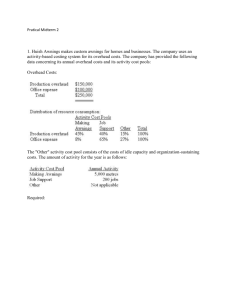

managerial accounting workbook version 1

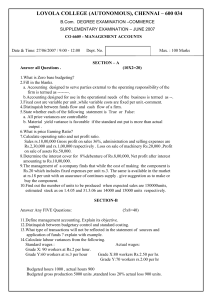

advertisement