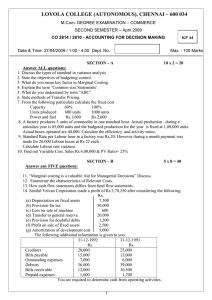

LOYOLA COLLEGE (AUTONOMOUS), CHENNAI – 600 034

advertisement

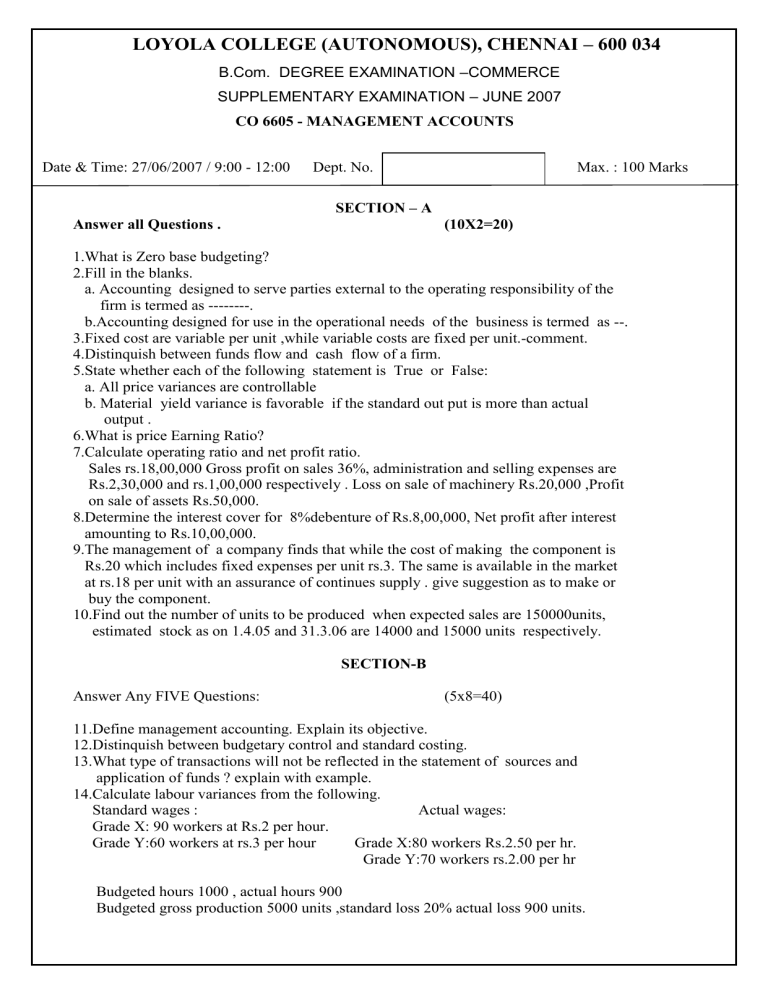

LOYOLA COLLEGE (AUTONOMOUS), CHENNAI – 600 034 B.Com. DEGREE EXAMINATION –COMMERCE SUPPLEMENTARY EXAMINATION – JUNE 2007 CO 6605 - MANAGEMENT ACCOUNTS Date & Time: 27/06/2007 / 9:00 - 12:00 Dept. No. Max. : 100 Marks SECTION – A Answer all Questions . (10X2=20) 1.What is Zero base budgeting? 2.Fill in the blanks. a. Accounting designed to serve parties external to the operating responsibility of the firm is termed as --------. b.Accounting designed for use in the operational needs of the business is termed as --. 3.Fixed cost are variable per unit ,while variable costs are fixed per unit.-comment. 4.Distinquish between funds flow and cash flow of a firm. 5.State whether each of the following statement is True or False: a. All price variances are controllable b. Material yield variance is favorable if the standard out put is more than actual output . 6.What is price Earning Ratio? 7.Calculate operating ratio and net profit ratio. Sales rs.18,00,000 Gross profit on sales 36%, administration and selling expenses are Rs.2,30,000 and rs.1,00,000 respectively . Loss on sale of machinery Rs.20,000 ,Profit on sale of assets Rs.50,000. 8.Determine the interest cover for 8%debenture of Rs.8,00,000, Net profit after interest amounting to Rs.10,00,000. 9.The management of a company finds that while the cost of making the component is Rs.20 which includes fixed expenses per unit rs.3. The same is available in the market at rs.18 per unit with an assurance of continues supply . give suggestion as to make or buy the component. 10.Find out the number of units to be produced when expected sales are 150000units, estimated stock as on 1.4.05 and 31.3.06 are 14000 and 15000 units respectively. SECTION-B Answer Any FIVE Questions: (5x8=40) 11.Define management accounting. Explain its objective. 12.Distinquish between budgetary control and standard costing. 13.What type of transactions will not be reflected in the statement of sources and application of funds ? explain with example. 14.Calculate labour variances from the following. Standard wages : Actual wages: Grade X: 90 workers at Rs.2 per hour. Grade Y:60 workers at rs.3 per hour Grade X:80 workers Rs.2.50 per hr. Grade Y:70 workers rs.2.00 per hr Budgeted hours 1000 , actual hours 900 Budgeted gross production 5000 units ,standard loss 20% actual loss 900 units. 15.Sri ltd. Manufactures two products X and Y. its sales dept. has three divisions: the sales assessment of the managers were Product; X= east-300000 units, west-600000 units and north-150000units. Product Y= east -400000 units ,west-500000 units, and north-nil Selling price X Rs.5 and Y Rs.4 in all areas. Arrangements are made for the extensive advertising of both products and it is estimated that the east division sales will increase by 150000units ,arrangements also have been made to bring sales in the north for product Y and 600000 units are expected. Sales in the west division represented unsatisfactory target ,it is agreed to increase both the estimate by 20%. Prepare a sales budget for the next period. 16. From the following ,find the most profitable product mix assuming that the Direct Labour hours , the key factor is limited to 18,600 hours. Products A B C Selling price per unit(Rs.) 60 55 50 Requirement per unit; Direct material 5kg 3kg 4kg Direct Labour 4hrs 3hrs 2hrs Variable overhead Rs.7 Rs.13 Rs.8 Cost of direct material per kg Rs.4 Rs.4 Rs.4 Direct Labour rate Rs.2 Rs.2 Rs.2 Maximum possible units of sale 4000 5000 1500 All three products are produced from the same direct material using the same type of machine and Labour. 17. Following is the balance sheet of mic ltd .as at 31st march 2006. Liabilities Rs. Assets Rs. Equity share capital 2,00,000 cash at bank 18,000 10%pref. share capital 2,00,000 Bills receivable 60,000 8% Debenture 80,000 short term investment40,000 9%public debts 40,000 Debtors 1,40,000 Bank overdraft 80,000 stock 80,000 Creditors 1,34,000 furniture 60,000 Proposed dividend 20,000 machinery 6,40,000 Reserves 3,00,000 goodwill 70,000 Provision for tax 40,000 preliminary expenses 20,000 Profit / loss a/c 40,000 --------------------11,34,000 11,34,000 ---------------------Comment on the financial position of the above co. by determining solvency ratios. 18. The following are the comparative balance sheet of xy ltd.as on 31-3-98&99 Liabilities 1998 1999 Assets 1998 1999 Share capital 3,50,000 3,70,000 land 1,00,000 1,50,000 Profit /loss a/c 50,400 52,800 stocks 2,46,000 2,13,500 9%debenture 60,000 30,000 goodwill 50,000 25,000 Creditors 51,600 59,200 cash 45,000 39,000 Debtors 71,000 84,500 --------------------------------------------5,12,000 5,12,000 5,12,000 5,12,000 --------------------------------------------2 Dividends declared and paid during the year Rs.17,500 Land was revalued at Rs.1,50,00 and the profit on revaluation credited to profit/loss a/c. Prepare cash flow statement as per AS3. SECTION-C Answer any two questions: (2x20=40) 19.Following are the summarized balance sheets of Airland co ltd.as as on 31.12.05&06 Liabilities 2005 2006 Assets 2005 2006 Eq share capital 3,00,000 3,00,000 Cash at bank 24,000 27,000 General reserve 64,200 78,000 Building 1,40,400 1,35,000 Profit /loss a/c 51,000 48,000 Investment 30,000 33,750 Creditors 29,250 19,140 Goodwill 39,000 39,000 Provision for debts 3,000 3,600 Stock 90,000 84,000 Provision for 57,000 63,000 Debtors 66,000 66,000 taxation prepaid expenses 210 900 Machinery 1,14,840 1,26090 ---------- ------------------- --------5,04,450 5,11,740 5,04,450 5,11,740 ------------ ----------------------------------a. Additional machinery was purchased in 1st June 2006 for Rs.15,000 b. An interim dividend of Rs.15,000 was paid in sep.2006 for Rs.15,000 c. Investment (cost Rs.15,000) was sold in 2006 for Rs.14,400 and an another investment was made for Rs.18,750. d. Income tax Rs.54,000 was paid during the year. You are required to prepare a statement showing sources and application of funds. Show all the workings that are part of the answer. 20.A Manufacturing is operating at 75% of normal capacity . It is proposed to offer a price reduction of 5% to 10% depending upon the sales volume desired. Given below are the relevant data. Capacity 75% 85% 100% Output in units 75,000 85,000 1,00,000 Selling price per unit Rs. 96 5%off 10%off Material cost per unitRs. 40 10%less 15%less Wages per unit Rs. 10 10 10 Fixed overhead: Production overhead Rs. 14,00,000 Selling & adm overhead 5,00,000 Variable production overhead:……………………………Rs.14,00,000 Variable selling and adm. Overhead………………………Rs.4,40,000 Prepare a budget to show profit/loss at each level of output and also compute variable and fixed cost per unit at different levels of operation and indicate which of the three level is most profitable. 3 21.From the following information ,you are required to prepare a balance sheet. Current Ratio 1.75 Liquid ratio 1.25 Stock turn over ratio (cost of sales/closing stock) 9 Gross profit ratio 25% Debt collection period 1.5 months Reserves and surplus to capital 0.20 Turn over to fixed assets ( on cost of sales) 1.2 Capital gearing ratio 0.60 Fixed assets to net worth 1.25 Sales for the year Rs.12,00,000 ************** 4