explanatory memorandum to the waste batteries

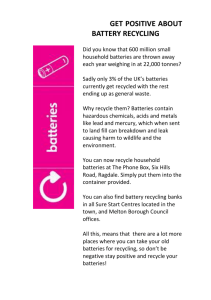

advertisement