You AF22

advertisement

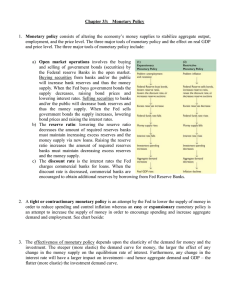

01/10/2019 Study note for AF 22 1. Key concepts and Terms a. Asset stock equilibrium: When the asset demands are put together with the asset supplies, financial equilibrium is attained. b. contractionary monetary policy: reinforce mechanism – supply declares – home currency appreciate c. Demand for money: not mean the demand for “income” or “wealth.” Rather, it refers to the desire to hold wealth in the form of money balances d. domestic reserves: loans and security holdings by the central bank, called domestic credit issued by the central bank or domestic reserves e. Efficient exchange market: If E(e) is equal to efwd in practice—an extremely difficult hypothesis to test because of the empirical problem of ascertaining expectations f. Excess demand for money: lead and will be eliminated by contractionary monetary policy. g. excess supply of money: lead and will be eliminated by expansionary monetary policy h. Exchange rate overshooting: “Overshooting” occurs when, in moving from one equilibrium to another, the exchange rate goes beyond the new equilibrium but then returns to it. i. expansionary monetary policy: raise prices and has increase the exchange rate j. incipient BOP deficit: money supply increase under a flexible rate leads to an incipient BOP deficit k. Incipient BOP surplus: spending is reduced on goods and services, and financial assets are sold to acquire larger cash balances. l. International reserves: International reserves are any kind of reserve funds, which central banks can pass among themselves, internationally. m. Monetary approach to the balance of payments: emphasizes that a country’s balance of payments, while reflecting real factors such as income, tastes, or factor productivity, is essentially a monetary phenomenon. n. Monetary approach to the exchange rate: With a flexible exchange rate, BOP deficits and surpluses will be eliminated by changes in the rate, but we need to examine the exchange rate changes in the context of money supply and demand. o. Monetary base: The sum of reserves held by banks plus currency outside banks (BR + C) p. Money multiplier: The money multiplier reflects the process of multiple expansion of bank deposits. q. Portfolio balance (or asset market) approach: changes in a country’s BOP position or exchange rate reflect changes in the relative demands and supplies of domestic and foreign financial assets. r. Rational expectations transactions demand for money: The relationship between Y and L is expected to be positive. 2. Issue/dilemmas a. RELATIONSHIPS BETWEEN MONETARY CONCEPTS IN THE UNITED STATES i. Average reserves of all depository institutions in the United States at the end of December 2014 were $2,574.8 billion. ii. On the liabilities side of the balance sheet, we see that banks and other depository institutions held $2,378.0 billion on deposit at the Federal Reserve. iii. The policy actions that were taken by the Federal Reserve to address the global financial crisis and the slow recovery from it resulted in some significant changes to its balance sheet 3. A analytical framework/technical tools a. Balance Sheet, Federal Reserve Banks b. Expected Inflation Rate c. Monetary Equilibrium and the Balance of Payments d. A Two-Country Framework e. Asset Demand i. ii. id = if + xa – RP iii. xa = E(e) /e e = E(e)/ e – 1 iv. L = f(id, if, xa, Yd, Pd, Wd) − − − + + + v. Bd = h(id, if, xa, Yd, Pd, W + − − − − + vi. eBf = j(id, if, xa, Yd, Pd, Wd) − + + − − + f. Portfolio Balance: Wd = Ms + Bh + eBo g. h. Portfolio Adjustments i. Asset Market Equilibrium in the Dornbusch Mode j. Adjustment to an Increase in the Money Supply in the Dornbusch Model 4. Source www.federalreserve.gov Who’s Who in Economics: A Biographical Dictionary of Major Economists Alternative Solutions to Developing-Country Debt Problems Globalization and Its Challenges