AP Review OVER GRAPHS

advertisement

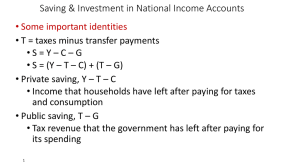

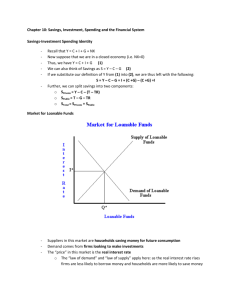

1. Production Possibilities Curve 2. Supply 3. Demand 4. Dollars market/currency 5. Money market 6. Loanable Funds 7. Phillips Curve 8. Ceiling 9. Floor 10. ADAS with SRAS and LRAS 1. 2. 3. 4. 5. 6. 7. Production Possibilities Frontier Supply and Demand Currency Market AD-AS Model Loanable Funds Model Phillips Curve Money Market 1 Production Possibilities Graph • Assumptions: – Full Employment – Fixed Resources and Technology • Movements – Along curve shows opportunity cost – Outward shift illustrates economic growth – Inward shift indicates destruction of resources • Producing Capital Goods will lead to greater economic growth than producing consumer goods. (Butter will lead to more growth than guns) Production Possibilities Graph Capital Goods Points A,B,C, are efficient pts. Point D is underutilization Point E is economic growth A May Lead to most Future economic growth E B D C Consumer Goods 2 Supply and Demand • Demand Changes when: – Income changes – Related Products, complements and substitutes, (price or quality change) – Expectations (future price change) – Consumers (more or less added) – Tastes, Fads, Preferences change Demand Increase: As Demand Increases, Price and Quantity Increase as well. Price S1 P2 P1 D2 D1 Q1 Q2 Quantity Demand Decrease: As Demand Decreases, Price and Quantity decrease as well Price S1 P1 P2 D1 D2 Q2 Q1 Quantity • Supply Changes When: – Input prices change (resources and wages) – Government (tariffs, quotas, and subsidies) – Number of sellers change – Expectations (about price and product profitability change) – Disasters (weather, strikes, etc..) Supply Increase: As Supply Increases, Quantity Increases, but Price Falls. S1 Price S2 P1 P2 D1 Q1 Q2 Quantity Supply Decrease: As Supply Decreases, Quantity Decreases, but Price Increases. S2 Price S1 P2 P1 D1 Quantity Q2 Q1 Price Floor 1. Price set above equilibrium 2. Producers produce too much 3. Consumers demand less than what is produced 4. Surplus created – Qs > Qd D S P P Surplus Qd Price Ceiling 1. Price set below equilibrium 2. Consumers demand too much 3. Producers produce too little 4. Shortage created – Qd > Qs D S P P Shortage Qs Qd Qd 3 Currency Market Currency Terms • Appreciation: Currency is increasing in demand (stronger dollar) – U.S. Currency will appreciate when • more foreigners: travel to the U.S., • buy more U.S. goods or services, or • buy the U.S. dollar to invest in bonds Currency Terms • Depreciation: Currency is decreasing in demand (weaker dollar) Being SUPPLIED in exchange for other currency. – U.S. Currency will depreciate when fewer foreigners: travel to the U.S., buy fewer U.S. goods or services, or sell the U.S. dollar to invest in their own bonds 4 AD-AS Model Aggregate Demand Downward sloping: 1. Real-Balances Effect: change in purchasing power Price Level 2. Interest-Rate Effect: Higher interest rates curtail spending 3. Foreign Purchase Effect: Substitute foreign products for U.S. products AD (C + I + G + X) Real GDP Aggregate Demand • Determinants of AD: – C + I + G + Nx – An increase in any of these will increase AD and shift the curve to the right. – A decrease in any of these will cause a decrease in AD and shift the curve to the left Aggregate Demand Determinants • Consumption – – – – Wealth Expectations Debt Taxes • Investment – Interest Rates – Expected Returns • Technology • Inventories • Taxes • Government – Change in Gov. spending • Net Exports – National Income Abroad – Exchange Rates Aggregate Supply Factors: • R: resource prices (wages and materials, as well as OIL) • A: actions by government (Taxes, Subsidies, more regulation) • P: productivity (better technology) Aggregate Supply • Short Run: – Assumes that nominal wages are “sticky” and do not respond to price level changes. – Is Upward sloping as businesses will increase output to maximize profits • Long Run: – Curve is vertical because the economy is at its fullemployment output. – As prices go up, wages have adjusted so there is no incentive to increase production. LRAS SRAS P AD Y Real GDP or Real output or Real income Recessionary Gap Inflationary Gap 5 Loanable Funds Loanable Funds Market Demand for Loanable Funds Loanable funds are used for three purposes 1. Business Investment 2. Government deficit financing 3. International Investment or lending Demand for Loanable Funds Curve The demand for loanable funds shows the relationship between the real interest rate and the quantity of loanable funds demanded. It shows that the quantity of loanable funds will be lower at a high real interest rate than at a lower real interest rate. Loanable Funds Market Supply of Loanable Funds Loanable funds come from three places 1. Private savings 2. Governmental budget surpluses 3. International borrowing Supply of Loanable Funds Curve i 6% 4% 40 60 LF Equilibrium in the Loanable Funds Market Shifts in Demand for Loanable Funds The major determinant of the demand for loanable funds is expected profit. When the expected profit changes, the demand for loanable funds changes. The greater the expected profit of new capital, the greater is the amount of investment and the greater is the demand for loanable funds. When the expected profit increases and we earn more from our investment, the more affordable it becomes to borrow loanable funds – even when the interest rate. Shifts in Supply of Loanable Funds 1. Disposable income (shifts the supply of loanable funds) 2. Wealth (shifts the supply of loanable funds) 3. Expected future income (shifts the supply of loanable funds) 4. Default risk (shifts the supply of loanable funds) 6 Phillips Curve 7 Money Market