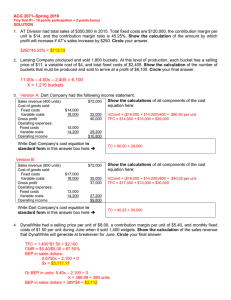

Cost Cost is anything of value foregone or sacrificed to attain an objective. Classification of Costs 1. Based on function or group of activities involved a. Manufacturing or Production Cost. Costs incurred in production such as labor, materials and manufacturing costs b. Commercial or Operating Expenses. It consists of 1) distribution costs or selling expenses which are incurred in the process of selling, and 2) general and administrative expenses which are incurred in the general direction, control and administration of the enterprise. 2. Based on their relation to the product. a) Direct Materials b) Direct Labor c) Manufacturing Overhead. – Indirect costs 3. Based on their relation to departments a. Direct department costs – directly identifiable with department b. Indirect department costs - not directly identifiable with department and need to be allocated among a number of departments 4. As to timing of charges against revenue a. Period cost refers to cost that is totally charged against current revenue. b. Product cost refers to cost that is allocated between sold and unsold units. 5. Based on their behaviour or variability a. Variable costs – costs that vary in direct proportion to the changes in the volume of production within a relevant range. Ex. Direct materials, sales commission, and direct labor b. Fixed costs – costs not affected by the changes in volume of production or sales within a relevant range. Ex. Depreciation, rental c. Mixed or semi-variable costs – costs that vary in amount but not in direct proportion to changes in volume of production. Partly fixed and partly variable. Ex. Light, water, and telephone expenses 6.. Based on the accounting period benefited a. Capital expenditures – refers to outlays that benefit future periods and are classified as assets. b. Revenue expenditures – benefit the current period only and are classified as expense. 7. Based on cost for planning and control a. Budgeted costs – refers to costs estimated to be incurred in undertaking an activity or in the completion of a project. b. Standard costs – refers to costs per unit of finished product for materials, labor and factory overhead which are predetermined based on an intensive research on the product and the manufacturing process involved in its manufacture. 8. Based on the economics involved in making managerial decisions a. Opportunity costs – refer to the benefits or advantages foregone in rejecting an alternative. b. Imputed costs – refer to the peso amount assigned to an item but which has not been the subject of a transaction so that no liability is incurred nor is there a need for cash outlay. c. Controllable costs – refer to cost items which can be regulated depending on the level of management one occupies. It may also be defined as those incurred in a responsibility center over which the manager of the responsibility center has significant influence. d. Differential costs - refer to cost items which vary in two or more alternative choices. e. Marginal costs – refer to the increase in total cost brought about by the production of additional unit. f. Sunk costs – refer to historical cost and is therefore irrelevant in the decision making process. g. Out-of-pocket costs – refer to costs requiring disbursements. h. Relevant costs – refer to the future differential costs i. Discretionary costs – costs incurred depending on the discretion of the manager. What is a Break Even Analysis? The Break Even Analysis (BEA) is a useful tool to study the relation between fixed costs and variable costs and revenue. It’s inextricably linked to the Break Even Point (BEP), which indicates at what moment an investment will start generating a positive return. It can be graphically represented or calculated with a simple mathematical calculation. A Break-Even Analysis calculates the size of the production at a certain (selling) price that is necessary to cover all the costs that have been incurred. Break Even Analysis components To understand how this analysis works, it’s wise to at least mention the following cost concepts. Fixed costs Fixed costs are also called overhead. These costs are always occur after the decision to start an economic activity and they relate directly to the level of production, but not the quantity of production. Fixed costs include (but are not limited to) depreciation of materials, interest costs, taxes and general overhead costs (labour costs, energy costs, depreciation costs). A carpentry business that mainly makes tables, chairs and closets, employs 50 people. The business has a large number of fixed costs. It’s about costs that come back every month and stay the same, and can only change after a year. Think for instance of salaries, monthly energy bills and the depreciation costs of current assets (including machines) and fixed assets (such as a building). Variable costs Variable costs are costs that change in direct relation to the volume of production. This concerns for instance selling costs, production costs, fuel and other costs that are directly related to the production of goods or an investment in capital. For a carpentry business, mainly the costs for raw materials, auxiliary materials, semi-finished goods such as wood, nails and copper handles, are variable. If they are producing 50 closets per month, they use less than when they produce 75 closets in some other month. Therefore, these costs vary every month. Financial Tool The Break Even Analysis is a handy tool to decide if a company should or should not start producing and selling a product. In addition, you can calculate the Break Even Point (BEP), also known as the critical point. It is the turnover at which the total revenue would equal the total costs. In that case, the organisation would break even and both the fixed and variable costs will be earned back. If the turnover is lower than the total costs, it’s a loss. Everything over this critical point can be booked as profit. Formula In order to calculate the Break Even Point within the Break Even Analysis, you need certain data, namely the fixed costs, the selling price of the product and the variable costs per product. The Break Even Point is determined by the moment when the fixed costs have been earned back. That only happens because of the so-called contribution margin; the selling price minus the variable costs. When the fixed costs are divided by the contribution margin, you get the Break-Even Point. Break Even Point = fixed costs / ( selling price – variable costs ) Break Even Analysis advantages The main advantage of a Break-Even Point is that it explains the relationship between costs, production volume and revenue. This analysis can be expanded to show how the changes between fixed and changing cost relations will affect profit levels and the Break-Even Point in for instance product prices or turnovers. The Break Even Analysis is particularly useful when it is combined with partial budgeting techniques. The most important advantage to using the method is that it shows the minimally required amount of economic activity, necessary to prevent potential losses. Furthermore, based on the BreakEven Point formula, it’s easy to make additional calculations that provide insight into the profitability of the investment. https://www.toolshero.com/financial-management/break-even-analysis/ Breakeven Point (BEP) Computation Methods/Approaches a) Algebra Method = BEP Peso Sales = Fixed Costs + Variable Costs BEP Sales Volume = BEP Peso Sales/Unit Selling Price or Unit SP = FC + Variable rate b) Contribution Margin (CM) = BEP Peso Sales = Fixed Cost/CM % = BEP Sales Volume = Fixed Cost/CM per Unit Example where Total Fixed Costs amounted to P20,000; the Variable Rate is P3, and Unit Selling Price is P4. Relevant range 0 to 40,000 units Algebra Method Let X = BEP Peso Sales X = FC + VC X = P20,000 + ( P3/P4 X) X = P20,000 + .75 X X - .75X = P20,000 .25X = P20,000 X = P20,000/.25 X = P80,000 Let X = BEP Sales Volume X = BEP Peso Sales/Unit SP X = P80,000/P4 X = 20,000 units Or 4X = P20,000 + 3X 4X -3X = P20,000 X = 20,000 units Using the preceding example where Total Fixed Costs amounted to P20,000; the Variable Rate is P3, and Unit Selling Price is P4. Contribution Margin (CM) Approach CM per unit = Unit Selling Price – Unit Variable Cost = P4 – P3 = P1 CM % = CM per unit/Unit Selling Price = P1/P4 = 0.25 or 25% BEP Peso Sales = Fixed Cost/CM % = P20,000/0.25 = P80,000 BEP Sales Volume = Fixed Cost/CM per Unit Or Fixed Cost/ Unit Selling Price – Variable Cost = P20,000/1 = 20,000 units Or P20,000/ P4-P3 = 20,000 units Proof: Sales (20,000 X P4) P 80,000 Less: Variable Costs (20,000 x P3) 60,000 Contribution Margin (20,000 xP1) P 20,000 Less: Fixed Costs 20,000 Net Income (Loss)/Break-even P 0 Using the preceding example where Total Fixed Costs amounted to P20,000; the Variable Rate is P3, and Unit Selling Price is P4. Sales with desired profit of P10,000 Algebra Method Let X = BEP Peso Sales X = FC + VC + P10,000 X= = P20,000 + ( P3/P4 X) + P10,000 X = P20,000 + .75 X + P10,000 X - .75X = P20,000 + P10,000 .25X = P30,000 X = P30,000/.25 X = P120,000 Let X = BEP Sales Volume X = BEP Peso Sales/Unit SP X = P120,000/P4 X = 30,000 units Or 4X = P20,000 + 3X +P10,000 4X -3X = P30,000 X = 30,000 units Homework for Friday August 31, 2018 Problem 1. Framework Co. Unit Selling Price P40 Variable Rate per Unit P32 Fixed Costs per Annum P48,000 Relevant range 0 -10,000 units Requirements: Using contribution margin method compute the following: BEP Sales Volume b. BEP Peso Sales c. Proof computation d. Plot a CVP graph e. BEP volume with desired profit of P9,000 f. BEP Peso Sales with desired profit of P 9,000 g. Proof computation. Based on the data given in problem 1 calculate the following using algebraic method: a. BEP Sales Volume b. BEP Peso Sales c. BEP volume with desired profit of P9,000 d. BEP Peso Sales with desired profit of P 9,000 Problem 2. Calculate using contribution method the break-even point in units (volume) and in sales dollars , and prepare a CVP graph when sales price per unit is $35, variable cost per unit is $28 and total fixed cost is $7,000. If My people who are called by My name will humble themselves, and pray and seek My face, and turn from their wicked ways,then I will hear from heaven, and will forgive their sin and heal their land. - 2 Chronicles 7:14