factory equipment 4,000

Marketing, distribution and customer service cost 93,000

General and administrative cost 29,000

Required a) Calculate cost of direct material used b) Calculate cost of goods manufactured c) Calculate cost of goods sold d) If revenue for the year is $300, 000, prepare income statement for the Company.

Problem 2 .Fortunately certain accounting records were kept in another building. It revealed the following for the period from january1, 2004 to January 29, 2004.

Direct material purchased

WIP January1

Direct material january1, 2004

Finished goods january1, 2004

16,000

30,000

$160,000

34,000

MOH cost 40% of conversion cost

Revenue 500,000

Direct labor cost

Prime cost 294,000

180,000

Gross profit based on sales

Cost of goods available for sale

Requirements a.

Direct material destroyed b.

Cost of goods manufactured c.

Finished goods destroyed d.

WIP destroyed

450,000

20%

Problem 3 : The cost department of Randall manufacturing company collected the following cost data for financial statement presentation for the year ended on December31, 2005.

Inventories January1,2005 December31,2005

Direct material

Work in process

$34,500

$ 81,500

$49,300

$42,000

Units of Finished goods

Cost of Finished goods

300unit

$48,600

420 units

?

Additional information.

Sales during the year are 3,880 units at $220 per unit

Direct material purchased ------- $364,000

Prime cost -------------- $511,700

MOH cost -------------------- 48% of conversion cost

Operating expense ---------------- 50%of gross profit

All units in the ending finished goods inventory are from current period production.

Requirements :

Compute the following based on the above information.

1.

Cost of direct material used

2.

Units of goods manufactured

3.

Cost of goods manufactured

4.

Cost of goods sold

5.

Operating income

Problem 3 : ABC Electronics Company has two departments to manufacture computers,

Assembly and testing departments. First component parts are assembled in assembly department and then transferred out to testing department. Direct materials are added some where in between the assembly process but conversion costs are added evenly through out the assembly process.

The company uses process costing system. The following data are for the month of January for assembly department.

Physical units Direct material Conversion cost

Beginning WIP 400 $2,484,000 $464,000

Started in the month 2,500

Completed units 2,300

Cost added during the month 16,100,000 6,960,000

Additional information

There are 200 spoiled units 50% of which is abnormal

Degree of completion –Beginning WIP

Direct material (90% complete)

Conversion cost (40% complete)

Degree of completion –Ending WIP

Direct material (60% complete)

Conversion cost (30% complete)

Requirements: Under FIFO method a) Summarize the flow of physical units b) Compute equivalent unit in terms of each cost c) Compute cost per equivalent unit d) Assign the cost to units completed and WIP ending e) Pass the necessary journal entries

Problem 4 : The following data pertain to Milan tire and Rubber Company for the month of May.

WIP may1 (units)

Units started during may

?

60,000

Total units to account for

Units completed and transferred out

WIP may 31 ( in units)

Total equivalent units: Direct material

Total equivalent units: Conversion cost

75,000

?

10,000

75,000

?

WIP may 1:Direct material

WIP may 1:Conversion cost

Cost incurred during may: Direct material

Cost incurred during may: Conversion cost

WIP may1;Total cost

Cost per equivalent: Direct material

Cost per equivalent: Conversion

Total cost per equivalent unit

Br 135,000

?

?

Br 832,250

Br 172,500

Br 9.4

?

Br 21.65

Additional information

Direct material and conversion activities occurs uniformly through out the process

Milan uses weighted average process costing

The may 1 WIP was 100% complete for direct material and 20% complete for conversion cost

Required:

Prepare production report for the month of May, the report should show

1.

Units to account for ,units accounted for and percentage of completion

2.

Equivalent unit of production

3.

Total cost to account for

4.

Cost per equivalent

Cost of completed and transferred out and cost of ending WIP inventory