Macroeconomic theory and policy

advertisement

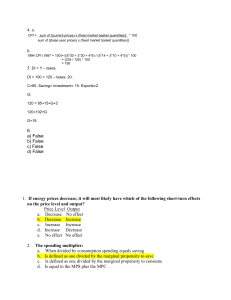

Previous model of economy consisted of households, firms, government and foreign sector. Prices, wages and interest rates fixed & output determined by aggregate demand. Similar to S & D. AD/AS deals with economy as a whole, NOT individual markets. AD-AS General price level ( as measured by CPI) Supply and Demand Price of particular good/service Total production of goods and services Quantity of a particular good or service. Equilibrium AD AS curve indicates price levellevels (P0) & ofreal output totalproduction/income expenditure which will (or be Vertical axis: general price levellevels. (P). (Y). Horizontal axes: total production/income aggregate (Ysupplied ): point demand) where at different at AD various & price AS intersect. price levels. 0 Aggregate demand = C + I + G + X - Z consumption spending by households (C) investment spending by firms (I) government spending (G) exports (X) minus imports (Z). 2 important questions regarding the aggregate demand curve: • Why does AD curve slope downwards? • What determines the position of the AD curve? 3 main reasons for why AD curve slopes downward… a) The wealth effect • When prices fall, real value of money increases • Real value assets increases • Real wealth of households increases. • Encourages households to spend more → consumption spending (C) and thus AD increase. b) The interest rate effect • Price level falls → • less money demanded → • decline in interest rates → • increased investment spending (I) → • Increased quantity of goods and services demanded → aggregate spending increase. c) The international trade effect • Fall in price level → • decline in interest rates → • increased outflow of capital in pursuit of higher interest rates → • greater demand for foreign currency (lower demand for the rand) → • depreciation of R → • weaker rand boosts exports (X) slows imports (Z) → • increase in demand for domestic goods and services demanded → • increase in AD. 13244 All non-price determinants of C, I, G, X and Z affect the position of the AD Changes will result in a shift of the curve. • Quantity supplied LR independent of the price level → LRAS vertical. • Total production in LR depends on quantity & quality (productivity) of FOP. • LR output AKA potential, full-employment output or natural rate of output. • Changes in availability and productivity FOP will shift LRAS curve.