AP Macroeconomics: Aggregate Demand & Supply Notes

advertisement

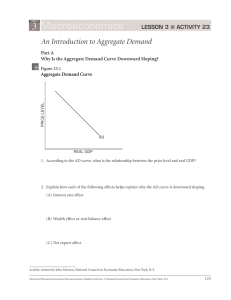

AP Macroeconomics – UNIT 3 Aggregate Demand and Aggregate Supply; Fluctuations of Output & Prices AP Exam Significance Students must understand t he graphs used in this unit. Students will be required to interpret, use, and draw graphs. This is the most difficult material you will encounter in this macroeconomics course. Aggregate Demand • Downward sloping aggregate demand curve is explained by: 1) The Wealth Effect 2) The Income Effect 3) The Foreign Purchases Effect AD is downward sloping because a change in the price level changes the purchasing power of money held by the public. • • The Aggregate Demand Curve is the relationship between the level of prices and the quantity of real GDP demanded. The Determinants of AD 1) Changes in Consumer Spending • Changes in money supply • Changes in taxes • Demand for goods and services • Foreign income and business confidence 2) Changes in Investment Spending 3) Changes in Government Spending 4) Changes in Net Export Spending The aggregate demand curve simply describes the demand for total GDP at different price levels. Factors That Increase AD Decreases in Taxes Increase in Government Spending Increase in money supply Factors That Decrease AD Increase in taxes Decrease in Government Spending Decrease in money supply Aggregate Supply Simple AS curve will consist of upward sloping SRAS Curve and the vertical LRAS Curve. Aggregate Supply curve is divided into three ranges: • • 1. Keynesian Range (horizontal) 2. Upward Sloping or Intermediate Range 3. Classical Range (vertical) • The Aggregate Supply Curve is the relationship between the level of prices and the quantity of output supplied. • Determinants of AS 1. 2. 3. 4. Changes in Input Prices Changes in Productivity Changes in the Legal Institutional Environment Changes in the Quantity of Available Resources Aggregate Supply Horizontal Range Vertical Range When there are a lot of unemployed resources; a recession or depression. When real GDP is at a level with unemployment below the full-employment level where any increase in demand will result only in an increase in prices. Intermediate Range Resources are getting closer to full-employment levels, which creates upward pressure on wages and prices. Macroeconomics Short Run in Macroeconomics Period of time that prices do not change very much. Long Run in Macroeconomics Reflects the idea that in the long run, output is determined solely by factors of production. Differences Between SRAS and LRAS Short Run Aggregate Supply An aggregate supply curve relevant to a time period in which input prices (particularly nominal wages) do not change in response to changes in price level. Long Run Aggregate Supply The aggregate supply curve associated with a time period in which input prices (especially nominal wages) are fully responsive to changes in price level. Sticky Prices and Their Macroeconomic Consequences Normally, the price system coordinates what goes on in an economy: Who does what? What resources to use? How much to make? From whom to buy? Sticky Prices Prices do not adjust immediately; they are sometimes “sticky”. Wages adjust slowly. Therefore, prices also adjust slowly. Price Stickiness Requires alternative rules to coordinate economic activity: Workers and firms let demand determine the level of output in the short run. Firms often negotiate long-term contracts (with both suppliers and laborers) that set prices in the short run and allow output to fluctuate. Summary of Classical/Keynesian Thinking • Classical theory dominated US economic thought and policy up to the Great Depression. • Keynesian thought has dominated since. • Think about changes in the level of government involvement. Keynesian Income-Expenditure Model • been replaced with AD/AS Model • LIMITATION: Keynesian is a fixed price model thus it cannot show changes in price level. • BENEFIT: You can clearly see the effects of changes (precision) in consumption, investment, and government expenditures on the equilibrium level of income. Disposable Income • Income that people have to spend or save after personal taxes are subtracted from personal income. DI = PI – PIT • Keynesian Belief is that consumption rises more slowly than income as disposable income increases. • Consumers have a tendency to consume less than they can from disposable income they receive and this affects society’s ability to control the levels of its output, employment, and prices. Marginal Propensity to Consume (MPC) • Fraction by which consumers change their consumption as their disposable income changes. • MPC = Change in Consumption / Change in Income • We can also examine spending habits by studying saving habits, MPC can be examined through MPS • Marginal Propensity to Save (MPS) o MPS = Change in Saving / Change in Income Income Expenditure Model • Keynesian Theory of Consumption • Belief that real disposable income is most important determinant of consumption in the short run. • Consumption Function (Savings Function) o What might cause the consumption function to shift? Change in Level of Consumption 1. Wealth 2. Price Level 3. Consumer Debt 4. Consumer Expectations 5. Taxation • 45 degree Reference Line – all points show where consumption spending is equal to disposable income Dissaving • Spending that is greater than income. It can come from already accumulated savings or it can be borrowed. Autonomous Consumption • Part of consumption that does not depend on income. • The minimum level of consumption that would still exist if a consumer had no income. Induced Consumption • Part of consumption that does depend on income. Recessionary Gap • The amount by which AE at FE GDP fall short of those required to achieve FE GDP. • Insufficient total spending contracts the economy. Inflationary Gap • The amount by which an economy’s AE at the FE GDP exceed those just necessary to achieve the FE GDP. Investment Function • Instability • What determines the level of investment spending? o Expected Rate of Profit (driven by profit motive) o Real Interest Rates (Financial cost of borrowing money) Multiplier 1 / (1 – MPC) Spending Behavior 1 / MPS Savings Behavior