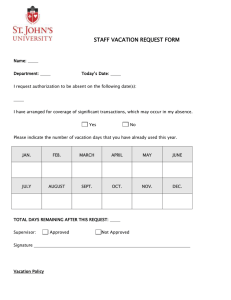

Vacation policy for employees who are eligible for the "core" benefit

advertisement

Vacation policy Updated: January 2004 This vacation policy applies to employees who are eligible for the “core” benefit program. The core program applies to the majority of benefits – eligible full-time, part-time, term contract and temporary employees of BP who are on U.S. dollar payrolls. This vacation policy does not apply to certain groups of employees, such as at-site retail employees, hourly employees of Amoco Fabrics and Fibers Company, heritage Castrol employees on BP payroll prior to January 1, 2003, and members of a collective bargaining unit who have elected not to adopt this vacation policy. Vacation benefits for those employees who are not covered by this vacation policy will be in accordance with their employers’ vacation policies as described in their published policies. 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 1 Eligibility Vacation benefits for newly hired employees Vacation benefits schedule Vacation benefits available to experienced new hires Reduction in vacation benefits Timing and sse of vacation benefits Pay during vacation Holiday during vacation Vacation benefits while on short-term disability Vacation benefits not used by year end Payment of vacation benefits due to termination of employment Employees on unpaid leave status as of December 31 whose employment Is not terminating Expatriates/local practices Eligibility An employee will be eligible for the vacation benefits described in this policy only if he/she is a full-time, temporary, term contract, or part-time employee and only if he/she fulfills the eligibility requirements set forth below. (a) Full-time, temporary, or term contract employees are eligible for vacation benefits on January 1 of each calendar year in accordance with the vacation benefits schedule set forth in Section 3 but subject to the provisions in Section 2 on vacation benefits for newly hired employees. (b) Part-time employees working at least 20 hours per week are eligible for vacation benefits on January 1 of each calendar year in accordance with the vacation benefits schedule set forth in Section 3 but subject to the provisions in Section 2 on vacation benefits for newly hired employees. Part-time employees are eligible for the same number of weeks of vacation benefits as reflected in the vacation benefits schedule; however, a week of vacation benefits for a part-time employee is based on the normal number of hours per week that the part-time employee is scheduled to work as of December 31 of the previous calendar year. Example: A part-time employee with two years of credited service whose normally scheduled work week is 30 hours per week as of December 31, 1999 will be eligible for two 30-hour weeks of vacation or 60 total hours of vacation as of January 1, 2000. 1 Note: An employee with part-time status as of December 31 will qualify for vacation benefits to be used in the following calendar year based on the normal number of hours per week that the part-time employee is scheduled to work as of December 31. In the event that an employee changes his/her schedule of the normal number of hours to be worked each week and/or changes to full-time status during the year in which the vacation benefits are being used, the vacation benefits that are available to be used during that year remain based on the normal number of hours per week that the part-time employee is scheduled to work as of December 31 of the previous calendar year. This is because the vacation benefits that an employee is eligible to use each year are based on the employee’s normal work schedule as of December 31 of the previous calendar year. (c) Full-time, temporary, term contract, or part-time employees must continue to have the status of full-time, temporary, term contract, or part-time employees as of December 31 of each calendar year to qualify for vacation benefits to be used in the following calendar year. In addition, the employee must be in active pay status (i.e., actively at work, on vacation, on an excused absence with pay, or receiving short-term disability benefits for a work-related or non-work-related illness or injury) as of December 31 of each calendar year to qualify for vacation benefits to be used in the following calendar year. Employees who are on unpaid leave status (i.e., on unpaid suspension, on any unpaid leave of absence, or in any other unpaid status) as of December 31 of a calendar year will qualify for vacation benefits to be used in the following calendar year only upon their return to active pay status. > back to contents 2 Vacation benefits for newly hired employees Full-time, temporary, term contract, or part-time newly hired employees will be eligible to use two weeks of vacation benefits at the point in time when they have both completed six months of credited service and crossed into a new calendar year. Once the employee is eligible to use these vacation benefits, the vacation benefits must be used by the end of the current calendar year. On January 1 of the following calendar year, the employee will be eligible for vacation benefits in accordance with the vacation benefits schedule set forth in Section 3. In the event that a newly hired employee completes six months of credited service prior to crossing into a new calendar year, the employee will be eligible to use one week of vacation benefits as of the completion of six months of credited service. Once the employee is eligible to use these vacation benefits, the vacation benefits must be used by the end of the current calendar year. However, if the completion of six months of credited service will occur at any time during the month of December, the employee will be allowed to use the vacation benefits beginning on December 1 of the current calendar year. On January 1 of the following calendar year, the employee will be eligible for vacation benefits in accordance with the vacation benefits schedule set forth in Section 3. For newly hired part-time employees, a week of vacation benefits is based on the normal number of hours per week that the part-time employee is scheduled to work as of the date that the part-time employee completes six months of credited service, as is described generally in Section 1(b). > back to contents 3 Vacation benefits schedule The vacation benefits set out below are described in hours and weeks based on an employee working a traditional full-time five-day per week eight-hour per day schedule. An employee who works an alternative schedule, such as a 9/80 compressed work week or a 4/12 work schedule, may have benefits that differ but are comparable – as determined by the Company – to those set out below. 2 Vacation benefits for full-time, temporary, term contract, and part-time employees are determined by the length of an employee’s Company credited service as shown in the following schedule: Company Credited Service Annual Vacation Benefits 1 through 4 years* 80 hours/2 weeks 5 through 9 years 120 hours/3 weeks 10 through 19 years 160 hours/4 weeks 20 through 29 years 200 hours/5 weeks 30 or more years 240 hours/6 weeks *Subject to the provisions in Section 2 on vacation benefits for newly hired employees. Note: As noted above, the hours of vacation benefits as reflected in this schedule assume that an employee is working a traditional full-time five-day per week eight-hour per day schedule. As discussed in Section 1(b), part-time employees are eligible for the same number of weeks of vacation benefits as reflected in this schedule; however, the hours of vacation benefits as reflected in this schedule must be adjusted for part-time employees to reflect the normal number of hours per week that the part-time employee is scheduled to work as of December 31 of the previous calendar year. Example: A part-time employee with two years of credited service whose normally scheduled work week is 30 hours per week as of December 31, 1999 will be eligible for two 30-hour weeks of vacation or 60 total hours of vacation as of January 1, 2000. For the years in which an employee will reach his/her 5th, 10th, 20th, or 30th service anniversary and will be entitled to increased vacation benefits as set forth in the schedule above, the employee does not have to wait until the actual anniversary date to qualify for the additional vacation benefits. The employee is eligible to use the additional vacation benefits on January 1 of the year in which he/she will reach the applicable service anniversary. > back to contents 4 Vacation benefits available to experienced new hires In order to enhance the Company’s ability to recruit experienced new hires, additional vacation benefits may be granted to new full-time, temporary, term contract, or part-time employees who have the following minimum amounts of relevant work experience. (a) An experienced new hire with at least five years but less then ten years of relevant work experience may be granted one additional week of vacation benefits. An experienced new hire with at least ten years of relevant work experience may be granted two additional weeks of vacation benefits. The experienced new hire would be eligible to use these vacation benefits along with the vacation benefits as reflected in the vacation benefits schedule set forth in Section 3 (for a total of either three or four weeks, as applicable) after both completing six months of credited service and crossing into a new calendar year. As is the case with other vacation benefits for newly hired employees, if the experienced new hire completes six months of credited service prior to crossing into a new calendar year, the experienced new hire would be eligible to use one-half of his/her total vacation benefits (either one and one-half or two weeks, as applicable) during the remaining calendar year, and would then be eligible to use his/her entire vacation benefits on January 1 of the following calendar year. Relevant work experience is defined as having past work experience that is directly related and applicable to the new BP position. The hiring manager/supervisor (generally, in consultation with the HR manager or advisor) makes the determination and has the right to deny additional vacation benefits on the basis of budget, project timing requirements, or other business needs, even if the new employee has relevant work experience. 3 (b) An experienced new hire who is eligible to use one additional week of vacation benefits as the result of having five years but less than ten years of relevant work experience will be eligible for a fourth week of vacation benefits on an accelerated basis. This employee will be eligible for a fourth week of vacation benefits in the year in which he/she reaches his/her fifth BP service anniversary. (c) Experienced new hires who have additional vacation benefits due to their relevant work experience will be eligible for their fifth and sixth weeks of vacation benefits in accordance with the normal vacation benefits schedule set forth in Section 1.3. This means that the employee will be eligible for his/her fifth week of vacation benefits in the year in which he/she reaches his/her 20th BP service anniversary, and the employee will be eligible for his/her sixth week of vacation benefits in the year in which he/she reaches his/her 30th BP service anniversary. There will be no acceleration in the awarding of the fifth and sixth weeks of vacation benefits. > back to contents 5 Reduction in vacation benefits If an employee qualifies for vacation benefits in accordance with Section 1, there will be no reduction in vacation benefits for the period of time when the employee is on an excused absence with pay, receiving short-term disability benefits for a work-related or non-work-related illness or injury, on unpaid suspension, on any unpaid leave of absence, or in any other unpaid status. > back to contents 6 Timing and use of vacation benefits So that vacations will not unduly affect the efficient transaction of Company business, management reserves the right to designate the time when vacation benefits may be used, and all scheduling is subject to supervisory approval. Further, where allowed by business situations, vacation benefits may be used in increments of either a full day of vacation or a fractional day of vacation. An employee desiring to take a fractional day of vacation may work part of a day and use vacation benefits for either the beginning or remaining part of that day. However, in order to accommodate business situations, management may refuse to allow an employee to use vacation benefits in fractional days. > back to contents 7 Pay during vacation Vacation pay is based on your straight time pay for the regularly scheduled hours you would have worked during the vacation period. Vacation pay does not include overtime and/or premium pay and is not counted as working time when computing overtime hours. Vacation pay is paid through your regular paycheck cycle and is subject to normal authorized and/or required payroll deductions. > back to contents 8 Holiday during vacation If a recognized paid holiday occurs during an employee’s vacation, the employee will receive holiday pay for that day instead of vacation pay. > back to contents 4 9 Vacation benefits while on short-term disability An employee who is receiving benefits under the Short-term Disability Plan may interrupt those benefits at any time to use vacation benefits. In all cases, the Company will require that an employee receiving short-term disability benefits use all remaining vacation benefits by the end of the year, and the Company will interrupt short-term disability benefits on a date that will permit that result to occur. However, if the employee so chooses, he/she can elect to carry over one week of his/her vacation benefits as described in Section 10(a). Failure to make such an election will result in all vacation benefits being used by the end of the year. > back to contents 10 Vacation benefits not used by year end Vacation benefits are not cumulative and must be used during the calendar year with the following exceptions only: (a) An employee may carry over up to one week of vacation benefits each year for use in the following calendar year. (One week of vacation benefits will be 40 hours of vacation for employees working a traditional full-time five-day per week eight-hour per day schedule; 44 hours of vacation for employees working a 9/80 compressed work week; or 48 hours of vacation for employees working a 4/12 work schedule. For part-time employees, the total hours of vacation benefits that can be carried over will be based on the normal number of hours per week that the part-time employee is scheduled to work as of December 31 of the previous calendar year.) Vacation benefits that are carried over must be used in that following calendar year. Unused carried over vacation benefits cannot be carried over from year to year. An employee who wishes to carry over vacation benefits must make a positive election to do so during the designated annual enrollment period. Employees who work in California are not subject to a carry over maximum and all unused vacation benefits will be carried over for use in the following calendar year. (b) In the event that extraordinary circumstances arise which will prevent an employee from taking a scheduled vacation, vacation benefits in excess of one week can be deferred to the following calendar year only with the approval of the appropriate Business Unit Leader or Functional Department Manager and the respective Human Resources Manager. If such approval is obtained, the deferred vacation benefits must be used by March 15 of the following calendar year. If the vacation benefits in question are one week or less, they should be carried over in accordance with Section 10(a). Vacation benefits that were already carried over from a previous calendar year under Section 10(a) may not be deferred into another calendar year under this section. (c) Granting pay in lieu of vacation benefits will not be permitted without the approval of the appropriate Business Unit Leader or Functional Department Manager and the respective Human Resources Manager and will only be allowed when the circumstances described in Section 10(b) have occurred and deferment of vacation benefits in excess of one week will not be possible. > back to contents 11 Payment of vacation benefits due to termination of employment If an employee terminates employment due to resignation, discharge, retirement or death, vacation related payment(s) will be made as soon as administratively possible after the situation occurs that results in the payment(s). Applicable taxes will be withheld from any lump-sum payments of vacation benefits at a flat tax rate – that is, bonus rate. (a) Remaining unused ccurrent year vacation benefits. A payment will be made for any remaining vacation benefits that the employee was eligible to use in the current calendar year but which had not been used as of the effective date of the termination. This payment will include any unused vacation benefits that either the employee was eligible to use as an experienced new hire as described in Section 1.4 or were carried over from the previous calendar year as described in Section 10(a). An employee should not be allowed to 5 extend his/her termination date by using vacation benefits once he/she is no longer reporting to work. Instead, these remaining unused vacation benefits will be paid out at termination. (b) Pro rata vacation benefits. A pro rata payment for vacation benefits that the employee would have been eligible to use in the following calendar year will be made to the employee provided that the employee is in active pay status (as defined in Section 1(c)) at the time of termination. This payment will be calculated by taking 1/12 of the vacation benefits that the employee would have been eligible to use in the following calendar year and multiplying by the number of calendar months in the current calendar year in which the employee was on the Company’s payroll for at least one day in the month, even if the employee was on unpaid leave status (as defined in Section 1(c)) for part of the year. For part-time employees, in making this pro rata calculation, the hours of vacation benefits that the employee would have been eligible to use in the following calendar year will be based on the normal number of hours per week that the part-time employee is scheduled to work at the time of termination. (Note: Section 11 (c) and (d) provide information on special employment circumstances that affect the pro rata vacation benefits payments to be made at the time of termination.) (c) Pro rata vacation venefits for newly hired employees. Employees who are in active pay status (as defined in Section 1(c)) at the time of termination but who have not already completed six months of credited service (i.e., have not crossed their six-month anniversary date) will also receive a pro rata payment for vacation benefits. This payment will be calculated by taking 1/12 of the vacation benefits that the employee would have been eligible to use in the following calendar year if he/she had completed six months of credited service and multiplying by the number of calendar months since the employee’s date of hire in which the employee was on the Company’s payroll for at least one day in the month, even if the employee was on unpaid leave status (as defined in Section 1(c)) for part of that period. For part-time employees, in making this pro rata calculation, the hours of vacation benefits that the employee would have been eligible to use in the following calendar year will be based on the normal number of hours per week that the part-time employee is scheduled to work at the time of termination. Employees who have not already completed six months of credited service will not receive any payment for remaining unused current year vacation benefits as described in Section 11(a) as they have not yet become eligible to use any current year vacation benefits. (d) Pro rata vacation benefits for employees on unpaid leave status at time of termination. Employees who are on unpaid leave status (as defined in Section 1(c)) at the time of termination may be eligible for one of the following pro rata payments for vacation benefits. If the employee was on unpaid leave status as of December 31 of the previous calendar year and did not return to active pay status at any time in the current calendar year, then if the employee was in active pay status for at least one day in any month in the previous calendar year, he/she will receive a pro rata payment. This payment will be calculated by taking 1/12 of the vacation benefits that the employee would have been eligible to use in the current calendar year had the employee returned to active pay status and multiplying by the number of calendar months in the previous calendar year in which the employee was in active pay status for at least one day in the month. For part-time employees, in making this pro rata calculation, the hours of vacation benefits that the employee would have been eligible to use in the current calendar year will be based on the normal number of hours per week that the part-time employee is scheduled to work as of December 31 of the previous calendar year. If the employee was in active pay status for at least one day in any month in the current calendar year, he/she will receive a pro rata payment. This payment will be calculated by taking 1/12 of the vacation benefits that the employee would have been eligible to use in the following calendar year and multiplying by the number of calendar months in the current calendar year in which the employee was in active pay status for at least one day in the month. For part-time employees, in making this pro rata calculation, the hours of vacation benefits that the employee would have been eligible to use in the following calendar year will be based on the normal number of hours per week that the part-time employee is scheduled to work at the time of 6 termination. In addition, this employee would receive a payment for any remaining unused current year vacation benefits, as described in Section 11(a). > back to contents 12 Employees on unpaid leave status whose employment is not terminating Employees who are on unpaid leave status (as defined in Section 1(c)) as of December 31 of a given calendar year and who are not terminating employment may be eligible for one of the following vacation related payments, which will be made as soon as administratively possible after December 31 of the given calendar year. Applicable taxes will be withheld from any lump sum payments of vacation benefits at a flat tax rate – that is, bonus rate. (a) If the employee was eligible to use vacation benefits in the current calendar year, then the employee will be paid for any remaining vacation benefits that the employee was eligible to use in the current calendar year but which had not been used or carried over as described in Section 10(a) by December 31. (b) If the employee was not eligible to use vacation benefits in the current calendar year (by virtue of being on unpaid leave status as of December 31 of the previous calendar year and not returning to active pay status at any time in the current calendar year), then if the employee was in active pay status for at least one day in any month in the previous calendar year, he/she will receive a pro rata payment for vacation benefits. This payment will be calculated by taking 1/12 of the vacation benefits that the employee would have been eligible to use in the current calendar year had the employee returned to active pay status and multiplying by the number of calendar months in the previous calendar year in which the employee was in active pay status for at least one day in the month. For part-time employees, in making this pro rata calculation, the hours of vacation benefits that the employee would have been eligible to use in the current calendar year will be based on the normal number of hours per week that the part-time employee is scheduled to work as of December 31 of the previous calendar year. > back to contents 13 Expatriate/local practices The provisions of this vacation policy are intended to have general applicability to those employees who are covered by this policy. However, vacation benefits for an employee on an expatriate assignment may differ from those described in this policy. In addition, it is recognized that in certain locations, business or functional units may decide to adopt provisions for their employees that differ from some of the provisions set forth in this policy. > back to contents 7