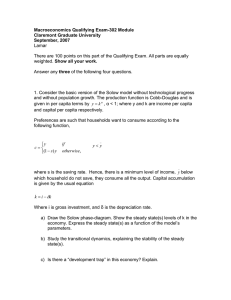

Chapter 5 The Solow Growth Model By Charles I. Jones Media Slides Created By Dave Brown Penn State University 5.1 Introduction • In this chapter, we learn: – How capital accumulates over time. – How diminishing MPK explains differences in growth rates across countries. – The principle of transition dynamics. – The limitations of capital accumulation, and how it leaves a significant part of economic growth unexplained. • The Solow Growth Model: – Builds on the production model by adding a theory of capital accumulation – Was developed in the mid-1950s by Robert Solow of MIT – Was the basis for the Nobel Prize he received in 1987 • Additions / differences with the model: – Capital stock is no longer exogenous. – Capital stock is now “endogenized.” – The accumulation of capital is a possible engine of long-run economic growth. 5.2 Setting Up the Model Production • Start with the previous production model – Add an equation describing the accumulation of capital over time. • The production function: – Cobb-Douglas – Constant returns to scale in capital and labor – Exponent of one-third on K • Variables are time subscripted (t). • Output can be used for consumption or investment. Consumption Investment Output • This is called a resource constraint. – Assuming no imports or exports Capital Accumulation • Goods invested for the future determines the accumulation of capital. • Capital accumulation equation: Next year’s capital This year’s Investment capital Depreciation rate • Depreciation rate – The amount of capital that wears out each period – Mathematically must be between 0 and 1 in this setting – Often viewed as approximately 10 percent • Change in capital stock defined as • Thus: • The change in the stock of capital is investment subtracted by the capital that depreciates in production. Case Study: An Example of Capital Accumulation • To understand capital accumulation, we must assume the economy begins with a certain amount of capital, K0. • Suppose: – The initial amount of capital is 1,000 bushels of corn. – The depreciation rate is 0.10. Labor • To keep things simple, labor demand and supply not included • The amount of labor in the economy is given exogenously at a constant level. Investment • Farmers eat a fraction of output and invest the rest. Fraction Invested • Therefore: – Consumption is the share of output we don’t invest. Case Study: Some Questions about the Solow Model • Differences between Solow model and production model in previous chapter: – Dynamics of capital accumulation added – Left out capital and labor markets, along with their prices • Why include the investment share but not the consumption share? – No need to—it would be redundant – Preserve five equations and five unknowns • Stock – A quantity that survives from period to period. • tractor, house, factory • Flow – A quantity that lasts a single period • meals consumed, withdrawal from ATM • A change in stock is a flow of investment. 5.3 Prices and the Real Interest Rate • If we added equations for the wage and rental price, the following would occur: – The MPL and the MPK would pin them. – Omitting them changes nothing. • The real interest rate - The amount a person can earn by saving one unit of output for a year - Or, the amount a person must pay to borrow one unit of output for a year - Measured in constant dollars, not in nominal dollars • Saving – The difference between income and consumption – Is equal to investment A unit of investment becomes a unit of capital • - The return on saving must equal the rental price of capital. • Thus: - The real interest rate equals the rental price of capital which equals the MPK. 5.4 Solving the Solow Model • The model needs to be solved at every point in time, which cannot be done algebraically. • Two ways to make progress – Show a graphical solution – Solve the model in the long run • We can start by combining equations to go as far as we can with algebra. • Combine the investment allocation and capital accumulation equation. Depreciation Investment • Substitute the fixed amount of labor into the production function. • We have reduced the system into two equations and two unknowns (Yt, Kt). • The Solow Diagram – Plots the two terms that govern the change in the capital stock – New investment looks like the production functions previously graphed but scaled down by the investment rate. Using the Solow Diagram • If the amount of investment is greater than the amount of depreciation: – The capital stock will increase until investment equals depreciation. • here, the change in capital is equal to 0 • the capital stock will stay at this value of capital forever • this is called the steady state • If depreciation is greater than investment, the economy converges to the same steady state as above. • Notes about the dynamics of the model: – When not in the steady state, the economy exhibits a movement of capital toward the steady state. – At the rest point of the economy, all endogenous variables are steady. – Transition dynamics take the economy from its initial level of capital to the steady state. Output and Consumption in the Solow Diagram • As K moves to its steady state by transition dynamics, output will also move to its steady state. • Consumption can also be seen in the diagram since it is the difference between output and investment. Solving Mathematically for the Steady State • In the steady state, investment equals depreciation. • Sub into the production function • Solve for K* • The steady-state level of capital is – Positively related with the • investment rate • the size of the workforce • the productivity of the economy – Negatively correlated with • the depreciation rate • Plug K* into the production function to get Y*. • Plug in our solved value of K*. • Higher steady-state production – Caused by higher productivity and investment rate • Lower steady-state production – Caused by faster depreciation • Finally, divide both sides of the last equation by labor to get output per person (y) in the steady state. • Note the exponent on productivity is different here (3/2) than in the production model (1). – Higher productivity has additional effects in the Solow model by leading the economy to accumulate more capital. 5.5 Looking at Data through the Lens of the Solow Model The Capital-Output Ratio • Recall the steady state. • The capital to output ratio is the ratio of the investment rate to the depreciation rate: • Investment rates vary across countries. • It is assumed that the depreciation rate is relatively constant. Differences in Y/L • The Solow model gives more weight to TFP in explaining per capita output than the production model. • We can use this formula to understand why some countries are so much richer. • Take the ratio of y* for two countries and assume the depreciation rate is the same: From Chapter 4 See figure 5.3 (next slide) • We find that the factor of 108 that separates rich and poor countries’ income per capita is decomposable: – TFP differences – Investment differences 5.6 Understanding the Steady State • The economy reachs a steady state because investment has diminishing returns. – The rate at which production and investment rise is smaller as the capital stock is larger. • Also, a constant fraction of the capital stock depreciates every period. – Depreciation is not diminishing as capital increases. • Eventually, net investment is zero. – The economy rests in steady state. 5.7 Economic Growth in the Solow Model • Important result: there is no long-run economic growth in the Solow model. • In the steady state, growth stops, and all of the following are constant: – Output – Capital – Output per person – Consumption per person • Empirically, however, economies appear to continue to grow over time. – Thus, we see a drawback of the model. • According to the model: – Capital accumulation is not the engine of long-run economic growth. – After we reach the steady state, there is no long-run growth in output. – Saving and investment • are beneficial in the short-run • do not sustain long-run growth due to diminishing returns Meanwhile, Back on the Family Farm • Harvest starts with a small stock of seed. – Grows larger each year, for a time – Settles down to a constant level • Diminishing returns – A fixed number of farmers cannot harvest huge amounts of corn. – Growth eventually stops. Case Study: Population Growth in the Solow Model • Can growth in the labor force lead to overall economic growth? – It can in the aggregate. – It can’t in output per person. • The presence of diminishing returns leads capital per person and output per person to approach the steady state. – This occurs even with more workers. 5.8 Some Economic Experiments • The Solow model: – Does not explain long-run economic growth – Does help to explain some differences across countries • Economists can experiment with the model by changing parameter values. An Increase in the Investment Rate • Suppose the investment rate increases permanently for exogenous reasons. – The investment curve • rotates upward – The depreciation curve • remains unchanged – The capital stock • increases by transition dynamics to reach the new steady state • this happens because investment exceeds depreciation – The new steady state • is located to the right • investment exceeds depreciation An Increase in the Investment Rate – The capital stock • increases by transition dynamics to reach the new steady state • this happens because investment exceeds depreciation – The new steady state • is located to the right • investment exceeds depreciation • What happens to output in response to this increase in the investment rate? – The rise in investment leads capital to accumulate over time. – This higher capital causes output to rise as well. – Output increases from its initial steadystate level Y* to the new steady state Y**. A Rise in the Depreciation Rate • Suppose the depreciation rate is exogenously shocked to a higher rate. – The depreciation curve • rotates upward – The investment curve • remains unchanged – The capital stock • declines by transition dynamics until it reaches the new steady state • this happens because depreciation exceeds investment – The new steady state • is located to the left • What happens to output in response to this increase in the depreciation rate? – The decline in capital reduces output. – Output declines rapidly at first, and then gradually settles down at its new, lower steady-state level Y**. Experiments on Your Own • Try experimenting with all the parameters in the model: – Figure out which curve (if either) shifts. – Follow the transition dynamics of the Solow model. – Analyze steady-state values of capital (K*), output (Y*), and output per person (y*). Case Study: Wars and Economic Recovery • Hiroshima and Nagasaki – Returned close to their original economic position in just a few decades • Vietnam – In both villages that were bombed or left untouched, poverty, literacy, and consumption were similar 30 years after the war. • Implications of Solow growth model? 5.9 The Principle of Transition Dynamics • If an economy is below steady state – It will grow. • If an economy is above steady state. – Its growth rate will be negative. • When graphing this, a ratio scale is used. – Allows us to see that output changes more rapidly if we are further from the steady state – As the steady state is approached, growth shrinks to zero. • The principle of transition dynamics – The farther below its steady state an economy is, (in percentage terms) • the faster the economy will grow – The farther above its steady state • the slower the economy will grow – Allows us to understand why economies grow at different rates Understanding Differences in Growth Rates • Empirically, for OECD countries, transition dynamics holds: – Countries that were poor in 1960 grew quickly. – Countries that were relatively rich grew slower. • Looking at the world as whole, on average, rich and poor countries grow at the same rate. – Two implications of this: • most countries have already reached their steady states • countries are poor not because of a bad shock, but because they have parameters that yield a lower steady state Case Study: South Korea and the Philippines • South Korea – 6 percent per year – Increased from 10 percent of U.S. income to 75 percent • Philippines – 1.6 percent per year – Stayed at 10 percent of U.S. income • Transition dynamics predicts – South Korea must have been far below its steady state. – Philippines is already at steady state. • Assuming equal depreciation rates • The long-run ratio of per capita incomes depends on – The ratio of productivities (TFP levels) – The ratio of investment rates 5.10 Strengths and Weaknesses of the Solow Model • The strengths of the Solow Model: – It provides a theory that determines how rich a country is in the long run. • long run = steady state – The principle of transition dynamics • allows for an understanding of differences in growth rates across countries • a country further from the steady state will grow faster • The weaknesses of the Solow Model: – It focuses on investment and capital • the much more important factor of TFP is still unexplained – It does not explain why different countries have different investment and productivity rates. • a more complicated model could endogenize the investment rate – The model does not provide a theory of sustained long-run economic growth. Summary • The starting point for the Solow model is the production model. • The Solow model – Adds a theory of capital accumulation. – Makes the capital stock an endogenous variable • The capital stock today – Is the sum of past investments – Consists of machines and buildings that were bought over the last several decades • The goal of the Solow model is to deepen our understanding of economic growth, but in this it’s only partially successful. • The fact that capital runs into diminishing returns means that the model does not lead to sustained economic growth. • As the economy accumulates more capital – Depreciation rises one-for-one – Output and therefore investment rise less than one-for-one • because of the diminishing marginal product of capital • Eventually, the new investment is only just sufficient to offset depreciation. – The capital stock ceases to grow. – Out capital stock ceases to grow. – The economy settles down to a steady state. • The first major accomplishment of the Solow model is that it provides a successful theory of the determination of capital. – Predicts that the capital-output ratio is equal to the investment-depreciation ratio • Countries with high investment rates – Should thus have high capital-output ratios – This prediction holds up well in the data. • The second major accomplishment of the Solow model is the principle of transition dynamics. – The farther below its steady state an economy is, the faster it will grow. • Transition dynamics – Cannot explain long-run growth – Provide a nice theory of differences in growth rates across countries. • Increases in the investment rate or TFP – Increase a country’s steady-state position and growth for a number of years • In general, most poor countries have – Low TFP levels – Low investment rates, • the two key determinants of steady-state incomes • If a country maintained good fundamentals but was poor because it had received a bad shock – It would grow rapidly – This is due to the principle of transition dynamics. Additional Figures for Worked Exercises This concludes the Lecture Slide Set for Chapter 5 Macroeconomics Third Edition by Charles I. Jones W. W. Norton & Company Independent Publishers Since 1923 Additional Solow graph examples from previous editions of slides The Solow Diagram graphs these two pieces together, with Kt on the x-axis: Investment, Depreciation At this point, dKt = sYt, so Capital, Kt Suppose the economy starts at this K0: •We see that the red line is above Investment, Depreciation the green at K0 •Saving = investment is greater than depreciation •So ∆Kt > 0 because •Then since ∆Kt > 0, Kt increases from K0 to K1 > K0 K0 K1 Capital, Kt Now imagine if we start at a K0 here: Investment, Depreciation •At K0, the green line is above the red line •Saving = investment is now less than depreciation •So ∆Kt < 0 because •Then since ∆Kt < 0, Kt decreases from K0 to K1 < K0 Capital, Kt K1 K0 We call this the process of transition dynamics: Transitioning from any Kt toward the economy’s steady-state K*, where ∆Kt = 0 Investment, Depreciation No matter where we start, we’ll transition to K*! At this value of K, dKt = sYt, so K* Capital, Kt We can see what happens to output, Y, and thus to growth if we rescale the vertical axis: • Saving = investment and Investment, Depreciation, Income depreciation now appear here • Now output can be Y* graphed in the space above in the graph • We still have transition dynamics toward K* • So we also have dynamics toward a steady-state level of income, Y* K* Capital, Kt