GaN-on-Silicon Wafers: Power Electronics Industry Review

advertisement

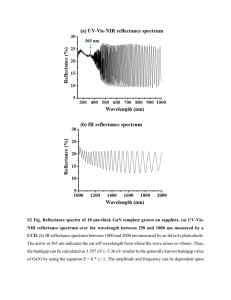

J A N U A R Y 2 0 1 2 I S S U E N ° 4 I N D U S T R Y Ramping production: EpiGaN is aiming to begin producing 6-inch GaN-on-silicon epitaxial wafers in the first quarter of 2012. (Courtesy of EpiGaN/Arnaud Collette) R E V I E W GaN-on-silicon wafers: the enabler of GaN power electronics Low cost silicon substrates have brought the first GaN devices to market. AZZURRO Semiconductors, EpiGaN, NTT Advanced Technology, Oxford Instruments Plasma Technology and Powdec discuss what remains to be done to further penetrate into the silicon-dominated power electronic world. “G aN in power semiconductors is one of the buzzwords the electronics industry, in terms of the numbers of people talking about it.” So says Chris Hodson, product manager for power semiconductors at semiconductor equipment producer Oxford Instruments Plasma Technology (OIPT), based in Yatton, UK. In fact, today it’s more than just a buzzword – it’s a commercial reality, even if the available GaN transistors are only just beginning to wrest a first small share in the power electronics market from silicon. El Segundo, California’s International Rectifier and EPC Corporation are behind the highest profile initial GaN devices, rated up to 200 V, to stake claims in this sector. And both companies’ offerings have a major underlying characteristic in common that helps make them commercially viable: they are produced starting from comparatively low cost silicon substrates. As well as keeping raw material costs to a minimum for device makers, such substrates also allow them to exploit the same tools currently used with silicon for 6 many back-end processes. This promise is attracting many other companies, creating the “buzz”. But even with the increasing popularity of GaN-on-silicon technologies, are they really the ideal solution for power electronics that they seem? What challenges remain, and can any other substrate technologies compete? The investors backing Germany’s AZZURRO Semiconductors were convinced enough in the potential of the company’s GaN-on-silicon epitaxial wafers to provide €14.5 million ($17.9 million) funding in November 2010. It used that money to establish a new site in Dresden, which it moved to from its original Magdeburg facility in summer 2011, and where it is now ramping up production to reach maximum output in summer 2012. The company also supplies epiwafers to the high-brightness LED sector, but Erwin Ysewijn, vice-president, sales and marketing, at AZZURRO noted that customers in the power electronics industry have different needs. P O W E R D e v ’ I S S U E Tokyo, Japan based NTT Advanced Technology (NTT-AT) already supplies GaN-on-silicon epitaxial wafers with breakdown voltages up to 1,800 V for RF applications. “Now we are at 6-inch, but we are developing 8-inch epiwafers,” said Takashi Kobayashi, executive engineer for the nanotechnology business unit at NTT-AT. Kobayashi noted that with breakdown voltages largely dependent on the thickness of the epilayers, this should be readily translated to power electronic applications. And while most of the company’s power electronics customers are still in development, he also emphasises that through a manufacturing collaboration with fellow Japanese company Mitsubishi Chemical, NTT-AT already has ample Expanding capability: having offered 6-inch GaN-on-silicon wafers since 2005, AZZURRO Semiconductors says 200 mm wafers should be "technically feasible" in 2012. (Courtesy of AZZURRO Semiconductors AG) “The wafers which we ship need reasonably large diameters because I don’t think that to date there is any power semiconductor maker who has any interest in 2-inch or 4-inch wafers,” Ysewijn said. “They all want 150 mm and a reasonable outlook for 200 mm and that’s what we can accommodate.” 200 mm GaN-on-silicon epiwafers from AZZURRO will be technically feasible in the first half of 2012, Ysewijn said. “Commercial shipments will depend on market requirements, which are certainly different between the LED and highvoltage market,” he noted. Hasselt, Belgium’s EpiGaN, an epiwafer producing company spun out of nearby giant semiconductor research center Imec, likewise raised €4 million ($5.1 million) from investors in July 2011. Marianne Germain, chief executive officer at EpiGaN, explained that her company was also using the funding to establish production facilities, which will commence operation in the first quarter of 2012. Even before that facility opens, EpiGaN claims it can already make GaN-on-silicon substrates capable of producing devices that reach the breakdown voltage seen as pivotal in driving uptake of GaN. “Today we deliver 6-inch 600 V wafers,” she said. “This is where we think it will be the most easy to outperform silicon, and this is for us the highest priority. From there we have two development routes: one to move to 200 mm, and one to go to voltages more than 1,000 V.” P O W E R D e v ’ N ° 4 J A N U A R Y 2 0 1 2 market within the next year. “In order to obtain high breakdown voltage between the drain and the silicon substrate, a thick AlGaN/AlGaN multilayer buffer, typically 4 to 5 μm thick for 600V class, is needed,” Kawai said. “Such thicker buffers induce high epitaxial cost.” Aggressive on passivation Kawai feels that there are other, even bigger problems, to be faced too. “Current collapse is a severe issue encountered in today’s highvoltage GaN devices, and not yet resolved enough,” Kawai said. “The large electric field near the gate edge kicks channel electrons into both the surface and the GaN layer, resulting in an increase of the channel resistance. Metal “Today we deliver 6-inch 600 V wafers. This is where we think it will be the most easy to outperform silicon, and this is for us the highest priority,” says Marianne Germain, EpiGaN. production capacity to support them when they reach the commercialisation stage. “We’ve transferred manufacturing technology so that they can produce epiwafers with the same quality as NTT-AT, but we NTT-AT can sell them,” Kobayashi said. “Together, we can produce a few thousand wafers a month right now.” But Hiroji Kawai, president and co-founder of the Yokohama, Japan, GaN wafer producer and device developer Powdec, is doubtful that 600 V voltages and higher will reach the market quickly. While his company has developed 1,100 V breakdown voltage GaN transistors, he doesn’t expect commercial production on large diameter silicon wafers until 2013 or 2014. He also says that he is “conservative” on the chances of any 50 A, 600 V GaN devices appearing on the field plate technology associated with a high quality passivation film could accommodate the collapse, but it’s not yet enough in practice.” With passivation, where oxides or nitrides are deposited as protection onto devices, potentially part of the solution to this problem reaches beyond epitaxial structure. As a supplier of etching equipment for GaN in the LED industry that are readily converted to power electronics processes, OIPT is well equipped to supply the means to solve device processing issues. It also sells plasma-enhanced CVD tools for passivation in high-power silicon devices, and is now seeing its ALD equipment gaining interest in association with GaN. “An ALD dielectric can provide a high interface quality leading to lower leakage and higher breakdown in devices, and Crushing current collapse: Japan’s Powdec has developed 1,100 V transistors with a superjunction field plate using a GaN/AlGaN/GaN polarization junction concept (left) which is more effective at preventing current collapse than a conventional metal field plate (right). (Courtesy of Powdec) 7 J A N U A R Y 2 0 1 2 I S S U E N ° 4 it’s being used for GaN-on-silicon based devices for surface passivation also, but also to provide some isolation for the higher voltage devices,” Hodson said. While etching and passivation steps might usually be considered as processes undertaken by device makers, Germain said that passivation is part of the offering available in EpiGaN’s GaNon-silicon wafers. “After properly controlling the stress in the material, the second thing that we consider as important is the passivation,” she explained. “We cap the wafer with in-situ SiN, deposited by MOCVD as part of the epiwafer growth process and this gives a strong advantage in terms of device performance, controlling the traps, and also in terms of device reliability. There are very strong indications that the insitu SiN is increasing the material’s robustness. Stressing the device at high temperature leaves the material completely unchanged if you cap it with SiN grown in-situ. Whereas if you have an AlGaN/GaN HEMT structure with a GaN cap at some point it starts relaxing and you destroy your channel properties. This is a key advantage, which we will believe will solve one of the biggest problems, the dynamic behaviour of the devices.” Another hurdle that Powdec’s Kawai says GaN-on-silicon power devices must overcome is attaining adequate yields for high power High mobility: NTT-AT supplies 6-inch GaN-on-silicon wafers with an AlGaN/GaN HEMT epitaxial structure. (Courtesy of NTT-AT) though the reverse current is larger than that of its SiC counterparts,” he said. “However, this can be resolved by implementing the ‘junction barrier’ structure same as the structure employed by SiC.” And OIPT’s Hodson noted that before GaN-onsilicon technology broke through, freestanding GaN substrates had been considered a potential starting point for making power devices. “We’ve had conversations with the people on power semiconductors, and there’s interest in “Current collapse is a severe issue encountered in today’s high-voltage GaN devices, and not yet resolved enough,” Hiroji Kawai, Powdec,” said Hiroji Kawai, Powdec. devices. “Surface defect contamination during MOCVD growth is one of the major factors determining die yield, with the die cost increasing rapidly with die size,” he said. “The size of an LED die is smaller than 0.1 mm2, whereas transistors capable of about 10 A have a die size as large as several mm2. I do not know whether the present and future commercial reactors can produce such a large die with high yield.” Powdec, by contrast, is bringing a GaN Schottky diode to market that is deposited on a sapphire substrate. His company grows the GaN layers using an epitaxial lateral overgrowth method that it says delivers a dislocation density several hundreds of times lower than conventional approaches. “Our purely vertical diode sustains more than 800 V with very small on-resistance, 8 freestanding GaN if it’s cost-effective,” he said. “But that’s always been the barrier, they’re great, but if you’ve got to buy a 2-inch GaN at a market price in excess of $2,000, it doesn’t make commercial sense usually.” As well as GaN-on-silicon, NTT-AT also supplies epitaxial wafers up to 4-inch diameter deposited on sapphire and SiC and 2-inch diameter on freestanding GaN. GaN-on-silicon is really the only choice for Kobayashi’s power electronic customers, however. “GaN-on-SiC is used in power amplifiers in base stations, but the SiC substrate price is very expensive,” Kobayashi said. “We don’t think it’s used in power devices because the competitor is silicon. Usually to compete with silicon, they try to use large diameter substrates, at least 6-inch.” Kobayashi also suggests that defects in GaNon-silicon aren’t such a problem for yield, but admits there could be concerns for long-term performance. “2-5 x109 is our typical dislocation density,” he said. “That level does not affect device performance or I-V characteristics, but we are not sure if it affects reliability – that’s still in development.” Optimising GaN growth conditions also helps deal with the dynamic behaviour problems seen in the devices. “Current collapse is influenced both by epilayer Deviation minimised In 2008 OIPT acquired Silver Spring, Maryland, based TDI Inc. and its HVPE technology, which rapidly deposits thick GaN layers. Now, Hodson says, it is preparing to exploit this approach in tools intended to make GaN wafers more accessible. “We’re pursuing a multi-wafer HVPE approach to produce freestanding GaN with the potential for low dollar-per-wafer numbers,” he said. Wafer homogeneity: thickness mapping of an EpiGaN wafer’s uniformity obtained by in-situ metrology. Uniformity is 0.6% over the 150 mm III-Nitrides layer, with 5mm edge exclusion. (Courtesy of EpiGaN) P O W E R D e v ’ I S S U E Power GaN main players and related products (Power GaN report, Yole Développement, Feb. 2012) Company AZZURRO (GE) BeMiTec (GE) Dowa Electronics Materials (J) EPC (US) EpiGaN (B) Furukawa (J) GaN Systems (CA) International Rectifier (US) MicroGaN (GE) NTT (J) OnChip Power (US) Panasonic (J) Powdec (J) Sanken (J) Sumitomo SEI (J) Toshiba (J) Transphorm Inc. (US) GaN epiwafer X GaN device FL X X X X X X FL X X X X X X X X X FL X X X X X X FL: Fab-less business model. Design only Power GaN pure-players quality and device technology,” Kobayashi said. “We have improved epilayer quality to prevent current collapse.” But AZZURRO’s Ysewijn feels that delivering consistent epiwafer quality is even more important than “only” minimising defect density – although this is still very important. “Yes, the better the quality of the material, the higher the breakdown voltage, the lower the onresistance,” he commented. “AZZURRO’s first target on a specification is to get a good performance on all the parameters on all the wafers with minimum deviation. It’s better to have a stable quality meeting 90 per cent of all the parameters than to have one wafer meet 100 per cent of the parameters but the next five wafers will not meet any of the parameters. The GaN world already wants to produce thousands of devices reproducibly. We supply stable materials with quality control material to the device makers.” Such a focus underlines that the ability to grow GaN epitaxial layers on silicon substrates is well established and becoming increasingly commercialised. And while device design problems remain to be solved the sheer weight of researchers and companies studying them mean that the question must be not if, but when, GaN-on-silicon power electronics will be successful. Andy Extance for Yole Développement N ° 4 J A N U A R Y Marianne Germain, Co-founder and CEO, EpiGaN Germain received the M.S. degree and PhD degree in Electrical Engineering from the University of Liege (ULg) in 1993 and 1999, respectively. In 2001, she joined IMEC in Leuven (BelgiumSince 2004 and 2010, she was Program Manager of IMEC’s “Efficient Power” program, which aimed at developing high-efficiency solutions for power applications beyond the Si limits enabled by GaN-on-Si technology. She pursued training management course in Vlerick Management School (Gent) in 2008/2009. In may 2010, with her colleague Joff Derluyn and Stefan Degroote, she co-founded EpiGaN, a spin-off based licensing imec technology which manufactures and sells GaN-on-Si epiwafers for electronic devices. Chris Hodson, Product Manager for ALD and power semiconductors, Oxford Instruments Plasma Technology Hodson has worked at Oxford Instruments for over 10 years specialising in deposition process techniques including PECVD, ICP-CVD and ALD. Chris is responsible for the Power Semiconductor products and processes which include etch and deposition processes for silicon based devices as well as wide-bandgap devices. Dr. Hiroji Kawai, Co-founder and President, Powdec K.K. Dr Kawai co-founded Powdec in 2001 to produce high quality GaN wafers and to develop next-generation GaN power devices with drastically lower power consumption. His expertise lies in compound semiconductor devices, starting GaN research in 1994. He also specializes in high quality growth techniques such as MOCVD and equipment design. Dr Kawai spent 30 years of his career at the Sony Research Center in Yokohama, prior to the founding of Powdec, where he served as the General Manager and Principle Research Scientist. He received his PhD in electrical engineering and Bachelor of Science in chemical engineering from Shizuoka University, Japan. Takashi Kobayashi, Executive Engineer, NTT Advanced Technology’s Nano-Technology Business Unit. Kobayashi graduated from Tohoku University in Sendai Japan in 1981. Then he joined NTT Laboratories to study III-V compound semiconductor materials such as GaAs, InP, and GaN for electric device applications. He moved to NTT Advanced Technology Corp. (NTT-AT) in 2008 to manage its GaNbased epiwafer business for power electronics applications. Now he is now responsible for the GaN epi business section in NTT-AT. Erwin Ysewijn, Vice-President, Sales and Marketing, Azzurro Semiconductors Ysewijn started his marketing and sales career in 1989 working at Hitachi Semiconductors, getting familiar with Japanese and international business culture. Since then the spent most of his time in Asia, covering among others, Korea, India, Taiwan and China, working on marketing, sales and strategic M & A projects, excelling in intercultural topics and growing the business. In his last position before joining Azzurro he was heading the global marketing activities at Lantiq. Protecting performance: an ALD dielectric, produced using Oxford Instruments Plasma Technology’s FlexAL tool shown here, can provide a high interface quality leading to lower leakage and higher breakdown in devices. (Courtesy of Oxford Instruments Plasma Technology) P O W E R D e v ’ 2 0 1 2 9

![Structural and electronic properties of GaN [001] nanowires by using](http://s3.studylib.net/store/data/007592263_2-097e6f635887ae5b303613d8f900ab21-300x300.png)