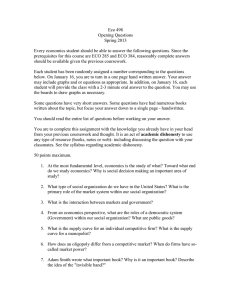

Copy of HL Economics Notes

advertisement