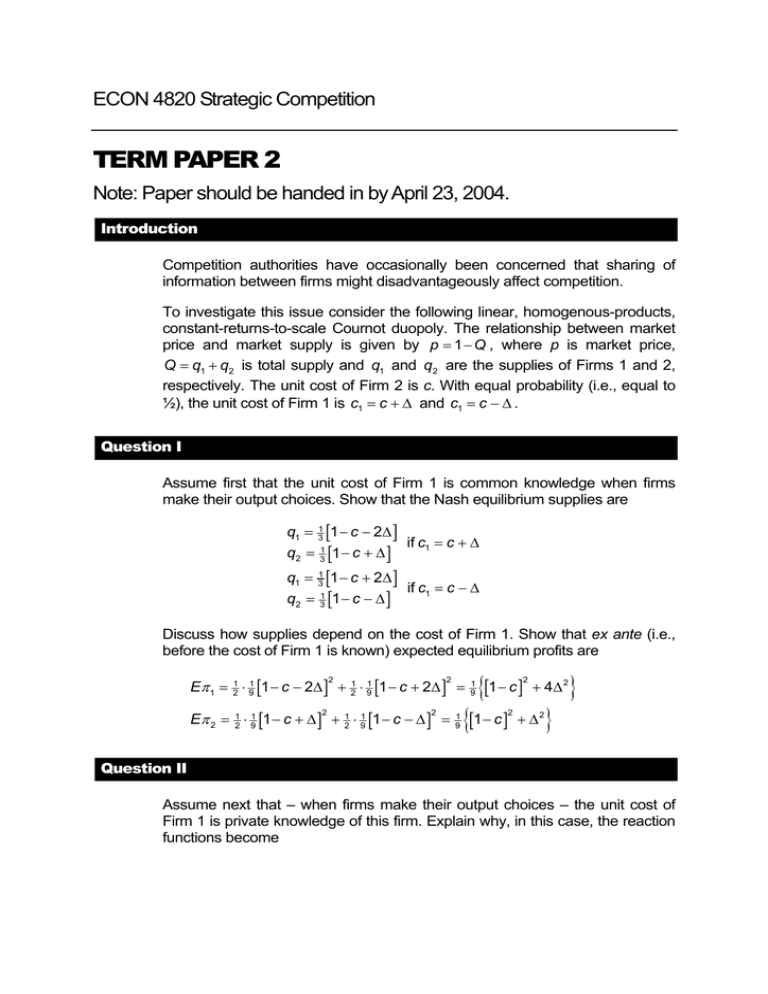

TERM PAPER 2 ECON 4820 Strategic Competition

advertisement

ECON 4820 Strategic Competition

TERM PAPER 2

Note: Paper should be handed in by April 23, 2004.

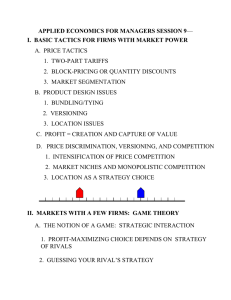

Introduction

Competition authorities have occasionally been concerned that sharing of

information between firms might disadvantageously affect competition.

To investigate this issue consider the following linear, homogenous-products,

constant-returns-to-scale Cournot duopoly. The relationship between market

price and market supply is given by p = 1 − Q , where p is market price,

Q = q1 + q2 is total supply and q1 and q2 are the supplies of Firms 1 and 2,

respectively. The unit cost of Firm 2 is c. With equal probability (i.e., equal to

½), the unit cost of Firm 1 is c1 = c + ∆ and c1 = c − ∆ .

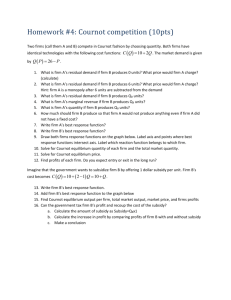

Question I

Assume first that the unit cost of Firm 1 is common knowledge when firms

make their output choices. Show that the Nash equilibrium supplies are

q1 = 31 [1 − c − 2∆ ]

if c1 = c + ∆

q2 = 31 [1 − c + ∆ ]

q1 = 31 [1 − c + 2∆ ]

if c1 = c − ∆

q2 = 31 [1 − c − ∆ ]

Discuss how supplies depend on the cost of Firm 1. Show that ex ante (i.e.,

before the cost of Firm 1 is known) expected equilibrium profits are

{[1− c ] + 4∆ }

{[1− c ] + ∆ }

Eπ 1 = 21 ⋅ 91 [1 − c − 2∆ ] + 21 ⋅ 91 [1 − c + 2∆ ] =

2

2

Eπ 2 = 21 ⋅ 91 [1 − c + ∆ ] + 21 ⋅ 91 [1 − c − ∆ ] =

2

2

1

9

2

1

9

2

2

2

Question II

Assume next that – when firms make their output choices – the unit cost of

Firm 1 is private knowledge of this firm. Explain why, in this case, the reaction

functions become

1

⎪⎧ 2 [1 − q2 − c − ∆ ] if c1 = c + ∆

q1(q2 ) = ⎨ 1

⎪⎩ 2 [1 − q2 − c + ∆ ] if c1 = c − ∆

q2 (Eq1 ) = 21 [1 − Eq1 − c ]

while equilibrium supplies are

q1 = 31 ⎣⎡1 − c − 32 ∆ ⎦⎤

if c1 = c + ∆

q2 = 31 [1 − c ]

q1 = 31 ⎡⎣1 − c + 32 ∆ ⎤⎦

if c1 = c − ∆

q2 = 31 [1 − c ]

Discuss how supplies depend on the cost of Firm 1. Compare with the fullinformation case above. Show that ex ante expected profits are

Eπ 1 =

1

9

{[1− c ] + ∆ }

Eπ 2 =

1

9

[1 − c ]

2

9

4

2

2

Question III

Comparing the two cases above, explain why firms – if they could commit to

such an agreement before any information about Firm 1’s cost is known –

would agree to share information about costs. Discuss the implications for

consumers of such an agreement.

Question IV

The above analysis was based on the assumption of Cournot competition.

Discuss how the results would change if, instead, Bertrand competition was

assumed.

Question V

Lastly, discuss other issues that may be relevant with regard to the question of

whether or not information sharing between firms should be allowed.

2