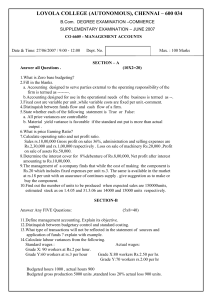

managerial accounting workbook version 1

advertisement