PDF Annual Report

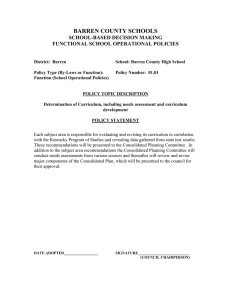

advertisement