ad valorem tax3

advertisement

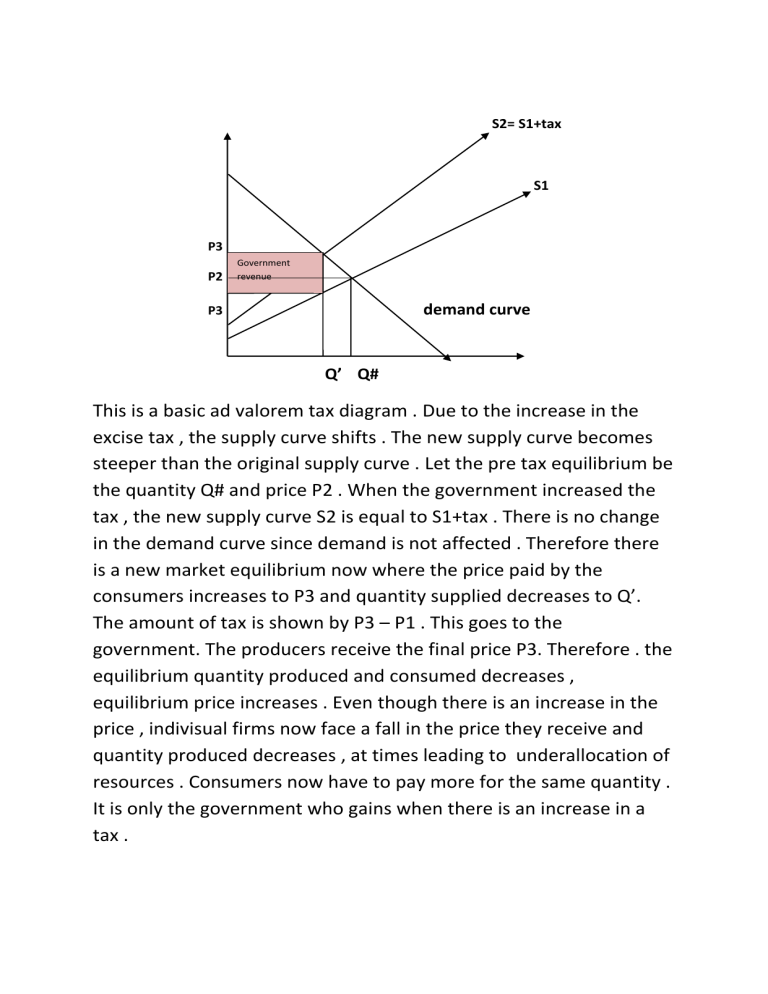

S2= S1+tax S1 P3 P2 Government revenue demand curve P3 Q’ Q# This is a basic ad valorem tax diagram . Due to the increase in the excise tax , the supply curve shifts . The new supply curve becomes steeper than the original supply curve . Let the pre tax equilibrium be the quantity Q# and price P2 . When the government increased the tax , the new supply curve S2 is equal to S1+tax . There is no change in the demand curve since demand is not affected . Therefore there is a new market equilibrium now where the price paid by the consumers increases to P3 and quantity supplied decreases to Q’. The amount of tax is shown by P3 – P1 . This goes to the government. The producers receive the final price P3. Therefore . the equilibrium quantity produced and consumed decreases , equilibrium price increases . Even though there is an increase in the price , indivisual firms now face a fall in the price they receive and quantity produced decreases , at times leading to underallocation of resources . Consumers now have to pay more for the same quantity . It is only the government who gains when there is an increase in a tax . It may not be a healthy idea when we say that government can increase their revenue without raising taxes . It may not be possible . Instead the consumers can switch to other alternatives and use cycles for short distances and use public transport . These solutions help prevent pollution too . Petrol and diesel are non renewable fuels . We need to conserve them for our future generations . Also an increase in the economy of the country will help overcome this problem . We , the citizens of India can work together and increase the economy of the country .